In this article, I’ll be discussing the costs of renting versus owning a home. We’ll take a closer look at the financial implications of both options and analyze which one may be more cost-effective for a frugal lifestyle. By the end of this article, you’ll have a better understanding of the expenses associated with renting and owning, allowing you to make a more informed decision when it comes to your housing choices.

Comparing the Costs of Renting vs. Owning

Introduction

As someone who has pondered the idea of moving out of my parents’ house and into a place of my own, the question of whether to rent or own has frequently crossed my mind. The cost implications of both options are at the forefront of my decision-making process, and I’m sure I’m not alone in this. Therefore, in this article, I will explore the costs associated with renting and owning a home, weighing the pros and cons of each to help you make an informed decision.

Understanding Renting and Owning

Definition of Renting

Renting refers to the act of paying a predetermined amount of money to a landlord or property management company in exchange for the right to occupy a residence. Renters typically sign a lease agreement, which specifies the duration of the lease, the monthly rent amount, and any other conditions or restrictions.

Definition of Owning

Owning, on the other hand, involves purchasing a property, either outright with cash or with the help of a mortgage loan, and assuming full legal ownership and responsibility for the property. Homeowners have the freedom to make modifications to their property and enjoy the potential benefits of equity and appreciation.

Factors Influencing the Cost of Renting

Monthly Rent

The most obvious cost of renting is the monthly rent payment, which is usually fixed for the duration of the lease agreement. The rental price often depends on factors such as the location, size, condition, and amenities of the rental property. Rent prices can vary significantly from one area to another, so it’s important to research the local rental market when considering renting.

Security Deposits

In addition to the monthly rent, renters are often required to make a security deposit before moving into a rental property. This deposit serves as a safeguard for the landlord against any potential damage or unpaid rent. While security deposit amounts vary, they are typically equivalent to one or two months’ rent. As long as the property is left in good condition, renters can expect to have their deposit returned in full.

Utilities

Renters are responsible for covering the cost of utilities such as electricity, water, gas, and internet. These expenses can add up quickly, especially in areas with high utility rates. It’s important to consider these costs when budgeting for a rental property.

Maintenance and Repairs

One of the advantages of renting is that the landlord is primarily responsible for maintenance and repairs. If an appliance breaks or there are issues with plumbing, for example, the landlord is typically responsible for fixing these problems. However, it’s worth noting that this convenience is factored into the monthly rent, and the tenant indirectly pays for it.

Factors Influencing the Cost of Owning

Mortgage Payments

One of the most significant costs associated with owning a home is the mortgage payment. Unless you’re fortunate enough to be able to purchase a property outright, most homeowners take out a mortgage loan to finance their purchase. The monthly mortgage payment includes the principal amount borrowed, interest, and potentially private mortgage insurance (PMI) for those who have a down payment of less than 20%.

Down Payment

When purchasing a home, buyers are typically required to make a down payment. The down payment is a percentage of the total purchase price that the buyer must pay upfront. This amount can vary, but it’s commonly around 20% of the property’s value. A larger down payment can help lower the monthly mortgage payment and avoid the need for PMI.

Property Taxes

Homeowners are responsible for paying property taxes, which are determined by the local government and are based on the appraised value of the property. These taxes contribute to funding local services such as schools, infrastructure, and emergency services. Property tax amounts can vary significantly depending on the location and value of the property.

Insurance

Homeowners insurance is an essential expense for protecting your investment. This insurance provides coverage in case of damage to the property due to natural disasters, accidents, or theft. The cost of homeowners insurance depends on factors such as the value of the property, its location, and the coverage required. It’s important to shop around and compare quotes from different insurance providers to ensure you get the best coverage at the most affordable price.

Maintenance and Repairs

Unlike renting, homeowners are solely responsible for the maintenance and repairs of their property. This includes routine tasks such as lawn care and cleaning, as well as unexpected repairs such as a leaking roof or a broken water heater. Budgeting for regular maintenance and setting aside funds for future repairs is crucial for homeownership.

Homeowners Association Fees

In some cases, homeowners may also have to pay homeowners association (HOA) fees. These fees are typically associated with properties located in planned communities, condominiums, or townhomes. HOA fees cover the costs of maintaining common areas, shared amenities, and exterior maintenance. The amount of these fees can vary greatly depending on the location and the services provided by the HOA.

Benefits of Renting

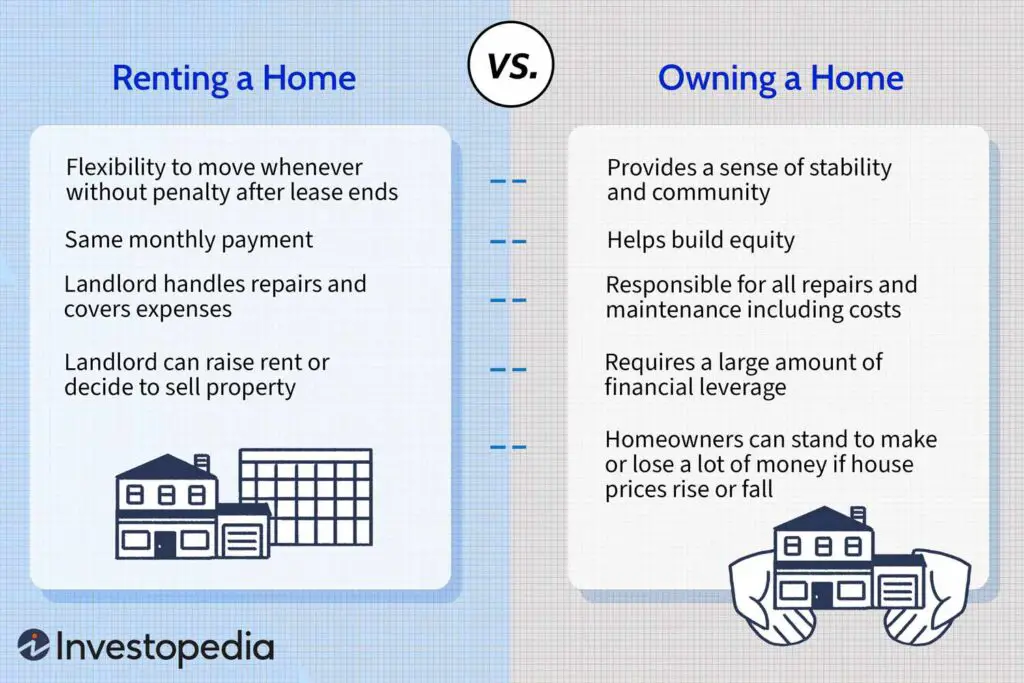

Flexibility

Renting offers a level of flexibility that owning cannot match. As a renter, I can easily move to different locations without the hassle of selling a property. This flexibility is particularly advantageous for individuals who frequently change jobs, have unpredictable life circumstances, or simply enjoy exploring different neighborhoods.

Less Responsibility

Renting typically involves less responsibility compared to owning a home. As a renter, I don’t have to worry about repairs, property taxes, or homeowners insurance. If something breaks or goes wrong, I can simply contact my landlord or property manager to have it fixed.

Lower Upfront Costs

Renting generally requires a smaller upfront investment compared to homeownership. As a renter, I don’t have to worry about saving for a down payment or covering closing costs associated with purchasing a property. This lower upfront cost makes renting more accessible for those who may not have significant savings or want to delay the commitment of homeownership.

Drawbacks of Renting

No Equity

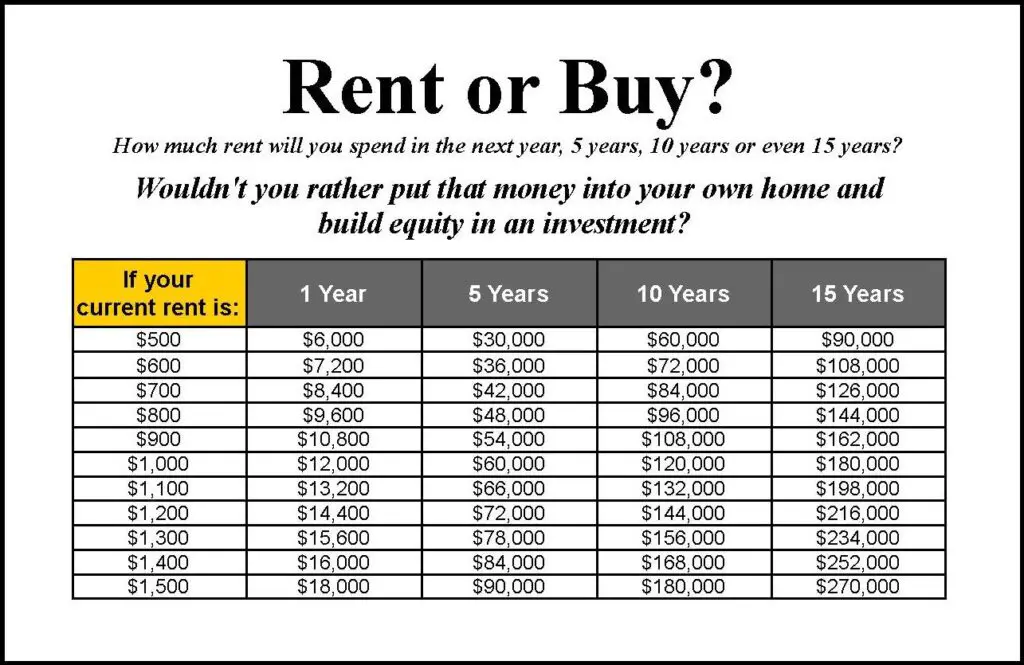

Perhaps the biggest downside of renting is the lack of equity-building. When I make monthly rent payments, that money goes toward the landlord’s pocket, and I don’t accrue any ownership in the property. This means that I miss out on the potential for long-term financial gain that comes with homeownership.

No Control over Rental Property

As a renter, I have limited control over the property I’m living in. I must adhere to any rules or restrictions set forth by the landlord or property management company. This lack of control can be frustrating for people who have a desire to make modifications or personalize their living space.

Less Stability

Renting typically offers less stability compared to owning a home. As a renter, my lease agreement is typically renewed on an annual basis, and there is always the possibility of rent increases or the landlord deciding not to renew the lease. This lack of stability can make it challenging to establish long-term roots or plan for the future.

Benefits of Owning

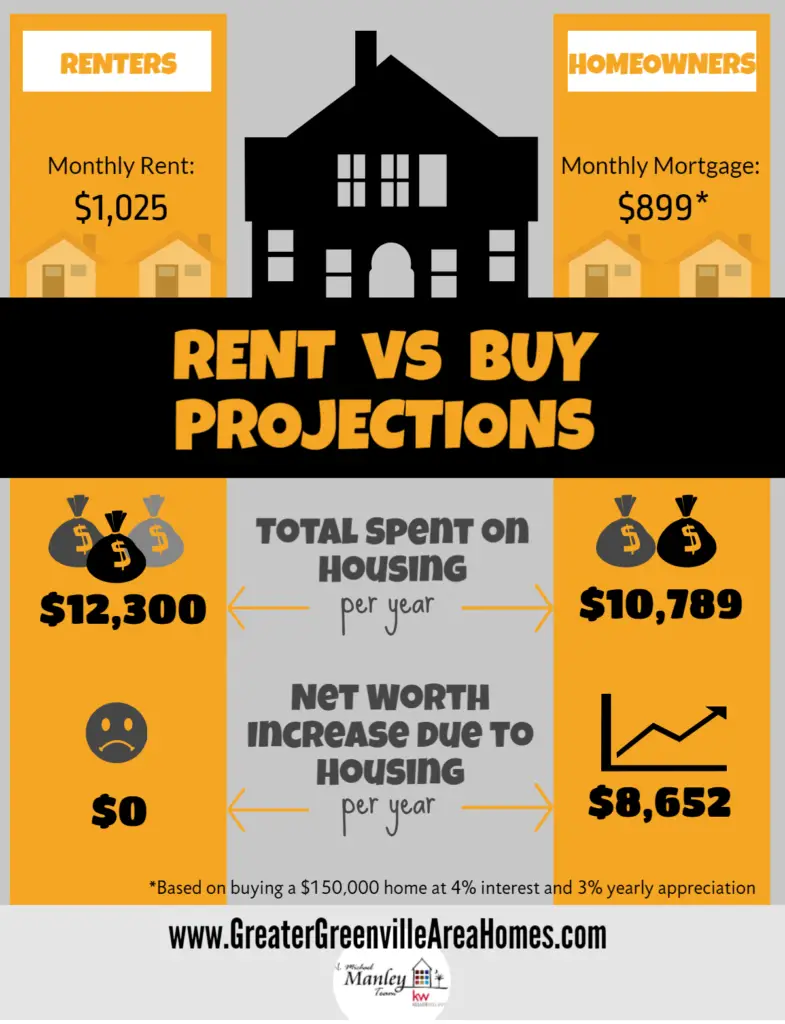

Building Equity

The biggest advantage of homeownership is the opportunity to build equity. When I make mortgage payments, a portion goes toward paying down the principal balance on my loan. This gradually increases my ownership stake in the property. Over time, as the property appreciates in value, I can build significant equity, which can be advantageous for future financial endeavors.

More Control over Property

Owning a home provides me with the freedom to make modifications and improvements to the property to suit my personal preferences and needs. As a homeowner, I can paint the walls, upgrade appliances, or make any other changes without seeking permission from a landlord. This sense of ownership and control is a significant advantage for those who want to create a living space tailored specifically to their taste.

Potential for Appreciation

Historically, real estate has shown the potential for appreciation over time. When I own a home, I have the opportunity to benefit from any increase in property values. This can provide a significant return on investment in the long run, especially in areas with a strong housing market.

Drawbacks of Owning

Higher Upfront Costs

Owning a home comes with higher upfront costs compared to renting. I need to save for a down payment, closing costs, and potentially hire professionals to conduct inspections or appraisals. These costs can amount to a significant sum of money and may pose a challenge for those who don’t have substantial savings.

Responsibility for Maintenance

As a homeowner, I’m solely responsible for maintaining and repairing my property. This can be an ongoing and sometimes costly responsibility. From routine tasks like landscaping to unforeseen repairs, such as a leaky roof, these expenses can add up over time.

Possibility of Depreciation

While real estate generally has the potential for appreciation, there is also the possibility of depreciation. Economic downturns, changes in the neighborhood, or an oversupply of similar properties can cause a decrease in property values. Homeowners should be aware that the value of their investment can fluctuate and may not always increase.

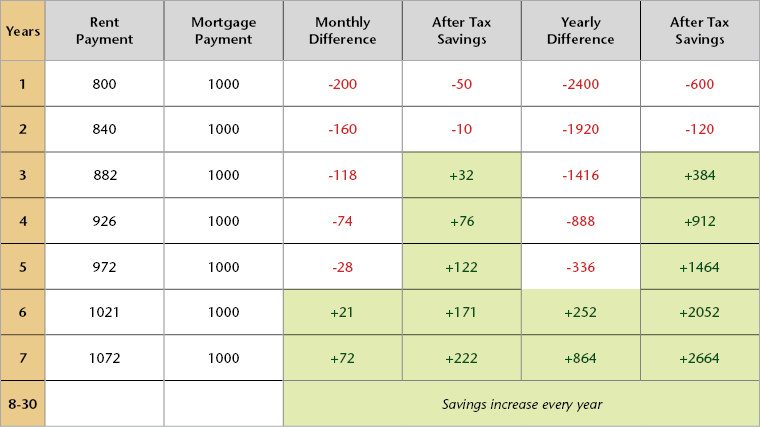

Cost Comparison Analysis

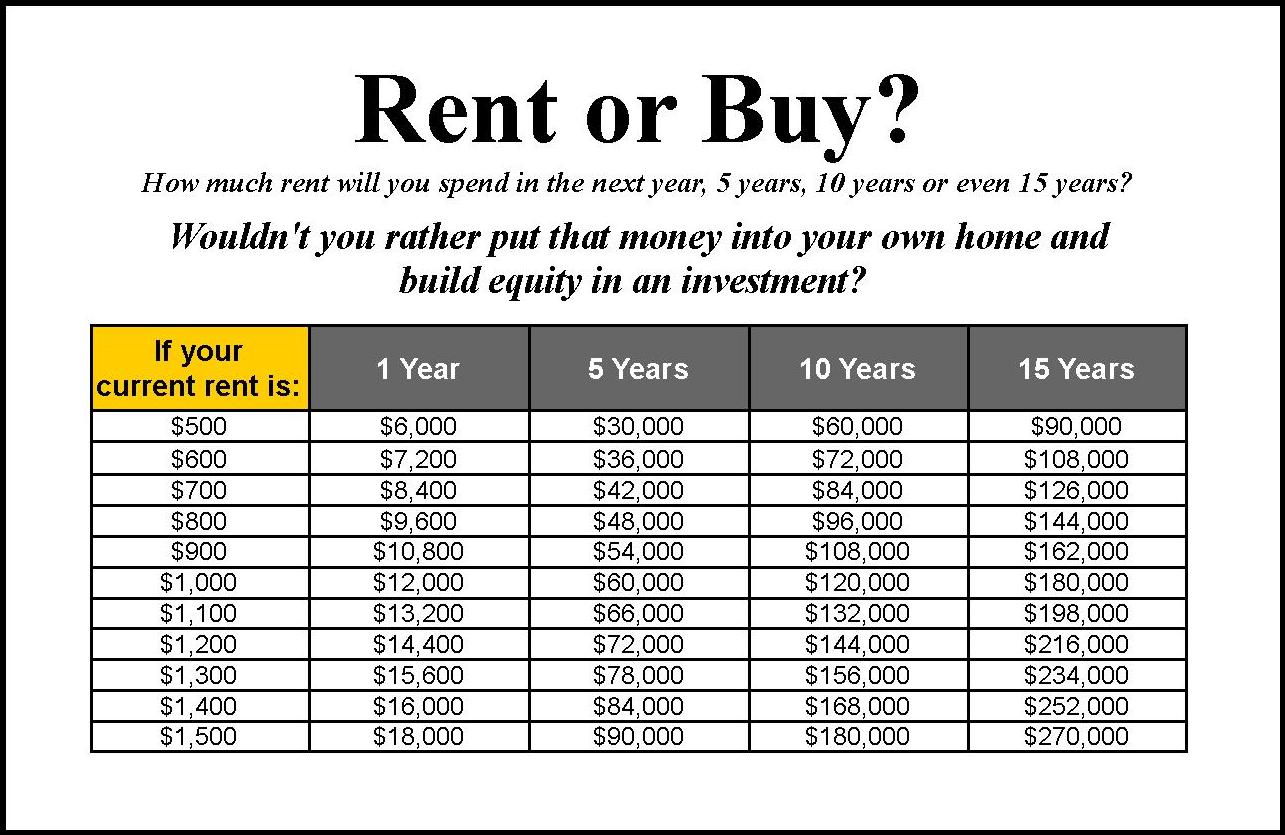

Calculating Renting Costs

To calculate the cost of renting, start with the monthly rent payment. Add to that any security deposits and the cost of utilities, which can vary based on consumption and local rates. It’s also essential to account for any potential rental increases during the duration of the lease. Although the cost of renting may seem straightforward, it’s crucial to consider the opportunity cost of not building equity.

Calculating Owning Costs

Calculating the cost of owning a home is more complex. First, determine the monthly mortgage payment, factoring in the interest rate, loan term, and any additional costs such as PMI. Then, add property taxes, insurance premiums, and any HOA fees. Finally, set aside funds for regular maintenance and budget for potential repairs. Remember to include the opportunity cost of tying up funds in a property that could be invested elsewhere.

Long-Term Analysis

When comparing the long-term costs of renting and owning, it’s essential to consider the potential appreciation of a property and the potential return on investment. Owning a home allows for the possibility of building significant equity, while renting offers the flexibility of easily moving to different locations. It’s important to weigh these factors against each other and consider the individual’s financial goals and circumstances.

Factors to Consider when Making a Choice

Financial Situation

Your financial situation plays a crucial role in the decision to rent or own. Consider factors such as available savings, income stability, credit history, and potential future income growth. Owning a home typically requires a more significant upfront investment, while renting may be a more affordable option in the short term.

Future Plans

Consider your plans for the future. If you anticipate job changes, relocation, or lifestyle shifts in the near future, renting may provide the necessary flexibility. Alternatively, if you plan to settle down in a specific location for an extended period and want to build equity, homeownership may be the better choice.

Market Conditions

Real estate market conditions can influence the decision to rent or own. If property values are high and rental rates are relatively low, it may be more cost-effective to rent. Conversely, in areas where property values are appreciating rapidly, owning may provide a better long-term investment opportunity.

Personal Preferences

Personal preferences also play a significant role in the decision-making process. Consider factors such as lifestyle, desired level of control over the living space, and willingness to take on additional responsibilities. Some individuals may prioritize the feeling of ownership and the ability to personalize their living space, while others may value the flexibility and lower responsibilities associated with renting.

Real-Life Examples of Renting vs. Owning

Example 1: Single Professional

A single professional who frequently travels for work and values flexibility may find it more beneficial to rent. Renting allows for an easier relocation if job opportunities arise in different cities. Additionally, the lower maintenance responsibilities and upfront costs make renting a more attractive option for someone with a busy lifestyle.

Example 2: Young Family

A young family looking to settle down and create a stable home environment may prefer homeownership. Owning a property can provide a sense of stability and the opportunity to personalize the living space for the whole family. Appreciation potential and the ability to build equity also make homeownership an appealing choice for those looking to invest in their future.

Example 3: Retired Couple

A retired couple with fixed income and a desire to downsize may find renting to be a more suitable option. Renting provides the flexibility to explore different locations and eliminates the responsibilities of homeownership, allowing them to focus on enjoying their retirement years without the burden of upkeep and maintenance.

Conclusion

Choosing between renting and owning a home involves weighing the pros and cons associated with the costs of each option. Renting offers flexibility, less responsibility, and lower upfront costs, while owning provides the opportunity to build equity, take control of the property, and potentially benefit from long-term appreciation. By considering factors such as financial situation, future plans, market conditions, and personal preferences, you can make an informed decision that aligns with your lifestyle and financial goals. Ultimately, the decision to rent or own should be based on your individual circumstances and what you believe will bring you the most satisfaction and financial security in the long run.