So I stumbled upon this article called “Investing on a Budget: A Beginner’s Guide” and let me tell you, it’s got some great tips for anyone looking to invest without breaking the bank. As someone who’s always on the lookout for ways to make my money work harder for me, I was instantly drawn to this title. I mean, who doesn’t want to learn how to invest on a budget, right?

If you’re like me and have been wanting to dip your toes into the world of investing but aren’t quite sure where to start, this article promises to be a helpful resource. I’m excited to dive in and see what strategies and advice they have in store for us beginners. From what I can gather, it seems like they’ll be covering everything from the basics of investing to specific tips for those of us on a tight budget. So if you’re interested in learning how to grow your wealth without spending a fortune, this article might just hold the key. I can’t wait to see what I’ll be learning from it!

Introduction

Understanding the importance of investing

Investing is an essential part of building wealth and achieving financial security. It allows us to grow our money over time and generate passive income. However, many individuals mistakenly believe that investing is only for the wealthy or those with a large sum of money to spare.

In reality, investing is not limited to the affluent. Regardless of your income level, you can start investing on a budget and gradually expand your portfolio as your financial situation improves. This beginner’s guide will provide you with practical advice on investing on a budget, helping you take the first steps towards financial independence.

Overview of investing on a budget

Investing on a budget means making the most of your available resources to create a comprehensive and diversified investment portfolio. It involves being mindful of expenses and focusing on low-cost investment options that offer attractive returns. By adopting a frugal lifestyle and making strategic choices, you can build your wealth over time without sacrificing financial stability.

In this guide, we will explore various investment options, explain the benefits of each, and discuss how to research and select investments that align with your financial goals. We will also delve into risk management strategies, long-term investing strategies, and the importance of monitoring and adjusting your investments to ensure optimal performance.

Setting Financial Goals

Identifying short-term and long-term goals

Before you begin investing, it is crucial to determine your financial goals. Are you looking to save for a down payment on a house? Are you planning for retirement? Do you want to finance your child’s education? Identifying your short-term and long-term financial goals will help you allocate your resources appropriately and make informed investment decisions.

Short-term goals typically have a time frame of less than five years, while long-term goals extend beyond that. Examples of short-term goals may include saving for a vacation, purchasing a car, or paying off high-interest debt. Long-term goals, on the other hand, involve saving for retirement, funding your children’s education, or building a sizable nest egg.

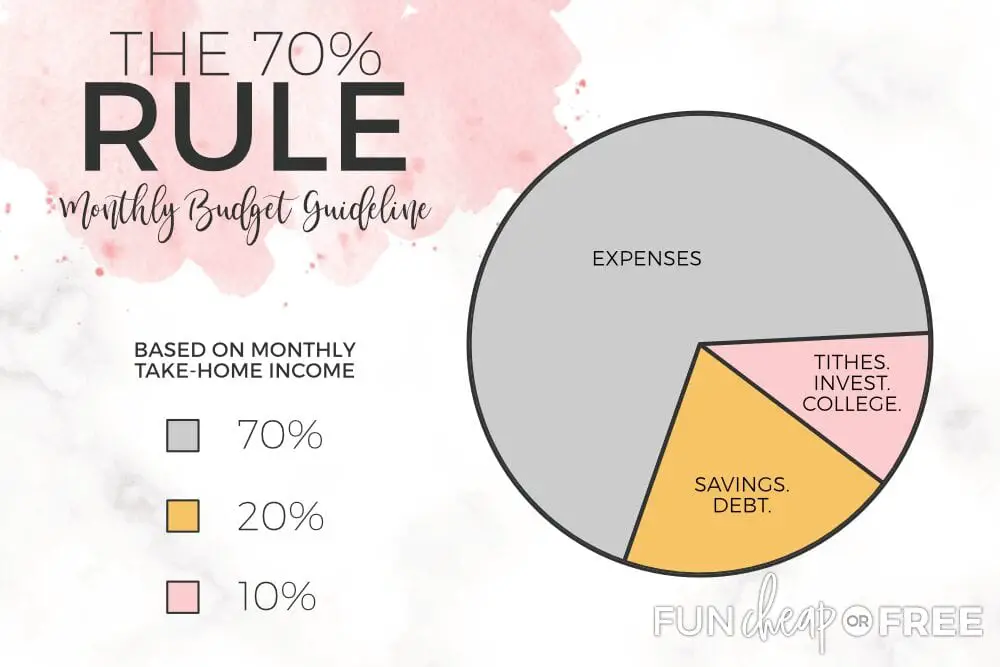

Creating a budget plan

Once you have determined your financial goals, it is essential to create a budget plan. A budget will help you track your income and expenses, enabling you to save and invest more effectively. Start by evaluating your monthly income and deducting your regular expenses such as rent or mortgage payments, utilities, groceries, and transportation costs.

Next, identify areas where you can cut back on unnecessary expenses. By adopting a frugal lifestyle, you can save more money to invest. Consider reducing dining out, entertainment expenses, and subscription services. Instead, focus on cooking at home, exploring free or low-cost activities, and cancelling any unused subscriptions.

By creating a budget plan and cutting back on unnecessary expenses, you will have more funds available for investment purposes. This disciplined approach to managing your finances will lay the foundation for successful investing on a budget.

Types of Investments

Introduction to stocks and bonds

When it comes to investing, stocks and bonds are two common asset classes to consider. Stocks represent ownership in a company, while bonds are debt securities issued by corporations or governments.

Stocks offer potential high returns but also come with a higher level of risk. The stock market can be volatile, with prices fluctuating daily based on various factors such as economic conditions, company performance, and market sentiment.

Bonds, on the other hand, tend to be less volatile and provide a more predictable income stream. They are often considered safer investments as they offer regular interest payments and the return of principal upon maturity. However, bond returns are typically lower than potential stock returns.

Exploring mutual funds and index funds

Mutual funds and index funds are investment vehicles that allow individuals to pool their money together with other investors and have their investments managed by professional fund managers.

Mutual funds are actively managed, meaning the fund manager actively buys and sells securities in an attempt to outperform the market. These funds charge management fees, which can affect your overall returns.

Index funds, on the other hand, passively track a specific index, such as the S&P 500. They aim to replicate the performance of the index rather than outperform it. As a result, index funds tend to have lower management fees and can offer a more cost-effective investment option for budget-conscious investors.

Understanding real estate investments

Real estate investments involve purchasing properties for the purpose of generating rental income or capital appreciation. Investing in real estate can provide a steady stream of passive income and potential tax advantages.

Rental properties involve purchasing residential or commercial properties and leasing them to tenants. The rental income covers your mortgage payments and maintenance costs while potentially generating positive cash flow. Over time, the value of the property may also appreciate, resulting in a substantial investment return.

House flipping, on the other hand, involves purchasing properties at a low price, renovating them, and selling them at a higher price. This investment strategy requires careful market research, knowledge of construction and renovation, and the ability to accurately assess the potential profitability of each property.

Real estate investments can be an excellent addition to your portfolio, providing diversification and potential long-term returns. However, they also come with risks such as property market fluctuations and maintenance costs. It is crucial to thoroughly research the real estate market and carefully consider your financial capacity before investing in properties.

Researching Investment Options

Using online resources to gather information

The internet is a valuable tool for researching investment options. Numerous online resources provide valuable information on stocks, bonds, mutual funds, index funds, and real estate investments. Websites such as Morningstar, Yahoo Finance, and Investopedia offer comprehensive insights into investment trends, valuation metrics, and expert analysis.

Take advantage of these resources to educate yourself about different investment opportunities, understand the risks associated with each option, and make informed investment decisions.

Analyzing risk and potential returns

When considering investment options, it is essential to analyze the potential risks and returns associated with each investment. Higher-risk investments often have the potential for higher returns, but they also come with a greater chance of losing money.

Consider your risk tolerance and financial goals when evaluating investment options. If your investing on a budget, you may lean towards more conservative investments with lower risk but also lower potential returns. Understanding and assessing risk is crucial for creating a well-balanced investment portfolio.

Considering investment diversification

Diversification is an essential risk management strategy when investing on a budget. It involves spreading your investment across different asset classes, sectors, and geographical locations to reduce the impact of any single investment’s poor performance.

By diversifying your portfolio, you can mitigate the risk of losing all your capital should one investment perform poorly. Consider allocating your funds across a mix of stocks, bonds, mutual funds, index funds, and real estate investments. This approach will help protect your investment portfolio from excessive volatility and potentially enhance your long-term returns.

Building an Investment Portfolio

Determining asset allocation

Asset allocation refers to the distribution of your investments across different asset classes. It is one of the most critical factors contributing to your investment portfolio’s performance. Determining the appropriate asset allocation depends on your risk tolerance, financial goals, and investment timeline.

A common rule of thumb is to subtract your age from 100 and allocate that percentage to stocks, with the remainder allocated to bonds. For example, if you are 30 years old, you would allocate 70% of your portfolio to stocks and 30% to bonds.

This approach balances the potential for higher returns from stocks with the stability and income provided by bonds. However, it is important to reassess and adjust your asset allocation periodically as your financial situation and risk tolerance may change over time.

Choosing suitable investment vehicles

After determining your asset allocation, it is essential to choose suitable investment vehicles. Look for low-cost options with attractive returns that align with your investment strategy and financial goals.

Consider investing in low-cost mutual funds and index funds that offer diversification and professional management at a reasonable cost. Additionally, explore online discount brokerage platforms that offer low fees and a wide range of investment options. These platforms provide convenient access to stocks, bonds, and exchange-traded funds (ETFs) that can help you build a well-diversified investment portfolio.

Creating a diversified portfolio

A diversified portfolio is crucial for reducing risk and maximizing potential returns. By investing in a mix of different asset classes and sectors, you can protect your investments from excessive volatility and potentially benefit from different market conditions.

Ensure your portfolio includes a mix of stocks, bonds, mutual funds, index funds, and potentially real estate investments. Aim to diversify within each asset class as well. For example, your stock portfolio should comprise stocks from various industries and geographical regions.

Building a diversified portfolio requires careful consideration of your risk tolerance, financial goals, and investment timeline. Regularly review and rebalance your portfolio to maintain the desired asset allocation and adapt to changing market conditions.

Maximizing Returns with Low-Cost Investments

Exploring low-cost investment options

When investing on a budget, it is important to explore low-cost investment options that minimize expenses and maximize returns. High expenses, such as management fees and transaction costs, can eat into your investment returns over time.

Consider investing in low-cost mutual funds and index funds that offer competitive returns and have low expense ratios. These funds are designed to replicate the performance of a specific index or sector, providing investors with broad market exposure at a fraction of the cost of actively managed funds.

Additionally, some online brokerage platforms offer commission-free trading on certain stocks, ETFs, and mutual funds. Take advantage of these platforms to minimize transaction costs and keep more of your investment returns.

Understanding expense ratios and fees

Expense ratios represent the percentage of a fund’s assets that are used to cover its annual operating expenses. These expenses include management fees, marketing costs, administrative fees, and other operational expenses.

When investing on a budget, it is crucial to pay attention to expense ratios. Lower expense ratios mean more of your investment’s returns will be retained in your portfolio. Compare expense ratios across different funds and choose those with lower fees to maximize your investment returns.

Additionally, be aware of any additional fees charged by investment platforms or advisors. These fees can significantly impact your overall returns, especially when investing with limited funds. Read the fine print and understand the fee structure before committing to any investment platform or financial advisor.

Comparing investment platforms

Investment platforms play a crucial role in your investing journey, especially when operating on a budget. It is essential to compare different platforms and evaluate their fees, available investment options, user experience, and customer support.

Look for online brokerage platforms that offer a wide range of investment options, competitive fees, and user-friendly interfaces. Consider platforms that provide educational resources, research tools, and excellent customer service to support your investing journey.

Take the time to research and compare different investment platforms to find the one that best suits your needs and investment goals. Remember, finding a platform that aligns with your budget and investment preferences can significantly impact your investment returns and overall experience.

Investing in Stocks

Fundamental analysis and stock selection

Investing in individual stocks can be an exciting way to participate in the growth of specific companies. However, it also comes with higher risk compared to other investment options. Therefore, conducting thorough research and performing fundamental analysis before investing in stocks is crucial.

Fundamental analysis involves evaluating a company’s financial health, profitability, growth prospects, and competitive advantages. Study the company’s financial statements, analyze industry trends, and consider the company’s competitive landscape.

Choose stocks that align with your investment strategy and financial goals. Consider factors such as the company’s management team, revenue growth, earnings potential, and the industry’s long-term prospects. Additionally, take into account the company’s valuation by comparing its price-to-earnings (P/E) ratio to industry peers.

Understanding different stock markets

Investing in stocks extends beyond your local stock exchange. There are various stock markets worldwide that offer opportunities for diversification and potentially higher returns. Consider exploring international stocks to diversify your portfolio and potentially benefit from emerging markets’ growth.

However, investing in international stocks introduces additional risks such as currency fluctuations, geopolitical factors, and differences in regulatory environments. Research and understand the specific risks associated with investing in each market and consult with a financial advisor if needed.

Managing risk and setting stop-loss orders

Managing risk is crucial when investing in stocks, especially when operating on a budget. Establishing a risk management strategy can protect your portfolio from significant losses and minimize potential financial setbacks.

One commonly used risk management tool is the stop-loss order. A stop-loss order is a predefined price at which an investor directs their broker to sell a particular stock. By setting a stop-loss order, you can limit your losses and automatically exit a position if the stock’s price declines below your specified level.

Setting stop-loss orders can provide peace of mind, especially during volatile market conditions. However, it is important to strike a balance to prevent triggering stop-loss orders too frequently, potentially missing out on long-term gains. Adjust your stop-loss levels based on the stock’s volatility and your risk tolerance.

Investing in Bonds

Overview of bond types

When investing on a budget, bonds can offer stability and reliable income. Understanding the different types of bonds and their characteristics can help you select the most suitable options for your investment portfolio.

Government bonds, also known as Treasury bonds, are issued by governments to raise funds. They are considered low-risk investments as governments are typically reliable borrowers. Government bonds come in various maturities, ranging from short-term to long-term.

Corporate bonds are issued by companies to raise capital for expansions, acquisitions, or refinancing existing debt. They typically offer higher yields compared to government bonds but come with higher default risk.

Municipal bonds are issued by state or local governments to finance public projects such as schools, hospitals, and infrastructure. They offer tax advantages and may be exempt from federal or state income taxes.

Assessing credit ratings and bond yields

When investing in bonds, it is important to assess the credit ratings of the issuing entity. Credit rating agencies such as Moody’s, Standard & Poor’s, and Fitch assign ratings to bonds based on the issuer’s creditworthiness. Bonds with higher credit ratings have lower default risk but usually offer lower yields.

Evaluate the risk-reward profile of each bond by considering its credit rating, yield, and maturity. Higher-yielding bonds often come with higher risk and longer maturities. Assess your risk tolerance, investment timeline, and income requirements when selecting bonds for your portfolio.

Understanding bond market fluctuations

Bond prices are influenced by various factors, including interest rates, inflation expectations, and the issuer’s creditworthiness. When interest rates rise, bond prices generally fall, and vice versa. This inverse relationship is due to the fixed interest payments provided by bonds.

Understand that bond prices fluctuate over time and that fluctuations can affect your investment returns. However, when held until maturity, bonds provide the return of principal. This predictable income stream makes bonds an attractive investment option for budget-conscious investors seeking stable returns.

Investing in Mutual Funds and Index Funds

Benefits and drawbacks of mutual funds

Mutual funds pool money from multiple investors and invest in a diversified portfolio of securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

One of the main benefits of mutual funds is diversification. By investing in a mutual fund, you gain exposure to a wide range of securities, reducing the risk associated with investing in individual stocks or bonds.

However, mutual funds often charge management fees, which can impact your overall returns. It is crucial to compare expense ratios, fund performance, and investment strategies when selecting a mutual fund.

Exploring index fund strategies

Index funds are a type of mutual fund that aims to replicate the performance of a specific index, such as the S&P 500 or the FTSE 100. These funds offer broad market exposure and lower expenses compared to actively managed funds.

Index funds provide investors with the opportunity to achieve returns similar to the overall market’s performance. They are particularly suitable for budget-conscious investors seeking long-term growth and low-cost investment options.

While index funds eliminate the need for active stock selection, it is important to assess the composition of the index the fund tracks. Understand the index’s methodology, sector allocation, and performance history before investing in an index fund.

Analyzing expense ratios and performance

When investing in mutual funds or index funds, pay attention to expense ratios and fund performance. Expense ratios represent the percentage of a fund’s assets used to cover operating expenses, as discussed earlier.

Evaluate a fund’s expense ratio in conjunction with its historical performance. A fund with a low expense ratio that consistently outperforms its benchmark index may be a suitable investment option. Be cautious of funds with high expense ratios, as they can significantly eat into your investment returns.

Research and compare expense ratios, fund performance, and investment strategies before investing in mutual funds or index funds. Opt for funds with low expenses and consistent performance over the long term.

Real Estate Investments

Overview of rental properties and house flipping

Real estate investments can provide attractive returns and a steady stream of income. Rental properties and house flipping are two common strategies in real estate investing.

Rental properties involve purchasing residential or commercial properties and leasing them to tenants. Rental income covers the property’s expenses, including mortgage payments, property taxes, insurance, and maintenance costs. Over time, rental properties can generate positive cash flow and potentially appreciate in value, offering long-term returns.

House flipping entails purchasing distressed properties, renovating them, and selling them for a profit. This strategy requires careful market analysis, knowledge of construction and renovation, and accurately assessing the potential profitability of each property. Successful house flipping can result in substantial short-term gains.

Calculating cash flow and return on investment

When investing in rental properties, it is crucial to calculate the potential cash flow and return on investment (ROI). Cash flow refers to the net income generated by the property after deducting all expenses. Positive cash flow indicates the property’s income exceeds its expenses, while negative cash flow means operating at a loss.

ROI measures the profitability of an investment and is typically expressed as a percentage. It accounts for both income generated and property appreciation over time. Consider all costs associated with purchasing and maintaining the property when calculating ROI.

Evaluate potential rental properties based on their location, rental demand, vacancy rates, and property management costs. Analyze the potential cash flow and ROI before committing to a rental property investment.

Evaluating real estate market trends

Real estate markets are influenced by various factors such as interest rates, population growth, economic conditions, and local market trends. It is essential to stay informed about market trends, supply and demand dynamics, and the impact of external factors on the local real estate market.

Monitor real estate market indicators such as home prices, days on market, and rental rates. Assess the potential risks and rewards associated with investing in specific regions or property types. Consult with real estate professionals or conduct thorough research to gain insights into local market conditions and make informed investment decisions.

Real estate investments can provide diversification and potential long-term returns. However, they require careful consideration, thorough research, and financial analysis to ensure a successful investment.

Risk Management Strategies

Diversification and asset allocation

Diversification is a risk management strategy that involves spreading investments across various asset classes, sectors, and geographical regions. By diversifying your portfolio, you reduce the impact of any single investment’s poor performance and protect your investments from excessive volatility.

Combining stocks, bonds, mutual funds, index funds, and potentially real estate allows you to mitigate risk and potentially enhance returns. Consider allocating your funds across different industries, market capitalizations, and investment styles within each asset class.

Additionally, asset allocation plays a crucial role in managing risk. Allocate your investments across different asset classes based on your risk tolerance, financial goals, and investment timeline. Regularly review and rebalance your portfolio to maintain the desired asset allocation and adapt to changing market conditions.

Setting realistic expectations

Setting realistic expectations is crucial when investing on a budget. Understand that investing is a long-term endeavor and that returns may vary year to year.

It is essential to align your expectations with your investment strategy and financial goals. Avoid chasing short-term market trends or trying to time the market. Instead, focus on building a solid investment portfolio that aligns with your risk tolerance and long-term objectives.

Consider historical market returns, the performance of various asset classes, and the impact of inflation on your investment returns. By setting realistic expectations, you can avoid making hasty investment decisions based on market fluctuations and stay committed to your long-term investment strategy.

Understanding market volatility

Market volatility is a natural part of investing. It refers to the rapid and significant price fluctuations in the financial markets. Understand that market volatility can lead to both potential gains and losses.

During periods of market volatility, it is important to stick to your investment plan and avoid making impulsive decisions based on short-term market movements. Stay focused on the long-term, be patient, and avoid panic selling during market downturns. Historically, markets have recovered from downturns and provided attractive long-term returns.

Prepare yourself for market volatility by diversifying your portfolio, regularly reviewing your investment strategy, and maintaining a long-term perspective. Seek professional advice when needed to ensure you have a solid understanding of market dynamics and appropriate risk management strategies.

Long-Term Investing Strategies

The power of compounding

The power of compounding is a key concept in long-term investing. It refers to the ability of an investment to generate earnings, which are then reinvested to generate more earnings. Over time, compounding can significantly enhance investment returns.

When investing on a budget, it is important to start early and consistently contribute to your investment portfolio. By reinvesting your investment earnings and letting them compound, you can benefit from exponential growth over the long term.

Consider utilizing tax-advantaged retirement accounts such as Individual Retirement Accounts (IRAs) or workplace retirement plans like 401(k)s. These accounts offer tax benefits and allow your investments to grow tax-free or tax-deferred, further magnifying the power of compounding.

Setting up retirement accounts

Investing on a budget should include planning for retirement. Starting early and contributing consistently to retirement accounts is crucial for long-term financial security.

Take advantage of tax-advantaged retirement accounts such as IRAs or employer-sponsored retirement plans. These accounts offer valuable tax benefits and allow your investments to grow tax-free or tax-deferred.

Contribute as much as you can afford to retirement accounts, especially if your employer offers a matching contribution. Aim to maximize your contributions to take advantage of these benefits and ensure a comfortable retirement.

Investing for financial independence

Apart from retirement planning, investing on a budget should also consider financial independence. Financial independence refers to the ability to cover living expenses and achieve personal goals without relying on employment income.

Invest in assets that generate passive income, such as dividend-paying stocks, rental properties, or income-generating mutual funds. Passive income streams can supplement your regular income and accelerate your journey towards financial independence.

Create a plan to accumulate assets that provide ongoing income while also focusing on growing your investment portfolio. Set specific financial independence goals and allocate your resources accordingly. Regularly review your progress, make necessary adjustments, and seek professional advice to maximize your chances of achieving financial independence.

Monitoring and Adjusting Your Investments

Regularly reviewing investment performance

Monitoring your investments is crucial for maintaining a healthy investment portfolio. Regularly review the performance of your investments and assess whether they align with your financial goals and risk tolerance.

Consider creating a schedule for reviewing your portfolio, such as quarterly or annually. During these reviews, evaluate the performance of individual stocks, bonds, mutual funds, or real estate investments. Compare their performance to relevant benchmarks and assess whether any adjustments are necessary.

Avoid making knee-jerk reactions based on short-term market fluctuations. Instead, focus on the long-term performance and fundamentals of your investments. If needed, consult with a financial advisor to gain insights and make informed decisions.

Rebalancing your portfolio

Rebalancing your portfolio is necessary to maintain the desired asset allocation and adapt to changing market conditions. Over time, certain investments may outperform others, causing your asset allocation to deviate from your original target.

Regularly reassess your asset allocation and rebalance your portfolio to bring it back in line with your desired allocation. For example, if your stock holdings have outperformed your bond holdings, consider selling a portion of your stocks and using the proceeds to purchase more bonds.

Rebalancing ensures that your investment portfolio remains aligned with your risk tolerance and financial goals. It forces you to sell high-performing investments and buy underperforming ones, allowing you to “buy low and sell high” and potentially enhance your portfolio’s performance.

Seeking professional advice when needed

While investing on a budget is an excellent way to build wealth, seeking professional advice can provide valuable insights and guidance. Financial advisors can help you assess your risk tolerance, determine your financial goals, and develop a comprehensive investment strategy.

Consider consulting with a financial advisor, especially when making significant financial decisions, such as setting up retirement accounts, purchasing real estate, or planning for major life events. A professional advisor can provide tailored advice based on your specific circumstances and ensure you stay on track to achieve your financial goals.

Conclusion

Investing on a budget is an achievable goal that can lead to significant financial growth and long-term stability. By understanding the importance of investing, setting financial goals, researching investment options, and building a diversified portfolio, you can start your investment journey even with limited funds.

Adopt a frugal lifestyle, regularly review your investments, and commit to long-term investment strategies. Use the power of compounding, establish retirement accounts, and seek professional advice when needed. By following these steps, you can increase your chances of achieving financial independence and realizing your long-term financial goals.

Remember, investing is a journey, and it requires patience, discipline, and ongoing education. Start investing on a budget today and take control of your financial future.