Introduction

When it comes to managing our finances, we often hear the terms ‘frugal’ and ‘cheap’ being used interchangeably. However, understanding the difference between these two concepts is crucial as it can greatly impact our lifestyle and financial well-being. In this post, I will provide a comprehensive comparison between being frugal and being cheap, shedding light on their distinctions and how they can affect our everyday lives.

Frugal: A Mindset of Smart Spending

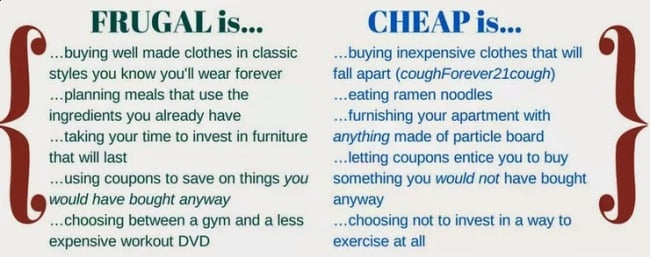

Being frugal is all about making wise decisions when it comes to spending our hard-earned money. It is a lifestyle choice driven by a desire to achieve financial security and maximize the value of every dollar we spend. Instead of mindlessly splurging on unnecessary and excessive purchases, frugal individuals prioritize needs over wants, focusing on value and quality. They embrace smart shopping techniques such as using coupons, seeking out sales, and buying in bulk to save money in the long run. Frugality is not about living a miserable and deprived life; rather, it is a conscious effort to make informed choices that align with our financial goals.

Cheap: Prioritizing Cost-Cutting Above All Else

On the other hand, being cheap involves prioritizing cost-cutting to an extreme extent, often at the expense of quality or social experiences. Cheap individuals typically look for the lowest possible price without considering other factors such as durability, reliability, or long-term benefits. This can lead to buying poor quality products or services that end up costing more in the long run due to frequent repairs or replacements. Being cheap often entails a reluctance to spend money, even when necessary, which can result in missed opportunities and a lower quality of life.

In the following sections, I will delve deeper into various aspects of frugality and cheapness such as budgeting, shopping habits, and lifestyle choices. By understanding these differences, we can adopt a mindset that allows us to make informed financial decisions and live a fulfilling yet financially responsible life. So, let’s dive in and explore the world of frugality versus cheapness!

Definition of Frugal

Frugal living has become an increasingly popular lifestyle choice for many individuals, including myself. People often confuse frugality with being cheap, but there is a significant difference between the two. Being frugal means making conscious and intentional choices to prioritize spending on what truly matters, while being cheap implies cutting corners and prioritizing saving money at all costs.

Characteristics of a Frugal Lifestyle

There are several key characteristics that define a frugal lifestyle. Firstly, it involves careful budgeting and tracking expenses, ensuring that every dollar is spent wisely. This doesn’t mean depriving oneself of necessities or pleasures; rather, it means being mindful of spending and seeking value for money. Secondly, frugality encourages resourcefulness and creativity by finding alternative ways to fulfill needs and desires. Whether it’s finding affordable substitutes, repurposing items, or adopting do-it-yourself practices, frugal individuals are adept at making the most of what they have.

Benefits of Being Frugal

Living a frugal lifestyle offers numerous advantages. Firstly, it enables financial stability and security, allowing individuals to save for emergencies, retirement, and future goals. By avoiding unnecessary expenses, frugal individuals have more control over their financial situation and can reduce the burden of debt. Secondly, frugality promotes mindful consumption, reducing waste and having a positive impact on the environment. By prioritizing quality over quantity and avoiding impulsive purchases, frugal individuals contribute to a more sustainable future. Lastly, frugality fosters a sense of contentment and gratitude, as it reminds us to appreciate the things we have and find joy in simple pleasures.

while frugality and cheapness may seem similar, they are fundamentally different. Frugality is about making intentional choices, finding value for money, and living within means, whereas cheapness involves prioritizing saving money without considering long-term consequences or the quality of life. By embracing a frugal lifestyle, individuals can enjoy financial stability, reduce waste, and find contentment in simplicity.

Definition of Cheap

Characteristics of a Cheap Lifestyle

When it comes to living on a budget and making wise financial choices, there is a fine line between being frugal and being cheap. As the owner of frugaldude.org, a website dedicated to promoting a frugal lifestyle, I often find myself explaining the distinction between these two concepts.

So, let’s start by defining what it means to be cheap. A cheap individual has a strong desire to save money at any cost, often sacrificing quality and long-term benefits for short-term savings. They are always on the lookout for the cheapest option, regardless of the value or quality it provides.

Being cheap typically involves cutting corners, opting for inferior products, and constantly seeking out the absolute lowest price. These individuals prioritize quantity over quality, always striving to get more for less. Their mindset revolves around the idea of spending as little money as possible, without considering the potential consequences.

Drawbacks of Being Cheap

However, it’s important to note that being cheap does have its drawbacks. Bargain-hunting and constantly seeking the cheapest option can lead to a lack of quality and durability in your purchases. Cheaply made products may break or wear out quickly, resulting in more frequent replacements and ultimately costing you more in the long run.

Moreover, being cheap can often strain social relationships. Constantly choosing the cheapest options may come off as stingy or selfish to others. Being unwilling to contribute or evenly split costs can create tension and strain friendships over time.

while being frugal involves making conscious and informed decisions to save money, being cheap carries the negative connotation of cutting corners and prioritizing short-term savings over long-term value. So, choose wisely and strike a balance between frugality and cheapness to lead a financially responsible and fulfilling life.

Word count: 252 words

Frugal vs. Cheap: Key Distinctions

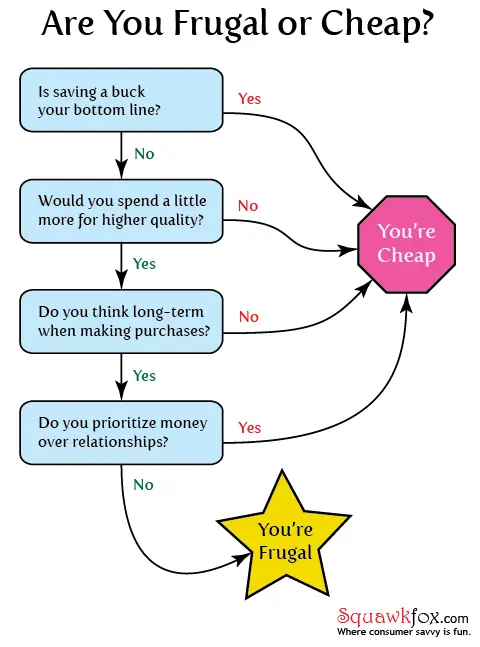

Understanding Intentions

When it comes to managing our finances, there are two terms that often get intertwined: frugal and cheap. However, it’s important to recognize that these two words have different connotations and carry distinct attitudes towards spending. Being frugal means being mindful of your expenses and making intentional choices to save money without compromising on quality or value. On the other hand, being cheap often implies prioritizing saving money at all costs, sometimes sacrificing quality, value, and even social etiquettes.

Frugal individuals aim to make the most of their financial resources by focusing on long-term goals, value-driven purchases, and finding creative solutions to save money. Their intention is to lead a fulfilling life without overspending. They prioritize quality and value, seeking out deals, discounts, and using coupons to stretch their dollar. Frugal individuals are conscious of the impact their spending has not only on their current financial situation but also on their future.

Long-term vs. Short-term Impact

One key distinction between frugal and cheap is the impact their choices have on the long-term. Frugal individuals understand the value of investing in quality products that may cost more upfront but last longer. They prioritize sustainability and think in terms of cost per use rather than just the initial price tag. By making wise choices, they can save money in the long run and achieve their financial goals.

Cheap individuals, however, focus on short-term savings, seeking the lowest price possible regardless of quality. They may opt for the cheapest version of a product or service, even if it means it won’t last as long or won’t meet their needs effectively. Cheap decisions often lead to regret in the long run when the low-quality item breaks or fails to deliver on its intended purpose. As a result, the cheap approach can end up costing more money in the long term as replacements or repairs become necessary.

understanding the difference between being frugal and being cheap can greatly impact how we manage our finances. Being frugal means making intentional choices to save money without compromising on value. It involves prioritizing long-term goals and embracing quality over immediate savings. On the other hand, being cheap often leads to short-sighted decisions based solely on price, potentially resulting in regrets and additional expenses down the road. Choose wisely and adopt a frugal mindset to enjoy a fulfilling and financially stable life.

Frugal Living Techniques

Budgeting and Financial Planning

When it comes to living a frugal lifestyle, one of the key techniques is budgeting and financial planning. By carefully tracking and controlling your spending, you can ensure that your hard-earned money is being used wisely. Start by creating a budget that outlines your income and expenses, and allocate specific amounts for essentials such as housing, transportation, and groceries. This will not only help you manage your finances effectively, but also give you a clearer picture of where you can cut back without sacrificing your needs.

Smart Shopping Habits

Another important aspect of frugal living is adopting smart shopping habits. This means being thrifty and strategic when it comes to purchasing goods and services. Look for sales, compare prices, and consider buying in bulk or second-hand to save money. Additionally, make use of coupons, loyalty programs, and cash-back apps to maximize your savings. Remember, being frugal doesn’t mean you have to deprive yourself of nice things; it simply means being conscious of your spending and finding smart ways to get the most value for your money.

Reducing Waste and Consumption

Frugal living also emphasizes the importance of reducing waste and consumption. By being mindful of our environmental impact and minimizing unnecessary expenses, we not only save money but also contribute to a more sustainable future. Avoid excessive packaging and single-use items, opt for reusable alternatives, and practice energy-saving habits such as turning off lights and unplugging electronics when not in use. By embracing a minimalist mindset and focusing on essentials, we can free ourselves from the burden of unnecessary possessions and live a more fulfilling, frugal lifestyle.

frugal living is about making conscious choices to prioritize our financial well-being while minimizing our environmental impact. By adopting budgeting and financial planning techniques, smart shopping habits, and reducing waste and consumption, we can achieve a more balanced and fulfilling lifestyle. So why not start implementing these frugal living techniques today and see the positive impact it can have on your life?

Cheap Living Practices

Seeking Low-Quality Products

When it comes to living a cheap lifestyle, one of the common practices is seeking out low-quality products. This approach focuses solely on finding the cheapest option available, without considering the long-term consequences. While this may save you money in the short term, it often leads to frequent replacement and additional expenses in the long run. Cheaply made items are more likely to break or wear out quickly, requiring constant replacements. This cycle of buying cheap products can end up costing you more money in the long term.

Neglecting Necessities

Another aspect of cheap living is neglecting necessities. This means depriving oneself of essential items or services in order to save money. While it’s understandable to cut back on non-essential expenses, neglecting basic needs such as nutritious food, healthcare, or a safe living environment can have serious consequences on your well-being. Saving money should never come at the expense of your health, safety, or overall quality of life.

Ignoring Quality for Price

A common trait of a cheap lifestyle is prioritizing price over quality. This means choosing the lowest priced item without considering durability, functionality, or ethical production practices. While this may seem like a frugal approach, it often leads to disappointment and dissatisfaction with your purchases. Investing in higher quality products may require a higher initial cost, but in the long run, it can save you money by lasting longer and providing better overall value.

Living a cheap lifestyle may seem tempting, especially in a consumer-driven society that constantly promotes discounts and bargains. However, it’s important to distinguish between being cheap and being frugal. Being frugal means finding ways to save money without compromising on quality or neglecting essential needs. It involves making wise choices that align with your financial goals and long-term well-being. So, rather than simply seeking out the cheapest options available, consider the value and overall impact of your purchases. Remember, being frugal is about making conscious choices that support a balanced and sustainable lifestyle.

Frugality Mindset

Resourcefulness and Creativity

When it comes to leading a frugal lifestyle, having a mindset of resourcefulness and creativity is essential. Being frugal means finding creative solutions to save money without sacrificing quality or enjoyment. It’s about thinking outside the box and finding alternative ways to achieve what you want without breaking the bank.

One aspect of resourcefulness is finding ways to repurpose items or use them in multiple ways. For example, instead of buying brand new furniture, you can explore thrift stores or online marketplaces for secondhand pieces that can be refurbished or repainted to fit your style. This not only saves money but also adds a unique touch to your home decor.

Another way to be resourceful is by embracing DIY projects. Whether it’s sewing your own clothes, growing your own fruits and vegetables, or even making your own cleaning supplies, taking matters into your own hands can save you a significant amount of money in the long run. Plus, it allows you to customize things to your own taste and needs.

Prioritizing Value Over Cost

Being frugal doesn’t mean being cheap. The key difference lies in prioritizing value over the initial cost. Being cheap often involves sacrificing quality for the sake of saving a few dollars. Frugality, on the other hand, means carefully considering the long-term value and overall cost-effectiveness of a purchase or decision.

For example, let’s say you need to replace a household appliance. A cheap approach might be to go for the lowest-priced option regardless of its energy efficiency or durability. However, a frugal mindset would lead you to research different models, compare their energy ratings, and choose the one that offers the best combination of affordability and long-term cost savings on utility bills.

Frugality also involves considering the value of experiences. Instead of constantly splurging on material possessions, a frugal individual may prioritize spending on experiences that create lasting memories, such as travel or quality time with loved ones.

adopting a frugality mindset means being resourceful and creative in finding ways to save money, while also prioritizing value and long-term cost-effectiveness. It’s not about being cheap, but rather about making intentional choices that align with your financial goals and values. So, next time you’re faced with a spending decision, think about how you can apply the principles of frugality to make the most of your resources.

“Cheapness Mindset”

Extreme Cost Cutting

When it comes to managing our finances, we often strive to find ways to save money without compromising our quality of life. However, there is a fine line between being frugal and being cheap. It’s important to understand the distinction in order to make informed decisions about our spending habits.

The cheapness mindset is characterized by extreme cost-cutting measures. Cheap individuals prioritize saving money above all else, often at the expense of their own well-being or the well-being of others. They may resort to buying low-quality products or skimping on essential items in order to save a few dollars.

Short-sighted Decision Making

One of the key traits of a cheap mindset is short-sighted decision making. Cheap individuals tend to focus on immediate savings rather than considering the long-term consequences of their choices. They may opt for the cheapest option available without considering the potential hidden costs or the impact on their overall financial health.

For example, someone with a cheap mindset may choose to buy a poorly-made, inexpensive electronic device, only to have it break down after a short period of time. In the end, they end up spending more money on replacements or repairs than if they had invested in a higher quality item from the beginning.

It’s important to note that being frugal, on the other hand, is about smart spending and making thoughtful choices. Frugal individuals prioritize value for money and long-term savings rather than simply going for the cheapest option available. They understand the importance of investing in quality products and services that will last longer and provide greater value in the long run.

By adopting a frugal mindset, individuals can strike a balance between saving money and enjoying a high quality of life. It’s all about making conscious decisions that align with our values and long-term financial goals.

Impacts on Health and Well-being

One of the key considerations when comparing frugality and cheapness is the impact they have on our health and overall well-being. Both approaches to managing finances have distinct effects that can greatly influence our quality of life.

Frugal’s Positive Impact on Saving and Stress

Being frugal entails practicing mindful spending, prioritizing needs over wants, and seeking long-term value in purchases. This approach ultimately leads to financial stability and savings. By being conscious of our spending habits and adopting frugal practices, we can gradually build a safety net for unexpected expenses or future investments.

Moreover, being frugal can significantly reduce stress levels. When we take control of our finances and actively manage our budget, we can avoid the anxiety that often accompanies financial uncertainty. By living within our means, we experience a sense of empowerment and peace of mind, knowing that we are making responsible choices for our financial future.

Cheapness’ Negative Effects on Health

On the other hand, choosing cheapness over frugality can have adverse effects on our health. Opting for the cheapest options regardless of quality or long-term implications can lead to compromising our well-being. For instance, buying cheap and processed foods may seem cost-effective initially, but they can contribute to health issues such as obesity, malnutrition, and chronic diseases in the long run.

Additionally, constantly seeking the cheapest options without considering the overall value can lead to poor consumer experiences. Cheap products may break easily, lack durability, or fail to meet our needs. This can result in frustration, disappointment, and even additional expenses to replace these low-quality items.

It is important to recognize the difference between being frugal and being cheap. While frugality promotes financial responsibility and long-term well-being, cheapness can have negative consequences for our health and overall satisfaction. By prioritizing our needs, seeking value, and making thoughtful choices, we can embrace a frugal lifestyle that positively impacts both our finances and our well-being.

Social Perceptions

Frugality: Responsible and Sensible

As the founder of FrugalDude.org, I believe it is important to shed light on the misconceptions surrounding frugality and cheapness. Understanding the difference between these two concepts is crucial in adopting a frugal lifestyle and making informed financial decisions.

Frugality is often associated with responsible and sensible spending habits. It is about being mindful of our expenses and maximizing the value of our hard-earned money. Frugal individuals prioritize their needs over wants, seeking ways to stretch their budget without sacrificing quality. They understand the importance of saving for the future and avoid frivolous spending.

Being frugal doesn’t mean living a life of deprivation. On the contrary, it empowers individuals to make intentional choices that align with their values, allowing them to live within their means while still enjoying life’s pleasures. Frugal individuals are resourceful and creative when it comes to finding alternatives or cost-saving solutions, such as buying secondhand items, utilizing coupons, or DIY projects.

Cheapness: Negative Connotations

Cheapness, on the other hand, carries negative connotations. Cheap individuals have a reputation for prioritizing cost above all else, often to the detriment of others. They seek the lowest price without considering the consequences or long-term sustainability of their choices. Cheapness is associated with cutting corners, compromising on quality, and exploiting others for personal gain.

While frugality is a mindset centered around responsible spending, cheapness reflects a lack of consideration for the value of goods and services. Cheap individuals might engage in unethical practices, such as haggling excessively, underpaying service providers, or even engaging in fraudulent activities that harm others in the process.

while frugality and cheapness may both involve being mindful of expenses, their underlying philosophies and intentions differ vastly. Frugality promotes responsible and sensible spending, adhering to a budget while making thoughtful choices. Cheapness, on the other hand, is marked by a disregard for quality and ethical considerations. By understanding the difference between frugality and cheapness, we can make informed decisions that not only benefit our personal finances but also contribute positively to our communities.

Achieving a Balance

Incorporating Frugality into Daily Life

When it comes to finding ways to save money and adopt a frugal lifestyle, it’s important to strike a balance. Being frugal doesn’t mean being cheap, and vice versa. As an advocate of the frugal lifestyle, I have discovered that finding this balance is crucial for long-term success.

Incorporating frugality into daily life requires conscious decision-making and a shift in mindset. It’s about making intentional choices that prioritize saving money without sacrificing quality and value. This can be achieved through various practices such as budgeting, meal planning, and adopting a minimalistic approach to material possessions. By being mindful of our spending habits and making thoughtful choices, we can make significant savings over time.

Avoiding Excessive Cheapness

While frugality promotes smart spending, excessive cheapness can have negative consequences on our overall well-being. Being cheap often means compromising on the quality of products or services, which can lead to dissatisfaction and even additional expenses in the long run. It’s important to recognize the difference between being frugal and being cheap.

Avoiding excessive cheapness means knowing when it’s worth spending a little extra for better quality or durability. It means understanding the value of investing in certain areas of our lives, such as education, health, or personal development. By finding the balance between frugality and reasonable spending, we can ensure that we are making smart financial choices without compromising our overall well-being.

achieving a balance between frugality and cheapness is essential for a sustainable and fulfilling lifestyle. By incorporating frugality into our daily lives and avoiding excessive cheapness, we can make meaningful savings while still prioritizing quality and value. It’s important to remember that being frugal doesn’t mean being cheap, but rather finding the balance that works best for our individual circumstances and goals. So let’s embrace the frugal lifestyle with mindfulness and intentionality, and watch our savings grow while enjoying a fulfilling life.

Conclusion

In conclusion, it is important to understand the difference between being frugal and being cheap. While both can involve saving money, the motivations and approaches behind each lifestyle choice are distinct.

Being Frugal

Being frugal is all about making conscious decisions to spend money wisely. Frugal individuals prioritize value and quality over instant gratification. They make deliberate choices to save money without sacrificing their overall well-being and happiness. Frugality is a long-term mindset that focuses on maximizing resources, minimizing waste, and planning for the future. Frugal individuals often invest in quality products that will last longer and provide more value over time.

Being Cheap

On the other hand, being cheap is solely driven by the desire to spend as little money as possible in the moment, without considering the long-term consequences. Cheap individuals tend to prioritize saving money above all else, often at the expense of their own comfort, well-being, or the quality of the products or services they purchase. They may try to cut corners, haggle excessively, or buy poor-quality goods simply because they are the cheapest option available.

The Key Difference

The key difference between frugality and cheapness lies in the mindset and underlying values that drive each approach. Being frugal is about finding a balance between saving money and maintaining a good quality of life, whereas being cheap is solely focused on saving money regardless of the consequences. Being frugal allows individuals to make informed decisions that align with their priorities and long-term goals, while being cheap may result in short-term financial savings but can negatively impact quality of life in the long run.

While both frugal and cheap options can lead to financial savings, it is essential to consider the overall value, quality, and impact on personal well-being when making spending decisions. By understanding the difference between frugality and cheapness, individuals can make informed choices that align with their values and help them achieve long-term financial stability and contentment.