Introduction

Picture this: you’re cruising along with your frugal lifestyle, carefully budgeting your expenses, and even managing to put a little money aside each month. Life seems pretty good, right? But what happens when the unexpected strikes? Are you prepared for those unforeseen emergencies that can throw your whole financial world off balance? That’s where having an emergency fund becomes crucial, especially when embracing a frugal lifestyle.

The Importance of Emergency Funds

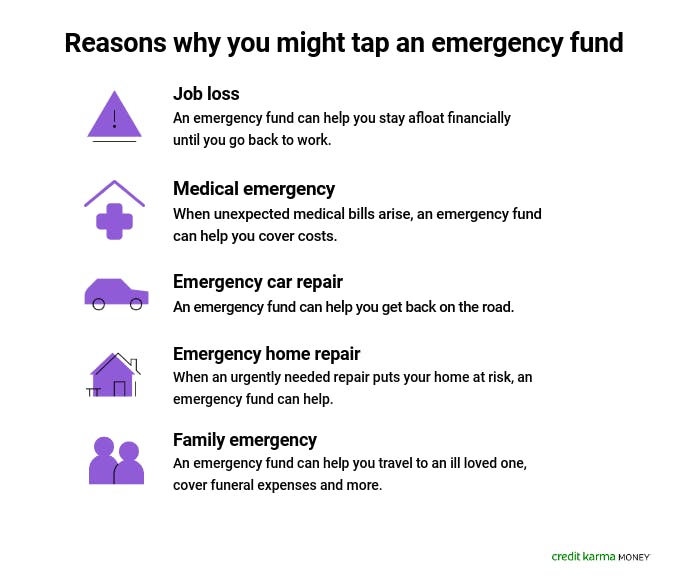

Having an emergency fund is like having a safety net for your finances. It provides a cushion to fall back on when life throws you a curveball. Whether it’s an unexpected car repair, a medical emergency, or even losing your job, having this financial backup can provide peace of mind and prevent you from spiraling into debt.

But why take a frugal approach to building an emergency fund? Well, being frugal means making wise financial choices and being conscious of how we spend our hard-earned money. By actively saving and cutting unnecessary expenses, we can build our emergency fund faster and maintain our frugal lifestyle even in times of crisis.

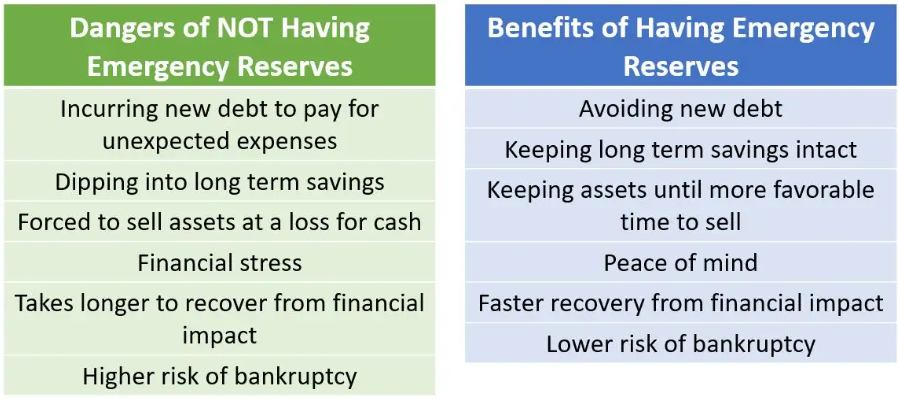

The Benefits of a Frugal Emergency Fund

A frugal emergency fund offers several benefits. Firstly, it allows us to avoid relying on credit cards or loans when unexpected expenses occur. By using our own savings, we can avoid high interest rates and the stress that comes with accumulating debt. Additionally, having an emergency fund enables us to make wiser financial decisions. We can tackle emergencies head-on without compromising our long-term financial goals.

Moreover, a frugal approach to building an emergency fund teaches us good financial habits such as discipline, patience, and delayed gratification. It challenges us to develop resourcefulness and find creative ways to save money. By embracing a frugal lifestyle and prioritizing the importance of emergency funds, we can build a strong financial foundation that will sustain us through any storm.

a frugal emergency fund is an essential tool for any individual pursuing a frugal lifestyle. By recognizing the importance of having a financial safety net, we can protect ourselves from unexpected events and maintain our financial stability. So, let’s embrace the frugal approach and start building that emergency fund today!

Financial Stability in Times of Crisis

Having an emergency fund is crucial for maintaining financial stability, especially during times of crisis. Whether it’s a sudden job loss, a medical emergency, or a major home repair, unexpected expenses can arise at any moment. Without an emergency fund, I would be left scrambling to find money to cover these expenses, potentially going into debt or relying on high-interest loans.

By having a dedicated savings account for emergencies, I can face these unexpected financial challenges without feeling overwhelmed. Emergency funds provide a sense of security, knowing that I have financial resources readily available to handle any crisis that may come my way.

Cushioning Effect on Unforeseen Expenses

An emergency fund serves as a cushion for unforeseen expenses, protecting my budget from being derailed. Instead of having to cut back on essential expenses or dip into savings earmarked for specific goals, I can rely on my emergency fund to cover those unexpected costs.

For example, if my car suddenly breaks down and requires costly repairs, I don’t have to worry about compromising other financial obligations. With an emergency fund, I can confidently address the issue without compromising my monthly budget. This cushioning effect allows me to maintain my frugal lifestyle while still being prepared for the unexpected.

Peace of Mind and Reduced Stress

Perhaps the most significant benefit of having an emergency fund is the peace of mind and reduced stress it brings. Knowing that I have a financial safety net in place alleviates the anxiety of the unknown. Instead of constantly worrying about what could go wrong, I can focus my energy on other aspects of my frugal lifestyle and personal growth.

Whether it’s the peace of mind that comes from knowing I’m prepared for any financial challenge or the reduced stress that comes from having a safety net, the importance of emergency funds cannot be overstated. It is an essential component of living a frugal and financially stable life. So, start building your emergency fund today and experience the numerous benefits it has to offer.

Building an Emergency Fund

When it comes to living a frugal lifestyle, one of the most important aspects to consider is the establishment of an emergency fund. As a frugal individual, I understand the significance of being prepared for unexpected financial challenges that may arise. In this section, I will provide detailed insights into building an emergency fund and highlight key strategies that can be employed to achieve this goal.

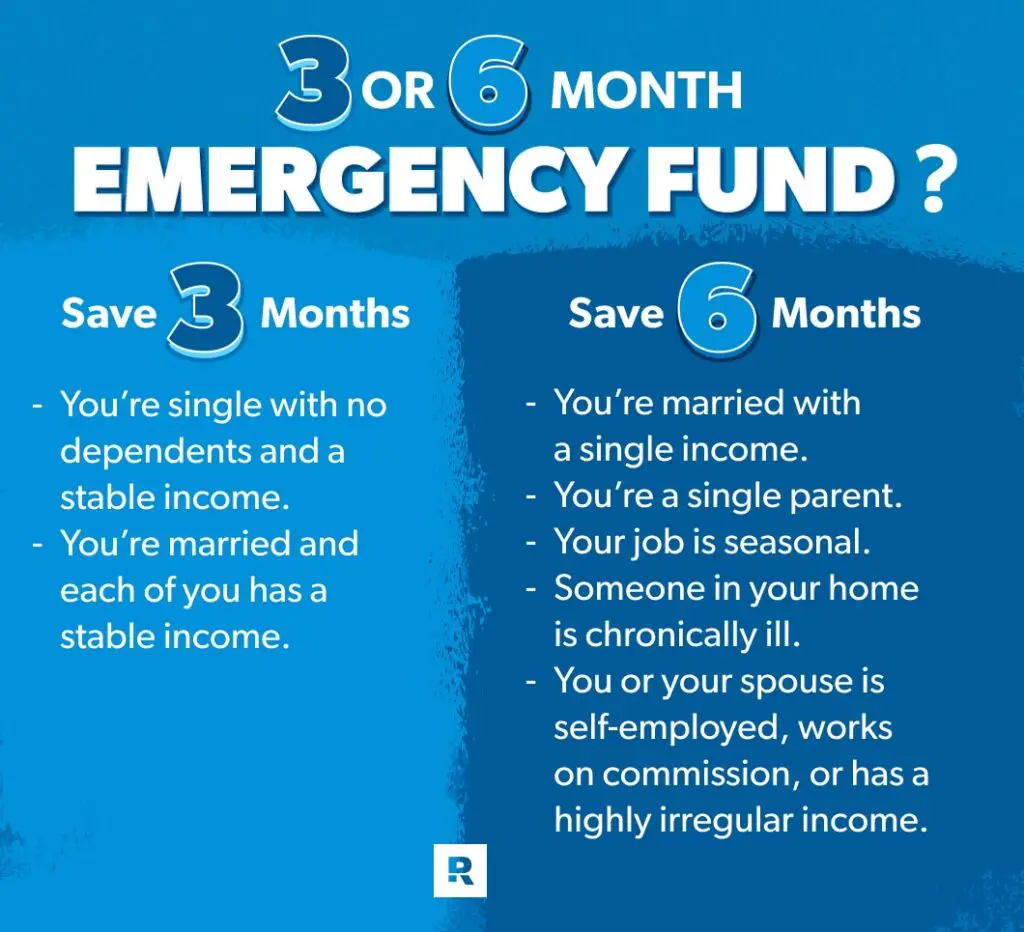

Determining the Ideal Amount

The first step in building an emergency fund is to determine the ideal amount that should be saved. Financial experts suggest that, as a general rule of thumb, individuals should aim to save three to six months’ worth of living expenses. However, the actual amount can vary depending on personal circumstances, such as job stability or health issues. It is essential to carefully evaluate your own situation and set a realistic goal.

Setting Realistic Savings Goals

Once the ideal amount has been determined, it is crucial to set realistic savings goals. Start by assessing your monthly income and expenses. Identify areas where you can cut back on discretionary spending and redirect those funds towards your emergency fund. It might require some sacrifices, but remember that building a safety net for unforeseen circumstances is paramount.

Creating a Budget and Cutting Expenses

To effectively save for an emergency fund, creating a budget is essential. Review your monthly expenses and identify areas where you can reduce costs. Save money by cooking meals at home, utilizing public transportation, or canceling unnecessary subscriptions. Every penny saved will bring you closer to your emergency fund goal.

Automating Savings

Making regular deposits into your emergency fund can be simplified by automating your savings. Most banks offer services that allow you to automatically transfer funds from your paycheck or checking account into your savings account. By setting up automated transfers, you can ensure consistent contributions without the temptation to spend the money elsewhere.

Exploring Additional Income Streams

In some cases, cutting expenses alone may not be enough to build your emergency fund. Consider exploring additional income streams to boost your savings. This can involve taking on a part-time job, freelancing, or starting a side business. The extra income generated can then be allocated towards your emergency fund, helping you reach your financial goals faster.

By following these strategies, you will be able to build a robust emergency fund that will provide you with a sense of financial security in times of unexpected events. Being proactive in preparing for the unknown is a fundamental aspect of frugal living. Remember, it is always better to be safe than sorry when it comes to your financial stability.

Where to Keep Emergency Funds

One of the most critical aspects of emergency fund management is determining where to keep your funds. The aim is to strike a balance between accessibility and growth potential while minimizing risk. Here are some options to consider:

Savings Accounts

Savings accounts are a popular choice due to their accessibility and low risk. They provide a secure place for your emergency funds, typically offering interest rates that may not yield substantial growth but can help preserve the value of your savings over time. Plus, they offer easy access to funds when needed, making them an ideal option for emergencies.

Money Market Accounts

Similar to savings accounts, money market accounts are low-risk and provide a higher yield. They typically offer a slightly higher interest rate and may require a higher minimum deposit. Money market accounts often come with checks and debit cards for enhanced access to funds, making them a suitable option for emergencies.

Certificates of Deposit (CDs)

Certificates of Deposit are another option worth considering. They typically provide higher interest rates compared to savings or money market accounts but come with a fixed term, meaning the money has to remain untouched for a specific period. This makes CDs an excellent choice for individuals who can afford to lock away their funds for a predetermined period without needing immediate access.

High-Yield Savings Accounts

For individuals willing to explore more options, high-yield savings accounts offer higher interest rates compared to traditional savings accounts. These accounts are usually offered by online banks, which often operate with lower overhead costs. However, keep in mind that these accounts may require higher minimum balances or have limited access to physical branches.

Other Low-Risk Investment Options

In addition to traditional savings and banking options, you may consider other low-risk investment opportunities for your emergency funds. These may include short-term government bonds or treasury bills, which offer higher interest rates while maintaining a relatively low risk profile.

Avoiding High-Risk Investments

Although it may be tempting to seek higher returns, it’s crucial to avoid high-risk investments with your emergency funds. The goal of these funds is to provide stability and peace of mind during unforeseen circumstances. Therefore, it’s recommended to steer clear of stocks, real estate, or any other investment that may expose your emergency funds to significant market fluctuations.

understanding the various options for keeping your emergency funds is crucial. Consider the level of risk you are comfortable with, your access needs, and the possibility for growth. By strategically placing your funds in low-risk accounts or investments, you can ensure their security while also allowing them to grow and support you during times of unexpected financial challenges.

Maintaining and Growing the Emergency Fund

Budget Reviews and Adjustments

One of the most crucial aspects of maintaining an emergency fund is regularly reviewing and adjusting my budget. I understand that unexpected expenses can arise at any time, so it is important for me to have a clear understanding of my financial situation. By regularly reviewing my budget, I can identify areas where I can reduce expenses or cut back on unnecessary spending. This allows me to free up more funds that can be allocated towards my emergency fund.

Rebuilding the Emergency Fund After Use

There may be occasions when I need to dip into my emergency fund to cover unexpected expenses. However, after using the funds, it is vital for me to prioritize rebuilding the fund as soon as possible. I understand that emergencies can happen again at any time, and having a depleted emergency fund can leave me vulnerable and stressed. By committing to replenishing the fund, no matter how long it takes, I can ensure that I am always prepared for future unexpected events.

Continuing to Contribute Regularly

To ensure that my emergency fund remains adequate, I make it a point to contribute to it regularly. Even during months when my expenses are low or when I have no immediate emergencies, I still allocate a portion of my income to the fund. This consistent contribution helps to grow the fund over time, providing me with a larger safety net for any future financial hardships.

Investing Excess Emergency Funds

Once my emergency fund reaches a comfortable level, I have found it beneficial to invest any excess funds. By doing so, I can make my money work for me and potentially earn some additional income. However, I always make sure to invest in low-risk options to protect the principal amount. This way, I can still access the funds quickly if needed, while also potentially growing my emergency fund over time.

Reevaluating Financial Goals

As I progress on my frugal journey and my financial situation improves, it is essential for me to reevaluate my financial goals, including my emergency fund target. As I achieve some of my goals, I may need to adjust the size of my emergency fund to account for changes in my circumstances. This ongoing evaluation ensures that my emergency fund remains relevant and aligned with my current financial standing.

maintaining and growing an emergency fund is a crucial component of a frugal lifestyle. By regularly reviewing my budget, replenishing the fund after use, contributing consistently, investing excess funds wisely, and reevaluating financial goals, I can ensure my emergency fund remains reliable, providing me with peace of mind for any unexpected financial challenges that may arise.

Tips for Frugal Living to Support Emergency Funds

Life is full of unexpected situations. Whether it’s a sudden job loss, a medical emergency, or an unexpected home repair, having a financial safety net in the form of an emergency fund is crucial. As a frugal individual, I understand the importance of being prepared for these unforeseen circumstances without breaking the bank. In this section, I will share some practical tips for frugal living that can help you build and maintain an emergency fund.

Cutting Back on Non-Essential Expenses

One of the first steps in saving for an emergency fund is identifying and cutting back on non-essential expenses. This could mean reevaluating your subscription services, dining out less frequently, or finding free or low-cost alternatives for entertainment. By consciously reducing these discretionary expenses, you can redirect that money toward your emergency fund.

Meal Planning and Cooking at Home

Another effective way to save money is by meal planning and cooking at home. By preparing your meals in advance and utilizing ingredients you already have, you can significantly reduce your monthly grocery bill. Additionally, cooking at home allows you to control the quality and nutritional value of your meals, promoting both frugality and good health.

Shopping Smart and Using Coupons

Being a frugal person means utilizing all available resources to save money. Take advantage of sales, discounts, and coupons to maximize your savings while shopping. Whether it’s groceries, clothing, or household items, a little research and planning can go a long way in helping you build your emergency fund.

Energy and Water Conservation

Conserving energy and water not only benefits the environment but also helps you save money on utility bills. By making simple changes like using energy-efficient appliances, turning off lights when not in use, and fixing leaky faucets, you can reduce your monthly expenses and contribute to your emergency fund.

DIY Projects and Repairs

Instead of immediately hiring professionals for every repair or renovation task, consider tackling some projects yourself. Learning basic DIY skills can save you a significant amount of money in labor costs and help you stretch your emergency fund further.

Prioritizing Quality Over Quantity

When making purchasing decisions, it’s important to prioritize quality over quantity. Investing in durable, long-lasting items might have a higher upfront cost, but it can save you money in the long run by avoiding frequent replacements. This approach not only reduces the strain on your emergency fund but also promotes a more sustainable and mindful lifestyle.

Building a Minimalist Mindset

Adopting a minimalist mindset can have a profound impact on your finances. By embracing the idea of living with less, you’ll naturally be inclined to avoid unnecessary purchases and prioritize experiences over material possessions. This shift in mindset can free up resources that can be directed towards your emergency fund.

building and maintaining an emergency fund is an essential aspect of a frugal lifestyle. By cutting back on non-essential expenses, meal planning, shopping smart, conserving energy and water, embracing DIY projects, prioritizing quality over quantity, and adopting a minimalist mindset, you can protect yourself from unexpected financial setbacks. Start implementing these frugal living tips today and take control of your financial future.

Utilizing Emergency Funds Wisely

Only for True Emergencies

One of the most important aspects of having an emergency fund is to ensure that it is used only for true emergencies. It can be tempting to dip into it for non-essential purchases or unexpected expenses that are not emergencies. However, it is crucial to remember that emergency funds are designed to provide financial security in times of crisis. By reserving the funds solely for genuine emergencies, such as medical emergencies, job loss, or major car repairs, we can ensure that the money is available when it is truly needed.

Categorizing and Allocating Funds

Another smart approach to utilizing emergency funds is to categorize and allocate the funds based on priority. By identifying different types of emergencies and assigning predetermined amounts to each category, we can ensure that the funds are allocated in a strategic and efficient manner. For example, some categories may include healthcare emergencies, home repair emergencies, and unexpected travel expenses for family emergencies. By separating the funds, we are able to tackle each emergency with a focused approach, without depleting the entire fund at once.

Building a Plan for Emergency Fund Use

Having a well-thought-out plan for utilizing emergency funds is crucial. It involves considering various scenarios and determining the appropriate amount of funds to be used in each situation. For instance, if a medical emergency arises, a portion of the emergency fund may be used to cover medical bills, while keeping the remaining funds intact for other emergencies. By creating a plan that prioritizes the use of the funds, we can ensure that they are utilized effectively, without jeopardizing our financial stability.

Replenishing the Fund After Use

Once the emergency funds have been utilized, it is important to make replenishing them a top priority. Allocating a certain percentage of monthly income towards rebuilding the emergency fund ensures that it is slowly but steadily replenished. It is crucial to remember that emergencies can occur at any time, and having a fully funded emergency fund is essential for continued financial security.

Seeking Professional Advice if Needed

It is always beneficial to seek professional advice when it comes to managing emergency funds. Financial advisors can provide valuable insights and guidance on how to make the most out of emergency funds. They can help us develop a comprehensive plan for managing the funds and provide strategies for building a robust emergency fund that aligns with our financial goals and circumstances.

By utilizing emergency funds wisely, categorizing and allocating them strategically, building a plan for their use, and diligently replenishing them after use, we can ensure that our emergency funds provide us with the financial security we need during unexpected times. Seek professional advice, if necessary, to make informed decisions about emergency fund management. Remember, a frugal lifestyle goes hand in hand with being prepared for the unexpected.

Emergency Funds vs. Credit Cards or Loans

As a frugal advocate, I firmly believe in the importance of emergency funds. In this section, I want to explore why emergency funds are superior to relying on credit cards or loans when unexpected expenses arise.

Avoiding High-Interest Debt

Using credit cards or taking out loans may seem like a quick solution when faced with a financial emergency, but the high-interest rates can trap you in a cycle of debt that is difficult to escape. By having an emergency fund, you can avoid falling into this costly and stressful situation.

Reducing Financial Stress

One of the key advantages of having an emergency fund is the peace of mind it brings. Knowing that you have a financial safety net to rely on in times of crisis can help reduce stress and anxiety. This newfound sense of security allows you to focus on finding solutions to the problem at hand rather than worrying about how you will pay for it.

Preserving Credit Score

Relying solely on credit cards or loans can negatively impact your credit score. Large amounts of debt and missed payments can lower your score and limit your future financial opportunities. By having an emergency fund, you can maintain your credit score by avoiding excessive debt and ensuring timely payments.

Advantages and Disadvantages of Using Credit

While credit cards and loans can provide immediate access to funds, they come with their own set of advantages and disadvantages. It’s important to carefully consider the terms and conditions of any credit you use. Comparing these options with having an emergency fund allows you to make an informed decision that aligns with your frugal lifestyle.

Creating a Strategy for Emergency Situations

Having an emergency fund is not enough; it’s equally important to have a strategy in place for when unexpected expenses arise. By setting clear guidelines for when and how to use your emergency fund, you can ensure that it remains intact and continues to provide the financial security you need.

while credit cards and loans may offer a temporary solution to financial emergencies, they often come with long-term consequences. Embracing a frugal approach and prioritizing the establishment and maintenance of an emergency fund will not only provide immediate relief during unexpected situations but also contribute to a healthier and more resilient financial future. So start building your emergency fund today and experience the peace of mind that comes with being prepared for the unexpected.

Teaching Frugality and Emergency Funds

Educating Children About Money

As a frugal individual, I firmly believe in the importance of teaching children about money management from an early age. By introducing the concept of emergency funds to our children, we set them up for financial success in the future. Starting with simple lessons on saving, budgeting, and setting financial goals, we can instill in them the value of being prepared for unexpected circumstances.

Teaching Budgeting and Saving Skills

By teaching children the importance of budgeting and saving, we help them develop a frugal mindset. With a focus on creating a budget and prioritizing expenses, they learn to live within their means and understand the importance of saving for emergencies. By allocating a portion of their allowance or earnings towards an emergency fund, children learn the value of delayed gratification and the benefits of having a safety net when unexpected expenses arise.

Leading by Example

As adults, it is crucial that we practice what we preach. By demonstrating responsible financial habits ourselves, we create a positive influence on our children. This involves openly discussing our own emergency funds and explaining why they are essential. By including our children in financial discussions and decisions, we foster a sense of responsibility and encourage them to adopt frugal habits.

Encouraging Independence and Responsibility

As our children grow older, it is essential to empower them to take control of their own finances. By gradually increasing their financial responsibilities, such as managing their own savings account or budgeting for school expenses, we enable them to develop independence and responsibility. This not only prepares them for their future financial endeavors but also reinforces the significance of emergency funds as a vital component of financial stability.

By emphasizing the importance of emergency funds from an early age, we equip our children with invaluable financial knowledge and skills. As they navigate life’s uncertainties, they will be better prepared to handle unforeseen circumstances, ensuring a more secure and frugal future. So, let’s start teaching our children about emergency funds today and provide them with the tools they need for a financially responsible and prosperous tomorrow.

Cultural Perspectives on Emergency Funds

Different Viewpoints on Saving and Preparedness

In my exploration of frugal living, I have come to realize that the importance of emergency funds varies across different cultures. Each culture has its own unique viewpoint on saving and preparedness, shaped by various factors such as economic stability, societal values, and historical events.

Analyzing Cultural Factors

When analyzing cultural perspectives on emergency funds, it is crucial to consider the economic stability of a society. In countries with a robust social safety net and readily available financial support during emergencies, individuals may feel less inclined to prioritize emergency funds. On the other hand, in nations where economic uncertainty prevails, the importance of having a safety net becomes paramount.

Societal values also play a significant role in shaping cultural perspectives. In some cultures, there may be a greater emphasis on communal support, where individuals rely on their close-knit communities in times of crises rather than solely relying on personal emergency funds. This communal approach to preparedness can be seen as a form of frugality, as it encourages resource-sharing and mutual aid.

Adapting Frugality in Different Cultures

Frugality, as a lifestyle choice, can be adapted to different cultures while still emphasizing the significance of emergency funds. Educating individuals about the benefits of having a financial cushion while also respecting cultural values and norms is crucial. By tailoring frugality practices to fit cultural contexts, we can encourage individuals to save for unforeseen expenses without disregarding their established societal frameworks.

understanding cultural perspectives on emergency funds is essential in promoting a frugal approach to financial preparedness. By analyzing economic stability, societal values, and adapting frugality practices, we can encourage individuals from various cultures to make emergency funds a priority. Whether it be through personal savings, community support, or a combination of both, the importance of having a financial safety net remains crucial in navigating uncertainties that may arise in life.

Conclusion

The Importance of Emergency Funds: A Frugal Approach

In conclusion, it is clear that having an emergency fund is an essential aspect of living a frugal lifestyle. By setting aside a portion of our income for unexpected expenses, we can protect ourselves from falling into financial ruin or accumulating debt. It allows us to handle emergencies without having to rely on high-interest credit cards or personal loans.

Building and maintaining an emergency fund requires discipline and commitment. It may be difficult to set aside funds when we have immediate wants or desires. However, it is crucial to prioritize our long-term financial stability over short-term gratification.

An emergency fund serves as a safety net, providing us with peace of mind and a sense of security. It allows us to navigate through life’s unexpected twists and turns without causing unnecessary stress or worry. By being prepared, we are better equipped to handle any situation that may arise.

Additionally, having an emergency fund can help us achieve our financial goals. With the safety net of an emergency fund in place, we can confidently pursue our dreams, invest in our future, and seize opportunities that come our way. It provides us with the freedom to take calculated risks without the fear of financial instability.

In essence, emergency funds are not just about being prepared for the worst-case scenario; they are about actively choosing to live a frugal and responsible lifestyle. It is an investment in ourselves and our future. So let’s start prioritizing the importance of emergency funds and take the necessary steps to build one today. Together, we can embrace the frugal approach and gain control over our financial well-being.

I hope this article has provided valuable insights and practical advice on the significance of emergency funds in a frugal lifestyle. Remember, being prepared is key, and with an emergency fund in place, we can confidently face whatever challenges life throws our way.