Living frugally doesn’t have to be a daunting task. In fact, it can be a rewarding and fulfilling way to approach daily life. By incorporating simple yet effective habits into your daily, monthly, and yearly routines, you can develop frugal habits that will not only help you save money but also lead to a more sustainable and intentional lifestyle. From creating a budget to meal planning and practicing mindful spending, this article will guide you on your journey to mastering the art of frugality and transforming it into a lifelong habit. So, get ready to embrace a simpler, more economical way of living that will give you financial freedom and peace of mind.

Creating a Frugal Mindset

Understanding the Benefits of Frugality

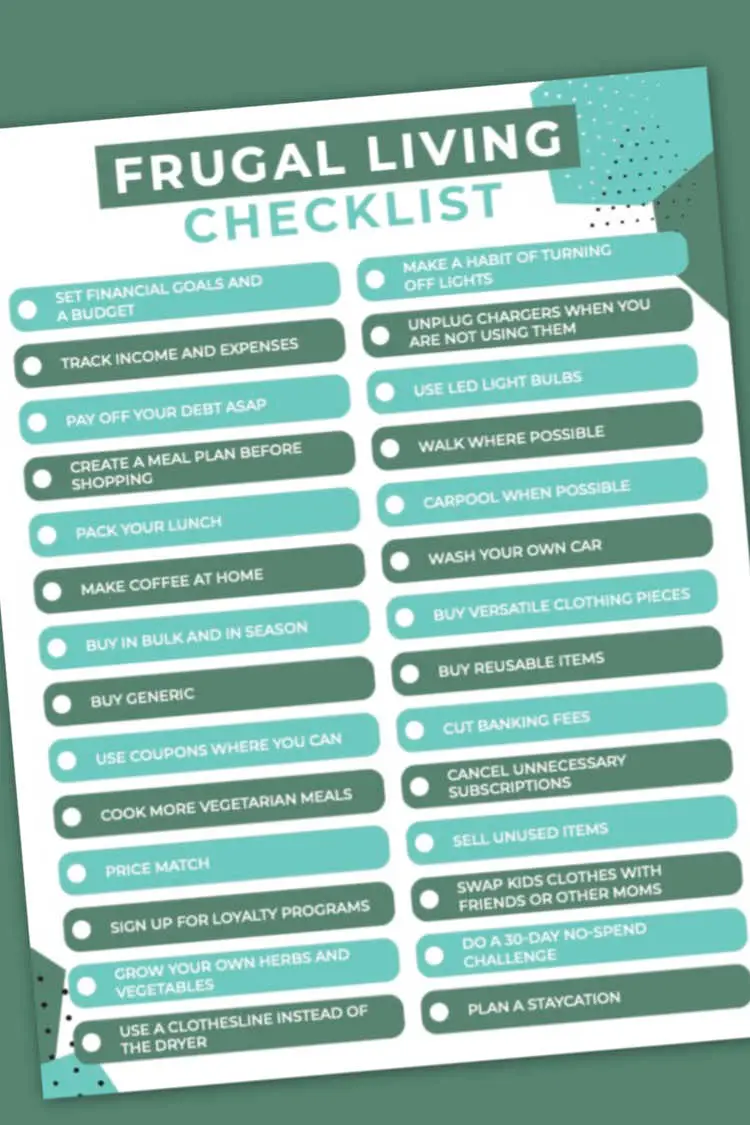

Having a frugal mindset is all about adopting a mindset of mindful spending and saving. It’s about making conscious choices that align with your financial goals and values. By embracing frugality, you can enjoy numerous benefits, such as:

-

Financial stability: By practicing frugality, you can reduce your expenses and increase your savings, leading to greater financial stability.

-

Debt reduction: Frugality allows you to pay off debt faster and avoid accumulating unnecessary debt in the first place.

-

Flexibility and freedom: Saving money through frugality gives you the freedom to pursue your dreams and goals, whether it’s starting your own business, traveling, or investing in your future.

-

Reduced stress: Financial worries can significantly impact your mental health. By adopting a frugal mindset, you can reduce financial stress and enjoy a more relaxed and fulfilling life.

Identifying Your Financial Goals

Before diving into the specifics of frugal living, it’s essential to identify your financial goals. What do you want to achieve financially? Do you want to save for retirement, buy a house, or pay off a significant debt? Once you have a clear picture of your financial goals, it becomes easier to develop a frugal mindset that aligns with your aspirations.

Changing Your Attitude towards Money

Developing a frugal mindset also entails shifting your attitude towards money. Instead of viewing money as a means to instant gratification, start seeing it as a tool for achieving your long-term financial goals. This change in mindset involves being more mindful of your spending habits, valuing experiences over material possessions, and seeking satisfaction from saving rather than splurging.

Budgeting and Expense Tracking

Setting up a Realistic Budget

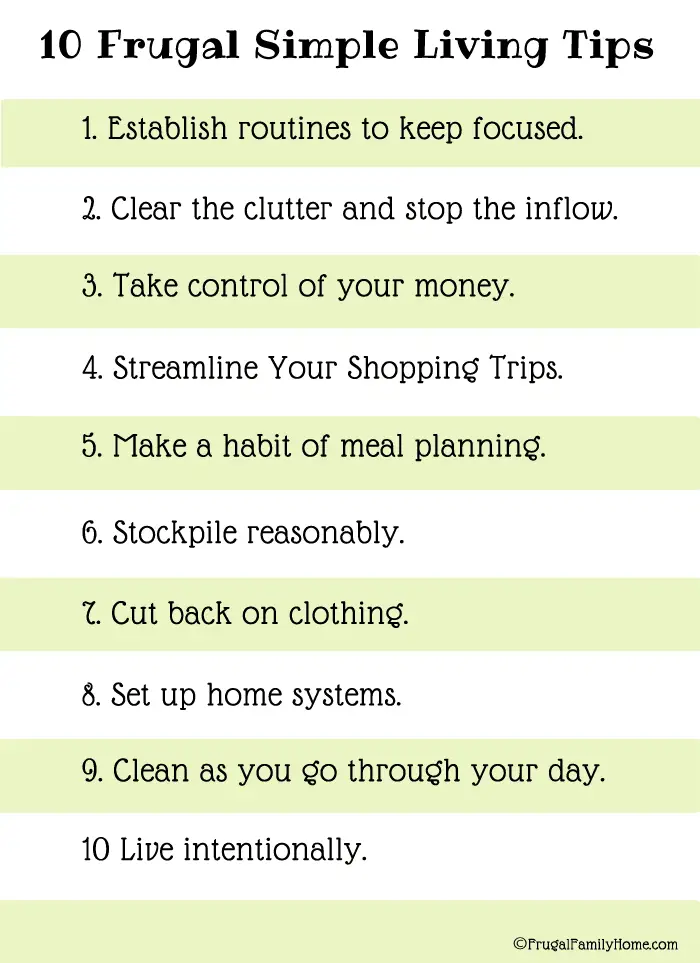

One of the cornerstones of frugal living is creating a realistic budget. A budget helps you track your income, expenses, and savings, ensuring that you are always in control of your financial situation. To set up a budget, start by listing all your sources of income and subtract your fixed expenses, such as rent, utilities, and debt payments. Allocate a portion of your income to savings and set limits for variable expenses, such as groceries and entertainment.

Tracking Your Daily Expenses

Tracking your daily expenses is crucial for maintaining a frugal lifestyle. By diligently recording every penny you spend, you gain a clear understanding of your spending habits. This awareness allows you to identify areas where you can cut back or find more cost-effective alternatives. Whether you use a notebook, a spreadsheet, or budgeting apps, tracking your expenses is a vital habit for maintaining a frugal mindset.

Using Budgeting Apps

In today’s technological age, numerous budgeting apps can assist you in managing your finances. These apps offer features like expense tracking, bill reminders, and even automated savings. Some popular budgeting apps include Mint, You Need a Budget (YNAB), and PocketGuard. By utilizing these apps, you can simplify the process of budgeting and expense tracking, making it easier to achieve your financial goals.

Reviewing and Adjusting Your Budget Regularly

A frugal mindset requires flexibility and adaptability. As your financial situation evolves, it’s essential to review and adjust your budget to ensure it remains realistic and aligned with your goals. Regularly assess your expenses, income, and savings to identify any necessary modifications. By regularly reviewing and adjusting your budget, you can stay on track and make the most out of your financial resources.

Smart Shopping Strategies

Making a Shopping List

One of the simplest yet most effective frugal shopping strategies is making a shopping list. Before going to the store or shopping online, take the time to plan out your purchases. By creating a detailed list, you can avoid impulse buying and stick to buying only what you need. Remember to prioritize essential items and avoid unnecessary purchases that can derail your frugal goals.

Comparing Prices

Another smart shopping strategy is to compare prices before making a purchase. With a plethora of online retailers and price comparison websites available, finding the best deals has never been easier. Take the time to research and compare prices to ensure you’re getting the best value for your money. Don’t forget to consider factors like quality, durability, and customer reviews when making your purchasing decisions.

Using Coupons, Discount Codes, and Cashback Offers

Take advantage of coupons, discount codes, and cashback offers to save money on your purchases. Many retailers and websites offer these discounts, whether it’s through physical coupons or online codes. Additionally, cashback websites and apps allow you to earn a percentage of your purchase back as cash. Be sure to check for available discounts and cashback offers before making any purchase to maximize your savings.

Shopping During Sales and Promotions

Timing your purchases to coincide with sales and promotions is another smart shopping strategy. Retailers often offer discounts and promotions during seasonal sales, holidays, and clearance events. By being patient and strategic with your shopping, you can save a significant amount of money. Keep an eye out for upcoming sales, sign up for newsletters, and follow your favorite stores on social media to stay updated on the latest deals.

Avoiding Impulse Buying

Impulse buying can quickly derail any efforts towards a frugal lifestyle. Practice restraint and remind yourself of your financial goals before making any impulsive purchase. Try implementing a waiting period before buying non-essential items, giving yourself time to assess whether it’s a true need or a momentary want. Learning to differentiate between necessities and desires is crucial for maintaining a frugal mindset.

Meal Planning and Cooking at Home

Creating a Weekly Meal Plan

Meal planning is a fantastic frugal habit that can save you both time and money. By creating a weekly meal plan, you can organize your meals in advance, ensuring that you have a clear idea of what to cook each day. Take inventory of your pantry and fridge, brainstorm meal ideas, and create a shopping list based on the ingredients you need. Not only does meal planning prevent last-minute expensive takeout, but it also allows you to make use of leftovers effectively.

Shopping for Ingredients in Bulk

When grocery shopping, consider purchasing non-perishable items in bulk. Buying items in larger quantities often leads to significant cost savings in the long run. Look for bulk sections in grocery stores or consider joining a wholesale club to access lower prices. However, be mindful of perishable items that may spoil before you can consume them all. Only buy in bulk if you are confident you can use the products before they expire.

Avoiding Dining Out Frequently

Eating out regularly can quickly drain your bank account. While the occasional treat is fine, making it a habit can significantly impact your finances. Opt for cooking at home more often to save money and have more control over your meals’ nutritional value. Prepare meals in advance and take them to work for lunch, as this can help you avoid costly takeout options.

Learning Basic Cooking Skills

Developing basic cooking skills is not only a valuable life skill but also an effective way to save money. By learning how to cook from scratch, you can avoid relying on expensive pre-packaged meals or dining out. Starting with simple recipes and gradually expanding your cooking repertoire will allow you to create delicious and cost-effective meals at home.

Using Leftovers for Future Meals

Wasting food is not only detrimental to the environment but also to your wallet. Instead of throwing away leftovers, incorporate them into future meals. Get creative with your leftovers by repurposing them into new dishes or incorporating them into packed lunches. By utilizing leftovers effectively, you minimize food waste and maximize your grocery budget.

Saving on Utilities and Household Expenses

Conserving Energy and Water

Reducing your energy and water consumption not only benefits the environment but also your monthly bills. Simple habits like turning off lights when not in use, using energy-efficient appliances, and adjusting your thermostat can lead to significant savings over time. Likewise, adopting water-saving practices like fixing leaks, taking shorter showers, and using efficient irrigation systems can lower your water bills.

Turning off Electronics and Appliances

Leaving electronics and appliances on standby mode can still consume energy, even when they are not in use. Make it a habit to turn off and unplug electronics and appliances when they are not needed, such as when you leave the house or go to sleep. Utilize power strips to easily switch off multiple devices at once, further reducing energy wastage.

Utilizing Natural Light

Maximize the use of natural light in your home by opening curtains and blinds during the day. Natural light not only provides better illumination but also reduces the need to rely on artificial lighting. Be mindful of how you arrange furniture and decor to maximize the entry of natural light into your living spaces.

Insulating Your Home

Proper insulation plays a crucial role in maintaining a comfortable indoor temperature and reducing energy consumption. Insulate your home by sealing gaps around windows and doors, insulating your attic, and improving insulation in walls. By reducing heat transfer, you can lower your heating and cooling bills and create a more energy-efficient home.

Finding Ways to Reduce Internet and Phone Bills

In today’s interconnected world, internet and phone bills can take a significant chunk out of your budget. To reduce these expenses, consider negotiating with your service providers for better rates or exploring alternative providers. Bundle services if possible, and regularly review your plans to ensure they align with your current needs.