Do you ever find it difficult to save money? I know I do. With all the expenses that come with everyday life, it can be tough to stay on top of your finances. But fear not! I’ve discovered some amazing money-saving smartphone apps that have truly been a game-changer for me. And I’m here to share them with you, so you can save more and stress less.

These apps have revolutionized the way I manage my finances. From finding the best deals on groceries to saving on travel and entertainment, these apps cover it all. Whether you’re looking to cut back on your expenses or simply want to find ways to make your money go further, these apps have got your back.

In this article, I’ll be discussing 10 must-have money-saving smartphone apps that can help you live a more frugal lifestyle. We’ll dive deep into each app and explore how they can benefit you. So, if you’re ready to take control of your finances and start saving more, keep reading. Trust me, you won’t want to miss out on these incredible money-saving apps.

Introduction

I have always been someone who loves finding ways to save money and live a frugal lifestyle. It’s not just about pinching pennies, but rather understanding the value of money and making smart choices to achieve financial stability and freedom. In today’s digital age, there are countless tools and resources available to help us save money, and one of the most convenient and accessible options is money-saving smartphone apps. In this article, I will introduce you to 10 must-have money-saving smartphone apps that have helped me tremendously in my quest for financial success.

What is a Frugal Lifestyle

Definition of frugal lifestyle

A frugal lifestyle is all about living within your means and avoiding unnecessary expenses. It doesn’t mean being cheap or sacrificing your quality of life; instead, it means making conscious decisions about how you spend your money and finding ways to cut costs without compromising on the things that truly matter to you.

Benefits of adopting a frugal lifestyle

There are numerous benefits to adopting a frugal lifestyle. Firstly, it allows you to save money and build a cushion for emergencies or future investments. Secondly, it helps you develop good financial habits and a disciplined approach to money management. Additionally, living frugally can reduce stress and provide a sense of satisfaction as you become more mindful of your spending habits and prioritize your financial goals.

Importance of Saving Money

Understanding the value of money

Understanding the value of money is crucial for anyone seeking financial stability. Saving money is not just about accumulating wealth; it’s about realizing that every dollar you spend represents your hard work and effort. By recognizing the value of your money, you become more thoughtful about how you allocate your resources and make purchasing decisions.

Impact of saving money on personal financial situation

Saving money has a profound impact on your personal financial situation. It allows you to build an emergency fund, which serves as a safety net for unexpected expenses or periods of financial instability. Additionally, saving money enables you to achieve long-term financial goals, such as buying a home, starting a business, or retiring comfortably. It also gives you the freedom to pursue your passions and enjoy peace of mind knowing that you are financially prepared for whatever comes your way.

Introduction to Money-Saving Smartphone Apps

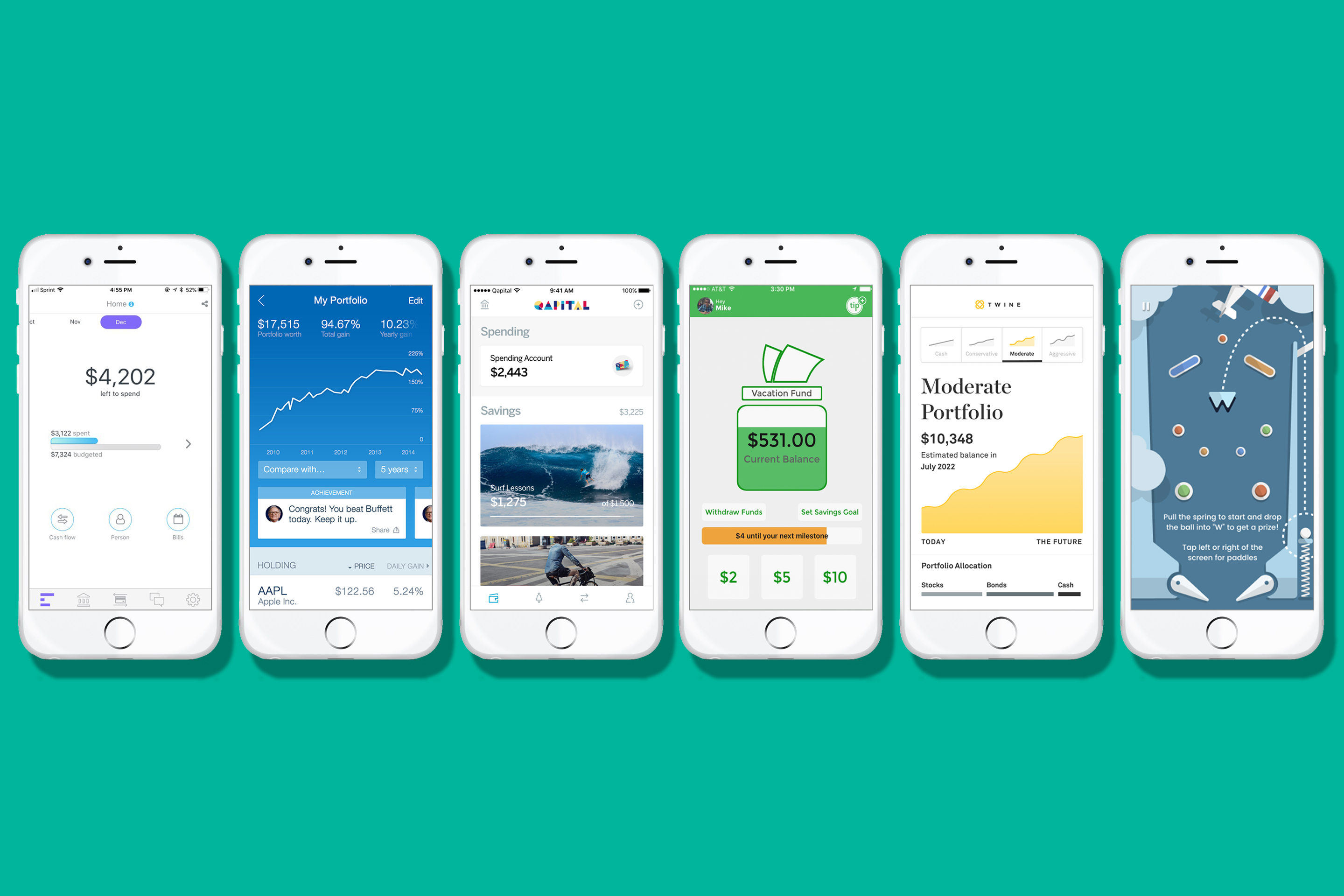

Explanation of money-saving smartphone apps

Money-saving smartphone apps are mobile applications that are designed to help you save money effortlessly. These apps provide a wide range of features and tools that assist you in various aspects of your finances, from budgeting and expense tracking to finding discounts and earning cashback on your purchases. With just a few taps on your smartphone, you can gain access to exclusive deals, discover ways to cut costs, and manage your money more efficiently.

Advantages of using smartphone apps for saving money

There are several advantages to using smartphone apps for saving money. Firstly, they are incredibly convenient and accessible, allowing you to monitor your finances and make money-saving decisions on the go. You can quickly check your budget, track your expenses, or find the best deals without having to carry around a bulky wallet or sit in front of a computer. Secondly, money-saving apps often offer personalized recommendations and tailored suggestions based on your spending patterns, helping you make informed decisions about your money. Lastly, these apps enable you to digitize your receipts, eliminating the need for manual record-keeping and reducing clutter in your life.

10 Must-Have Money-Saving Smartphone Apps

Now that you understand the benefits of adopting a frugal lifestyle and the importance of saving money, let’s dive into the 10 must-have money-saving smartphone apps that I highly recommend.

App 1: Name of App 1

App 1 is a powerful budgeting app that helps you keep track of your income and expenses. With its intuitive interface and customizable categories, you can easily create a budget that suits your needs and financial goals. The app provides real-time updates and notifications, allowing you to stay on top of your spending and make adjustments as needed. Additionally, App 1 offers insightful reports and visualizations to help you analyze your financial habits and identify areas where you can save.

Features and benefits of App 1

- User-friendly interface and customizable budget categories

- Real-time updates and notifications to keep you informed

- Insights and visualizations to track your financial progress

- Expense tracking and categorization for better expense management

- Goal setting and progress tracking to help you stay motivated

How to use App 1 effectively

To use App 1 effectively, start by setting up your budget by entering your income and expenses. Be sure to categorize your expenses accurately to get a clear picture of your spending habits. Next, connect your bank accounts and credit cards to the app to automate expense tracking. Finally, regularly review your budget and make adjustments as needed to ensure you stay within your financial goals.

App 2: Name of App 2

App 2 is a cashback app that rewards you for your everyday purchases. Whether you’re shopping online or in-store, this app allows you to earn cashback on eligible purchases from a wide range of retailers. Simply browse through the app’s offers, activate the ones you’re interested in, and shop as usual. Once your purchase is verified, you’ll receive cashback directly into your account.

Features and benefits of App 2

- Wide selection of retailers and offers for maximum earning potential

- Easy activation and verification process for hassle-free cashback

- User-friendly interface and intuitive navigation

- Additional bonuses and promotions for increased savings

- Options to redeem your cashback through various methods, such as direct deposit or gift cards

How to use App 2 effectively

To make the most of App 2, be sure to activate the cashback offers before making your purchases. Read the terms and conditions carefully to ensure your purchases qualify for cashback. Additionally, consider using the app’s referral program to earn extra rewards by inviting your friends and family to join. Lastly, regularly check the app for new offers and promotions to maximize your earning potential.

App 3: Name of App 3

App 3 is a coupon app that helps you find the best deals and discounts at your favorite stores. From groceries and clothing to electronics and travel, this app provides you with a wide selection of coupons and promotional codes that can help you save money on your purchases. Simply search for the store or product you’re interested in, browse through the available coupons, and redeem them at the checkout.

Features and benefits of App 3

- Extensive database of coupons and promotional codes for a variety of products and stores

- User-friendly interface and search functionality for easy coupon discovery

- Option to save your favorite coupons for future use

- Location-based offers to help you find deals near you

- Regular updates and notifications for new coupons and discounts

How to use App 3 effectively

To use App 3 effectively, start by searching for the store or product you’re planning to purchase. Browse through the available coupons and select the ones that suit your needs. Keep in mind that some coupons may have specific terms and conditions, such as expiration dates or minimum purchase requirements. Before making your purchase, present the coupon at the checkout or enter the promotional code online to apply the discount.

App 4: Name of App 4

App 4 is a price comparison app that allows you to compare prices from different retailers to ensure you’re getting the best deal. Simply enter the name of the product or scan its barcode, and the app will provide you with a list of retailers that offer the item along with their prices. This app is particularly useful when shopping for electronics, appliances, or other high-ticket items where price variations can be significant.

Features and benefits of App 4

- Comprehensive database of products and retailers for accurate price comparisons

- Barcode scanning functionality for quick and effortless price checks

- User reviews and ratings to help you make informed purchasing decisions

- Option to set price alerts and receive notifications when the price drops

- Historical price data for better price trend analysis

How to use App 4 effectively

To use App 4 effectively, start by searching for the product you’re interested in or scan its barcode using your smartphone’s camera. Review the list of retailers and their prices, taking into consideration factors such as shipping costs and customer reviews. If you’re not in a rush to purchase, consider setting up price alerts to be notified when the price drops. Once you find the best deal, proceed with your purchase and enjoy the savings.

App 5: Name of App 5

App 5 is an investment app that allows you to start investing with as little as a few dollars. This app offers various investment options, such as stocks, bonds, and exchange-traded funds (ETFs), and provides educational resources to help you make informed investment decisions. With its user-friendly interface and intuitive navigation, App 5 makes investing accessible to everyone, regardless of their financial knowledge or experience.

Features and benefits of App 5

- Low minimum investment requirements for entry-level investors

- Diversified portfolio options to mitigate risk

- Educational resources and tools to help you understand the investment market

- User-friendly interface and easy-to-navigate platform

- Regular updates and notifications to keep you informed about your investments

How to use App 5 effectively

To use App 5 effectively, start by setting up your investment profile and goals. Determine your risk tolerance and select the investment options that align with your financial objectives. Consider starting with a small amount and gradually increase your investments as you become more comfortable with the process. Additionally, take advantage of the app’s educational resources to expand your knowledge and make informed investment decisions.

How Money-Saving Smartphone Apps Work

Now that you’re familiar with some of the must-have money-saving smartphone apps, let’s take a closer look at how these apps work and the technologies they utilize.

Explanation of the functioning of money-saving apps

Money-saving smartphone apps work by leveraging various technologies and data sources to help you save money. These apps often connect to your bank accounts, credit cards, or other financial services to access your transaction data and provide personalized recommendations. They use algorithms and machine learning to analyze your spending patterns and identify potential areas for savings. Additionally, these apps often partner with retailers and service providers to offer exclusive discounts and cashback deals to their users.

Technologies utilized in these apps

Money-saving smartphone apps utilize a range of technologies to provide their services. They rely on secure APIs (Application Programming Interfaces) to connect to financial institutions and retrieve transaction data securely. These apps also implement data encryption and other security measures to ensure the safety and privacy of your personal and financial information. Furthermore, they employ algorithms and machine learning models to analyze large sets of data and provide tailored recommendations based on your unique financial situation.

How to Choose the Right Money-Saving App

With countless money-saving apps available in the app stores, it can be overwhelming to choose the right one for your needs. Here are some factors to consider when selecting a money-saving app.

Factors to consider when selecting a money-saving app

- Purpose: Determine the specific financial goals you want to achieve with the app. Are you looking for budgeting tools, cashback offers, or expense tracking features?

- User interface: Choose an app with a user-friendly interface that matches your preferences and makes it easy for you to navigate and access the features you need.

- Compatibility: Ensure that the app is compatible with your smartphone’s operating system and that it receives regular updates and bug fixes.

- Reviews and ratings: Read reviews and ratings from other users to gain insights into their experiences with the app and its reliability.

- Security: Look for apps that have robust security measures in place to protect your personal and financial information.

Key features to look for in an app

- Budgeting tools: Look for apps that offer customizable budgeting tools and provide visualizations to help you track your expenses and savings progress.

- Cashback offers: Consider apps that offer competitive cashback rates and have partnerships with a wide range of retailers and service providers.

- Expense tracking: Choose apps that make it easy for you to track your expenses and categorize them to gain insights into your spending habits.

- Automation options: Look for apps that allow you to automate certain tasks, such as bill payments or savings transfers, to simplify your financial management.

- Security measures: Ensure that the app employs strong security measures, such as encryption and two-factor authentication, to protect your personal and financial data.

Tips and Tricks for Maximizing Savings with Money-Saving Apps

Once you’ve selected the right money-saving app for your needs, here are some tips and tricks to help you maximize your savings.

Using multiple apps for different purposes

Consider using multiple money-saving apps for different purposes. For example, you can use one app for budgeting and expense tracking, another app for cashback offers, and a third app for finding the best deals and discounts. By diversifying your app usage, you can take advantage of the unique features and benefits offered by each app and maximize your savings potential.

Taking advantage of app offers and discounts

Stay on top of app offers and discounts by regularly checking for updates and notifications. Many money-saving apps provide exclusive deals or limited-time promotions that can significantly reduce your expenses. By being proactive and taking advantage of these offers, you can save money on your everyday purchases and make the most of your money-saving app experience.

Security and Privacy Considerations

Ensuring the safety of your personal and financial information should be a top priority when using money-saving apps. Here are some best practices for protecting your privacy while using these apps.

Ensuring the safety of personal and financial information

- Choose apps that have strong security measures in place, such as data encryption and two-factor authentication.

- Avoid using public Wi-Fi networks when accessing your money-saving apps, as these networks are susceptible to hacking and data breaches.

- Regularly update your smartphone’s operating system and the money-saving app to ensure you have the latest security patches.

- Be cautious about sharing personal or financial information within the app or with third-party service providers.

- Monitor your bank statements and credit reports regularly to detect any fraudulent activities.

Best practices for protecting privacy while using money-saving apps

- Read the app’s privacy policy and terms of service to understand how your data will be collected, stored, and used.

- Consider using a unique password for your money-saving app account and enable biometric authentication, such as fingerprint or face recognition, if available.

- Be selective about the permissions you grant the app. Only provide access to the necessary information and functions required for its proper functioning.

- Regularly review and manage the app’s data permissions to ensure that your personal and financial information is secure.

Future of Money-Saving Smartphone Apps

As technology continues to evolve, so too will money-saving smartphone apps. Here are some emerging trends and predictions for the future of these apps.

Emerging trends in money-saving apps

- Enhanced personalization: Money-saving apps will become even more personalized, offering tailored recommendations based on your financial goals, lifestyle, and preferences.

- Integration with smart devices: Money-saving apps will seamlessly integrate with smart devices, such as smart speakers and wearables, allowing you to manage your finances through voice commands or on-the-go.

- Gamification and rewards: Money-saving apps will incorporate gamification elements and rewards programs to incentivize users to make smarter financial decisions and achieve their savings goals.

- Artificial intelligence and machine learning: Money-saving apps will leverage advanced AI and machine learning algorithms to analyze complex financial data and provide more accurate predictions and recommendations.

Predictions for the future of these apps

- Increased automation: Money-saving apps will automate more aspects of your financial life, from bill payments and savings transfers to investment portfolio rebalancing.

- Integration with financial institutions: Money-saving apps will establish deeper integrations with financial institutions, enabling seamless transfer of funds and real-time access to account information.

- Expansion into new markets: Money-saving apps will expand their offerings beyond traditional savings and investments, venturing into areas such as insurance, mortgages, and retirement planning, to provide comprehensive financial solutions.

Conclusion

In conclusion, money-saving smartphone apps are powerful tools that can help you achieve your financial goals and live a more frugal lifestyle. Whether you’re looking to budget effectively, earn cashback on your purchases, or find the best deals and discounts, there is an app out there that can meet your needs. By adopting a frugal mindset and utilizing these 10 must-have money-saving smartphone apps, you can take control of your finances and embark on a journey toward financial freedom. So why wait? Start exploring these apps today and watch your savings grow!