Introduction

As a senior, finding ways to save money and maintain a frugal lifestyle has become increasingly important to me. With the rising costs of healthcare, housing, and daily expenses, it is crucial to adopt frugal living habits in order to stretch our limited budgets. In this post, I will share some valuable tips that have helped me navigate through the challenges of frugal aging and save money without sacrificing my quality of life.

Budgeting: Prioritizing and Planning

Creating a budget is the first step towards frugal living. It involves tracking your income and expenses to gain a clear understanding of your financial situation. Start by listing all your essential expenses, such as housing, healthcare, and groceries. Then, allocate a specific portion of your income to each category. By prioritizing your expenses and cutting down on discretionary spending, you can ensure that you are living within your means.

Saving on Everyday Expenses

There are several ways to save money on everyday expenses, such as utilities and groceries. Consider switching to energy-efficient appliances and using LED light bulbs to reduce your electricity bill. Look out for sales and discounts when purchasing groceries and consider joining a loyalty program at your local supermarket. Additionally, try to cook at home more often instead of dining out, as it can significantly lower your food expenses.

Exploring Senior Discounts

One of the advantages of being a senior is the availability of various discounts. Many retailers, restaurants, and entertainment venues offer special rates for seniors. It is worth researching and taking advantage of these discounts to save money. Don’t be shy to ask for discounts when shopping or dining out as many establishments do not advertise these offers.

Downsizing and Decluttering

Consider downsizing your living space to reduce expenses and simplify your life. Evaluate whether your current housing arrangement is suitable for your needs and explore more affordable options, such as downsizing to a smaller home or moving into a senior community. Decluttering your belongings can also generate extra income by selling unused or unwanted items.

Embracing a Thrifty Lifestyle

Living frugally does not mean sacrificing happiness. Embracing a thrifty lifestyle can actually lead to greater fulfillment. Instead of spending money on material possessions, focus on experiences, such as spending time with loved ones or engaging in hobbies. Shift your mindset from materialism to gratitude, and you will find that the true joys in life do not come from material possessions.

adopting a frugal lifestyle as a senior can lead to financial stability and peace of mind. By budgeting, saving on everyday expenses, taking advantage of senior discounts, downsizing, and embracing a thrifty lifestyle, we can navigate through the challenges of frugal aging and find joy in the simple pleasures of life.

Understanding Frugal Living

Definition of frugal living

Frugal living is a lifestyle choice that focuses on being economical and mindful of expenses in order to save money. It involves living within your means, making conscious decisions about spending, and finding creative ways to stretch your resources. Frugal living does not mean sacrificing quality of life; rather, it encourages prioritizing needs over wants and finding satisfaction in simple pleasures.

Importance of frugal living

For seniors, frugal living can be particularly beneficial in managing their finances and ensuring a secure future. As we age, our expenses may increase while our income may decrease due to retirement or fixed incomes. Embracing frugal living can help seniors maintain financial stability and independence.

By adopting a frugal lifestyle, seniors can stretch their retirement savings, reduce debt, and build an emergency fund for unexpected expenses. Being mindful of expenses also allows seniors to have more control over their money and make informed decisions based on their priorities.

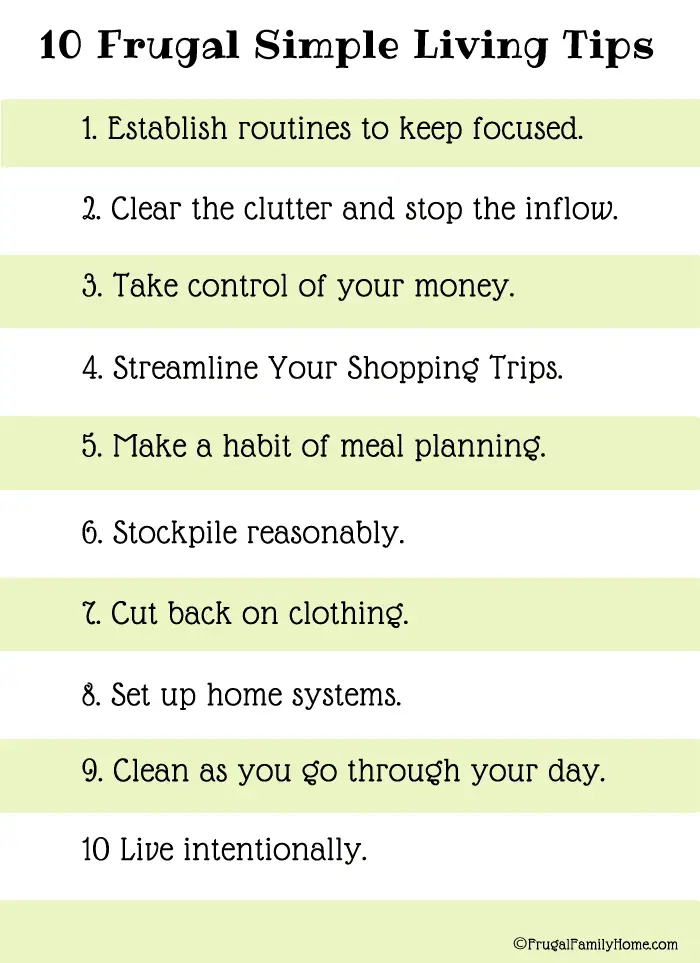

Practical frugal living tips for seniors

-

Budgeting: Create a monthly budget that outlines your income, expenses, and savings goals. Track your spending to identify areas where you can cut back or make adjustments.

-

Meal planning: Plan your meals in advance and make a grocery list to avoid impulse purchases. Cooking at home not only saves money but also allows you to have healthier and more nutritious meals.

-

Saving on utilities: Turn off lights and unplug appliances when not in use, reduce water usage, and adjust your thermostat to save on energy bills.

-

Shopping smart: Compare prices, use coupons, and take advantage of senior discounts offered by stores and services. Consider buying in bulk or second-hand to save even more.

-

Socializing on a budget: Instead of expensive outings, explore free or low-cost activities such as visiting local parks, attending community events, or organizing picnics with friends.

Remember, frugal living is a journey, and it’s all about making small changes that can lead to significant savings over time. By embracing frugality, seniors can enjoy financial security, peace of mind, and a fulfilling retirement.

Frugal Living Tips for Seniors

As a senior looking to save money, there are several strategies and habits you can adopt to embrace a frugal lifestyle. Managing retirement savings effectively is crucial to ensure financial stability. By diversifying your investments and considering low-risk options, you can make your savings work for you without taking unnecessary risks.

Cutting down on unnecessary expenses is another effective way to save money. Review your monthly bills and subscriptions to identify any services you no longer need or use. Canceling these subscriptions can free up funds for more essential expenses. Additionally, consider downgrading your cable or internet plan to a more affordable option that still meets your needs.

Creating a budget and diligently tracking your expenses can also help you manage your finances effectively. By knowing where your money is going, you can identify areas where you may be overspending and make necessary adjustments. This conscious awareness of your spending habits can make a significant difference in your overall savings.

Take advantage of coupons and discounts whenever possible. There are numerous websites and apps that offer discounts on groceries, clothing, and other everyday items. By utilizing these resources, you can save a substantial amount of money over time.

Cooking at home and meal planning can also contribute to significant savings. Not only is eating out often more expensive, but cooking your meals also allows you to have full control over the ingredients and portion sizes. Consider preparing meals in bulk and freezing them for later consumption to save both time and money.

When it comes to transportation, consider utilizing public transportation or carpooling as an affordable alternative to driving. This can help you save on fuel costs, maintenance, and parking fees. Additionally, explore senior discounts and benefits that may be available for public transportation services.

Saving on healthcare expenses is crucial for seniors. Be proactive in researching and comparing healthcare plans to find the most cost-effective option that provides adequate coverage. Additionally, consider generic medications instead of brand-name ones, as they are often more affordable while still being equally effective.

Embracing energy-efficient living can lead to significant savings on utility bills. Invest in energy-efficient appliances and light bulbs, and be mindful of your energy consumption patterns. Simple habits like turning off lights when not in use and adjusting the thermostat can make a noticeable difference in your monthly bills.

Engaging in DIY projects and repairs can also help you save money on various household tasks. With the abundance of online tutorials and resources available, you can acquire new skills and fix minor issues around your home without having to hire a professional.

It is crucial to eliminate debt and avoid relying on credit cards whenever possible. High-interest rates can quickly accumulate, making it harder to achieve financial stability. Develop a plan to pay off any outstanding debt gradually and try to live within your means.

Finally, encourage social connections and shared resources within your community. Participate in local events, swap goods or services with neighbors, and collaborate on group activities. By sharing resources and experiences, you can build a supportive network while enjoying additional savings.

By implementing these frugal living tips, you can take control of your finances, stretch your retirement savings, and enjoy a more financially secure future. Remember, small changes can add up to significant savings without compromising your quality of life.

Financial Planning for Seniors

As I approach my golden years, I’ve come to realize the importance of financial planning for seniors. It’s no secret that managing finances becomes increasingly crucial as we age, especially with the rising costs of healthcare, living expenses, and unexpected emergencies. In this post, I want to share some valuable tips that have helped me navigate the world of frugal living as a senior citizen.

Importance of Financial Planning in Senior Years

One of the first lessons I learned was the significance of seeking professional advice. Financial experts, such as certified financial planners or accountants, can provide guidance tailored to our unique needs and financial situations. Their expertise can help us make informed decisions and maximize our savings.

Seeking Professional Advice

Seeking professional advice doesn’t mean relying solely on others. It’s essential to actively participate in our financial planning journey. Setting financial goals is a crucial step towards achieving financial security and independence. Whether it’s saving for retirement, reducing debt, or pursuing a long-held dream, having goals motivates us and helps shape our financial decisions.

Creating a Retirement Budget

Creating a retirement budget has been transformative for me. By carefully examining my income and expenses, I could identify areas where I could cut back without sacrificing my quality of life. It’s important to be realistic and account for all essential expenses, such as housing, healthcare, and daily living costs. Additionally, setting aside funds for hobbies, travel, or unexpected expenses ensures that we can enjoy our retirement years without constant financial stress.

Investing Wisely

Investments play a significant role in securing our financial future. However, it’s important to choose investments wisely and ensure they align with our risk tolerance and long-term goals. Diversifying portfolios and seeking low-cost investment options can help maximize returns and mitigate risks.

Understanding Income Streams and Entitlements

Lastly, as seniors, it’s crucial to have a comprehensive understanding of our income streams and entitlements. It’s common to rely on sources such as pensions, Social Security, and retirement savings. Exploring additional benefits and entitlements can provide extra financial security, such as tax breaks, government assistance, or discounts for seniors.

By implementing these financial planning strategies, seniors can embrace frugal living and enjoy their retirement years with confidence. It’s never too late to start taking control of our finances and securing a bright and financially stable future.

Healthcare and Insurance Considerations

For seniors, healthcare and insurance can be a major concern when it comes to managing their finances. Understanding the different options available is crucial in ensuring that you make the most cost-effective choices. Let’s delve into some important considerations in this area.

Understanding Medicare and Medicaid

Medicare and Medicaid are two government-funded programs that provide healthcare coverage for seniors. Medicare is available to individuals aged 65 and older, while Medicaid is designed for low-income seniors who meet specific eligibility criteria. Familiarize yourself with the coverage and benefits offered by these programs to determine which one suits your needs best.

Choosing the right healthcare plan

Apart from Medicare and Medicaid, there are various private healthcare plans available for seniors. Compare and research different options to find the one that offers the most comprehensive coverage at affordable rates. Consider factors such as monthly premiums, deductibles, and copayments, as well as the network of healthcare providers available under each plan.

Minimizing medical expenses

To reduce your overall medical expenses, consider preventive care as a priority. Regular check-ups and screenings can help catch potential health issues early on. Additionally, make the most of any wellness programs or discounts offered through your insurance provider. Take advantage of generic drugs whenever possible, as they tend to be more cost-effective than brand-name medications.

Managing prescription medication costs

Prescription medications can often be a significant expense for seniors. Look into prescription drug plans (Part D) that can help cover the costs of your medications. Compare different plans to find one that includes the medications you need at the lowest prices.

Long-term care options

Planning for long-term care is imperative for seniors, as the costs can be substantial. Research the different options available, such as home care services, assisted living facilities, or nursing homes. Consider long-term care insurance if it aligns with your financial situation and goals.

Senior housing and affordability

Housing is an essential aspect of frugal living for seniors. Consider downsizing to a smaller, more affordable home, or explore options such as senior co-housing or subsidized housing programs. Look for communities that offer amenities and services specifically catered to seniors, ensuring a comfortable and affordable living situation.

Taking the time to understand your healthcare and insurance options, as well as exploring cost-saving measures, can significantly impact your financial well-being as a senior. By making informed decisions and considering alternatives, you can maintain a frugal lifestyle while managing your healthcare needs effectively.

Maintaining a Frugal Lifestyle for Seniors

As a senior, I understand the importance of living frugally in order to make the most of my retirement years. Throughout my own journey, I have discovered various ways to save money and stretch my budget. In this section, I will outline some valuable tips that have helped me maintain a frugal lifestyle.

Practicing Mindful Spending

One of the first steps in living frugally is to prioritize needs over wants. By carefully evaluating my purchases and considering whether they are necessary, I avoid unnecessary expenses. I also make a habit of comparing prices, utilizing coupons, and taking advantage of sales to get the best value for my money.

Continuing Education and Personal Growth on a Budget

Learning should never stop, regardless of age or financial situation. Many universities and community colleges offer discounted or free courses for seniors. I have taken advantage of these opportunities to further my education and pursue personal interests without breaking the bank.

Frugal Travel and Vacation Tips

Traveling does not have to be expensive. I have found that planning trips during off-peak times and utilizing budget-friendly accommodations can significantly reduce costs. Additionally, exploring local destinations and taking advantage of senior discounts can make travel more affordable and enjoyable.

Exploring Free or Low-Cost Leisure Activities

There are countless free or low-cost activities available for seniors to enjoy. I have joined community centers, senior groups, and clubs that organize various recreational activities at little to no cost. Additionally, local libraries often offer free access to books, movies, and classes, providing endless opportunities for entertainment and personal enrichment.

Effective Use of Technology and Internet Resources

Utilizing technology and the internet can help seniors save money and stay connected. From researching and comparing prices online to utilizing ride-sharing apps and virtual communication platforms, technology has made it easier for me to access information, services, and entertainment at a lower cost.

Sustainable and Eco-Friendly Practices

Living frugally goes hand in hand with adopting sustainable habits. By reducing energy consumption, recycling, and using eco-friendly products, I not only save money on bills but also contribute to a healthier environment for future generations.

Incorporating these frugal living tips into my daily life has allowed me to maintain a comfortable retirement without sacrificing the quality of life. By being mindful of my spending, pursuing personal growth on a budget, and taking advantage of resources available to seniors, I have discovered that frugal living can be both rewarding and fulfilling.

Dealing with Financial Challenges in Retirement

Coping with reduced income and unexpected expenses

Retirement is a wonderful phase of life where we can finally enjoy the fruits of our labor and have time for the things we love. However, it often comes with reduced income, making it crucial to find ways to cope with these financial challenges. One of the best tips I’ve found is to create a budget. By carefully analyzing my expenses and income, I can prioritize what’s important and cut unnecessary costs.

Supplementing income through part-time work or freelance opportunities

Sometimes, even with a carefully planned budget, we may find ourselves needing additional income. One way to tackle this challenge is by exploring part-time work or freelance opportunities. This not only provides extra money but also keeps us engaged and active. Personally, I discovered my passion for writing and started freelancing, which not only brings in some extra cash but also gives me a sense of fulfillment.

Managing financial emergencies

Financial emergencies can be stressful, especially when we’re on a fixed income. The key to managing these situations is to prepare for the unexpected. I’ve found it helpful to establish an emergency fund, a separate account specifically for unexpected expenses. By contributing a small amount regularly, I have peace of mind knowing I can handle financial emergencies without relying on credit cards or loans.

Avoiding financial scams and frauds

Unfortunately, seniors are often targeted by scammers and fraudsters looking to take advantage of their vulnerability. To protect myself, I’ve become vigilant in educating myself about common scams and frauds. Some precautions I take include never sharing personal information over the phone, verifying the legitimacy of any charity before donating, and regularly checking my bank statements for any suspicious activities.

Remember, frugal living in retirement doesn’t mean sacrificing happiness. It’s about making smart choices with our money and finding ways to live comfortably on a reduced income. By implementing these tips, we can tackle financial challenges head-on and enjoy a fulfilling and worry-free retirement. So let’s embrace frugal living and make the most of our golden years!

Psychological and Emotional Aspects of Frugal Living

Overcoming Societal Pressures and Consumerism

As a senior, I understand the constant societal pressures to keep up with the latest trends and consumerism. However, embracing frugal living has allowed me to break free from these expectations and find a sense of liberation. By letting go of the need to constantly spend and accumulate material possessions, I have been able to redefine my priorities and focus on what truly matters in life.

Finding Fulfillment in Simple Pleasures

One of the most rewarding aspects of frugal living is discovering the joy and contentment that can be found in simple pleasures. Whether it’s enjoying a walk in nature, spending quality time with loved ones, or pursuing a hobby, these activities bring genuine happiness without the need for excessive spending. By shifting my perspective towards appreciating the little things, I have found that it is the experiences and memories that truly enrich my life, rather than material possessions.

Boosting Self-Esteem and Contentment

Frugal living has also had a positive impact on my self-esteem and overall contentment. By embracing a simpler lifestyle, I have become less concerned with impressing others or seeking validation through material possessions. Instead, I have focused on building self-confidence through personal growth and cultivating meaningful relationships. This shift in mindset has allowed me to appreciate the unique qualities I possess and find contentment from within, rather than relying on external factors.

Building Resilience and Adapting to Change

Lastly, frugal living has taught me the importance of building resilience and adapting to change. This has been particularly valuable in my senior years, as life inevitably brings unexpected challenges and transitions. By developing the ability to live within my means and embrace simplicity, I have built a stronger foundation for navigating these changes with grace and flexibility. Frugal living has empowered me to face uncertainty with confidence, knowing that true happiness resides in inner fulfillment rather than external circumstances.

embracing frugal living as a senior has not only allowed me to save money, but it has also brought about significant psychological and emotional benefits. Overcoming societal pressures and consumerism, finding fulfillment in simple pleasures, boosting self-esteem and contentment, and building resilience and adaptability are just a few of the ways in which frugal living has made a positive impact on my life. By prioritizing what truly matters and embracing a simpler lifestyle, I have found true happiness and contentment in my senior years.

Conclusion

Take Control of Your Finances

In conclusion, adopting a frugal lifestyle as a senior can greatly improve your financial well-being and provide you with a sense of security for the years to come. By implementing these practical tips, you can take control of your finances and stretch your retirement savings further.

Embrace a Simple and Minimalist Lifestyle

Living frugally doesn’t mean sacrificing comfort or enjoyment. Instead, it encourages us to embrace a simple and minimalist lifestyle. By prioritizing our needs over wants, we can avoid unnecessary expenses and find contentment in the things that truly matter.

Utilize Discounts and Savings Opportunities

As seniors, we are eligible for a wide range of discounts and savings opportunities. From senior-specific discounts at restaurants and stores to reduced rates on travel and entertainment, taking advantage of these offers can significantly decrease our expenses. Be sure to ask about senior discounts wherever you go and always carry your senior identification card.

Maximize the Use of Available Resources

When it comes to frugal living, it’s crucial to be resourceful and make the most out of what we already have. Whether it’s utilizing library services instead of buying books, growing our own vegetables, or repurposing items instead of purchasing new ones, finding creative ways to minimize expenses is key. This not only allows us to save money but also promotes sustainability and reduces waste.

Seek Support from Community Organizations

Lastly, don’t hesitate to seek support from community organizations that cater to seniors. Many local agencies and nonprofits offer assistance programs, discounts, and services that can help ease the financial burden. From subsidized housing to meal assistance programs, these organizations are there to support us and provide valuable resources.

By implementing these frugal living tips, seniors can achieve financial stability, reduce financial stress, and enjoy a more secure and fulfilling retirement. Remember, it’s never too late to start living frugally – every small step counts towards a more prosperous future. So, embrace the frugal lifestyle and embark on a rewarding journey towards financial freedom!