Are you ready to embark on a thrifty journey and save some serious cash? Look no further! In this article, we will introduce you to a variety of money-saving challenges that will help you achieve your financial goals throughout the year. From the popular 52-week Money Challenge to the innovative No Spend Month Challenge, these challenges are designed to kickstart your saving habits and transform your financial outlook. So get ready to embrace frugality and watch your savings soar as we present you with a range of exciting and rewarding money-saving challenges for the year ahead.

1. The 52-Week Money Challenge

What is the 52-Week Money Challenge?

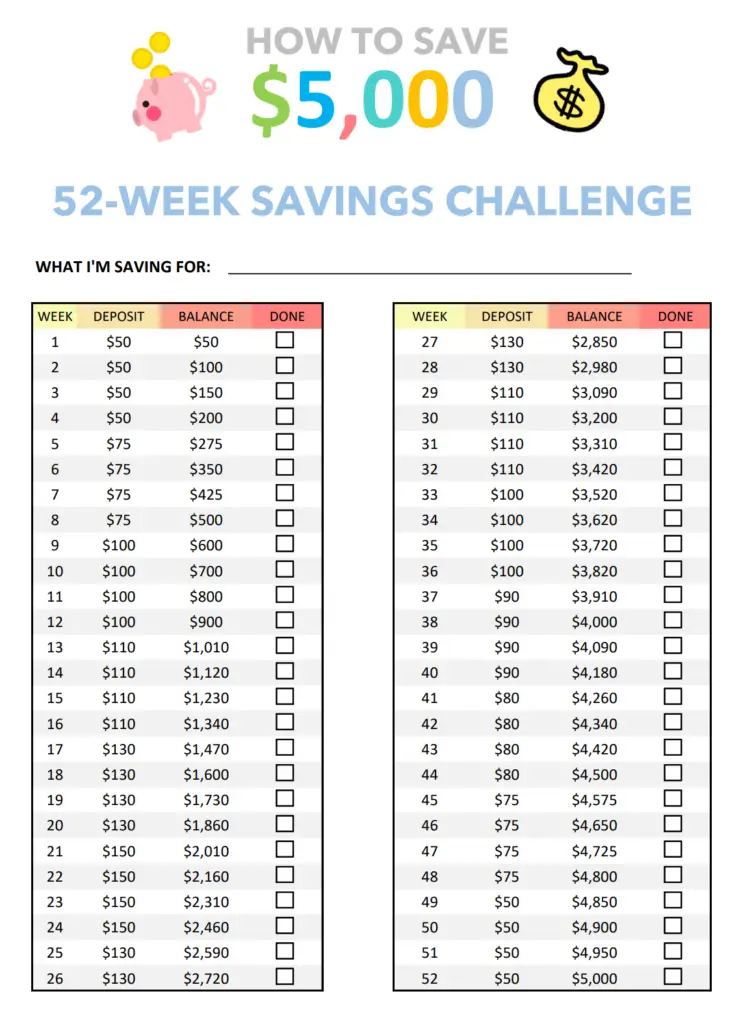

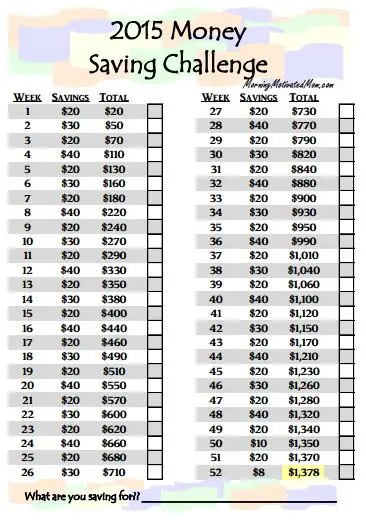

The 52-Week Money Challenge is a popular savings challenge that encourages you to save a specific amount each week for a year. The challenge is designed to gradually increase your savings throughout the year, making it easier to reach your financial goals.

How does it work?

The concept of the 52-Week Money Challenge is simple. In the first week, you save $1. In the second week, you save $2. Each week, you increase the amount you save by $1. By the end of the year, you will have saved a total of $1,378.

The challenge can be done in different ways depending on your preferences and financial situation. Some people prefer to start with a higher amount and decrease it each week, while others choose to save a fixed amount each week. The key is to stay consistent and stick to your savings plan.

Tips for success

-

Plan ahead: Before starting the 52-Week Money Challenge, create a savings plan and determine what you will do with the money once you’ve completed the challenge. This will help you stay motivated and focused on your financial goals.

-

Automate your savings: Set up an automatic transfer to a separate savings account each week. This will make it easier to stick to the challenge and ensure that you don’t forget to save.

-

Find creative ways to save: Look for opportunities to save money throughout the week. For example, you can pack your lunch instead of eating out or try a no-spend weekend. Small changes can add up over time and help you save more.

-

Track your progress: Use a tracking sheet or a budgeting app to keep track of your savings. Seeing your progress visually can be motivating and encourage you to keep going.

-

Stay accountable: Consider doing the challenge with a friend or family member. Having someone to share your progress and challenges with can make the journey more enjoyable and help you stay committed.

2. The No-Spend Challenge

What is the No-Spend Challenge?

The No-Spend Challenge is a money-saving challenge that involves cutting out all non-essential spending for a set period of time. It encourages you to be mindful of your purchases and focus on your needs rather than wants.

How does it work?

During the No-Spend Challenge, you commit to not spending money on non-essential items such as eating out, shopping for clothes, or going to the movies. Instead, you prioritize your essential needs, such as groceries, bills, and transportation.

The duration of the challenge can vary depending on your goals and financial situation. Some people opt for a weekend challenge, while others challenge themselves to a month or even longer.

Tips for success

-

Set clear rules: Before starting the No-Spend Challenge, define what is considered essential and non-essential spending. This will help you avoid ambiguous situations and make it easier to stick to the challenge.

-

Plan your meals: Meal planning can significantly reduce your grocery bill and eliminate the temptation to eat out. Take some time to plan your meals for the challenge period and create a shopping list based on what you already have at home.

-

Find free or low-cost activities: Just because you’re cutting out non-essential spending doesn’t mean you have to be bored. Look for free or low-cost activities in your community, such as hiking, exploring local parks, or organizing a game night with friends.

-

Reduce impulse buying: Impulse purchases can quickly derail your No-Spend Challenge. Before making a purchase, give yourself a cooling-off period of 24 hours to determine if it’s a genuine need or simply a want. This can help you make more intentional decisions.

-

Use cash: Consider using cash instead of credit or debit cards during the challenge. Physically handing over cash can make you more aware of your spending and help you resist unnecessary purchases.

3. The Shopaholic Detox Challenge

What is the Shopaholic Detox Challenge?

The Shopaholic Detox Challenge is a challenge designed to help you break free from compulsive shopping habits and develop healthier spending habits. It aims to bring awareness to your shopping patterns and help you regain control of your finances.

How does it work?

The Shopaholic Detox Challenge involves abstaining from unnecessary shopping for a specified period of time. This means refraining from buying items that are not essential or that you can live without.

To make the challenge more effective, it’s important to identify the triggers that lead to your shopping habits. Are you more likely to shop when you’re stressed or bored? Understanding these triggers will help you find healthier alternatives to cope with those emotions.

Tips for success

-

Define your goals: Before starting the Shopaholic Detox Challenge, identify your financial goals and what you hope to achieve by breaking free from compulsive shopping. Whether it’s saving for a vacation or paying off debt, having a clear goal can help you stay motivated.

-

Unsubscribe from marketing emails: One of the biggest temptations for shopaholics is the constant bombardment of marketing emails and advertisements. Take the time to unsubscribe from these newsletters to minimize your exposure to temptation.

-

Find alternative outlets: Instead of turning to shopping when you’re stressed or bored, explore alternative activities or hobbies that bring you joy. This could be exercising, reading, practicing mindfulness, or pursuing a creative project.

-

Practice mindful spending: Before making a purchase, ask yourself if the item brings long-term value or if it’s just a temporary desire. Consider waiting 24 hours before making a decision to see if the desire to purchase diminishes.

-

Seek support: Overcoming a shopping addiction can be challenging, but you don’t have to do it alone. Reach out to supportive friends and family or consider joining a support group or seeking professional help. Having a support system can make a significant difference in your journey towards healthier spending habits.