Introduction

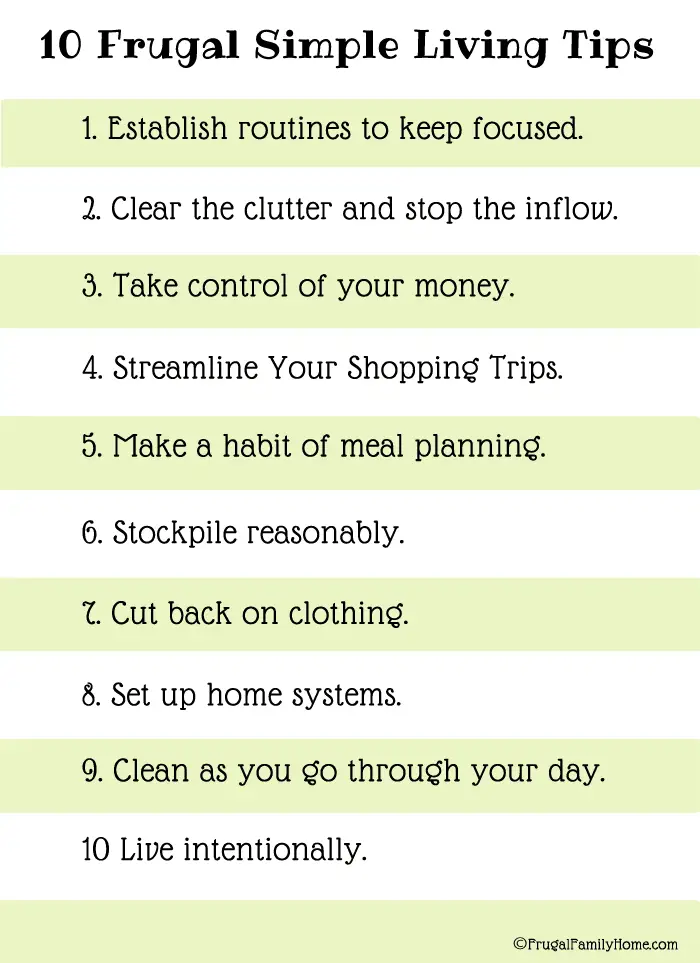

Welcome to Frugal Living 101! If you’re looking to save money and live a more financially responsible life, you’ve come to the right place. In this article, I’ll be sharing essential tips for beginners on how to start saving money today.

Why Choose Frugal Living?

Frugal living is all about making intentional decisions when it comes to your spending habits. By adopting a frugal lifestyle, you can achieve financial independence, reduce debt, and build a solid foundation for your future. It’s a simple yet effective way to take control of your finances and prioritize what truly matters to you.

Create a Budget and Track Your Expenses

The first step to saving money is creating a realistic budget. Take the time to evaluate your income and expenses, and allocate funds to different categories such as housing, transportation, groceries, and entertainment. Make sure to set aside savings as well. Tracking your expenses will help you identify areas where you can cut back and make necessary adjustments.

Cut Back on Unnecessary Expenses

One of the key principles of frugal living is cutting back on unnecessary expenses. Evaluate your spending habits and identify any non-essential items or services that you can easily live without. Look for ways to save on groceries, utilities, and entertainment. Consider alternative options such as cooking at home instead of eating out or using public transportation instead of owning a car.

Embrace the Thrift Store Mentality

Thrift stores can be your best friend when it comes to frugal living. Instead of buying new, embrace the thrift store mentality and start shopping for clothes, furniture, and household items at secondhand stores. You’ll be amazed at the quality items you can find at a fraction of the price.

Be Mindful of Your Energy Usage

Reducing your energy usage not only benefits the environment but also saves you money on utility bills. Be mindful of turning off lights when not in use, unplugging electronics when they’re not in use, lowering your thermostat settings, and using energy-efficient appliances.

Frugal Living

Definition and concept of frugal living

Frugal living is a lifestyle choice that involves being mindful of your spending habits and finding ways to save money. It is not about being cheap or stingy, but rather about making smart and intentional choices with your finances. Frugal living encourages you to prioritize your needs over wants and to find creative ways to stretch your dollars.

At its core, frugal living is about being resourceful and finding value in the simple things. It is about seeking satisfaction and contentment in experiences rather than material possessions. By adopting a frugal lifestyle, you can build financial stability and reduce stress caused by excessive debt or financial worries.

Benefits of adopting a frugal lifestyle

There are numerous benefits to embracing a frugal lifestyle. Firstly, it allows you to have greater control over your finances. By being mindful of your spending, you can allocate your money towards the things that truly matter to you, such as paying off debts, saving for emergencies, or investing for the future.

Secondly, frugal living helps you reduce unnecessary expenses. By cutting back on discretionary spending, you can free up valuable resources that can be used for more meaningful purposes. This can lead to a sense of freedom and peace of mind, knowing that you are not tied down by excessive material possessions or financial burdens.

Additionally, adopting a frugal lifestyle promotes environmental sustainability. By embracing minimalism and reducing waste, you not only save money but also contribute to a healthier and more sustainable planet. By consuming less and repurposing or reusing items, you minimize your ecological footprint and help protect the environment for future generations.

frugal living is a mindset and a lifestyle choice that can have a positive impact on your finances, well-being, and the environment. By being intentional with your spending, prioritizing needs over wants, and finding value in simplicity, you can embark on a journey towards financial freedom and a more fulfilling life.

Why Start Saving Money Today?

Importance of saving money

Saving money is an integral part of a frugal lifestyle. It allows you to prioritize your financial goals and secure a better future for yourself. By saving money, you can create an emergency fund, pay off debt, save for a down payment on a house, or even plan for retirement. Regardless of your income level, saving money should be a priority.

Financial security and peace of mind

Saving money provides a sense of financial security. Life is unpredictable, and unexpected expenses can arise at any moment. Having a savings cushion allows you to tackle these situations without stress or worry. Whether it’s a car repair, medical bills, or unforeseen emergencies, having funds readily available gives you peace of mind. Moreover, having savings means you won’t have to rely on credit cards or loans, avoiding the burden of high interest rates and debt.

Future financial growth

By saving money today, you are setting yourself up for future financial growth. The money you save can be invested wisely to generate even more income. Whether it’s through stocks, bonds, real estate, or other investment opportunities, your savings can work for you and provide additional sources of income in the long run. As time goes by, your investments can grow exponentially and contribute to your overall financial stability and prosperity.

Building good financial habits

Starting to save money today allows you to develop positive financial habits. It teaches you the importance of budgeting, prioritizing your spending, and living within your means. Over time, these habits become ingrained in your mindset, leading to a more efficient and sustainable way of managing your finances. By focusing on long-term goals and making smart financial choices, you can achieve a frugal lifestyle that aligns with your values and aspirations.

saving money is crucial for a frugal lifestyle. By recognizing the importance of saving, you can achieve financial security, peace of mind, future growth, and develop good financial habits. So why wait? Start saving money today and pave the way for a brighter and more prosperous future.

Understanding Your Expenses

As I embarked on my journey towards frugal living, I quickly realized that the first step towards saving money was understanding my expenses. This is a crucial skill that every frugal enthusiast needs to master in order to make meaningful changes to their financial habits.

Identifying and tracking your spending

Before you can start saving money, you need to know where your money is going. This requires identifying and tracking your spending. I began this process by thoroughly examining my bank statements and credit card receipts for the past few months. I was amazed at how much I was spending on unnecessary items like eating out or buying new clothes when I had a closet full of perfectly fine ones. By identifying these areas of overspending, I was able to create a realistic budget that reflected my true needs.

Differentiating between wants and needs

One of the most important aspects of frugal living is understanding the difference between wants and needs. I used to believe that I needed the latest gadgets, designer clothes, and extravagant vacations. However, I soon realized that these were merely wants, not necessities. By shifting my mindset and focusing on my true needs, I was able to cut down on unnecessary spending and start saving money.

By understanding my expenses and differentiating between wants and needs, I have taken significant steps towards a frugal lifestyle. It’s important to remember that frugality is not about depriving yourself of everything you enjoy but rather making intentional choices about how you spend your money. So why not start today? Take a closer look at your expenses, track your spending, and prioritize your needs over wants. Your bank account will thank you!

Creating a Budget

Importance of budgeting

Creating and sticking to a budget is an essential first step in frugal living. It allows you to gain control over your finances and helps in achieving your savings goals. Budgeting provides a clear overview of your income and expenses, enabling you to make informed decisions about your spending habits. By understanding where every dollar goes, you can identify areas where you can cut back and save money.

Steps to create an effective budget plan

To start, gather all your financial documents, such as bank statements, bills, and pay stubs. Begin by calculating your total monthly income, including wages, freelance earnings, and any additional sources. Next, analyze your expenses and categorize them into fixed (mortgage/rent, utilities, insurance, etc.) and variable (groceries, entertainment, dining out, etc.) costs.

Once you have a clear understanding of your income and expenses, it’s time to set financial goals. Determine how much you want to save each month and allocate a specific portion of your income towards savings. This will ensure that you prioritize saving rather than merely spending what is left after expenses.

After setting your goals, it’s time to track your spending. Monitor every expense for a month, jotting down even the smallest purchases. This exercise will help you identify patterns, areas of potential saving, and unnecessary expenditures.

With all this information, create a monthly budget using a spreadsheet or a budgeting app. Allocate your income to various expense categories and ensure that you do not exceed the designated amounts. Regularly review and adjust your budget as needed to reflect changes in income or expenses.

By following these steps and creating an effective budget, you will gain control over your finances and be on your way to achieving your savings goals. So, start today and embrace the frugal lifestyle!

Cutting Back on Expenses

Identifying areas to cut back on

When it comes to saving money, one of the first steps is to identify areas where you can cut back on your expenses. Take a close look at your monthly budget and analyze your spending habits. Are there any unnecessary purchases or subscriptions that you can eliminate? Are you spending too much on dining out or entertainment? By identifying these areas, you can start making conscious decisions about how to allocate your funds more wisely.

Tips for reducing common expenses

-

Groceries: One of the easiest ways to save money is by cutting back on your grocery expenses. Plan your meals for the week and create a shopping list before heading to the store. Look for sales or discounts and consider buying generic brands instead of name brands. Additionally, try to avoid impulse purchases and stick to your list.

-

Utilities: Take measures to reduce your utility bills by being mindful of your energy consumption. Turn off lights when you leave a room, unplug unused electronics, and adjust your thermostat to a reasonable temperature. Consider investing in energy-efficient appliances and make sure to regularly maintain them for optimal efficiency.

-

Transportation: Transportation costs can add up quickly, so it’s important to find ways to cut back in this area. Consider carpooling or using public transportation instead of driving alone. When it comes to fuel expenses, try to combine your errands into one trip and drive more efficiently by avoiding unnecessary acceleration or idling.

By implementing these tips and adjusting your spending habits, you can significantly reduce your overall expenses and start saving money. Remember, the key to frugal living is being mindful of your choices and making conscious decisions about how to allocate your funds. With commitment and discipline, you’ll be on your way to a more financially stable future.

Smart Shopping Strategies

Planning and making grocery lists

When it comes to saving money on groceries, a little bit of planning can go a long way. Before heading to the store, take some time to make a detailed grocery list. This will help you stay focused and avoid buying unnecessary items. Take inventory of what you already have in your pantry and fridge, and plan your meals accordingly. By knowing exactly what you need, you can eliminate impulse purchases and reduce food waste.

Using coupons and discounts effectively

Coupons and discounts can be a great way to save money on your everyday purchases. Start by checking your local newspaper or online coupon websites for deals on items you regularly buy. Take the time to compare prices at different stores to ensure you’re getting the best bang for your buck. Additionally, many stores offer loyalty programs or digital coupons that can easily be accessed through their websites or mobile apps. By taking advantage of these savings opportunities, you’ll be amazed at how much you can reduce your monthly expenses.

Expanding your shopping horizons

When it comes to frugal living, it’s important to think outside the box when it comes to shopping. Don’t limit yourself to just one store or brand. Explore different options, such as discount stores, thrift shops, and farmers markets, to find the best prices on the items you need. Buying in bulk can also save you money in the long run, so consider joining a wholesale club or purchasing larger quantities of non-perishable items. Remember, the goal is to find the best deals without sacrificing quality.

being a savvy shopper is essential for frugal living. By planning and making grocery lists, using coupons and discounts effectively, and expanding your shopping horizons, you can start saving money today. So why wait? Start implementing these smart shopping strategies and watch your savings grow. Happy saving!

Meal Planning and Cooking at Home

Benefits of meal planning and cooking at home

One of the best ways to save money and practice frugal living is by meal planning and cooking at home. Not only does this help you cut down on unnecessary expenses, but it also allows you to have more control over what you eat. By planning your meals in advance, you can make healthier choices and avoid the temptation of ordering takeout or eating out frequently.

Cooking at home has several benefits. Firstly, it is much cheaper than eating out or ordering in. When you cook your meals, you can buy ingredients in bulk, take advantage of sales, and use leftovers effectively. This way, you can stretch your budget and save a significant amount of money each month.

Secondly, meal planning and cooking at home also enables you to eat healthier. When you cook your meals, you have control over the ingredients you use, allowing you to make nutritious choices. Additionally, you can avoid processed foods and unhealthy additives that are often present in restaurant meals.

Tips for cost-effective meal planning

To start saving money through meal planning and cooking at home, consider the following tips:

-

Plan your meals for the week: Take some time each week to plan your meals in advance. This allows you to create a shopping list and buy only what you need, minimizing food waste and unnecessary expenses.

-

Embrace leftovers: Don’t let leftover food go to waste. Get creative with your meals by repurposing leftovers into new dishes. This saves you money, reduces food waste, and adds variety to your meals.

-

Shop strategically: Look for deals and discounts when shopping for ingredients. Consider buying in bulk and stocking up on pantry staples when they are on sale. This way, you can save money in the long run.

-

Cook in batches: Spend one day of the week cooking in bulk and freezing individual portions. This not only saves you time during busy weekdays but also helps you resist the urge to order takeout on hectic days.

By incorporating meal planning and cooking at home into your frugal lifestyle, you can save money, eat healthier, and enjoy the satisfaction of creating delicious meals right in your own kitchen.

Minimizing Debt and Interest

Understanding different types of debt

When it comes to starting a frugal lifestyle, one of the first steps you should take is to minimize debt and interest. Understanding the different types of debt is crucial in order to tackle them effectively. There are two main types of debt: secured and unsecured. Secured debt is backed by collateral, such as a mortgage or car loan, while unsecured debt, like credit card or medical bills, does not require collateral.

Secured debt often has lower interest rates and longer repayment periods, whereas unsecured debt tends to have higher interest rates and shorter repayment terms. Prioritizing the repayment of high-interest unsecured debt can save you a significant amount of money in the long run. It’s important to keep track of your debt and create a plan to pay it off systematically.

Strategies for paying off debt and avoiding interest

To start paying off your debt, it’s crucial to assess your financial situation and determine how much you can allocate towards debt repayment each month. One common strategy is the debt avalanche method, where you prioritize paying off the debt with the highest interest rate first, while making minimum payments on other debts. Once the highest interest debt is cleared, you move on to the next highest one and so on.

Another strategy is the snowball method, where you focus on paying off the smallest debt first, regardless of interest rate. This method can provide a psychological boost as you see the number of debts decreasing quickly, which motivates you to continue your debt repayment journey.

Saving Money on Utilities

Conserving energy to reduce utility bills

When it comes to saving money on utilities, one of the first steps to take is to conserve energy. By making a few simple changes around the house, you can significantly reduce your utility bills and contribute to a greener environment.

Firstly, consider upgrading your light bulbs to energy-efficient ones. LED bulbs are a great option as they consume less electricity and last longer. Additionally, remember to turn off the lights when you leave a room. It may seem like a small change, but it can add up to substantial savings over time.

Another easy way to conserve energy is by unplugging electronic devices when they are not in use. Many devices still draw power even when they are turned off, contributing to what is known as “vampire energy” consumption. Simply unplugging unused devices or using power strips can help you eliminate this wasteful energy usage.

Tips for saving on water and electricity

When it comes to water usage, there are a few simple habits that can go a long way in saving money. One of the most effective ways is to fix any leaky faucets or pipes promptly. A small leak may not seem significant, but it can waste gallons of water and drive up your water bill.

Additionally, be mindful of your water consumption when doing everyday tasks such as showering, brushing your teeth, or doing dishes. Taking shorter showers, turning off the faucet while brushing your teeth, and using a dishwasher instead of handwashing can all help you conserve water and reduce water bills.

When it comes to electricity, another money-saving tip is to make the most of natural light during the day. Open up your curtains and blinds to take advantage of sunlight instead of relying solely on electric lighting. Furthermore, ensure that you unplug appliances when they are not in use and adjust your thermostat to a reasonable temperature to avoid unnecessary energy consumption.

By implementing these tips and being mindful of your energy and water usage, you can start saving money on utilities today. Not only will your bank account benefit, but you’ll also be doing your part for a more sustainable future.

Frugal Entertainment and Leisure

One of the misconceptions about living frugally is that it means sacrificing all forms of entertainment and leisure. However, this couldn’t be further from the truth. In fact, there are plenty of ways to enjoy your favorite activities and still save money. Let me share some tips with you on how to have a frugal yet fulfilling leisure time.

Enjoying leisure activities on a budget

When it comes to leisure activities, there are countless options that won’t break the bank. For instance, instead of going to expensive concerts or sporting events, consider attending local community events, where admission fees are often minimal or even free. Additionally, many cities offer free outdoor concerts, movies in the park, and art exhibitions. Take advantage of these opportunities to indulge in entertainment without spending a fortune.

Finding free or low-cost entertainment

Another fantastic way to entertain yourself on a budget is by utilizing the resources available to you. Public libraries are a treasure trove of free entertainment. From books and magazines to movies and music, libraries offer a wide range of materials to satisfy any interest. Additionally, consider exploring local parks, hiking trails, and beaches, where you can enjoy the beauty of nature without spending a dime.

Making the most of online alternatives

In today’s digital age, the internet offers a wealth of free or low-cost entertainment options. Streaming services like YouTube or Spotify provide access to a vast array of music, podcasts, and videos, often at no cost. You can also find numerous online communities or forums that cater to specific hobbies or interests, allowing you to connect with like-minded individuals and participate in virtual activities at little to no expense.

By implementing these frugal entertainment tips, you can enjoy various leisure activities without draining your wallet. Remember, being frugal doesn’t mean giving up what you love, but rather finding alternative ways to indulge your passions while still saving money. So go ahead, embrace the frugal lifestyle, and make the most of your leisure time without the guilt of overspending.

Conclusion

Start Your Frugal Journey Today

In conclusion, frugal living is a lifestyle that allows you to make conscious choices to save money and live within your means. By implementing these frugal living tips, you can start saving money and achieving your financial goals. Remember, frugality is not about depriving yourself of enjoyment, but rather about finding creative ways to maximize your resources.

Prioritize Your Expenses

To begin your frugal journey, start by analyzing your current expenses. Assess what is truly essential and what can be cut back or eliminated entirely. Prioritize your expenses, putting your necessities first and eliminating unnecessary luxury items. By distinguishing between wants and needs, you can make more mindful spending decisions.

Create a Budget

Setting up a budget is crucial in frugal living. It allows you to track your income and expenses, giving you a clear picture of where your money is going. Evaluate your spending habits and identify areas where you can cut back. Allocate a specific amount for each expense category, such as groceries, transportation, and entertainment. Stick to your budget religiously to avoid overspending.

Embrace Minimalism

Consider adopting a minimalist lifestyle. Declutter your living space and let go of unnecessary possessions. Focus on quality over quantity and avoid impulsive buying. By embracing minimalism, you reduce the desire for material possessions and become more content with what you have. This shift in mindset will help you save money and prioritize experiences over things.

Plan Your Meals

Meal planning is a game-changer when it comes to saving money. By planning your meals in advance, you can make a detailed grocery list and avoid unnecessary purchases. Cook at home more often and experiment with affordable and nutritious recipes. By being mindful of your food budget, you can minimize waste and maximize savings.

Find Frugal Activities

Finally, it’s essential to find frugal activities that align with your interests and hobbies. Instead of spending money on expensive outings, explore free or low-cost alternatives. Take advantage of community events, visit local parks or museums, organize game nights at home, or start a book club. There are countless ways to have fun without breaking the bank.

Remember, becoming more frugal is a process, and it requires discipline and consistency. Every small step you take toward a frugal lifestyle will add up over time. So start today and take control of your finances. With these frugal living tips, you’ll be well on your way to achieving your financial goals and living a more intentional and fulfilling life.