Introduction

Hey there! Welcome to frugaldude.org, your ultimate resource for all things frugal living. If you’re looking to make the most of your hard-earned money and manage your household budget efficiently, you’ve come to the right place. In this article, I’ll be sharing some valuable tips and insights on how to run your household on a tight budget, the frugal way.

Understand Your Financial Situation

Before diving into the world of frugal living, it’s essential to have a clear understanding of your financial situation. Take some time to evaluate your income, expenses, and any outstanding debts or financial commitments. This evaluation will form the foundation of your frugal journey.

Create a Realistic Budget

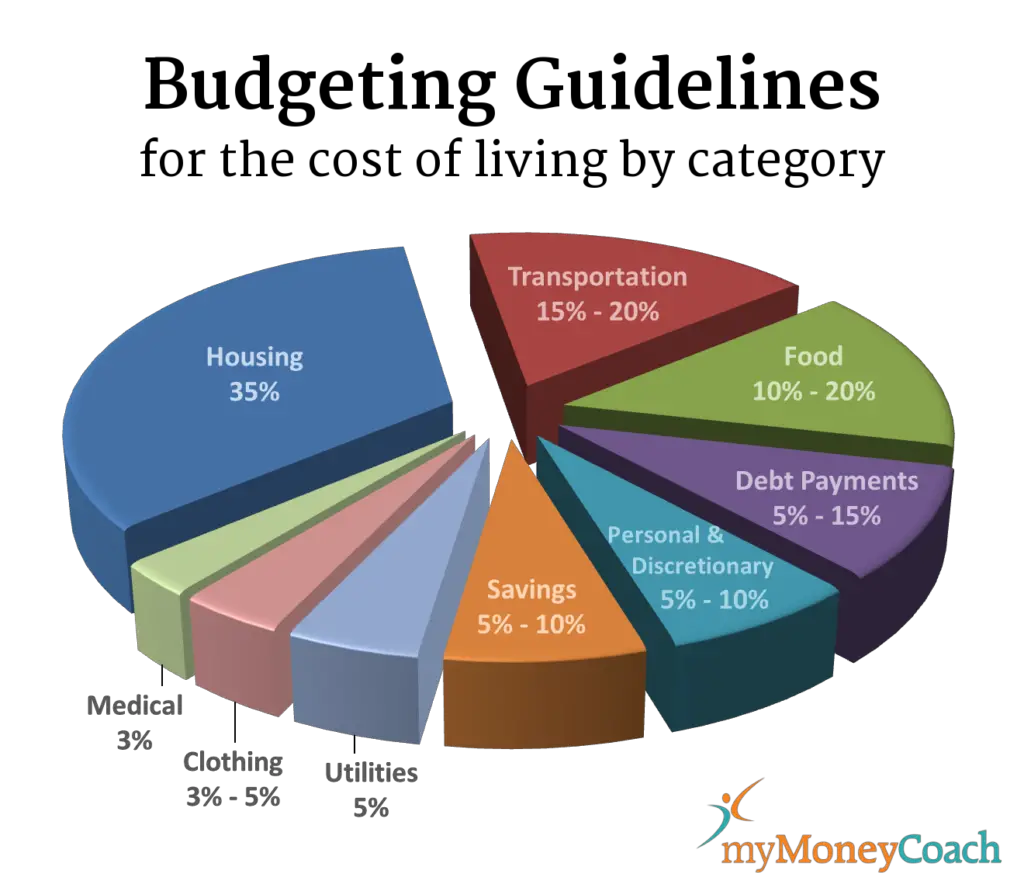

Once you have a grasp of your finances, it’s time to set up a realistic budget. Start by listing all your fixed expenses, such as rent or mortgage payments, utilities, and insurance. Then, track your variable expenses, like groceries, entertainment, and transportation, for a few months to get an accurate estimate of your spending habits. With this information, you can identify areas where you can cut back and allocate your funds more efficiently.

Reduce Your Monthly Bills

One of the most effective ways to save money is by reducing your monthly bills. Look for opportunities to decrease your utility bills by conserving energy or renegotiating contracts with service providers. Consider switching to cheaper phone plans, cutting cable subscriptions, or even downsizing your living space to reduce rent or mortgage costs.

Embrace Frugal Shopping Habits

When it comes to frugal living, adopting smart shopping habits is key. Start by making a shopping list and sticking to it to avoid impulse purchases. Prioritize buying generic and store-brand products over brand-name ones, as they are often just as good but come at a fraction of the cost. Don’t forget to compare prices and look for deals or discounts before making any major purchases.

Eliminate Unnecessary Expenses

Take a closer look at your spending habits and identify any unnecessary expenses that can be eliminated. Do you really need that gym membership if you can exercise at home or outdoors for free? Are subscription services, such as streaming platforms or monthly box subscriptions, worth the monthly expense? By cutting back on non-essential expenses, you’ll be amazed at how quickly your savings grow.

Understanding the Frugal Lifestyle

What is frugality?

Frugality is a lifestyle choice, a conscious decision to live within your means and make deliberate choices to save money. It’s about being mindful of your spending habits, prioritizing essential needs over unnecessary wants, and finding creative ways to make the most of every dollar. As a self-proclaimed frugal guru, I have discovered that frugality is not about deprivation, but rather about living a simpler, more intentional life.

Benefits of embracing frugality

Embracing a frugal lifestyle has numerous benefits that extend far beyond just saving money. By adopting a frugal mindset, you gain greater financial freedom and control over your household budget. This newfound financial stability allows you to reduce stress, eliminate debt, and build an emergency fund for unexpected expenses. Additionally, frugality encourages resourcefulness and creativity, as you learn to find innovative ways to save money while still enjoying a fulfilling life.

Common misconceptions about frugal living

Contrary to popular belief, frugal living does not mean living a miserable, penny-pinching existence. It’s about making conscious choices that align with your financial goals and values. Many people wrongly assume that frugal individuals are cheap or unwilling to spend money, but in reality, frugality is about making intentional and thoughtful decisions about where and how to allocate your resources. It’s about finding value in experiences rather than material possessions and seeking out cost-effective alternatives to achieve the same desired outcome.

By understanding the frugal lifestyle, you can take control of your household budget and make informed choices that align with your financial goals. Frugality is not about sacrifice or deprivation, but about prioritizing what truly matters and finding fulfillment in the simple pleasures of life. So, join me on this journey towards financial freedom and discover the joy of living a frugal and purposeful life.

Assessing Your Household Budget

Importance of budgeting

As someone who embraces a frugal lifestyle, managing my household budget is essential to ensure I am making the most of my resources. Budgeting allows me to track my income and expenses, prioritize my financial goals, and identify areas where I can potentially save money. This proactive approach helps me maintain control of my finances and make informed decisions about how I allocate my funds.

Tracking income and expenses

To effectively manage my household budget, I start by tracking my income and expenses. This means keeping a detailed record of all the money that comes into my household, including paychecks, bonuses, or any additional sources of income. Simultaneously, I meticulously record my expenses, whether they are fixed costs like rent or mortgage payments, utilities, and insurance, or variable expenses such as groceries, transportation, and entertainment.

By carefully tracking my income and expenses, I gain a clear understanding of my spending habits. This knowledge is invaluable as it allows me to identify areas where I may be overspending or wasting money unnecessarily.

Identifying areas for potential savings

Once I have a comprehensive overview of my income and expenses, I can better identify areas for potential savings. This involves scrutinizing my spending habits and evaluating whether there are opportunities to reduce costs without compromising on quality or value.

For instance, I might explore alternative grocery shopping options such as buying in bulk or taking advantage of discount stores. I could also assess my utility bills and look for ways to conserve energy and potentially switch to more affordable providers. Additionally, I might examine my entertainment expenses and find creative and frugal ways to have fun, such as opting for free or low-cost activities.

By actively seeking out areas for potential savings, I can make small but meaningful changes to my budget that accumulate over time, allowing me to maintain a thrifty lifestyle without feeling deprived.

assessing your household budget is a fundamental aspect of frugal living. By budgeting, tracking income and expenses, and identifying areas for potential savings, you can effectively manage your finances and make the most of your resources. It’s all about being intentional and proactive with your money to achieve your financial goals while living a fulfilling and frugal life.

Cutting Back on Expenses

Evaluating essential vs. non-essential expenses

When it comes to managing my household budget, one of the first steps I took was to evaluate my expenses and determine which ones were essential and which ones were non-essential. By doing this, I was able to identify areas where I could cut back and save some extra money.

Essential expenses are those that I absolutely need in order to maintain a basic standard of living. These typically include things like rent or mortgage payments, groceries, utilities, and transportation costs. Non-essential expenses, on the other hand, are those that aren’t necessary for day-to-day survival and can be eliminated or reduced without significantly impacting my quality of life.

Practical tips for reducing utility bills

Utility bills can often be a significant drain on my monthly budget, so finding ways to reduce them was a top priority for me. One simple way I was able to achieve this was by being mindful of my energy usage. I started turning off lights and appliances when not in use, adjusting my thermostat to conserve energy, and using energy-efficient light bulbs. Additionally, I made sure to properly insulate my home and seal any drafts to prevent energy loss.

Minimizing transportation costs

Transportation costs can quickly add up, especially if you rely heavily on a car. To cut back on these expenses, I found ways to minimize my reliance on my vehicle. I started carpooling with coworkers or neighbors whenever possible, using public transportation for my daily commute, and even biking or walking for shorter trips. Not only did this help me save money on gas and maintenance, but it also had the added benefit of promoting a healthier and more active lifestyle.

by evaluating my essential and non-essential expenses, finding practical ways to reduce utility bills, and minimizing my transportation costs, I have been able to successfully manage my household budget and live a more frugal lifestyle. It’s all about making conscious choices and being mindful of how every dollar is being spent.

Smart Shopping Strategies

Creating and sticking to a grocery budget

When it comes to managing your household budget, one of the most important aspects is your grocery spending. Creating a grocery budget can help you be more mindful of your purchases and prevent unnecessary expenses. Start by assessing your household’s needs and determine a realistic amount to allocate for groceries each month. To stick to your budget, make a list before heading to the store and only buy what you need. Avoid impulse buys by planning your meals in advance and purchasing ingredients accordingly. Additionally, consider buying in bulk for non-perishable items to save money in the long run.

Shopping for second-hand items

Another effective strategy for frugal living is shopping for second-hand items. Many things that we need in our households can easily be found in thrift stores, consignment shops, or online marketplaces. From furniture to clothing and kitchen appliances, you can score great deals on gently used items. Not only will you save money, but you will also be helping reduce waste by giving these items a second life. When shopping second-hand, keep an open mind and be patient as it may take some time to find exactly what you’re looking for.

Utilizing coupons and discounts

Coupons and discounts are a frugal shopper’s best friend. Before making any purchase, be sure to search for applicable coupons and discounts. Many websites and apps offer digital coupons that can be used at a variety of stores. Additionally, signing up for store loyalty programs or following your favorite brands on social media can provide you with exclusive discounts and promotions. It may require some extra effort, but the savings can add up significantly over time.

By implementing these smart shopping strategies, you can effectively manage your household budget and live a frugal lifestyle. Remember, it’s not about depriving yourself, but rather making thoughtful and intentional choices with your money.

Meal Planning and Cooking on a Budget

Managing a tight household budget doesn’t mean sacrificing delicious meals or resorting to unhealthy fast food options. With some smart planning and a few tips and tricks, you can enjoy budget-friendly meals that are both nutritious and tasty. In this section, I will discuss the benefits of meal planning, share some budget-friendly recipes and cooking techniques, and provide insight on reducing food waste.

Benefits of Meal Planning

Meal planning is essential when it comes to frugal living. It allows you to save time and money by knowing exactly what ingredients you need and avoiding unnecessary trips to the grocery store. By planning your meals in advance, you can also take advantage of sales and discounts, making it easier to stick to your budget. Additionally, meal planning enables you to make healthier choices as you have better control over portion sizes and ingredients.

Budget-friendly Recipes and Cooking Techniques

Cooking on a budget doesn’t mean compromising on taste or variety. There are numerous budget-friendly recipes available that are delicious, easy to make, and don’t break the bank. Opting for affordable ingredients such as beans, lentils, rice, and seasonal vegetables can help you create nutritious meals at a fraction of the cost. Additionally, learning simple cooking techniques like roasting, sautéing, and slow cooking can help you enhance the flavors of affordable ingredients and minimize the need for expensive additives.

Reducing Food Waste

Food waste is not only bad for your budget but also for the environment. Wasting food means throwing away your hard-earned money. To reduce food waste, plan your meals according to what you already have in your pantry and fridge. Use leftovers creatively to make new meals or freeze them for future use. Another great way to avoid waste is by repurposing ingredients – for example, turning vegetable peels into homemade vegetable stock. By being mindful of food waste, you can stretch your budget even further.

With these tips in mind, you can effectively manage your household budget while enjoying delicious and nutritious meals. Incorporating meal planning, budget-friendly recipes, and reducing food waste into your routine can lead to significant savings and a healthier, more sustainable lifestyle. So why wait? Start your frugal living journey today and see the positive impact it can have on your household finances!

Managing Debt and Saving Money

Strategies for paying off debt efficiently

As someone who prioritizes frugal living and managing my household budget effectively, I understand the importance of finding strategies to pay off debt efficiently. One approach that has worked well for me is the snowball method. This involves paying off the smallest debts first while making minimum payments on larger ones. Once the smaller debts are cleared, I can redirect those payments towards the next largest debt, gradually snowballing towards financial freedom.

Another useful strategy I employ is negotiating with creditors. By reaching out, explaining my financial situation, and proposing a realistic payment plan, I have been able to reduce interest rates or even settle for a lower amount. It’s a proactive approach that can make a significant difference in relieving financial burdens.

Importance of emergency funds

Having an emergency fund is crucial, especially when living on a tight budget. From unexpected medical expenses to car repairs, having funds set aside for emergencies can prevent us from relying on credit cards or accumulating more debt. I strive to save at least three to six months’ worth of living expenses in my emergency fund, providing a safety net in case of unforeseen circumstances.

Savings techniques for long-term goals

While managing my household budget, I also prioritize saving for long-term goals. One technique I find effective is automating savings. By setting up automatic transfers to a separate savings account, a portion of my income is consistently saved without any effort on my part. This ensures that I am consistently working towards my long-term goals, whether it’s purchasing a home, starting a business, or saving for retirement.

Another saving technique I employ is finding ways to cut expenses. This can include cooking at home instead of eating out, using public transportation, or canceling unused subscriptions. By identifying areas where I can make small adjustments, I am able to redirect those saved funds towards my long-term goals.

By managing debt efficiently and saving money strategically, I have found frugal living to be a sustainable and rewarding way to manage my household budget. It’s about making informed choices and prioritizing my financial wellbeing without sacrificing the things that truly matter. So, whether it’s paying off debt, building emergency funds, or saving for long-term goals, these strategies have helped me achieve financial stability while staying true to my frugal lifestyle.

Frugal Home Maintenance and Repairs

As someone who values frugal living, I understand the importance of managing my household budget wisely. One significant area where we can save money is in home maintenance and repairs. Taking a frugal approach to these tasks can help us stretch our dollars and make our homes more comfortable and functional.

DIY Home Maintenance Tips

One of the easiest ways to save money on home maintenance is by doing it yourself. By taking the time to learn basic maintenance tasks, you can avoid costly service calls and repairs. For example, you can learn how to unclog drains, replace broken tiles, or fix leaky faucets by watching online tutorials or reading DIY guides. Trust me, these skills will come in handy!

Prioritizing Repairs

When it comes to managing a tight budget, it’s essential to prioritize your home repairs. Identify the most critical repairs that need to be addressed immediately, such as a leaky roof or a malfunctioning HVAC system. By focusing on these high-priority tasks, you can allocate your limited financial resources effectively and minimize the risk of more extensive and expensive damage down the line.

Saving Money on Home Improvement Projects

Home improvement projects can eat up a significant portion of your budget if you’re not careful. However, there are ways to save money while still making your home more comfortable and appealing. Consider shopping at thrift stores or garage sales for furniture and decor items. Repurposing and upcycling existing items can also create a unique and budget-friendly look for your home. Additionally, explore low-cost alternatives for materials and hire local contractors who offer competitive rates.

By adopting a frugal mindset and implementing these tips for home maintenance and repairs, you can effectively manage your household budget without compromising your living standards. Remember, saving money in one area allows you to allocate funds for other important aspects of your life. Start embracing frugality today and see the positive impact it can have on your financial well-being.

Frugal Transportation Solutions

Carpooling and Ridesharing Options

When it comes to managing your household budget, finding ways to cut down transportation expenses can make a significant difference. One solution to consider is carpooling or ridesharing. By sharing a ride with others who have similar destinations, you can split the cost of fuel and reduce your overall transportation expenses. Websites and mobile apps dedicated to connecting drivers and passengers have made it easier than ever to find carpooling opportunities in your area. Plus, not only will carpooling save you money, but it also helps reduce traffic congestion and lowers your carbon footprint.

Maximizing the Use of Public Transportation

If carpooling isn’t a feasible option for you, maximizing the use of public transportation is another frugal solution. Depending on your location, public transportation may include buses, trains, trams, or subways. By utilizing these services instead of driving your own vehicle, you can save money on fuel, parking fees, and vehicle maintenance costs. Additionally, many cities offer discounted fares for seniors, students, and frequent commuters, providing even more savings. Research your local public transportation options and plan your journeys accordingly to make the most of this cost-effective alternative.

Maintaining a Fuel-Efficient Vehicle

For those who heavily rely on a personal vehicle, maintaining a fuel-efficient car is crucial for frugal living. Regularly servicing your vehicle, ensuring proper tire inflation, and using quality motor oil can contribute to better fuel efficiency. Additionally, adopting fuel-efficient driving habits such as avoiding sudden accelerations or braking, keeping a steady speed, and removing excess weight from your car can help save money on fuel costs. Consider investing in a hybrid or electric vehicle if you’re in the market for a new car, as these options offer even greater fuel efficiency and long-term savings.

By implementing these frugal transportation solutions, you can not only reduce your monthly expenses but also contribute to a more sustainable lifestyle. Embracing the concept of a frugal lifestyle means making mindful choices when it comes to managing your household budget – and transportation is a major factor in this equation. So, start exploring carpooling options, maximizing public transportation, and maintaining a fuel-efficient vehicle to pave the way towards a more frugal way of living.

Thrifty Entertainment and Leisure Activities

Low-cost or free recreational activities

As someone who values a frugal lifestyle, I am always on the lookout for low-cost or free recreational activities that can provide entertainment and leisure without straining my household budget. Thankfully, there are plenty of options available that allow me to have fun without breaking the bank.

One of my favorite ways to enjoy leisure activities without spending a fortune is by exploring local parks and cultural events. Many cities have amazing parks and recreational areas that offer free or low-cost access to the beauty of nature. Whether it’s taking a stroll along the walking trails, having a picnic with family and friends, or simply enjoying the scenery, these parks provide a wonderful way to relax and unwind.

Exploring local parks and cultural events

Additionally, I always keep an eye on local cultural events happening in my area. From art exhibitions and live music performances to community festivals and craft fairs, these events often offer free or inexpensive entry. They not only provide entertainment but also allow me to get a taste of the local arts and culture scene. Attending these events not only helps me save money but also supports local artists and organizations.

Organizing frugal family outings

When it comes to family outings, I make sure to plan ahead and find ways to make them affordable. I research attractions and venues in advance, looking for discounted tickets, promotional offers, or even free events. By doing so, I can create memorable experiences for my family without overspending.

embracing a frugal lifestyle doesn’t mean sacrificing entertainment and leisure activities. By taking advantage of low-cost or free recreational options such as exploring local parks and cultural events, as well as organizing smart family outings, I can enjoy a fulfilling and balanced life while managing my household budget effectively. So, why not give these thrifty entertainment ideas a try and see how they can enhance your frugal living journey?

Educating Children on Frugality

Teaching kids about money management

In today’s consumer-driven society, it is essential to teach children the value of money and instill in them good money management skills. One effective way to do this is by involving them in the household budget. Sit down with your children and explain to them the concept of a budget, including income and expenses. Encourage them to participate in decision-making processes by allowing them to suggest ways to save money. This not only educates them on financial matters but also empowers them to be financially responsible in the future.

Promoting a value-conscious mindset

Aside from teaching children about budgeting, it is important to promote a value-conscious mindset. Teach them to differentiate between wants and needs, and encourage them to prioritize needs over wants. Explain to them that material possessions do not equate to happiness and that true fulfillment can come from experiences and relationships. By instilling a value-conscious mindset in your children, you are setting them up for a lifetime of making wise and conscious spending choices.

Incorporating frugality in daily routines

Frugality should not be seen as a sacrifice but rather as a way of life. Find opportunities to incorporate frugality into your daily routines. Encourage the children to turn off lights and appliances when not in use, promote habits like meal planning and cooking at home, and involve them in activities that do not require excessive spending, such as hiking or organizing game nights. By demonstrating frugality in your daily life, you are teaching your children the importance of making mindful decisions and being resourceful.

Remember, educating children on frugality is not just about saving money. It is about instilling in them important life skills and values that will benefit them in the long run. By involving them in the household budget, promoting a value-conscious mindset, and incorporating frugality in daily routines, you are setting them on the path to financial security and a fulfilling life.

Conclusion

The Journey to Frugal Living

In conclusion, embracing a frugal lifestyle and managing your household budget can greatly impact your financial well-being. It may require adjustments, sacrifices, and a change in mindset, but the benefits are worthwhile. By adopting frugal habits, you can reduce expenses, save money, and achieve your financial goals.

Building a Solid Foundation

To begin the journey, it’s important to establish a solid financial foundation. This involves creating a budget, tracking your expenses, and identifying areas where you can cut back. By setting clear financial goals, prioritizing your spending, and making conscious choices, you can take control of your finances.

Smart Saving Strategies

One key aspect of frugal living is finding ways to save money. This can be achieved through various strategies, such as cutting back on unnecessary expenses, using coupons or discounts, and shopping smartly. By making informed purchasing decisions and embracing a minimalist mindset, you can make your money go further.

Thrifty Tips for Household Expenses

Managing your household expenses is crucial in maintaining a frugal lifestyle. Whether it’s utilities, groceries, or housing costs, there are several ways to save. From energy-efficient appliances and smart usage practices to meal planning and bulk buying, implementing these tips can significantly reduce your monthly bills.

Embracing a Resourceful Mindset

Frugal living is not just about saving money; it’s also about being resourceful. Repurposing items, practicing DIY skills, and exploring thrift stores or local markets can help you find affordable alternatives. This mindset shift encourages creativity, sustainability, and a reduced reliance on consumerism.

The Joys of Frugal Living

While the path to frugal living may initially seem challenging, it can lead to a more fulfilling life. By focusing on experiences rather than material possessions, practicing gratitude, and fostering meaningful connections, you’ll find that living within your means brings a sense of contentment and freedom.

In conclusion, managing your household budget through frugal living is an empowering journey. By implementing smart saving strategies, being mindful of your expenses, and embracing a resourceful mindset, you can take control of your finances and achieve financial stability. Remember, frugality is not about deprivation, but rather making conscious choices that align with your goals and values. So, start your frugal living journey today and reap the rewards it brings.