Have you ever wondered how some people seem to effortlessly save money while still enjoying life? I used to be so envious of those people who could effortlessly put away money for their future while still living a comfortable and fulfilling life. But then, I decided to take control of my finances and start a successful savings habit. And you know what? It’s not as difficult as it may seem!

Now, I’m not a financial expert, but I’ve learned a thing or two about starting a successful savings habit along the way. In this article, I’ll share with you some practical tips and strategies that I’ve personally found helpful. So, if you’ve been wanting to start saving money but don’t know where to begin, this article is for you!

One of the key ingredients to starting a successful savings habit is adopting a frugal lifestyle. Now, before you cringe at the thought of living a life full of deprivation and scarcity, let me assure you that being frugal doesn’t mean living a miserable life. It’s simply about being mindful of your spending and making intentional choices that align with your financial goals. It’s about prioritizing your needs and wants and finding creative ways to save money without sacrificing your happiness. In the upcoming paragraphs, I’ll delve deeper into different frugal living habits and how they can help you save money. So, stay tuned!

Introduction

Saving money is an essential habit that everyone should strive to cultivate. Whether you are planning for retirement, building an emergency fund, or working towards your long-term financial goals, saving money plays a crucial role in achieving financial stability and freedom.

In this article, I will guide you through the process of starting a successful savings habit. We will explore the benefits of saving money, how savings can provide financial security, and the impact of a savings habit on long-term goals. Additionally, we will discuss how to identify your financial goals, understand your current financial situation, develop a savings plan, track your progress, and overcome obstacles to stay motivated. We will also dive into investing your savings wisely, avoiding common savings mistakes, building a frugal lifestyle, finding additional income streams, and teaching children the value of saving. Lastly, we will touch upon planning for retirement and preparing for financial emergencies. So, let’s get started on the journey to financial stability!

The Benefits of Saving Money

Saving money brings numerous benefits that can positively impact your life in various ways. First and foremost, it provides a safety net during financial emergencies. Having savings allows you to handle unexpected expenses without relying on credit or loans, reducing the stress and financial burden that often come with such situations.

Moreover, saving money enables you to achieve your financial goals faster. Whether your goal is to buy a house, start a business, or travel the world, having a solid savings plan in place will help you accumulate the necessary funds more efficiently. It allows you to take advantage of opportunities when they arise and avoid the pitfalls of debt.

Additionally, saving money helps to create a sense of financial security and peace of mind. Knowing that you have a cushion of savings provides a sense of stability, knowing that you are prepared for unexpected events that may come your way.

How Savings Can Provide Financial Security

Financial security is a fundamental aspect of a stable and prosperous life. Savings play a crucial role in providing this security. By consistently saving a portion of your income, you are building a financial safety net that can act as a buffer during challenging times.

In the event of a job loss or unexpected medical expenses, having savings allows you to cover your basic needs without falling into crippling debt. It provides you with the freedom to explore new career opportunities or take a sabbatical to pursue personal growth.

Furthermore, savings enable you to weather economic downturns. Recessions and financial crises are inevitable, but having savings allows you to withstand the storm without compromising your lifestyle or sinking into financial hardship. It provides you with a sense of control over your financial future.

The Impact of a Savings Habit on Long-Term Goals

Having a savings habit is essential for achieving long-term financial goals. Whether your goal is to retire early, start a business, or fund your child’s education, consistent saving over a prolonged period can help you attain these objectives.

By saving a portion of your income regularly, you are harnessing the power of compound interest. Compound interest allows your savings to grow exponentially over time, generating significant returns on your investments. The earlier you start saving, the greater the impact of compound interest, demonstrating the importance of starting a savings habit as soon as possible.

Furthermore, a savings habit instills discipline and financial responsibility. It helps you develop a mindset that is focused on saving and prudent financial decision-making. Cultivating this habit early on will set you on the path to financial success and enable you to achieve your long-term goals.

Identifying Your Financial Goals

Before you embark on your savings journey, it is crucial to identify your financial goals. These goals will serve as your financial roadmap, guiding your saving and spending decisions. Identifying both short-term and long-term financial goals is important to maintain motivation and track your progress effectively.

Start by brainstorming your goals, both big and small. Do you want to purchase a new car? Are you planning to save for a down payment on a house? Do you have dreams of retiring early? Write down all your aspirations and dreams, no matter how big or small they may seem.

Next, prioritize your goals based on their timeline and importance to you personally. Some goals may have specific deadlines, such as saving for a wedding or a vacation. Others may be more long-term, like saving for retirement. Consider which goals are most important to you and focus your savings efforts accordingly.

Lastly, create a budget that aligns with your goals. A budget will help you allocate your income towards savings and other necessary expenses while still allowing for enjoyment and flexibility. By budgeting effectively, you ensure that your savings contributions are prioritized and that you are on track to achieve your financial goals.

Understanding Your Current Financial Situation

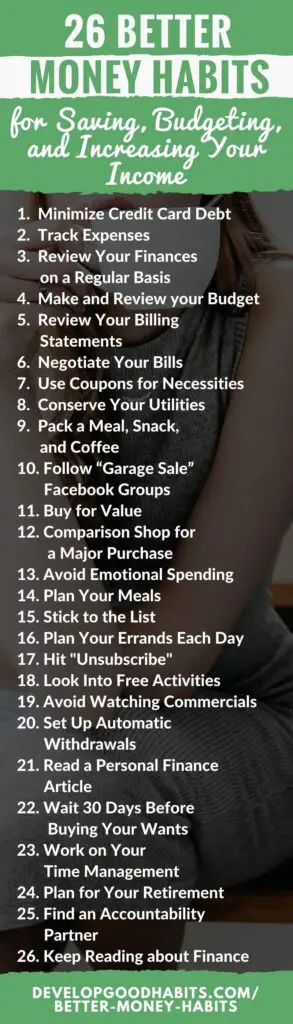

To effectively start a successful savings habit, it is essential to understand your current financial situation. This includes assessing your income and expenses, calculating your net worth, and identifying areas where you can cut expenses.

First, assess your income by compiling a list of all your income sources. This includes your salary, side gig earnings, investment returns, and any other sources of income. Having a clear understanding of how much money is coming in each month will help you determine how much you can allocate towards savings.

Next, calculate your expenses by tracking your spending for at least a month. This will give you a realistic view of where your money is going and help you identify any areas of overspending or unnecessary expenditures. Consider categorizing your expenses into fixed (such as rent or mortgage payments) and variable (such as entertainment or dining out) to better understand your spending habits.

Once you have a clear picture of your income and expenses, calculate your net worth. Net worth is calculated by subtracting your liabilities (such as debts) from your assets (such as savings, investments, and property). This provides a comprehensive view of your financial health and serves as a baseline for your savings journey.

Lastly, identify areas where you can cut expenses. Look for opportunities to reduce discretionary expenses and find ways to save on essential expenses. For example, you could cut back on dining out, cancel unnecessary subscriptions, or negotiate lower rates for insurance or utilities. By trimming unnecessary expenses, you can free up more money to allocate towards savings.

Developing a Savings Plan

Once you have a clear understanding of your financial goals and your current financial situation, it’s time to develop a savings plan. This plan will outline how much you need to save, the right savings account to use, how to automate your savings, and the importance of creating an emergency fund.

Determining How Much to Save

The first step in developing a savings plan is determining how much you need to save. This will depend on your financial goals and your current financial situation. Start by setting specific savings targets for each of your goals. For example, if your goal is to save for a down payment on a house, determine the amount you need to save and the timeline in which you want to achieve it.

Create a realistic and achievable savings schedule that aligns with your income and expenses. Consider allocating a percentage of your income towards savings, such as 10% or 20%. If you find that you are unable to save a significant percentage, even a small amount consistently can add up over time. The key is to be consistent and committed to your savings goals.

Choosing the Right Savings Account

Choosing the right savings account is crucial when starting a successful savings habit. Look for accounts that offer competitive interest rates and minimal fees. Avoid accounts with high account maintenance fees or minimum balance requirements, as these can eat into your savings growth.

Consider utilizing high-yield savings accounts or certificates of deposit (CDs) to maximize your savings returns. These accounts typically offer higher interest rates than traditional savings accounts, allowing your money to grow more rapidly. However, be aware of any restrictions or penalties associated with these accounts, such as early withdrawal fees for CDs.

Automating Your Savings

One of the most effective ways to ensure consistent savings is to automate your savings contributions. Set up automatic transfers from your main bank account to your savings account on a regular basis, such as monthly or bi-weekly. By automating your savings, you remove the temptation to spend the money elsewhere and make saving a priority.

Additionally, consider utilizing apps or online tools that round up your everyday purchases and deposit the rounded-up amount into your savings account. These tools make saving effortless and can help you accumulate extra savings without even noticing.

Creating an Emergency Fund

In addition to your general savings, it is crucial to create an emergency fund. An emergency fund acts as a financial safety net, providing you with peace of mind and security during unexpected events. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Start by setting a savings target for your emergency fund and allocate a portion of your monthly savings towards this fund until you reach your goal. Keep your emergency fund separate from your general savings account to ensure that it is not easily accessible for non-emergency purposes. Consider opening a separate high-yield savings account specifically for your emergency fund to maximize its growth potential.

Tracking Your Progress

Tracking your progress is essential to stay motivated and on track with your savings goals. By monitoring your savings growth and utilizing financial tracking tools, you can make data-driven adjustments to your savings plan and ensure that you are making steady progress towards your goals.

Start by regularly reviewing your savings account balances and comparing them to your savings targets. This will give you a tangible representation of your progress and help you identify any areas where you may need to increase your savings efforts.

Additionally, utilize financial tracking tools and apps to gain further insights into your financial health. These tools can help you visualize your spending patterns, track your income and expenses, and identify areas for improvement. By having a clear overview of your finances, you can make informed decisions that align with your savings goals.

Lastly, be prepared to make adjustments to your savings plan as needed. Life circumstances may change, and your goals may evolve over time. Regularly assess your goals and make adjustments to your savings contributions and timelines accordingly. Flexibility is key to maintaining long-term success in your savings journey.

Overcoming Obstacles and Staying Motivated

While starting a savings habit is an important step towards financial stability, it is not always an easy journey. There will be obstacles and challenges along the way that may test your resolve. However, by employing certain strategies and seeking support, you can overcome these obstacles and stay motivated.

Dealing with Unexpected Expenses

Unexpected expenses can derail your savings efforts if you are not prepared. However, by setting up an emergency fund and regularly contributing to it, you can mitigate the impact of such expenses. Having an emergency fund allows you to handle unexpected car repairs, medical bills, or other unforeseen events without relying on credit or derailing your savings progress.

Additionally, consider exploring different insurance options to protect yourself against various risks, such as health insurance, car insurance, or home insurance. Having adequate insurance coverage provides an extra layer of financial security and helps guard against unexpected expenses.

Avoiding Impulsive Spending

Impulsive spending can tempt even the most disciplined savers. To avoid falling into this trap, practice mindful spending and delay gratification. Before making a purchase, take a moment to ask yourself if it aligns with your financial goals and if it is a necessary expense. By incorporating this habit into your daily life, you can avoid unnecessary spending and maintain your savings focus.

Consider implementing a “waiting period” for significant purchases. This could range from a few days to a few weeks depending on the expense. By taking the time to reflect on the purchase, you can ensure that it is a considered decision rather than an impulsive one.

Seeking Support from Friends or Family

Building a savings habit can be more manageable when you have support from those around you. Share your goals and aspirations with friends or family members who can provide encouragement, accountability, and even join you in your savings journey. Having someone to share your challenges and successes with can be highly motivating and help you stay on track towards your financial goals.

Rewarding Yourself for Hitting Savings Milestones

While saving money requires discipline and sacrifice, it is important to reward yourself along the way to maintain motivation. Set milestones for your savings progress and celebrate when you achieve them. Rewards do not have to be extravagant or expensive. They can be as simple as treating yourself to a small indulgence or enjoying a day off to relax and recharge. By recognizing and celebrating your achievements, you reinforce the positive behavior of saving and motivate yourself to continue on your savings journey.

Investing Your Savings Wisely

As your savings grow, you may consider investing your money to further increase its growth potential. Investing allows you to generate returns on your savings that exceed the interest rates offered by savings accounts. However, it is crucial to approach investing with caution and proper knowledge.

Understanding Different Investment Options

There are various investment options available, each with its own risk and return profile. Before investing, familiarize yourself with these options and seek professional advice if needed. Consider investing in stocks, bonds, mutual funds, or real estate, among others. Each investment option has its own advantages and disadvantages, and it is important to understand the risks associated with each before committing your hard-earned savings.

The Importance of Diversification

Diversification is a key principle in investing. It involves spreading your investments across different asset classes or industries to reduce the risk of any single investment impacting your overall portfolio. By diversifying your investments, you minimize the potential losses from any one investment and maximize the potential for long-term growth.

Ensure that your investment portfolio is well-diversified by including a mix of stocks, bonds, and other asset classes. Consider investing in both domestic and international markets to further diversify your portfolio. This will help protect your savings from potential market fluctuations and increase the likelihood of achieving sustainable and consistent investment returns.

Seeking Professional Advice if Needed

Investing can be complex, particularly if you are new to it. If you are unsure of how to proceed or have a significant amount of savings that you want to invest, consider seeking professional advice from a financial advisor. A financial advisor can help you navigate the investment landscape, assess your risk tolerance, and create an investment strategy that aligns with your financial goals.

Remember, investing carries inherent risks, and it is important to thoroughly research and understand any investment before committing your savings. Be cautious of promises of quick or guaranteed returns and always evaluate investments based on their long-term potential and suitability for your specific financial situation.

Avoiding Common Savings Mistakes

When starting a savings habit, it is important to be aware of common mistakes that can hinder your progress. By identifying and avoiding these mistakes, you can ensure that your savings efforts are effective and fruitful.

Not Starting Early Enough

One of the most common mistakes is not starting a savings habit early enough. The power of compound interest cannot be overstated, and the earlier you start saving, the greater the impact of compound interest on your savings growth. Even if you can only save a small amount initially, starting early allows you to take advantage of the increased time for your savings to grow and accumulate over the long term.

Failing to Prioritize Savings

Another mistake is failing to prioritize savings. It can be tempting to prioritize immediate gratification and spending over saving for the future. However, to develop a successful savings habit, it is essential to make saving a priority. Allocate a consistent portion of your income towards savings before considering other discretionary expenses. By making saving a priority, you ensure that you are building a solid foundation for your financial future.

Relying Solely on Credit and Loans

Relying solely on credit and loans is a common mistake that can lead to a cycle of debt and financial instability. While credit and loans can help in certain situations, such as purchasing a home or funding education, it is important to avoid using them excessively. Instead, focus on saving up for major expenses and using credit and loans sparingly, if needed. By building up your savings, you reduce reliance on credit and loans, saving money on interest payments and avoiding the burden of debt.

Building a Frugal Lifestyle

A frugal lifestyle is an effective way to support your savings habit and maximize your financial resources. By adopting a mindset of mindful spending and prioritizing value over immediate gratification, you can build sustainable saving habits and reach your financial goals more efficiently.

The Benefits of Living Frugally

Living frugally offers numerous benefits beyond just saving money. It allows you to appreciate the value of the things you truly need and cherish experiences over material possessions. By living frugally, you can reduce stress related to financial worries and focus on what truly matters in life.

Furthermore, a frugal lifestyle promotes conscious consumption and reduces waste. By cutting unnecessary expenses and limiting your consumption, you can reduce your environmental footprint and contribute to a more sustainable future.

Cutting Unnecessary Expenses

A significant part of living frugally is cutting unnecessary expenses. Take a close look at your spending habits and identify areas where you can make cuts or find more affordable alternatives. Consider reducing discretionary expenses such as eating out, entertainment subscriptions, or shopping for non-essential items. By redirecting your spending towards meaningful experiences and essentials, you can free up more money to allocate towards savings.

Look for ways to cut costs in everyday activities, such as meal planning and cooking at home, utilizing public transportation or carpooling, and finding free or low-cost entertainment options. Small adjustments in your daily routines can add up to significant savings over time.

Developing Sustainable Saving Habits

Building sustainable saving habits involves incorporating frugality into your everyday life. Make conscious choices when it comes to spending, focusing on quality over quantity and value over immediate gratification. By developing these sustainable saving habits, you can ensure that your savings efforts are consistent and in line with your financial goals.

Finding Additional Income Streams

Finding additional income streams can accelerate your savings progress and provide extra flexibility in achieving your financial goals. By exploring side gigs or freelance opportunities, or utilizing your skills for extra income, you can increase your earning potential and boost your savings significantly.

Exploring Side Gigs or Freelance Opportunities

Side gigs or freelance opportunities offer a flexible way to earn additional income outside of your primary job. Consider your skills, talents, and interests and explore opportunities in the gig economy. This could include offering services such as dog walking, tutoring, writing, graphic design, or driving for ride-sharing services. By leveraging your skills and passions, you can earn extra income while pursuing your interests.

Utilizing Your Skills for Extra Income

In addition to side gigs, look for opportunities to utilize your skills for extra income in your current job or industry. Consider taking on additional responsibilities or projects that provide additional compensation. Alternatively, explore opportunities for career advancement or job changes that offer higher salaries or better benefits. By actively seeking ways to leverage your skills, you can increase your earning potential and accelerate your savings growth.

Teaching Children the Value of Saving

Teaching children the value of saving money is a crucial aspect of their financial education. By instilling good saving habits at an early age, you are equipping them with essential life skills that will benefit them throughout their lives.

Introducing Basic Financial Concepts

Start by introducing basic financial concepts to children at an age-appropriate level. Teach them about the importance of saving money, the concept of earning and spending, and the benefits of delayed gratification. Use real-life examples and activities to make these concepts relatable and engaging.

Involve children in family financial discussions, such as budgeting or saving for a trip or special purchase. This allows them to witness firsthand how saving is a part of daily life and involves the whole family. Encourage them to set their savings goals and help them brainstorm ways to achieve them.

Using Rewards and Incentives

Using rewards and incentives can be effective in motivating children to save money. Consider offering rewards for reaching savings milestones, such as matching their savings contributions or providing small gifts or experiences. This encourages them to save regularly and reinforces the positive behavior of saving.

Additionally, encourage children to save a portion of any money they receive as gifts or allowances. This teaches them the value of saving a portion of their income and helps them develop a savings habit early on.

Setting Up Savings Accounts for Children

Setting up savings accounts for children is an excellent way to introduce them to the banking system and help them manage their money. Many banks offer specific savings accounts designed for children, often with no or low fees and attractive interest rates. Work with your child to choose an account and actively involve them in monitoring their savings account balance and celebrating their savings milestones.

Planning for Retirement

Planning for retirement is a critical part of a successful savings habit. By starting early and consistently contributing to retirement funds, you can ensure a comfortable and financially secure retirement.

Understanding Retirement Accounts and Options

There are various retirement accounts and options to consider when planning for retirement. The most common retirement accounts include 401(k) plans, individual retirement accounts (IRAs), and pensions. Research and understand the benefits and drawbacks of each option and determine which ones are most suitable for your specific financial situation and goals.

Consider enrolling in employer-sponsored retirement plans, such as a 401(k), and take advantage of any employer matching contributions. These plans often come with tax advantages and can significantly boost your savings through employer matches.

Calculating Retirement Savings Needs

Calculating your retirement savings needs is crucial to ensure that you are saving enough to support your desired lifestyle during retirement. Take into account factors such as your desired retirement age, expected living expenses, healthcare costs, and any other specific needs or goals you may have.

Use retirement calculators or seek professional financial advice if needed to help you determine how much you need to save for retirement. Regularly reassess your retirement savings goals as your circumstances change, and make adjustments to your savings contributions as necessary.

Making Regular Contributions to Retirement Funds

Consistency is key when it comes to saving for retirement. Set up regular contributions to your retirement funds and make them a priority in your savings plan. Automating your retirement contributions, similar to general savings contributions, ensures that you are consistently saving towards your retirement goals.

Additionally, consider increasing your retirement contributions whenever possible, particularly when you receive a salary increase or a bonus. Increasing your contributions allows your retirement savings to grow more rapidly and helps you catch up if you have fallen behind on your savings targets.

Preparing for Financial Emergencies

Financial emergencies are inevitable in life, and being prepared to handle them is an important aspect of a successful savings habit. By creating an emergency fund and having a plan in place, you can navigate unexpected expenses without compromising your financial stability.

The Importance of Having an Emergency Fund

Having an emergency fund is crucial to provide for unexpected expenses and avoid falling into debt. An emergency fund acts as a financial safety net, providing you with peace of mind and security during challenging times.

Without an emergency fund, unexpected expenses may lead to high-interest debt or a disruption in your savings progress. By having a dedicated emergency fund, you can handle unexpected car repairs, medical expenses, or job loss without derailing your financial goals.

Identifying Potential Emergencies

Identifying potential emergencies allows you to better prepare for them and allocate the appropriate funds towards your emergency fund. Consider the types of unexpected expenses that could arise, such as car repairs, medical emergencies, or temporary loss of income. Research the average costs of these emergencies in your area and set a savings target for your emergency fund accordingly.

Creating a Plan to Handle Unexpected Expenses

Creating a plan to handle unexpected expenses involves allocating funds towards your emergency fund on a regular basis and establishing guidelines for when to use the funds. Determine the amount you want to save in your emergency fund, typically three to six months’ worth of living expenses, and set a savings schedule to reach this goal.

Outline the circumstances under which you will use your emergency fund. Ideally, these funds should only be used for true emergencies and not for discretionary expenses. Having a clearly defined plan for using your emergency fund helps ensure that it is reserved for its intended purpose and not easily depleted.

Conclusion

Starting a successful savings habit is a powerful step towards financial stability and freedom. By understanding the benefits of saving money, the role of savings in providing financial security, and the impact of a savings habit on long-term goals, you can set yourself on a path to a prosperous future.

Identifying your financial goals, understanding your current financial situation, and developing a savings plan are essential to lay the foundation for your savings journey. Tracking your progress, overcoming obstacles, and staying motivated help you stay on track and make the necessary adjustments to achieve your goals. Investing your savings wisely, avoiding common savings mistakes, and building a frugal lifestyle further support your savings efforts and maximize your financial resources.

Finding additional income streams, teaching children the value of saving, planning for retirement, and preparing for financial emergencies are all integral aspects of a successful savings habit. By incorporating these strategies into your financial planning, you can take control of your financial future and achieve the stability and freedom you desire.

Remember, starting a successful savings habit is a journey that requires discipline, commitment, and perseverance. With each savings milestone, you are one step closer to financial independence and the life you envision. Start today and embrace the power of saving!