So, have you ever stopped and thought about how important it is to have a strong understanding of financial literacy? It’s not just about knowing how to save money or manage your expenses, but it can actually make a huge difference in the overall quality of your life. And trust me, it’s not as complicated as it might sound. In fact, I’m going to break down five essential financial literacy concepts that everyone should know, and I promise you, it’s going to be a game-changer.

Alright, let’s dive right in. The first concept is all about embracing a frugal lifestyle. Now, I know what you might be thinking – being frugal sounds like a lot of penny-pinching and misery, right? Well, not necessarily! See, being frugal is actually about being mindful of your spending habits and making intentional choices when it comes to how you use your money. It’s about prioritizing your needs over your wants and finding ways to make your money stretch further. In this article, we’ll explore some practical tips and strategies to help you adopt a frugal lifestyle without feeling like you’re missing out. Trust me, your wallet and future self will thank you for it! And don’t worry, there’s more to come in this article that will equip you with the financial knowledge you need to succeed.

Benefits of Financial Literacy

As an individual, having financial literacy skills is crucial for several reasons. Firstly, it leads to financial independence, enabling me to take control of my own financial future. Secondly, it improves decision-making abilities, empowering me to make informed choices about how to manage my money. Lastly, it reduces stress and anxiety related to financial matters, as I am better equipped to handle financial challenges that may arise.

Financial Independence

Financial independence refers to the ability to support oneself without relying on others for financial assistance. By developing financial literacy skills, I am able to understand and navigate the complex world of personal finance. This knowledge allows me to earn and manage money effectively, which in turn grants me the freedom to make choices based on my own financial goals and aspirations.

Financial independence also allows me to break free from the cycle of living paycheck to paycheck. When I am financially literate, I can budget, save, and invest my money wisely, resulting in a more stable and secure financial future.

Improved Decision Making

Financial literacy plays a crucial role in improving my decision-making abilities. With a solid understanding of personal finance, I can make informed choices about where to allocate my money. This includes deciding how much to spend, how much to save, and where and when to invest.

Furthermore, financial literacy enables me to assess financial risks and rewards more effectively. By understanding concepts such as risk tolerance, diversification, and asset allocation, I can make strategic investment decisions that align with my financial goals.

Additionally, financial literacy equips me with the knowledge and skills to evaluate financial products and services. Whether it’s comparing credit cards, insurance policies, or investment options, I can confidently choose the options that best suit my needs and financial objectives.

Reduced Stress and Anxiety

Financial stress and anxiety can have a significant impact on both my mental and physical well-being. However, by developing financial literacy skills, I am better equipped to handle financial challenges, reducing the stress and anxiety associated with money management.

Having a clear understanding of budgeting, saving, and investing allows me to have a more accurate picture of my financial situation. This clarity helps me avoid overspending, take control of my debt, and reduce financial strain.

Moreover, financial literacy provides me with the tools to plan for unexpected expenses and emergencies. By building an emergency fund and having appropriate insurance coverage, I can alleviate the worry and uncertainty that often accompany financial emergencies.

Understanding Budgeting

Budgeting is a fundamental concept in financial literacy. It involves the process of creating a plan to manage income and expenses effectively, ensuring that my financial resources are utilized in the most efficient way possible.

Importance of a Budget

A budget serves as a roadmap for my financial journey. It allows me to prioritize my spending, allocate funds to different categories such as housing, transportation, groceries, and entertainment, and set aside savings for future goals.

With a budget, I can track my income and expenses, making it easier to identify areas where I may be overspending or where I can cut back. This knowledge helps me make adjustments and take control of my financial situation.

A budget also helps me plan for large expenses, such as buying a car or a house, by saving in advance. By incorporating these expenses into my budget, I can work towards achieving my goals without resorting to excessive debt.

Creating a Personal Budget

Creating a personal budget starts with assessing my income and determining my fixed and variable expenses. Fixed expenses are those that remain relatively consistent month to month, such as rent or mortgage payments, while variable expenses fluctuate, such as groceries or utility bills.

Once I have identified my income and expenses, I can allocate funds to each category based on my priorities and financial goals. It is important to ensure that my expenses do not exceed my income and to allocate a portion of my income towards savings.

Tracking Expenses

Tracking expenses is a vital component of maintaining a budget. By recording and categorizing my expenses, I can identify areas where I may be overspending and make adjustments accordingly.

There are various tools and apps available that can help me track my expenses effectively. These tools allow me to input my expenses and categorize them, providing a clear picture of where my money is going. This information can then be used to make informed financial decisions and adjust my spending habits if necessary.

Saving and Investing

Saving and investing are essential components of financial literacy. They provide me with the means to build wealth, achieve my financial goals, and secure a comfortable future.

Building an Emergency Fund

One of the first steps towards financial security is building an emergency fund. An emergency fund is a designated savings account that is specifically reserved for unexpected expenses or emergencies.

Having an emergency fund allows me to handle unexpected events, such as medical emergencies, car repairs, or job loss, without resorting to credit card debt or other forms of borrowing. By setting aside a portion of my income each month and gradually building up my emergency fund, I can create a financial safety net that provides peace of mind and financial stability.

Investment Options

Investing is an effective way to grow wealth over the long term. By investing my money wisely, I can potentially earn a higher return on my investment compared to traditional savings accounts.

There are various investment options available, including stocks, bonds, mutual funds, and real estate. Each option carries its own level of risk and potential for returns, so it is important to conduct thorough research and consider the level of risk that aligns with my financial goals and risk tolerance.

Investing can be done through brokerage accounts, retirement accounts, or automated investment platforms. The key is to start early and consistently contribute to my investments to take advantage of the power of compounding over time.

Compound Interest and its Benefits

Compound interest is a concept that works to my advantage when it comes to saving and investing. It refers to the interest earned on both the initial principal and any accumulated interest.

Compound interest allows my money to grow exponentially over time. By reinvesting the interest earned, I can earn interest on top of interest, leading to significant growth in my savings and investments.

The earlier I start saving and investing, the more time I have for compound interest to work its magic. This highlights the importance of starting early and consistently contributing to savings and investment accounts.

Credit Management

Credit management is an essential aspect of financial literacy. It involves understanding credit scores, managing credit cards responsibly, and avoiding excessive debt.

Importance of Credit Score

A credit score is a numerical representation of my creditworthiness. It is used by lenders, landlords, and other financial institutions to assess the level of risk associated with lending me money or providing credit.

Having a good credit score is important as it can affect my ability to secure loans or credit cards, and it can also impact the interest rates offered to me. A high credit score allows me to access credit at more favorable terms, saving me money in the long run.

To maintain a good credit score, I need to make timely payments on my credit accounts, keep credit utilization low, and manage debt responsibly. Regularly checking my credit report for errors or discrepancies is also important to ensure the accuracy of my credit score.

Managing Credit Cards

Credit cards can be powerful financial tools when used responsibly. They allow me to make purchases without immediately paying cash, provide fraud protection, and offer various rewards and benefits.

However, it is crucial to manage credit cards wisely to avoid falling into debt. This includes only charging what I can afford to pay off in full each month, keeping track of expenses, and paying bills on time to avoid interest charges and late fees.

Using credit cards responsibly and paying off balances in full can help me build a positive credit history, which in turn improves my credit score. By practicing responsible credit card management, I can enjoy the benefits of credit cards while avoiding unnecessary debt.

Avoiding Debt

Excessive debt can have a significant negative impact on my financial well-being. It can lead to financial stress, limit my options and financial freedom, and result in long-term financial struggles.

To avoid excessive debt, it is important to live within my means and avoid unnecessary borrowing. This involves creating and sticking to a budget, saving for large purchases instead of relying on credit, and paying off existing debt obligations in a timely manner.

It is also important to be mindful of the interest rates associated with different types of debt. High-interest debt, such as credit card debt, can quickly accumulate and become difficult to manage. By prioritizing debt repayment and focusing on reducing high-interest debt first, I can effectively manage my debt and avoid unnecessary financial burden.

Understanding Insurance

Insurance is an important aspect of financial literacy that provides protection against unexpected events and losses. It involves understanding the different types of insurance coverage available and ensuring adequate protection.

Types of Insurance

There are various types of insurance coverage that individuals should be aware of:

-

Health Insurance: Health insurance provides coverage for medical expenses and can help protect against significant healthcare costs. It is essential to have health insurance coverage to ensure access to necessary healthcare services and to avoid potential financial strain due to medical emergencies or illnesses.

-

Auto Insurance: Auto insurance provides coverage in the event of an accident, damage, or theft involving a vehicle. In many jurisdictions, it is a legal requirement to have auto insurance coverage. Understanding the different types of coverage available, such as liability, collision, and comprehensive, is essential to ensure adequate protection.

-

Home Insurance: Home insurance provides coverage for property damage and liability. It protects against losses caused by events such as fire, theft, or natural disasters. Having home insurance is crucial to protect one of the most significant investments individuals make – their homes.

Importance of Health Insurance

Having health insurance is essential for both financial and personal reasons. It provides access to necessary healthcare services and protects against high medical costs that can result from unexpected illnesses or injuries.

Without health insurance, medical expenses can quickly accumulate, leading to significant financial strain. By having adequate health insurance coverage, individuals can receive the necessary medical treatment without worrying about the financial implications.

Auto and Home Insurance

Auto and home insurance are also crucial for financial protection. In the event of an accident or damage to a vehicle or home, having insurance coverage ensures that the financial burden is minimized.

Auto insurance not only covers the cost of repairs but also provides liability coverage, protecting against potential legal and financial consequences in the event of an accident.

Home insurance provides financial protection for homeowners by covering repair or replacement costs in the event of damage or loss caused by covered events such as fire, theft, or natural disasters.

Understanding the importance of insurance coverage and selecting appropriate policies for individual needs is key to ensuring financial protection and peace of mind.

Retirement Planning

Retirement planning is an essential concept in financial literacy. It involves understanding the importance of retirement plans, the different types of retirement accounts available, and how to calculate retirement needs.

Importance of Retirement Plans

Retirement planning is crucial to ensure financial security and stability during the later years of life. Without proper planning and saving, individuals may find themselves struggling to meet their financial needs after retirement.

Retirement plans, such as employer-sponsored plans like 401(k)s or individual retirement accounts (IRAs), provide individuals with the opportunity to save and invest for retirement. These plans offer various tax advantages and incentives to encourage individuals to save for their future.

By starting early and consistently contributing to retirement plans, individuals can take advantage of the power of compounding and potentially grow their retirement savings significantly over time.

Types of Retirement Accounts

There are several types of retirement accounts individuals can utilize:

-

401(k): A 401(k) is an employer-sponsored retirement account. Contributions to a 401(k) are made on a pre-tax basis, meaning they are deducted directly from the individual’s paycheck before taxes. The funds in a 401(k) grow tax-deferred until withdrawal during retirement.

-

Traditional IRA: An IRA is an individual retirement account that individuals can contribute to independently. Contributions to a traditional IRA are made on a pre-tax basis, and the funds grow tax-deferred until withdrawal in retirement.

-

Roth IRA: A Roth IRA is another type of individual retirement account. Contributions to a Roth IRA are made on an after-tax basis, meaning they are not tax-deductible. However, qualified withdrawals from a Roth IRA during retirement are tax-free.

It is important to understand the rules and limitations associated with each type of retirement account to make informed decisions about saving and investing for retirement.

Calculating Retirement Needs

Calculating retirement needs is an essential step in retirement planning. It involves estimating the amount of money needed to maintain a desired standard of living after retirement.

Several factors should be considered when calculating retirement needs, including current income, lifestyle expectations, expected retirement age, and potential healthcare expenses.

Tools such as retirement calculators can assist in estimating retirement needs based on these factors. It is important to regularly review and adjust these estimates as circumstances and goals change over time.

By calculating retirement needs and setting specific savings goals, individuals can create a roadmap for saving and investing to achieve a secure and comfortable retirement.

Understanding Taxes

Understanding taxes is a fundamental aspect of financial literacy. It involves knowledge of different types of taxes, tax deductions and credits, and the process of filing taxes.

Types of Taxes

There are various types of taxes that individuals may encounter:

-

Income Tax: Income tax is levied on an individual’s earnings. It can be categorized into different tax brackets based on income levels, with higher income earners paying a higher percentage of their income in taxes.

-

Sales Tax: Sales tax is imposed on the purchase of goods and services. The rate of sales tax varies depending on the jurisdiction and the type of goods or services being purchased.

-

Property Tax: Property tax is levied on real estate property. The amount of property tax owed is based on the assessed value of the property.

-

Estate Tax: Estate tax is imposed on the transfer of assets after death. It applies to estates exceeding a certain value and varies based on the jurisdiction.

Tax Deductions and Credits

Tax deductions and credits can help reduce the amount of tax owed. Deductions reduce taxable income, while credits directly reduce the amount of tax owed.

Common tax deductions include mortgage interest, student loan interest, and contributions to retirement accounts.

Tax credits can be more beneficial as they directly decrease the amount of tax owed. Examples of tax credits include the child tax credit, earned income tax credit, and education-related credits.

Understanding and taking advantage of eligible tax deductions and credits can help reduce tax liabilities and potentially increase tax refunds.

Filing Taxes

Filing taxes is the process of reporting income and other relevant financial information to the government. It is important to file taxes accurately and in a timely manner to comply with legal requirements.

Individuals can file taxes independently or seek the assistance of professional tax preparers. The process typically involves gathering necessary documentation (such as W-2 forms, 1099 forms, and receipts), completing the appropriate tax forms, and submitting them to the relevant tax authorities.

Filing taxes can be complex, especially with changing tax laws and regulations. Staying informed about tax laws and seeking professional guidance if needed can help ensure compliance and optimize tax outcomes.

Managing Debt

Managing debt is a crucial component of financial literacy. It involves understanding different types of debt, implementing effective debt repayment strategies, and considering debt consolidation options.

Types of Debt

There are several types of debt individuals may encounter:

-

Student Loans: Student loans are loans taken out to finance education expenses. They can be categorized as federal loans or private loans, each with its own repayment terms and options.

-

Credit Card Debt: Credit card debt is accumulated when individuals carry balances on their credit cards and do not pay them off in full each month. High-interest rates associated with credit cards can make it challenging to manage and repay this type of debt.

-

Mortgage Debt: Mortgage debt refers to the debt owed on a home loan. This debt is typically repaid over an extended period, such as 15 or 30 years, and is secured by the property itself.

Debt Repayment Strategies

Developing effective debt repayment strategies is essential for managing debt and improving financial well-being. Several strategies can be employed:

-

Snowball Method: The snowball method involves prioritizing debt repayment by starting with the smallest debt balance and gradually working towards larger balances. Making minimum payments on all debts while allocating additional funds towards the smallest debt can provide a sense of accomplishment and motivation as debts are gradually eliminated.

-

Avalanche Method: The avalanche method focuses on prioritizing debt repayment based on interest rates. Debts with higher interest rates are targeted first, as they accumulate more interest over time. By allocating extra funds towards the highest-interest debt while making minimum payments on other debts, overall interest paid can be reduced.

-

Debt Consolidation: Debt consolidation involves combining multiple debts into a single loan to simplify repayment. This can be done through various methods, such as obtaining a personal loan or using a balance transfer credit card with a lower interest rate. Debt consolidation can streamline repayment and potentially lower interest costs.

Choosing the most suitable debt repayment strategy depends on individual circumstances and preferences. Assessing debt obligations, interest rates, and available resources can help determine the best approach.

Debt Consolidation

Debt consolidation can be an effective strategy for managing multiple debts. It involves combining debts into a single loan or credit account, simplifying repayment and potentially lowering interest costs.

There are different methods of debt consolidation, including obtaining a personal loan, using a home equity loan or line of credit, or transferring balances to a credit card with a lower interest rate.

By consolidating debts, individuals can streamline their repayment process, make a single monthly payment, and potentially reduce overall interest costs. However, it is crucial to carefully assess the terms and costs associated with the consolidation option to ensure it is a beneficial solution.

Financial Goal Setting

Financial goal setting is an important aspect of financial literacy. It involves identifying specific financial goals, creating a plan to achieve them, and regularly monitoring progress.

Identifying Goals

Before setting financial goals, it is important to clarify what I want to achieve. This may include short-term goals, such as saving for a vacation or paying off credit card debt, as well as long-term goals, such as buying a house or retiring comfortably.

Goals should be specific, measurable, attainable, relevant, and time-bound (SMART) to provide a clear framework for action.

Creating a Plan

Once goals are identified, creating a plan to achieve them is crucial. This involves breaking down goals into actionable steps and determining the necessary resources and timeline.

A financial plan may include elements such as budgeting, saving, investing, debt repayment strategies, and insurance coverage. It is important to regularly review and adjust the plan as circumstances and goals change.

Monitoring Progress

Monitoring progress is essential to ensure that financial goals are being achieved. Regularly reviewing goals, tracking expenses, and assessing savings and investment performance can provide valuable insights into progress.

By monitoring progress, I can make necessary adjustments, celebrate achievements, and stay on track towards reaching financial goals.

Estate Planning

Estate planning is an important element of financial literacy. It involves making arrangements for the distribution of assets and wealth after death, ensuring that wishes are carried out and potential tax implications are minimized.

Importance of Estate Planning

Estate planning allows individuals to have control over the distribution of their assets and ensures that loved ones are taken care of after death. Without proper estate planning, assets may be subject to probate, where the court determines how assets are distributed, potentially resulting in delays, disputes, and higher costs.

Estate planning also involves creating legal documents, such as wills and trusts, that serve as instructions for asset distribution. These documents can help reduce estate taxes and provide protection for beneficiaries.

Wills and Trusts

Wills and trusts are essential components of estate planning:

-

Will: A will is a legal document that specifies how assets should be distributed after death. It allows individuals to name beneficiaries, designate guardians for minor children, and make specific requests. Having a will ensures that assets are distributed according to personal wishes.

-

Trust: A trust is a legal arrangement where a person (the grantor) transfers assets to a trustee, who manages and distributes the assets to beneficiaries according to specific instructions. Trusts can be useful for minimizing estate taxes, protecting assets, and maintaining privacy.

It is important to regularly review and update wills and trusts to ensure they reflect current wishes and circumstances.

Inheritance Tax

Inheritance tax is a tax imposed on the transfer of assets from an estate to beneficiaries after death. The tax rate and thresholds vary depending on the jurisdiction.

Understanding the potential implications of inheritance tax is crucial for effective estate planning. Consulting with a financial advisor or estate planning professional can help navigate the complexities of inheritance tax and minimize its impact.

Financial Fraud and Scams

Being aware of financial fraud and scams is an important aspect of financial literacy. It involves understanding common scams, protecting personal information, and reporting fraudulent activities.

Common Scams

There are various types of financial scams that individuals should be aware of:

-

Phishing Scams: Phishing scams involve fraudulent attempts to obtain personal information, such as passwords or credit card numbers, by posing as a reputable entity through email, text message, or phone calls.

-

Ponzi Schemes: Ponzi schemes involve fraudulent investment operations where returns are paid to investors using funds obtained from new investors. This type of scam eventually collapses when there are no longer enough new investors to sustain the operation.

-

Identity Theft: Identity theft occurs when someone unlawfully obtains and uses another person’s personal information for financial gain. This can lead to unauthorized access to bank accounts, credit card fraud, or other criminal activities.

It is important to be vigilant and cautious when encountering unfamiliar offers or requests for personal information. Avoiding sharing personal information with unknown parties, regularly monitoring financial accounts, and reporting suspicious activities can help protect against financial fraud and scams.

Protecting Personal Information

Protecting personal information is crucial for safeguarding against identity theft and financial fraud. This includes:

-

Regularly monitoring financial accounts and credit reports for suspicious activity or errors.

-

Using strong, unique passwords for online accounts and regularly updating them.

-

Avoiding sharing personal information, such as social security numbers or passwords, through email or other unsecured means.

-

Shredding documents containing personal information before discarding them.

-

Being cautious when sharing personal information online or over the phone, especially with unknown individuals or companies.

Reporting Fraud

If I become a victim of financial fraud or encounter suspicious activities, it is important to report the incident to the appropriate authorities. This can include local law enforcement, state attorney general’s office, or federal agencies such as the Federal Trade Commission or the Consumer Financial Protection Bureau.

By reporting fraudulent activities, I can help protect myself and others from falling victim to scams and contribute to the prevention and prosecution of financial fraud.

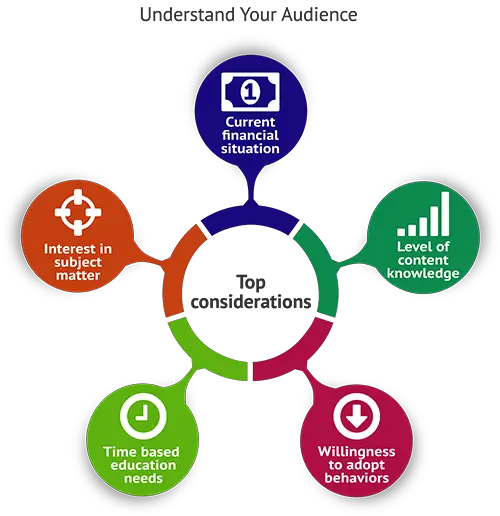

Teaching Financial Literacy

Teaching financial literacy is essential to empower individuals with the knowledge and skills to make informed financial decisions. It involves education and awareness at an early age, incorporating financial lessons at home, and utilizing school programs and resources.

Importance of Early Education

Introducing financial concepts to children at an early age is crucial for building a strong foundation of financial literacy. Early education can help children develop good financial habits, such as saving, budgeting, and understanding the value of money.

By integrating financial concepts into school curricula and offering financial literacy programs in community organizations, young individuals can be equipped with the necessary skills to make informed financial decisions throughout their lives.

Incorporating Financial Lessons at Home

Parents and guardians play a crucial role in teaching financial literacy to children. By incorporating financial lessons into everyday activities and discussions, children can develop a strong understanding of money management and financial principles.

Activities such as budgeting for family expenses, saving for specific goals, and involving children in financial decision-making can provide practical experiences and lessons that foster financial literacy.

School Programs and Resources

Schools and educational institutions can provide valuable resources and programs to promote financial literacy. This can include dedicated financial literacy courses, online resources, or partnerships with financial institutions or community organizations.

By equipping students with financial knowledge and skills, schools can empower them to make informed financial decisions and prepare them for the challenges and opportunities they may encounter in the future.

Impacts of Financial Literacy

Financial literacy has several positive impacts on both individuals and society as a whole. These impacts include individual financial well-being, economic stability, and reduced inequality.

Individual Financial Well-being

Financial literacy empowers individuals to take control of their financial well-being. It enables them to make informed decisions about saving, investing, managing debt, and planning for the future.

By having the knowledge and skills to navigate financial challenges and opportunities, individuals can achieve their financial goals, increase their financial security, and enjoy a higher quality of life.

Economic Stability

Financially literate individuals contribute to economic stability. They are better equipped to manage their personal finances, reducing the risk of financial crises or significant debt burdens that can impact the overall economy.

Moreover, financial literacy fosters responsible borrowing, investing, and spending habits, leading to a more stable and sustainable economy.

Reduced Inequality

Financial literacy plays a role in reducing economic inequality. By providing individuals with the knowledge and skills to effectively manage their finances, financial literacy can narrow the wealth gap and promote upward mobility.

Financial literacy education can empower individuals from all socioeconomic backgrounds to make informed financial decisions, access financial services, and break free from cycles of poverty.

Conclusion

Financial literacy is essential for navigating the complexities of personal finance, achieving financial goals, and securing a comfortable future. By understanding concepts such as budgeting, saving, investing, credit management, insurance, retirement planning, taxes, debt management, goal setting, estate planning, fraud prevention, and teaching financial literacy, individuals can take control of their financial well-being, contribute to economic stability, and reduce inequality.