In the video “I Quit Frugal Living: What I am Doing Instead” by Centsible Living With Money Mom, she shares her personal journey of quitting frugal living and the mistakes she made along the way. She explains that she used to think being frugal meant spending the least amount of money and always opting for the cheapest options. However, this mindset led her to make poor decisions, such as buying low-quality food and overeating, which ultimately resulted in her becoming morbidly obese. She also realized that constantly buying the cheapest items, from computers to shoes, ended up costing her more in the long run due to frequent repairs and replacements. Additionally, she put off necessary repairs, like foundation work, which resulted in higher costs later on. By sharing her experiences, she emphasizes the importance of making wise purchase decisions, investing in quality, and planning for the future rather than solely focusing on finding the cheapest options.

Frugal Living: My Misconceptions

Frugal living is often misunderstood as simply spending the least amount of money possible. However, this narrow definition fails to capture the true essence of frugality. The misconception arises from the belief that buying the cheapest quality goods and overeating on cheap, unhealthy food choices is the way to save money. People may also assume that opting for cheap items and delaying repairs can help cut costs. In addition, being underinsured or poorly insured, and putting off medical and dental care are seen as frugal decisions. Lastly, individuals might think that buying unnecessary items at a bargain price is a smart financial move. These misconceptions may appear to be financially beneficial in the short-term, but they often lead to long-term consequences that are harmful to both our well-being and our wallets.

Spending the least amount of money

The notion that spending as little money as possible is the crux of frugal living is an oversimplification. While it’s true that saving money is a key aspect of frugality, it is not the sole focus. Frugal living is about maximizing the value and ensuring every dollar spent is worth it. It’s not just about spending less; it’s about spending wisely.

Buying the cheapest quality

A common misconception is that buying the cheapest quality goods is the most frugal approach. However, this misconception fails to take into account the durability and longevity of such goods. Cheaply made products often have a shorter lifespan, leading to the need for frequent replacements. In the long run, spending a bit more on higher-quality items that last longer can be a more frugal choice.

Overeating and poor food choices

Another misconception is that frugal living means overeating on cheap, unhealthy food choices. While these food options may seem cost-effective at first, they can have severe consequences for our health. The long-term costs associated with poor nutrition, such as medical expenses, are often far higher than the money initially saved by consuming cheap, unhealthy meals.

Buying cheap items and repairs

Opting for cheap items and neglecting necessary repairs is another misconception associated with frugal living. While it may seem like a smart way to save money in the short term, it can lead to more significant expenses in the future. The costs of constantly replacing cheap items and delaying crucial repairs can quickly add up, resulting in higher long-term expenses.

Being underinsured and poorly insured

Some people see being underinsured or poorly insured as a frugal decision, assuming it will save them money on insurance premiums. However, this misconception overlooks the potential financial devastation that could occur in the event of an accident, illness, or natural disaster. Having adequate insurance coverage, although it may seem costly upfront, provides financial security and protects us from significant financial setbacks.

Putting off medical and dental care

Delaying necessary medical and dental care is another misconception associated with frugal living. Many people put off appointments or ignore symptoms to avoid the cost of healthcare. However, this can lead to more severe health issues and higher medical expenses in the long run. Regular check-ups and prompt treatment for any health concerns are essential for maintaining overall well-being and preventing costly complications down the road.

Buying unnecessary items

A prevalent misconception is that buying unnecessary items at a bargain price is a smart financial move. It can be tempting to purchase items on sale or at a discounted price, even if they are not needed. However, this habit of acquiring unnecessary things simply because they are cheap can drain our finances and contribute to clutter in our lives. By refraining from impulsive purchases, we can redirect our financial resources towards more meaningful and necessary expenditures.

The Consequences of Frugal Living

While the misconceptions around frugal living may seem appealing at first, they can lead to a range of negative consequences that far outweigh the short-term savings.

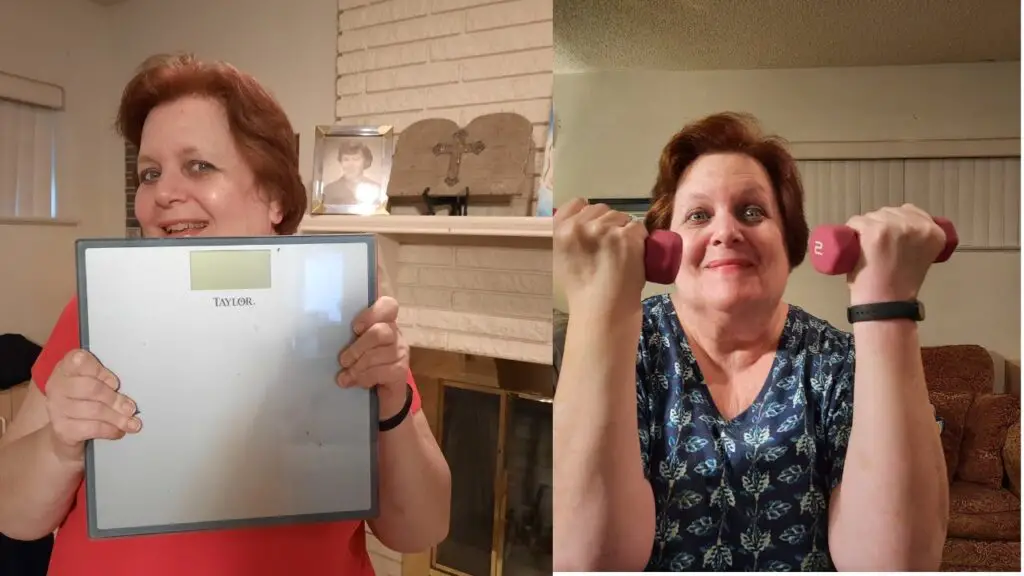

Morbid obesity

Overeating on cheap, unhealthy food choices can result in morbid obesity, which poses serious health risks. Obesity is associated with various health conditions, including heart disease, diabetes, and certain types of cancer. Treating these ailments can be financially burdensome and may require long-term medical care, thus counteracting any initial savings from cheaper food choices.

High repair and maintenance costs

Opting for cheap items and delaying necessary repairs can eventually lead to higher expenses. Cheaply made products often break or wear out quickly, requiring frequent replacements. Similarly, ignoring necessary repairs can exacerbate the damage and result in higher repair costs down the line. In contrast, investing in better-quality items and addressing repairs promptly can help minimize long-term maintenance expenses.

Lack of proper insurance coverage

Being underinsured or poorly insured can have dire financial consequences in unforeseen circumstances. Without adequate insurance coverage, individuals may face exorbitant medical bills, property damage expenses, or liability claims that can quickly drain their savings and even push them into debt. Proper insurance coverage provides peace of mind and safeguards against substantial financial setbacks.

Delayed medical and dental treatment

Putting off medical and dental care may seem like a prudent choice in the short term, but it can lead to more significant health issues and higher medical expenses in the long run. Delaying necessary treatments and neglecting preventive care may result in costly emergency procedures or extensive treatments that could have been avoided with timely intervention. By prioritizing regular healthcare appointments, we can detect and address potential health concerns before they become more complicated and expensive to treat.

Wasted money on unnecessary purchases

Buying unnecessary items at a bargain price can create a cycle of wasteful spending. Accumulating objects that serve no real purpose or bring minimal joy not only clutters our living spaces but also drains our financial resources. By shifting our focus towards intentional shopping and mindful consumption, we can save money and allocate our funds towards items and experiences that genuinely add value to our lives.

Changing Perspectives on Frugal Living

To avoid the pitfalls of misconceptions, it is essential to shift our perspective on frugal living towards a more enlightened path.

Intentional shopping and wise decision-making

Frugal living is not about restraining ourselves from making any purchases; instead, it emphasizes intentional shopping and wise decision-making. By carefully considering our needs and prioritizing items that align with our goals and values, we can make purchases that truly enhance our lives. This shift allows us to allocate our financial resources towards items and experiences that bring us joy and enrich our well-being.

Investing and saving for the future

Rather than solely focusing on immediate savings, frugal living encourages us to invest and save for the future. By setting aside a portion of our income for investment and savings accounts, we can build a foundation of financial security and pave the way for future financial independence. This proactive approach ensures that we are prepared for unexpected expenses and able to achieve our long-term goals.

Prioritizing quality over cost

Choosing quality over cost is a fundamental aspect of frugal living. Investing in well-made, durable products may seem expensive upfront, but it often proves to be more cost-effective in the long run. By opting for higher-quality items, we reduce our need for frequent replacements, ultimately saving money over time. Quality goods also tend to have better performance and longevity, providing us with more value for our hard-earned money.

Preparing for future expenses

Frugal living involves recognizing and preparing for future expenses. Whether it’s saving for retirement, creating an emergency fund, or planning for major life events, setting financial goals and actively working towards them helps ensure a more secure financial future. By anticipating and preparing for potential expenses, we can avoid being caught off guard and incurring unnecessary debt.

Learning from Past Mistakes

In our journey towards embracing a new perspective on frugal living, it’s crucial to acknowledge and learn from our past mistakes. Reflecting on our personal experiences can provide valuable lessons that guide us towards making wiser financial choices.

Accepting the past and focusing on the present

The first step in learning from past mistakes is to accept them and let go of any guilt or regret. Dwelling on past poor financial decisions will only hinder our progress towards a more frugal lifestyle. Instead, we should focus on the present moment and the actions we can take right now to improve our financial situation.

Making better purchase decisions

Reflecting on past purchases that turned out to be unnecessary or of poor quality allows us to make better decisions moving forward. By analyzing our spending habits and identifying patterns, we can avoid making similar mistakes in the future. This self-awareness empowers us to approach each purchase with a critical eye and ensure that we are making informed choices that align with our values and financial goals.

Reflecting on personal experiences

Looking back on personal experiences can provide valuable insight into the consequences of poor financial decisions. Whether it’s the burden of mounting medical bills or the frustration of constantly replacing cheaply made items, these experiences serve as reminders of the potential pitfalls associated with frugal living misconceptions. By reflecting on these experiences, we can avoid repeating the same mistakes and make smarter financial choices.

Seeking improvement and growth

Learning from past mistakes is not a one-time event but an ongoing journey of self-improvement. Embracing a growth mindset allows us to acknowledge our missteps and actively seek opportunities for growth. By continuously learning about personal finance, seeking guidance from financial experts, and staying open to new ideas, we can continue evolving our approach to frugal living and making wiser financial decisions.

Conclusion

Recognizing the misconceptions of frugal living is the first step towards adopting a more enlightened perspective on personal finance. By acknowledging the consequences of poor decision-making, such as morbid obesity, high repair costs, lack of insurance coverage, delayed medical treatment, and wasted money, we can shift our focus towards intentional shopping and wise decision-making. Prioritizing quality over cost and preparing for future expenses are key principles to incorporate into our financial journey. Embracing a new outlook on frugality and learning from past mistakes enables us to make wiser financial choices and ultimately achieve long-term financial well-being.