In the video “Practical Frugal Tips for Busy People” by Under the Median, you’ll find a wealth of tips and advice on how to save money in a quick and easy way. The creators of the video, Hope and Larry, share their personal experiences and strategies for living frugally and managing finances effectively. From meal prepping and repurposing leftovers to utilizing kitchen appliances like pressure cookers and crock pots, this video offers practical tips that can be implemented in just 15 minutes or less. They also touch on other areas of frugal living, such as using coupon and cash back browser extensions, cutting unnecessary subscriptions, and energy-saving techniques. With lively and friendly narration, Hope and Larry provide valuable insights for busy individuals who want to save money without spending a lot of time.

The tips and suggestions are based on the personal experiences and opinions of the creators and are not professional advice. It is advised to consult professionals for specific concerns. The video also includes affiliate links to tools and services that the creators love, as well as a tip jar for viewers to support the content creators. For more information and to watch other videos about saving money, you can visit Under the Median’s YouTube channel and website.

Importance of saving money and lack of time for many people

Saving money is an important aspect of financial planning and achieving financial stability. However, it can be a challenging task, especially when you have a busy schedule and a lack of time. Many people find it difficult to dedicate enough time to actively manage their finances and find ways to save money. Fortunately, there are several strategies that you can implement in just 15 minutes or less to start saving money and improve your financial situation.

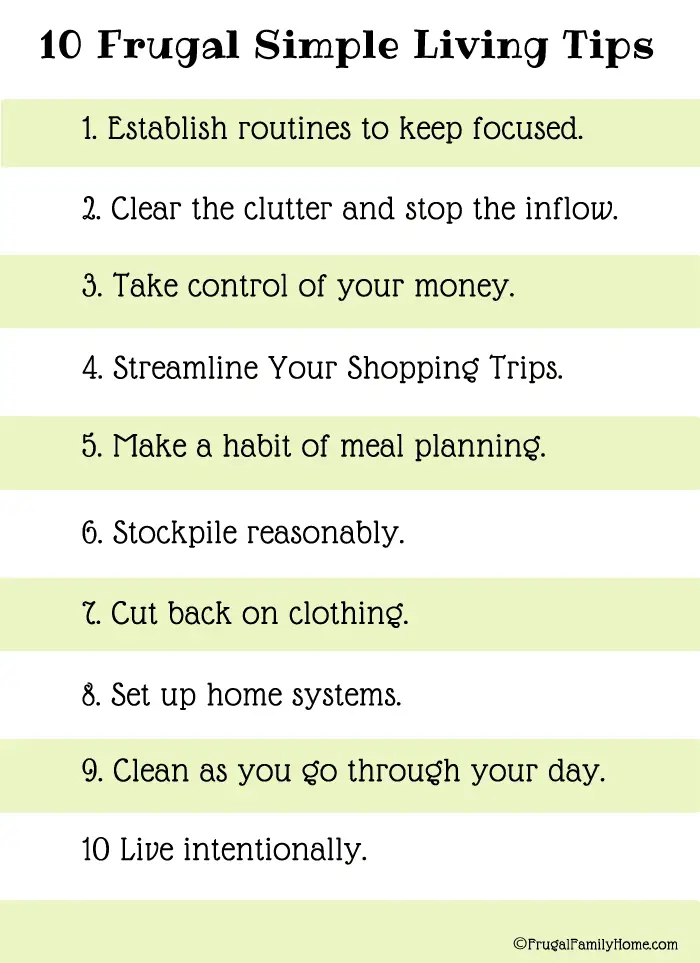

Tips for saving money in a frugal way in 15 minutes or less

-

Track your expenses

One of the first steps towards saving money is to have a clear understanding of where your money is going. Take just 15 minutes to review your bank statements or receipts and categorize your expenses. This will help you identify areas where you can cut back and save money.

-

Create a budget

Budgeting is a fundamental tool for saving money. Spend a few minutes to create a simple budget by listing your monthly income and fixed expenses. Allocate a certain amount for variable expenses like groceries, entertainment, and transportation. This will help you prioritize your spending and limit unnecessary expenses, ultimately leading to significant savings.

-

Set up automatic transfers

In the hustle and bustle of everyday life, it’s easy to forget about saving. Take a few minutes to set up automatic transfers from your checking account to a savings or investment account. By doing so, you’ll ensure that a portion of your income is regularly saved without any effort on your part.

-

Comparison shop online

Online shopping has become increasingly popular, and it provides an opportunity to save money effortlessly. Before making a purchase, spend a few minutes comparing prices and looking for discounts or promotions. Take advantage of cashback websites or browser extensions that automatically find the best deals for you.

-

Cancel unused subscriptions

Subscriptions for streaming services, magazines, or gym memberships can add up over time. In just a few minutes, review your monthly subscriptions and cancel any that you no longer use or need. By doing so, you’ll save money every month without sacrificing anything.

Importance of meal prepping to save money on lunches

Eating out for lunch can quickly drain your wallet, especially when done frequently. Meal prepping is a simple and efficient way to save money on lunches while also ensuring healthier eating habits.

Preparing your meals in advance allows you to control the ingredients, portion sizes, and overall nutritional value of what you consume. In just a few hours over the weekend, you can prepare a week’s worth of lunches and store them in reusable containers. This not only saves you money by eliminating the need to buy lunch every day but also saves time during the busy workweek.

You can experiment with different meal prep recipes based on your preferences and dietary needs. Focus on using affordable and nutrient-dense ingredients such as rice, beans, vegetables, and lean proteins. By planning and prepping your lunches, you’ll develop better eating habits and save money in the process.

Ideas for repurposing leftovers

Leftovers sometimes get a bad reputation, but they can actually be a great resource for saving money and reducing food waste. In just a few minutes, you can transform yesterday’s meal into a delicious dish with a few creative twists.

-

Stir-fry or fried rice

Leftover vegetables, proteins, and even rice can be easily repurposed into a quick stir-fry or fried rice. Simply sauté the ingredients with some oil, garlic, and soy sauce for a tasty and budget-friendly meal.

-

Sandwiches or wraps

If you have leftover roasted chicken, beef, or vegetables, use them to create a delicious sandwich or wrap. Add some fresh lettuce, tomato, and your favorite condiments for a quick and satisfying lunch.

-

Soup or stew

Leftover meat or vegetables can be transformed into a hearty soup or stew with just a few additional ingredients. Add some broth or stock, spices, and perhaps some beans or pasta to create a comforting and budget-friendly meal.

-

Casserole or pasta bake

Combine your leftovers with some pasta, sauce, cheese, and herbs to create a tasty casserole or pasta bake. This is a great way to repurpose multiple leftovers into a new and exciting dish.

Remember, the key is to get creative and think outside the box. With a little imagination, you can turn your leftovers into exciting new meals that will save you money and minimize food waste.

Benefits of simple meals and planning meals around one main ingredient

Planning meals around one main ingredient can simplify your cooking process and help you save money. By focusing on a single ingredient, you can buy it in bulk, take advantage of sales, and reduce food waste.

-

Increased affordability

When you plan meals around a single main ingredient, you can buy it in larger quantities or when it’s on sale. For example, if chicken is your main ingredient for the week, you can purchase a whole chicken or family-sized packages at a lower price per pound. By buying in bulk or taking advantage of sales, you’ll end up spending less on groceries in the long run.

-

Less food waste

When you plan meals around one main ingredient, you’ll be more intentional about using it throughout the week. This reduces the likelihood of other ingredients going to waste and saves you money. Additionally, you can repurpose any leftovers from one meal into another, further minimizing food waste.

-

Streamlined meal planning and prep

Planning meals around one main ingredient simplifies the meal planning and preparation process. With a focus on a single ingredient, you can brainstorm multiple meal ideas using it as a base. This saves time and mental energy in coming up with diverse meal options. It also makes grocery shopping more efficient, as you know exactly what you need to buy.

By planning meals around one main ingredient, you not only save money, but you also simplify the cooking process, reduce food waste, and streamline your meal planning.

Efficient use of pressure cooker or instant pot for cooking

Pressure cookers, such as the popular Instant Pot, are versatile kitchen appliances that can save you significant time and money in the kitchen. With their ability to cook food quickly and efficiently, these devices open up a world of possibilities for easy and delicious meals.

-

Time-saving cooking

Pressure cookers excel in reducing cooking time. They use high-pressure steam to quickly tenderize tough cuts of meat and cook grains, beans, and vegetables in a fraction of the time compared to traditional methods. In just a matter of minutes, you can have a tender and flavorful meal ready to serve.

-

Energy efficiency

Pressure cookers are known for their energy efficiency. By utilizing the power of pressure and steam, they require less time and energy to cook food compared to conventional cooking methods. This translates to lower energy bills and reduced environmental impact.

-

Versatility of recipes

Pressure cookers are incredibly versatile and can be used to cook a wide range of recipes. From soups and stews to risottos and desserts, the possibilities are endless. By exploring recipes specifically designed for pressure cookers, you’ll be able to create delicious meals without spending hours in the kitchen.

-

Tenderizes cheaper cuts of meat

The high-pressure cooking environment of pressure cookers is ideal for tenderizing cheaper cuts of meat. Those tough cuts, which would typically require long hours of simmering or slow cooking, can become tender and flavorful in a fraction of the time. This opens up opportunities to experiment with new cuts of meat while saving money on your grocery bill.

By utilizing a pressure cooker or Instant Pot, you can save time, energy, and money while still enjoying delicious and nutritious meals.

Benefits of using a crock pot for easy and time-saving cooking

Crock pots, or slow cookers, are a convenient and efficient way to prepare meals with minimal effort and time. These appliances are particularly useful for busy individuals who want to save money by cooking at home.

-

Set it and forget it

One of the greatest advantages of using a crock pot is the ability to set it and forget it. Once you have added your ingredients and set the desired cooking time and temperature, you can leave it unattended. This frees up your time to focus on other tasks while your meal slowly cooks to perfection.

-

Cost-effective cooking

Crock pots are designed to cook food slowly and at a low temperature, which helps tenderize cheaper cuts of meat. By using these cuts or opting for economical ingredients such as beans and lentils, you can save money without compromising flavor or quality.

-

Time-saving preparation

With a crock pot, there is no need for extensive prepping or constant monitoring in the kitchen. Simply chop your ingredients, add them to the pot, and let it work its magic. This saves you valuable time in the morning or evening, especially during hectic weekdays.

-

Leftover-friendly

Crock pots are known for producing large quantities of food with minimal effort. This means you’ll likely have leftovers to enjoy throughout the week or freeze for later. By repurposing these leftovers, you can save money on future meals and reduce food waste.

Utilizing a crock pot allows you to effortlessly prepare flavorful meals while saving time and money. With its convenience and versatility, it’s an essential kitchen tool for those seeking a frugal and efficient lifestyle.

Savings and convenience of switching to a new cell phone plan

In today’s digital age, a cell phone has become an essential part of our lives. However, many people are unaware that they may be overspending on their cell phone plans. By taking a few minutes to evaluate your current plan and explore alternatives, you can potentially save money while maintaining excellent service.

-

Review your usage

Start by reviewing your monthly cell phone bill and assessing your usage patterns. Are you utilizing all the data, minutes, and text messages included in your plan? Understanding your usage will help you identify if you’re paying for services you don’t need.

-

Explore different carriers

There are numerous cell phone carriers competing in the market, each offering various plans and pricing options. Spend a few minutes researching different carriers to see if they offer a better plan that aligns with your usage and budget.

-

Consider family or shared plans

If you have family members or friends with whom you can share a cell phone plan, consider pooling your resources and opting for a family or shared plan. These plans often offer discounts when multiple lines are included, resulting in significant savings for everyone involved.

-

Evaluate contract vs. prepaid options

Contract plans may offer discounted or subsidized devices, but they often come with long-term commitments and potential termination fees. On the other hand, prepaid plans provide flexibility and freedom without contractual obligations. Evaluate which option makes the most financial sense for your situation.

By taking the time to evaluate your cell phone plan and explore alternatives, you can potentially save money while still enjoying the convenience and functionality of your device.

Potential savings and convenience of paying bills annually or online

Paying bills is a regular occurrence for most individuals, but it’s often seen as a tedious and time-consuming task. However, by adopting certain strategies such as paying bills annually or online, you can save both time and money.

-

Annual payment discounts

Some service providers offer discounts or incentives for paying bills annually instead of monthly. This can be particularly advantageous for bills that remain relatively constant throughout the year, such as insurance premiums or membership fees. By making a lump-sum payment, you can potentially save a significant amount of money over time.

-

Online bill payment

Traditional bill payments via check or in-person can be time-consuming, especially if you have multiple bills to pay. Switching to online bill payment allows you to manage and pay your bills conveniently from the comfort of your home or on the go. Many companies provide incentives for enrolling in electronic billing and automatic payments, such as discounts or reduced service fees.

-

Automation and reminders

Setting up automatic bill payments ensures that your bills are paid on time, eliminating the risk of late fees or penalties. Additionally, utilizing reminders or alerts through online banking platforms can help you stay organized and prevent missed payments. This saves you time and helps maintain a good credit score.

-

Electronic statements

Opting for electronic statements instead of paper statements can save you money on printing and postage costs. It also reduces the clutter associated with physical documents. Most service providers offer the option to receive statements electronically, and it only takes a few minutes to sign up.

By paying bills annually, embracing online bill payment, setting up automation, and transitioning to electronic statements, you’ll save both time and money while simplifying your financial obligations.

Mention of a video on renegotiating bills and contracts for further assistance

For further assistance in renegotiating bills and contracts to save money, check out our helpful video guide. This video provides step-by-step instructions and tips on how to approach providers and negotiate better deals. By watching the video and applying the techniques shared, you can potentially save a significant amount of money on your monthly bills and contracts.

Remember, taking a few minutes to evaluate your options and implement these strategies can lead to substantial savings over time. With careful planning and a proactive approach, you can alleviate the financial strain and make the most of your hard-earned money.