So, I just came across this really interesting article titled “Effective Money-Saving Challenges for Financial Success.” And let me tell you, I am all about finding ways to be more frugal and save money. I mean, who doesn’t want to have more financial success, right? So, I’m really excited to dive into this article and see what these challenges are all about. I’m always up for trying new methods to save some extra cash and hopefully improve my overall financial situation.

From what I can gather, this article promises to give me some effective money-saving challenges that I should definitely try. I’m curious to know what these challenges are and how they can help me in my quest for financial success. It’s always good to have some concrete strategies and goals, so I’m interested to see how these challenges can help me in adopting a more frugal lifestyle. I have a feeling that this article is going to provide me with some practical and actionable tips that I can start implementing right away. I can’t wait to learn more and start my money-saving journey!

Effective Money-Saving Challenges for Financial Success

Frugal living is a path towards financial success that anyone can embark on. By adopting a frugal lifestyle, you can become more mindful of your spending habits, make conscious decisions about your expenses, and ultimately save more money. In this article, I will discuss the benefits of a frugal lifestyle, strategies to implement cost-cutting measures, ways to identify and prioritize essential expenses, creating and sticking to a budget, and securing financial stability through savings.

Understanding the Benefits of a Frugal Lifestyle

Living a frugal lifestyle comes with numerous benefits that can contribute to your overall financial success. When you adopt a frugal mindset, you become more conscious of your spending habits and are less likely to make impulsive purchases. This can help you avoid unnecessary expenses and save money in the long run. Additionally, a frugal lifestyle encourages resourcefulness and creativity in finding ways to meet your needs without spending a fortune. It also cultivates gratitude for what you have and promotes a minimalist approach, which can lead to a more fulfilling and less materialistic life.

Implementing Cost-Cutting Strategies

Implementing cost-cutting strategies is an essential step in the journey towards financial success. There are numerous ways you can save money in your day-to-day life. For instance, you can reduce your energy consumption by turning off lights and unplugging electronics when not in use, or by using energy-efficient appliances. Additionally, you can save on groceries by meal planning, buying in bulk, and shopping for deals and discounts. Other cost-cutting strategies include using public transportation, carpooling, utilizing free online resources, and cutting back on unnecessary subscriptions and memberships.

Identifying and Prioritizing Essential Expenses

To effectively manage your finances, it is crucial to identify and prioritize your essential expenses. This means distinguishing between needs and wants and making conscious choices about your spending. Start by listing all your expenses and categorizing them into essentials (such as housing, utilities, and groceries) and non-essentials (such as entertainment, dining out, and luxury items). Next, prioritize your essential expenses and allocate a specific portion of your income to cover them. By doing this, you can ensure that your basic needs are met while also allowing room for savings and discretionary spending.

Creating and Sticking to a Budget

One of the key elements of financial success is creating and sticking to a budget. A budget helps you track your income and expenses, plan for future expenses, and identify areas where you can cut back and save more money. Start by tracking your monthly income and fixed expenses, such as rent/mortgage, utilities, insurance, and loan payments. Then, allocate a specific amount for variable expenses like groceries, transportation, and leisure activities. Finally, set aside a portion of your income for savings and emergency funds. By regularly reviewing and adjusting your budget, you can establish healthy financial habits and make progress towards your financial goals.

Securing Financial Stability Through Savings

Saving money is an essential component of financial stability. It provides a safety net for unexpected expenses, helps you achieve long-term financial goals, and gives you peace of mind. To start saving effectively, you need to set specific savings goals and establish a savings plan. Determine how much you want to save each month or year and create a separate savings account to hold your savings. Automate your savings by setting up automatic transfers from your checking account to your savings account. Additionally, consider diversifying your savings by investing in low-risk options such as a high-yield savings account or a certificate of deposit. By prioritizing savings, you can build a solid foundation for financial stability and future success.

Money-Saving Challenges: A Fun and Effective Approach

While adopting a frugal lifestyle and implementing cost-cutting strategies are effective ways to save money, money-saving challenges can provide an added boost of motivation and fun to your savings journey. In this section, we will explore different money-saving challenges and how they can help you achieve your financial goals.

Introduction to Money-Saving Challenges

Money-saving challenges are structured programs or activities designed to encourage individuals to save money in a specific timeframe or through a particular approach. These challenges provide a structured framework, clear goals, and often incorporate gamification elements to make saving money more enjoyable and rewarding. By participating in money-saving challenges, you can develop a habit of saving, stay motivated, and witness tangible progress towards your financial goals.

Setting Realistic Saving Goals

Before embarking on a money-saving challenge, it is essential to set realistic saving goals. Consider your financial situation, income, expenses, and any upcoming financial commitments. Set a specific amount or percentage of your income that you aim to save through the challenge. It’s important to be realistic and choose a goal that is challenging yet attainable based on your individual circumstances. By setting achievable goals, you can stay motivated throughout the challenge and increase your chances of success.

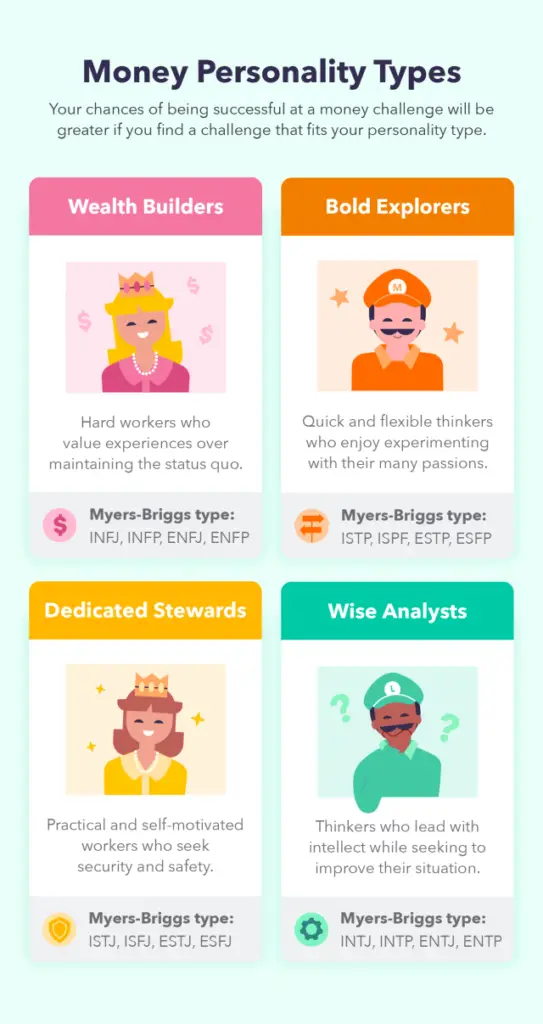

Choosing the Right Challenge for You

There are numerous money-saving challenges available, each catering to different lifestyles, preferences, and financial goals. When selecting a challenge, consider factors such as the duration of the challenge, the savings method involved, and the level of difficulty. Some popular money-saving challenges include the 52-Week Money Challenge, the No-Spend Challenge, the Meal Planning Challenge, the Energy-Saving Challenge, the Decluttering Challenge, and the Cash-Only Challenge. Choose a challenge that aligns with your interests, values, and financial priorities.

Challenges that Encourage Habit Formation

Money-saving challenges are not just about saving money in the short term; they also aim to cultivate long-lasting habits that can contribute to ongoing financial success. Many challenges focus on habit formation by encouraging participants to develop daily or weekly saving routines. By consistently saving small amounts over an extended period, you can develop discipline, improve your financial habits, and create a foundation for sustainable savings in the future.

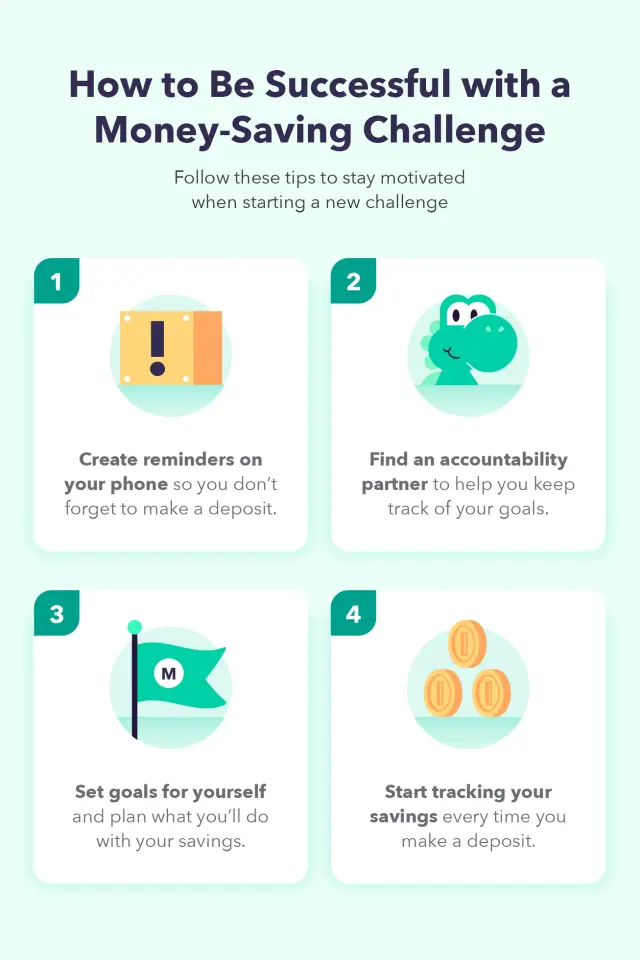

Incorporating Challenges into Your Daily Routine

To make the most of money-saving challenges, it is important to incorporate them into your daily routine. Treat saving money as a priority and integrate it into your everyday life. Set a specific time each day or week to review your progress, make deposits into your savings account, or brainstorm new ways to cut expenses. By making saving money a regular part of your routine, you can stay focused, accountable, and motivated throughout the challenge.

Challenge 1: The 52-Week Money Challenge

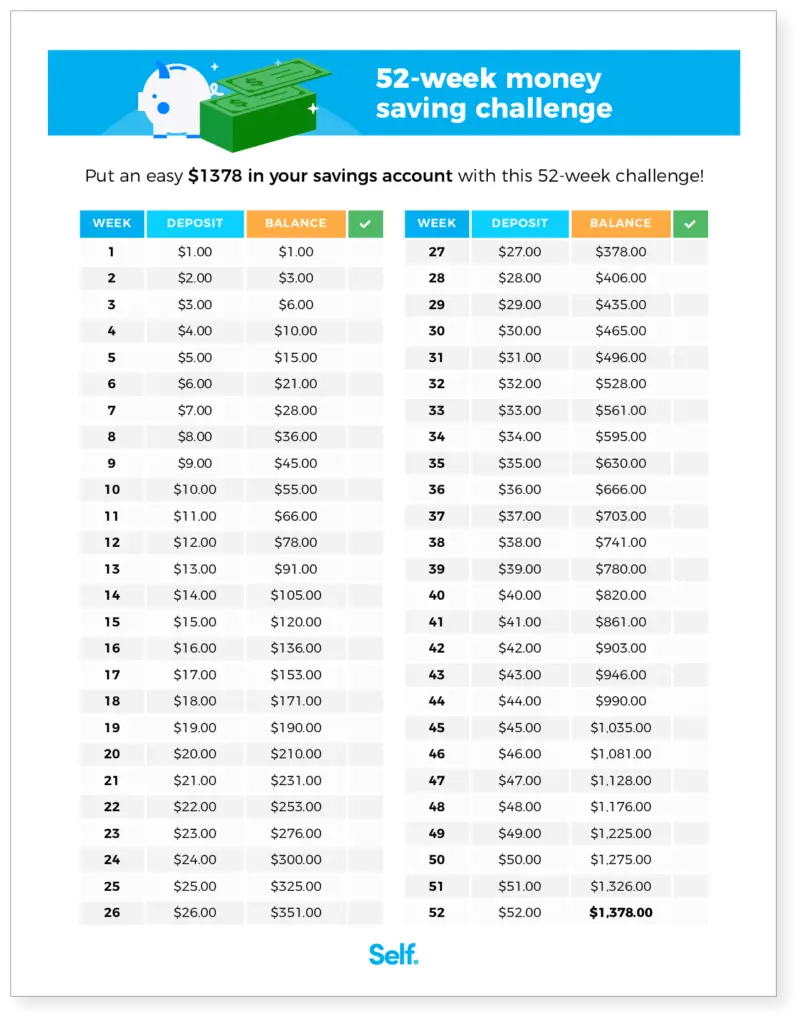

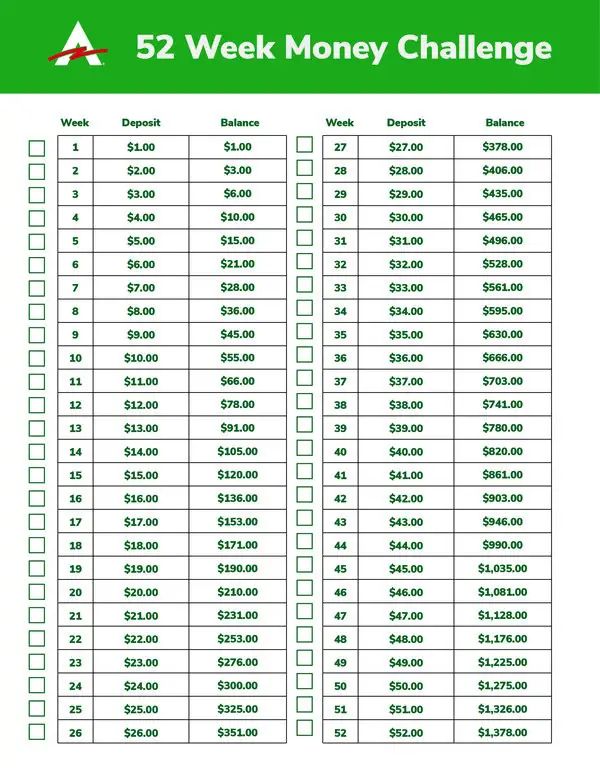

Understanding the Concept of the 52-Week Money Challenge

The 52-Week Money Challenge is a popular savings challenge that spans an entire year. The challenge involves saving a specific amount of money each week, gradually increasing the savings amount as the weeks progress. The challenge is structured in such a way that it starts with smaller increments and gradually builds up to larger sums. This allows participants to save more money over time while minimizing the impact on their monthly budget.

How to Get Started with the 52-Week Money Challenge

To get started with the 52-Week Money Challenge, you need to set up a savings plan and commit to saving a specific amount each week. Begin by deciding on an initial savings amount based on your financial capabilities. This can be as low as $1 or $5, depending on your comfort level. Each subsequent week, increase the savings amount by a fixed increment, such as $1 or $5. The total savings for the challenge will be the sum of all the weekly savings. Consider automating your savings by setting up automatic transfers from your checking account to your designated savings account.

Tips for Staying Motivated Throughout the Year

Staying motivated throughout a year-long challenge like the 52-Week Money Challenge can be challenging. Here are some tips to help you stay on track:

-

Make it visible: Create a visual representation of your progress, such as a chart or jar to track your savings. Seeing your savings grow visually can provide a sense of accomplishment and motivate you to continue saving.

-

Celebrate milestones: Set milestones for yourself at certain intervals, such as every three months or after reaching specific savings targets. Celebrate these milestones by treating yourself to something meaningful that aligns with your financial goals.

-

Join a community: Participate in online communities or forums where people are also taking part in the 52-Week Money Challenge. Share your progress, seek advice, and engage with others who are on the same savings journey. Having a support system can keep you motivated and accountable.

-

Find alternative sources of income: Consider exploring additional sources of income, such as freelance work or selling unused items, to supplement your savings. Generating extra income can help you reach your savings targets more quickly and keep you motivated.

Alternative Approaches to the 52-Week Money Challenge

While the traditional 52-Week Money Challenge entails increasing savings incrementally each week, you can also modify the challenge to suit your individual circumstances. Here are a few alternative approaches you can consider:

-

Reverse 52-Week Money Challenge: Instead of starting small and gradually increasing the savings amount, start with a higher savings amount and decrease it each week. This front-loads your savings, allowing you to save more money at the beginning of the challenge when motivation is typically higher.

-

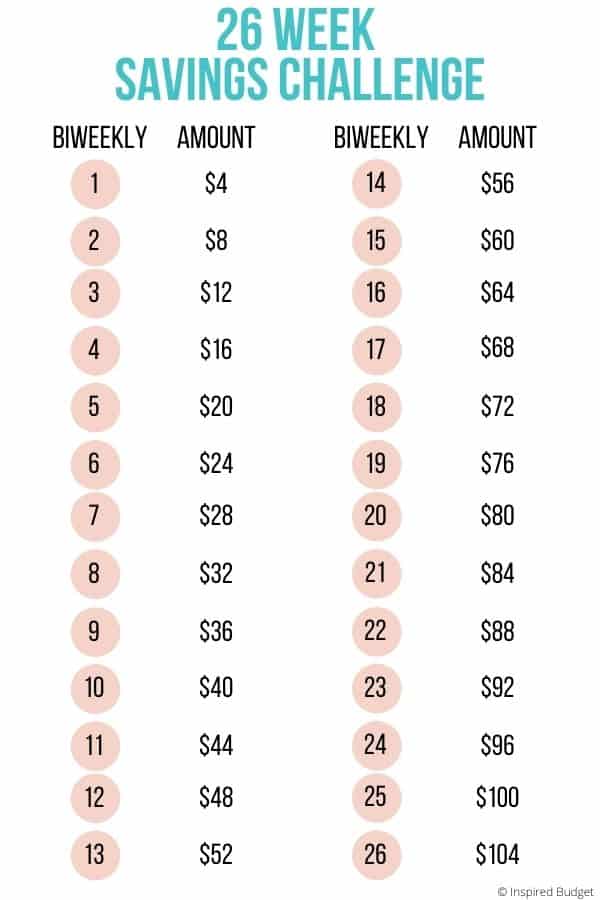

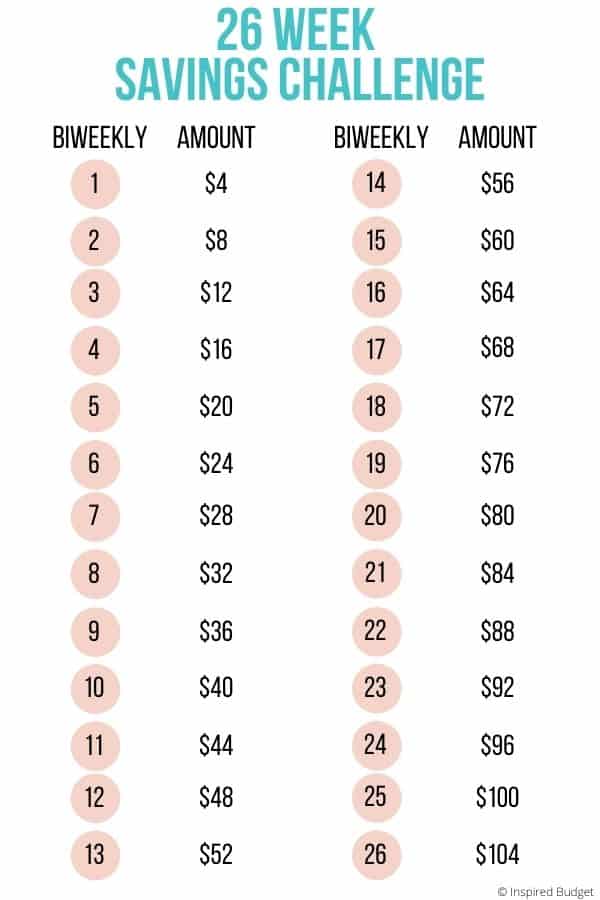

Bi-Weekly or Monthly Savings Challenge: If saving money weekly is not feasible for you, consider modifying the challenge to bi-weekly or monthly intervals. Determine a specific amount to save bi-weekly or monthly and adjust it as needed to fit your budget.

-

Customize Your Savings Increments: Instead of following a fixed increment, tailor the savings amounts based on what works best for you. Some weeks, you may choose to save more, while other weeks, you may save less. The key is to aim for an overall target by the end of the challenge.

Remember, the goal of any money-saving challenge is to develop a consistent savings habit and make progress towards your financial goals. Choose the approach that best aligns with your needs and circumstances.

Challenge 2: The No-Spend Challenge

Introduction to the No-Spend Challenge

The No-Spend Challenge is a money-saving challenge designed to help participants curb their spending habits and become more conscious consumers. The challenge involves refraining from spending money on non-essential items or activities for a specified period, whether it’s a week, a month, or longer. The goal is to evaluate and reassess spending habits, identify areas of unnecessary expenditure, and redirect the saved money towards important financial goals, such as debt repayment or savings.

Setting Rules and Guidelines for the No-Spend Challenge

To successfully complete the No-Spend Challenge, it is important to establish clear rules and guidelines. Define what constitutes an essential expense and identify specific categories or items that are off-limits during the challenge. This can include dining out, entertainment, clothing, or unnecessary subscriptions. Determine the duration of the challenge and commit to adhering to the rules throughout that period. It may also be helpful to share your goals and rules with a friend or family member who can hold you accountable and offer support.

Finding Creative Ways to Fulfill Your Needs without Spending

During the No-Spend Challenge, it is important to find creative ways to fulfill your needs without spending money. Look for alternatives to purchasing items or services by utilizing resources you already have or exploring free options. For example, instead of buying books, visit your local library, or borrow books from friends. Instead of dining out, prepare meals at home using ingredients you already have or organize potluck dinners with friends. Embracing a more minimalist lifestyle and focusing on experiences rather than material possessions can help you find fulfillment without spending money.

Benefits and Tips for Successful Completion of the No-Spend Challenge

Participating in the No-Spend Challenge can yield several benefits, including increased savings, reduced debt, improved financial discipline, and a greater appreciation for what you already have. Here are some tips to successfully complete the challenge:

-

Plan ahead: Before embarking on the No-Spend Challenge, plan your meals, activities, and any potential temptations that may arise. By planning ahead, you can avoid impulsive spending and stay on track with your goals.

-

Get creative with entertainment: Instead of spending money on activities, explore free or low-cost options for entertainment such as hiking, biking, visiting local parks or museums, or hosting game nights with friends.

-

Involve friends and family: Engage your loved ones in the challenge and encourage them to join you. Having a support system of people who are also committed to saving money can make the challenge more enjoyable and provide additional accountability.

-

Reflect on your spending habits: Use the No-Spend Challenge as an opportunity to reflect on your spending habits and evaluate whether your purchases align with your values and goals. Consider implementing long-term changes to your spending habits based on the insights gained during the challenge.

Remember, the No-Spend Challenge is not about deprivation or avoiding necessary expenses. Instead, it emphasizes mindfulness, intentional spending, and finding alternatives to unnecessary purchases.

Challenge 3: The Meal Planning Challenge

Importance of Meal Planning for Financial Success

Meal planning is a cost-effective strategy that can significantly contribute to your financial success. By planning your meals in advance, you can avoid the temptation of eating out or ordering takeout, which can be expensive. Meal planning also helps reduce food waste by allowing you to utilize ingredients efficiently, and it encourages healthier eating habits. Additionally, by sticking to a predetermined shopping list, you are less likely to make impulse purchases, saving you money.

Steps to Create an Effective Meal Plan

Creating an effective meal plan requires careful consideration of your dietary preferences, lifestyle, and budget. Here are the steps to create a meal plan:

-

Determine your nutritional needs: Consider any dietary restrictions or preferences, and ensure that your meal plan includes a balance of protein, carbohydrates, fruits, vegetables, and fats.

-

Plan your meals: Decide on the number of meals you need to plan for and allocate specific recipes or meal ideas to each mealtime. Consider factors such as convenience, ease of preparation, and versatility when selecting recipes.

-

Create a shopping list: Based on your meal plan, write down all the ingredients you will need for the week. Check your pantry and refrigerator to see if you already have some items on hand. This can help you identify what you need to purchase and avoid unnecessary duplication.

-

Shop smartly: With your shopping list in hand, head to the grocery store. Stick to your list and resist the urge to make impulse purchases. Consider buying in bulk for staple items and look for deals or discounts to further reduce costs.

Tips for Cost-Saving while Meal Planning

While meal planning itself is a cost-saving strategy, there are additional tips you can apply to optimize your savings:

-

Utilize leftovers: Incorporate leftovers into your meal plan to minimize food waste and stretch your ingredients. For example, roast a whole chicken on Sunday and use the leftovers for sandwiches, salads, or stir-fries throughout the week.

-

Buy seasonal produce: Seasonal produce is usually less expensive and more flavorful. Plan your meals around what is in season and take advantage of lower prices.

-

Cook in batches: Prepare large quantities of certain dishes that can be easily reheated or repurposed for multiple meals. This can save you time and money by reducing the need to cook from scratch every day.

-

Freeze leftovers: If you have more leftovers than you can consume within a few days, freeze them for later use. Label and date the containers for easy identification.

Additional Benefits of Adopting the Meal Planning Challenge

The benefits of adopting the Meal Planning Challenge go beyond financial savings. By planning your meals in advance, you can enjoy several additional advantages:

-

Time savings: Meal planning eliminates the need for last-minute trips to the grocery store or scrambling for meal ideas. By having a plan in place, you can save time and reduce stress associated with mealtime preparations.

-

Healthier eating habits: Meal planning enables you to make mindful choices about the ingredients and portion sizes of your meals. It can help you incorporate nutritious foods into your diet and avoid relying on convenient, but often less healthy, options.

-

Increased variety: Planning your meals ahead allows you to experiment with different recipes, flavors, and cuisines. It can introduce you to new dishes and help you broaden your culinary repertoire.

-

Reduced decision fatigue: Making decisions about what to eat each day can be mentally exhausting. By having a meal plan, you eliminate the need to make spontaneous decisions, freeing up mental energy for other tasks.

By embracing the Meal Planning Challenge, you can not only save money but also gain valuable skills and habits that promote a healthier and more organized lifestyle.

Challenge 4: The Energy-Saving Challenge

Understanding the Impact of Energy Consumption on Finances

Energy consumption has a significant impact on your monthly expenses. Being mindful of your energy usage and adopting energy-saving practices can lead to substantial savings over time. By reducing your energy consumption, you can lower your utility bills, decrease your carbon footprint, and contribute to a more sustainable future.

Identifying Opportunities for Energy Conservation

To effectively reduce your energy consumption, it is important to identify areas where you can make the most significant impact. Some common areas to focus on include:

-

Heating and cooling: Adjust your thermostat settings, use ceiling fans, and insulate windows and doors to optimize energy efficiency.

-

Lighting: Switch to energy-efficient LED bulbs, turn off lights when not in use, and utilize natural light whenever possible.

-

Appliances: Opt for energy-efficient appliances, unplug electronics when not in use, and use power strips to easily turn off multiple devices at once.

-

Water usage: Install low-flow showerheads and faucets, fix leaks promptly, and wash clothes in cold water whenever possible.

Implementing Effective Energy-Saving Techniques

Once you have identified areas where energy consumption can be reduced, implement the following energy-saving techniques:

-

Unplug devices: Many electronic devices consume energy even when they are turned off. Unplug electronics or use power strips to completely cut off power when not in use.

-

Use power-saving settings: Configure power-saving settings on your electronic devices, such as laptops and smartphones, to minimize energy consumption during idle periods.

-

Air-dry laundry: Whenever possible, air-dry your laundry instead of using a dryer. Hanging clothes outdoors or utilizing drying racks indoors can save significant amounts of energy.

-

Be mindful of water usage: Take shorter showers, turn off the tap while brushing your teeth, and only run the dishwasher or washing machine with full loads.

Measuring and Tracking Energy Consumption for Maximum Savings

To get a clearer picture of your energy consumption and monitor your progress, consider measuring and tracking your energy usage. Use energy monitoring devices or smart meters to measure your electricity usage and identify patterns of high consumption. You can also keep a log of your utility bills and compare month-to-month or year-over-year to see the impact of your energy-saving efforts. By regularly tracking and analyzing your energy consumption, you can make informed decisions and identify additional areas for improvement.

Challenge 5: The Decluttering Challenge

Recognizing the Connection between Clutter and Finances

The connection between clutter and finances is often underestimated. Clutter can have a negative impact on your financial well-being by contributing to impulsive purchases, hidden expenses, and a lack of organization. By decluttering your living space, you can gain clarity, reduce stress, and make more thoughtful decisions about your purchases and financial priorities.

Creating a Decluttering Plan and Schedule

To effectively declutter your living space, create a plan and schedule to guide your efforts. Start by identifying the areas or rooms that require decluttering, such as closets, cabinets, or garages. Break down the decluttering process into manageable tasks and allocate specific time slots to complete each task. Consider dedicating a certain number of hours per week or committing to a decluttering challenge that spans a set period. Having a plan and schedule in place can help you stay focused and motivated throughout the decluttering process.

Methods for Efficiently Sorting and Organizing Possessions

When decluttering, it is important to have a systematic approach to efficiently sort and organize your possessions. Consider the following methods:

-

The four-box method: Create four boxes or bins labeled as “Keep,” “Donate,” “Sell,” and “Trash.” As you go through your belongings, place each item in the appropriate box based on its value and relevance in your life.

-

KonMari method: Popularized by Marie Kondo, this method involves decluttering by category rather than by location. Start with clothing, then move on to books, papers, miscellaneous items, and sentimental items.

-

Room-by-room approach: Focus on one room at a time and systematically declutter and organize the items within that room. This method allows you to see progress in each space and provides a sense of accomplishment as you complete each room.

-

First-in, first-out rule: Implement the first-in, first-out rule for items that are easily replaceable, such as toiletries, pantry staples, and cleaning supplies. Use the items you purchased first to avoid stockpiling and wasting money.

Benefits of Decluttering for Financial and Mental Well-being

Decluttering not only has financial benefits but also contributes to improved mental well-being. By decluttering your living space, you can experience the following benefits:

-

Reduced stress: A cluttered living environment can be mentally draining and contribute to feelings of overwhelm and stress. Decluttering can create a sense of calm and order, promoting a more positive and peaceful state of mind.

-

Enhanced productivity: A cluttered space can hinder productivity and make it challenging to focus on important tasks. By removing clutter, you can create a more organized and efficient workspace, enabling you to be more productive and focused.

-

Financial savings: Decluttering can save you money in various ways. By organizing your possessions, you gain a better understanding of what you already have, reducing the likelihood of purchasing duplicate items. Additionally, decluttering can create opportunities to sell unused items and generate additional income.

-

Improved decision-making: Decluttering forces you to evaluate each item and make decisions about its value and usefulness in your life. This practice can extend to other aspects of decision-making and help you become more selective and deliberate in your purchasing choices.

By embracing the Decluttering Challenge, you can create a harmonious living environment, enhance your financial well-being, and experience a renewed sense of clarity and organization.

Challenge 6: The Cash-Only Challenge

Advantages of Switching to a Cash-Only Lifestyle

Switching to a cash-only lifestyle can provide numerous advantages in your journey towards financial success. By relying solely on physical cash for your purchases, you become more aware of your spending habits, avoid unnecessary debt, and gain greater control over your finances. Cash transactions offer immediate visibility and accountability, making it easier to track expenses and stick to a budget. Additionally, a cash-only lifestyle promotes mindful spending, as physical currency carries a tangible value that is often lost when using digital forms of payment.

Transitioning from Card-based Payments to Cash

Transitioning from card-based payments to a cash-only lifestyle requires careful planning and adjustment. Follow these steps to make a successful transition:

-

Understand your spending patterns: Analyze your previous card-based transactions to understand your typical spending habits. Identify areas where you tend to overspend or make impulsive purchases.

-

Determine a cash budget: Set a realistic cash budget for different expense categories, such as groceries, entertainment, and transportation. Allocate specific amounts of cash to each category, and be disciplined in sticking to those limits.

-

Use cash envelopes or jars: Allocate physical envelopes or jars for each expense category and distribute the predetermined cash amounts accordingly. Label each envelope or jar with the category name to maintain clarity and organization.

-

Leave cards at home: To avoid the temptation of falling back into card-based spending, leave your credit and debit cards at home when running errands or going out. This eliminates the option to make impulsive purchases and reinforces the cash-only mindset.

Managing Cash Flow and Staying within Budget

Effective cash flow management is essential when transitioning to a cash-only lifestyle. Follow these tips to stay within budget and effectively manage your cash flow:

-

Track expenses diligently: Keep a record of every cash transaction and update your expense log regularly. This will help you monitor your spending patterns, identify areas for improvement, and stay accountable to your budget.

-

Exercise discipline and self-control: Stick to your predetermined cash budgets for each expense category. Avoid borrowing or overspending in one category to compensate for another. Developing discipline and self-control is essential for successfully managing your cash flow.

-

Adjust your budgets as needed: Review your budgets periodically and make necessary adjustments based on your income, expenses, and financial goals. Be flexible and make changes as your circumstances evolve. Remember, a budget should be a tool for financial success, not a rigid set of rules.

-

Utilize digital tools for tracking: While you may be transitioning to a cash-only lifestyle, it can still be beneficial to use digital tools for tracking and monitoring your expenses. Numerous budgeting apps and software allow you to manually input cash transactions, providing a holistic view of your financial picture.

Long-Term Financial Benefits of the Cash-Only Challenge

Adopting a cash-only lifestyle can yield significant long-term financial benefits. By using physical cash for your purchases, you can:

-

Reduce debt: When using cash, you are limited to spending only what you have. This helps curb impulse purchases and avoid accumulating debt on credit cards or loans.

-

Increase savings: The physical act of handing over cash for a purchase can be a powerful reminder of its value. This mindfulness can encourage more conscious spending habits and free up additional funds for savings.

-

Develop financial discipline: Handling cash requires discipline and intentionality. By consciously making decisions about each purchase, you develop a greater sense of financial discipline and improve your overall money management skills.

-

Improve financial transparency: Utilizing cash allows for immediate visibility and transparency in your financial transactions. This clarity can help you identify areas of overspending and make proactive adjustments to stay within your budget.

By taking up the Cash-Only Challenge, you can experience these long-term financial benefits and gain a newfound sense of control over your financial future.

Conclusion: Achieving Financial Success through Effective Money-Saving Challenges

In conclusion, effective money-saving challenges can be instrumental in your journey towards financial success. By adopting a frugal lifestyle, implementing cost-cutting strategies, identifying essential expenses, creating and sticking to a budget, securing financial stability through savings, and participating in money-saving challenges, you can develop healthy financial habits, improve your financial well-being, and create a brighter financial future. The challenges outlined in this article, such as the 52-Week Money Challenge, the No-Spend Challenge, the Meal Planning Challenge, the Energy-Saving Challenge, the Decluttering Challenge, and the Cash-Only Challenge, provide structured frameworks, motivation, and fun ways to save money and improve your financial situation. Remember, consistency and commitment are key to achieving financial success. Take the first step today towards a more frugal lifestyle, and reap the rewards of effective money-saving challenges.