Living a frugal lifestyle goes beyond simply saving money. It’s about making conscious choices and finding creative ways to stretch your resources. In this comprehensive guide to frugal living, you will discover practical tips, strategies, and inspiration to help you live a fulfilling and financially responsible life. From budgeting and meal planning to reducing waste and embracing minimalism, this guide covers all aspects of frugality. Whether you are looking to pay off debt, save for a big goal, or simply find more joy in the simple pleasures, this guide will empower you to make wise financial decisions while enjoying a more intentional and sustainable lifestyle. Get ready to embark on a frugal living journey and unlock the secrets to living well on a budget.

Frugal Living: A Comprehensive Guide

What is Frugal Living?

Frugal living is a lifestyle that revolves around smart money management, conscious spending, and making the most out of every dollar. It is not about being cheap or sacrificing quality, but rather finding creative ways to save money and live a fulfilling life within your means. Frugal living involves being intentional about your spending choices, prioritizing your needs over wants, and finding satisfaction in the simple pleasures of life.

Benefits of Frugal Living

Adopting a frugal lifestyle can bring numerous benefits into your life. Firstly, it allows you to have better control over your finances. By carefully tracking your expenses and cutting unnecessary costs, you can free up money to build savings, pay off debt, or invest in your future.

Frugal living also cultivates a sense of mindfulness and gratitude. When you prioritize what truly matters to you and let go of excessive consumerism, you gain a new perspective on material possessions. Instead, you focus on experiences, relationships, and personal growth, which can lead to greater contentment and happiness.

Basic Principles of Frugal Living

The basic principles of frugal living revolve around conscious spending, saving money, and simplifying your lifestyle. Here are a few fundamental principles to consider:

-

Budgeting: Track your income and expenses to create a budget that aligns with your financial goals. Remember to allocate funds for essential expenses, savings, and debt repayment.

-

Differentiating between Needs and Wants: Distinguish between necessities and luxuries by assessing the value each purchase brings to your life. Prioritize spending on needs and carefully consider wants before making a purchase.

-

Mindful Spending: Practice mindful spending by considering the long-term impact of your purchases. Instead of impulse buying, take the time to research and evaluate each purchase to ensure it aligns with your values and financial goals.

-

Minimalism: Embrace minimalism by decluttering and simplifying your living space. By reducing the number of possessions, you can save money on storage, maintenance, and unnecessary purchases.

-

DIY and Repurposing: Explore do-it-yourself projects and repurposing items to fulfill your needs. From repairing clothes to upcycling furniture, embracing your creativity can save money and reduce waste.

Creating a Frugal Mindset

Adopting a frugal mindset is crucial for long-term success in frugal living. It involves reshaping your perspective on money, possessions, and happiness. Here are some strategies to help you create a frugal mindset:

-

Shift Your Focus: Instead of chasing material possessions, focus on experiences, relationships, and personal growth. Find joy in simple pleasures that don’t require excessive spending.

-

Practice Gratitude: Cultivate a sense of gratitude for what you already have. Appreciating the things you possess can help reduce the desire for unnecessary purchases.

-

Embrace Delayed Gratification: Train yourself to delay instant gratification by practicing patience. Rather than making impulse purchases, give yourself time to evaluate whether you truly need and want an item.

-

Surround Yourself with Like-minded Individuals: Connect with people who share your frugal lifestyle. Their support, insights, and success stories can reinforce your commitment to frugal living.

-

Continuous Learning: Stay informed about personal finance, budgeting, and frugal living strategies. Read books, listen to podcasts, or join online communities to expand your knowledge and stay motivated.

Reducing Expenses

One of the core aims of frugal living is to reduce expenses and save money. By adopting a frugal lifestyle, you can effectively cut costs without compromising your quality of life. Here are some practical ways to reduce expenses:

-

Evaluate Subscriptions: Review and cancel any unnecessary subscriptions or memberships that you no longer use or value. This can include streaming services, gym memberships, magazine subscriptions, and more.

-

Comparison Shopping: Always compare prices before making a purchase. Take advantage of price comparison websites and apps to ensure you get the best deal possible.

-

Bulk Buying: Purchase non-perishable items in bulk to take advantage of cost savings. This can apply to items such as toiletries, cleaning supplies, or pantry staples.

-

Negotiate Bills: Don’t be afraid to negotiate bills such as insurance or cable/internet. Research competitive rates and negotiate with your providers to lower your monthly expenses.

-

Declutter and Sell: Turn your unused or unwanted belongings into cash by decluttering and selling them online or through yard sales. This not only helps you generate income but also declutters your living space.

-

Utilize Coupons and Discounts: Keep an eye out for coupons, discounts, and promotional offers. These can help you save a significant amount of money on groceries, clothing, dining out, and more.

Saving Money on Groceries

One of the major expenses in any household is grocery shopping. However, with some planning and smart strategies, you can significantly cut down on your grocery bill. Here are some tips to save money on groceries:

-

Prepare a Shopping List: Before heading to the store, make a list of the items you need. Stick to the list and avoid impulsive purchases that can derail your budget.

-

Meal Plan: Plan your meals for the week ahead to avoid unnecessary trips to the store and impulsive purchases. Design your meal plan based on ingredients you already have and incorporate affordable, versatile ingredients.

-

Shop in Season: Purchase fruits and vegetables that are in season as they tend to be less expensive and fresher. You can also stock up on seasonal produce and freeze or preserve them for later use.

-

Use Store Loyalty Programs: Sign up for loyalty programs offered by grocery stores to receive discounts, personalized offers, and coupons. This can help you save money on your regular purchases.

-

Avoid Prepared and Prepackaged Foods: Preparing meals from scratch using whole ingredients is not only healthier but also more cost-effective. Avoid prepackaged foods that often come with a higher price tag.

-

Buy Generic and Store Brands: Opt for generic or store-brand products instead of name brands. The quality difference is often minimal, but the savings can be substantial.

Meal Planning and Batch Cooking

Meal planning and batch cooking are essential strategies for frugal living. By dedicating some time to plan your meals and cooking in batches, you can save both time and money.

-

Plan Your Meals: Create a weekly meal plan that takes into account your schedule, nutritional needs, and budget. Include recipes that use similar ingredients to minimize waste.

-

Make a Shopping List: Based on your meal plan, create a shopping list of all the ingredients you need. Stick to the list when grocery shopping to avoid unnecessary purchases.

-

Cook in Batches: Batch cooking involves preparing larger quantities of food and storing them in portions for future meals. This helps save time and reduces the temptation to eat out or order takeout.

-

Utilize Leftovers: Don’t let leftovers go to waste. Get creative and find ways to incorporate them into new dishes or create quick, easy lunches for the next day.

-

Freeze Food: If you have excess produce or cooked meals, consider freezing them for later use. This can help eliminate food waste and provide convenient meals whenever you need them.

-

Invest in Meal Prep Containers: Invest in high-quality, reusable meal prep containers to store your batch-cooked meals. This not only makes meal planning easier but also helps reduce single-use packaging waste.

Minimizing Utility Bills

Utility bills can quickly add up and take a toll on your monthly budget. However, by adopting some energy-saving habits and making small changes around the house, you can reduce your utility expenses. Here are some tips for minimizing utility bills:

-

Unplug Electronics: Many electronic devices consume energy even when not in use. Unplug chargers, appliances, and electronics when they are not actively being used to reduce phantom energy usage.

-

Optimize Thermostat Settings: Adjust your thermostat to save energy. In colder months, lower the temperature a few degrees, and in warmer months, raise it slightly. Utilize fans and blinds to regulate the temperature throughout the day.

-

Install Energy-Efficient Lighting: Switch to energy-efficient LED light bulbs that consume less electricity and last longer. This small change can have a significant impact on your energy consumption.

-

Use Power Strips: Connect multiple devices to power strips and turn them off when not in use. This prevents energy wastage from devices on standby mode.

-

Weatherize Your Home: Seal any drafts or air leaks in your home to prevent heated or cooled air from escaping. This can be done by caulking windows, insulating doors, and ensuring proper sealing around vents and pipes.

-

Conserve Water: Reduce water consumption by fixing leaks promptly, installing low-flow showerheads and faucets, and using your dishwasher and washing machine only when you have full loads.

Cutting Transportation Costs

Transportation costs, including commuting and maintaining a vehicle, can have a significant impact on your budget. To cut down on transportation expenses while still meeting your needs, consider these frugal living strategies:

-

Utilize Public Transportation: Depending on where you live, utilizing public transportation can be a cost-effective option compared to owning and maintaining a car. Explore bus or train routes that can help you save money on commuting.

-

Carpooling and Ride-Sharing: Share rides with friends, coworkers, or neighbors to split the costs of transportation. Consider using ride-sharing services or carpooling apps that connect drivers and passengers heading in the same direction.

-

Bicycle or Walk: If possible, consider commuting by bicycle or walking for shorter distances. This not only saves money on transportation but also promotes physical health and reduces carbon emissions.

-

Maintain Your Vehicle: Regularly maintain your vehicle to avoid costly repairs and improve fuel efficiency. Keep the tires properly inflated, change oil and filters on time, and follow the recommended maintenance schedule.

-

Choose Affordable Insurance: Shop around and compare insurance policies to find the best rates. Prioritize coverage that meets your needs while still being cost-effective.

-

Plan Efficient Routes: Optimize your travel routes to minimize both time and fuel consumption. Combine multiple errands into a single trip to avoid unnecessary backtracking or multiple trips.

Frugal Travel Tips

Traveling is an enriching experience, but it can also be expensive. However, with careful planning and frugal habits, you can enjoy memorable trips without breaking the bank. Here are some frugal travel tips:

-

Travel During Off-Season: Choosing to travel during off-peak seasons can result in significant savings on flights, accommodations, and tourist activities.

-

Book in Advance: Plan and book your flights and accommodation well in advance to take advantage of early bird discounts. Last-minute bookings often come with higher prices.

-

Compare Prices: Use comparison websites to compare prices for flights, accommodations, and rental cars before making a reservation. This can help you find the best deals and save money.

-

Utilize Travel Rewards and Points: Take advantage of travel rewards programs and credit cards that offer travel perks. Accumulate points to redeem for discounted or even free flights and hotel stays.

-

Cook Your Own Meals: Instead of eating out for every meal, consider booking accommodations with kitchen facilities. This allows you to prepare some of your own meals, which can help save money.

-

Explore Free or Low-Cost Activities: Research and prioritize free or low-cost activities and attractions at your destination. Many cities offer free walking tours, museums with discounted admission, and outdoor activities that won’t break the bank.

Managing Debt

Debt can weigh heavily on your finances and hinder your progress towards financial goals. Incorporating frugal living principles can help you manage and eliminate debt more effectively. Here are some strategies for managing debt:

-

Create a Debt Repayment Plan: Evaluate your outstanding debts and create a plan to pay them off systematically. Prioritize debts with the highest interest rates first while making minimum payments on the rest.

-

Minimize New Debt: Avoid taking on new debt whenever possible. Evaluate whether a purchase is essential and fits within your budget before deciding to finance it.

-

Negotiate Interest Rates: Reach out to your creditors to negotiate lower interest rates, especially if you have a good payment history. Lower interest rates mean more of your payment goes towards reducing the principal balance.

-

Snowball or Avalanche Method: Choose a debt repayment strategy that works best for you. The snowball method involves paying off the smallest debts first, providing the motivation to continue. The avalanche method focuses on debts with the highest interest rates to minimize interest costs.

-

Seek Professional Help if Needed: If you are overwhelmed with debt or struggling to manage your payments, consider seeking guidance from a financial counselor or debt management agency. They can provide personalized advice and help you navigate the road to debt freedom.

Investing and Saving for the Future

Frugal living extends beyond mere savings; it also emphasizes the importance of investing and preparing for the future. Building wealth and securing your financial future are essential elements of a frugal lifestyle. Here are some tips for investing and saving:

-

Emergency Fund: Establish an emergency fund to cover unexpected expenses or income disruptions. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

-

Retirement Planning: Contribute regularly to retirement accounts such as a 401(k) or Individual Retirement Account (IRA). Take advantage of employer matching contributions and explore the investment options available to grow your retirement savings.

-

Diversify Investments: Avoid putting all your eggs in one basket by diversifying your investment portfolio. Consider spreading your investments across different asset classes such as stocks, bonds, mutual funds, or real estate.

-

Automate Saving: Set up automatic transfers to move a portion of your income directly into a savings or investment account. This ensures consistent savings without the temptation to spend the money elsewhere.

-

Research and Educate Yourself: Stay informed about different investment options and financial strategies. Read books, attend workshops, or consult with financial advisors to make well-informed investment decisions.

Frugal Living Tips for Families and Children

Frugal living can be particularly beneficial for families with children, as it encourages financial responsibility and instills important life skills. Here are some frugal living tips specifically geared towards families:

-

Teach Children About Money: Educate your children about money management from an early age. Teach them the value of money, how to save, and the importance of making wise spending decisions.

-

Shop Secondhand: Find affordable children’s clothing, toys, and furniture by shopping at thrift stores, consignment shops, or online marketplaces. Children grow quickly, and they often outgrow items before they are fully worn out.

-

DIY Birthday Parties: Rather than spending a fortune on extravagant birthday parties, opt for DIY celebrations at home or local parks. Get creative with decorations, games, and homemade treats to make it a memorable event without breaking the bank.

-

Nurture Hobbies and Skills: Encourage children to develop hobbies and skills that are both enjoyable and budget-friendly. This can include arts and crafts, gardening, cooking, or sports that don’t require expensive equipment.

-

Plan Family Activities: Enjoy quality time together as a family without spending a fortune. Plan picnics, nature walks, movie nights at home, or volunteer activities that are free or low-cost.

-

Save on Education Expenses: Research and explore scholarship opportunities, grants, and subsidized educational programs to reduce the cost of education for your children. Encourage them to apply for scholarships and assist them with their applications.

Frugal Living and Health

Frugal living can have a positive impact on your overall health and well-being. By making conscious choices about your spending and lifestyle, you can prioritize your health without overspending. Here’s how frugal living and health are intertwined:

-

Prioritize Wellness: Focus on preventive care and maintaining a healthy lifestyle to reduce medical expenses in the long run. Exercise regularly, eat a balanced diet, get sufficient sleep, and manage stress effectively.

-

Cook at Home: Prepare meals at home using fresh ingredients to promote a nutritious diet. Home-cooked meals are generally healthier and more cost-effective than eating out or relying on processed foods.

-

Explore Free Fitness Options: Look for free fitness resources in your community, such as parks, walking trails, or free exercise classes. Utilize online workout videos or fitness apps that offer a wide range of routines without the need for a pricey gym membership.

-

Practice Mindful Spending: Allocate a portion of your budget to health-related expenses such as gym memberships, yoga classes, or wellness retreats. However, be mindful and evaluate whether the costs align with the benefits you receive.

-

Seek Preventive Care: Schedule routine check-ups and screenings to detect and prevent potential health issues early on. Investing in preventive care can help you avoid costly treatments down the line.

-

Embrace Mental Health Practices: Prioritize your mental well-being by incorporating stress-relief practices into your daily routine. Practice meditation, mindfulness, or other relaxation techniques to improve your overall mental health.

Frugal Living and the Environment

Frugal living is closely aligned with environmentally friendly practices. By reducing waste, conserving resources, and making mindful choices, you can minimize your impact on the environment while saving money. Here’s how frugal living and the environment go hand in hand:

-

Reduce, Reuse, Recycle: Embrace the mantra of reducing waste by utilizing reusable containers, bags, and water bottles. Recycle whenever possible and prioritize buying products made from recycled materials.

-

Upcycle and Repurpose: Give new life to old, unwanted items by upcycling or repurposing them. Get creative with DIY projects that transform discarded items into functional or decorative pieces.

-

Conserve Energy and Water: Minimize your energy consumption by turning off lights when not in use, utilizing energy-efficient appliances, and using natural light whenever possible. Conserve water by taking shorter showers, fixing leaks promptly, and utilizing water-saving devices.

-

Grow Your Own Food: Start a garden, whether it’s a few herbs on your windowsill or a backyard vegetable garden. Growing your own food can help reduce packaging waste, save money on groceries, and provide fresh, organic produce.

-

Simplify Your Wardrobe: Embrace a minimalist approach to your wardrobe by owning fewer clothing items made from sustainable and ethically sourced materials. Donate or sell clothes you no longer wear to reduce textile waste.

-

Buy Secondhand: Opt for secondhand items whenever possible, whether it’s clothes, furniture, electronics, or books. Shopping at thrift stores or through online marketplaces reduces the demand for new products, minimizing the environmental impact.

Frugal Living Online Resources

The internet offers a wealth of resources and communities dedicated to frugal living. Here are some valuable online resources to support and inspire your frugal journey:

-

Online Forums and Communities: Join online forums and communities where individuals share tips, success stories, and advice on frugal living. Participate in discussions, ask questions, and contribute your own experiences.

-

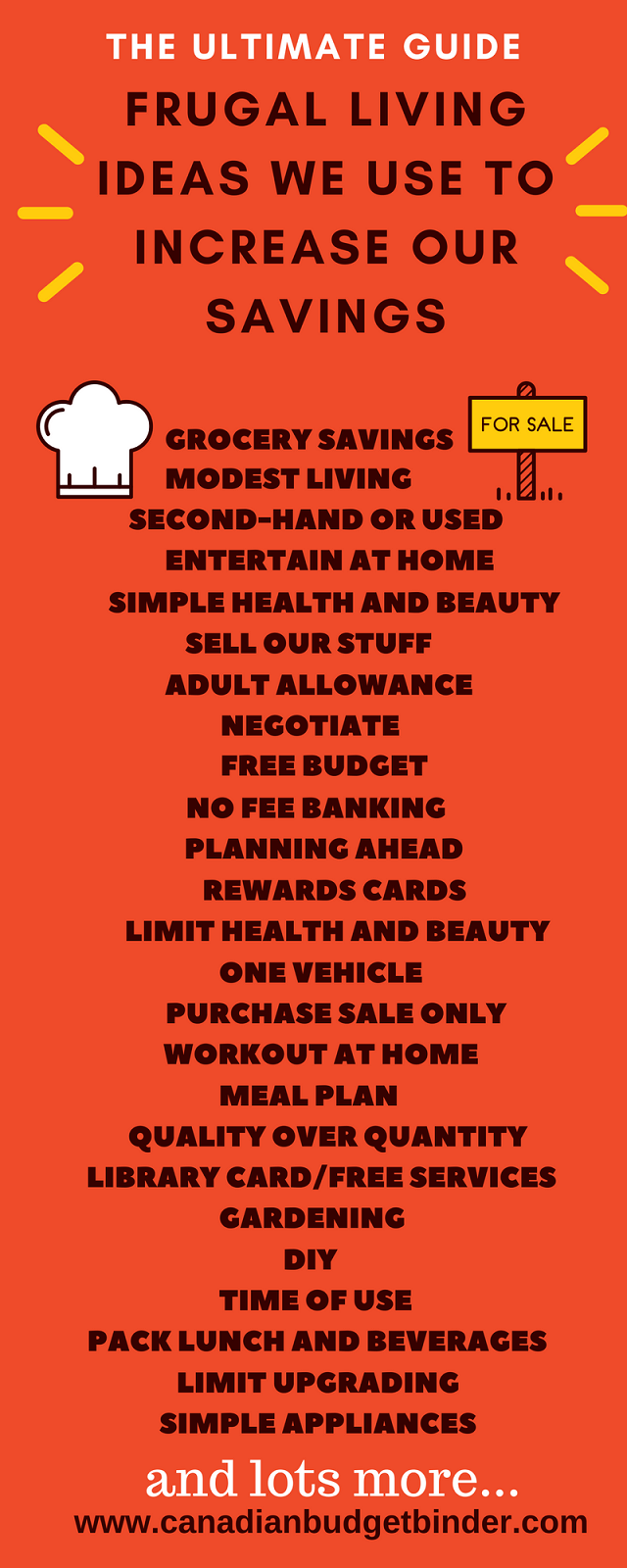

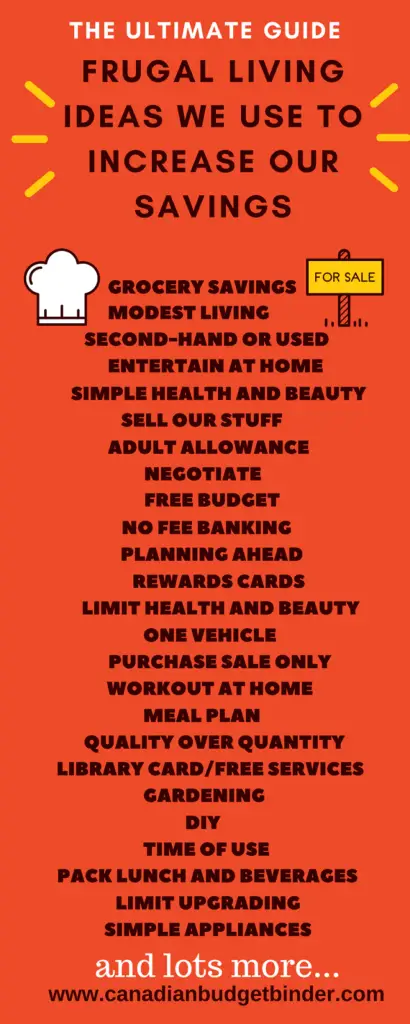

Personal Finance Blogs: Many personal finance bloggers delve into various aspects of frugal living. Explore blogs dedicated to budgeting, saving money, frugal hacks, and minimalist living.

-

Frugal Living Websites: Visit websites that provide comprehensive information and tips on frugal living. These websites often include practical advice, strategies, and recipes to help you save money and live a frugal lifestyle.

-

Social Media Groups: Join frugal living groups on social media platforms such as Facebook or Reddit. These communities provide a space to connect with like-minded individuals, ask questions, and exchange ideas.

-

Online Budgeting Tools: Utilize online budgeting tools and apps to track your income, expenses, and savings goals. These tools often offer features such as expense categorization, goal setting, and financial insights.

Conclusion

Frugal living is much more than just saving money; it’s a mindset that prioritizes financial responsibility, mindful spending, and living a fulfilling life within your means. By adopting the principles of frugal living, you can reduce expenses, save money, and build a sustainable future. Whether you’re a single individual, a family, or someone looking to improve their financial well-being, incorporating frugal living practices into your life can lead to greater financial security, reduced stress, and a more balanced perspective on money and possessions. Start small, embrace the journey, and enjoy the numerous benefits that frugal living has to offer.