Living a rich life doesn’t necessarily mean having a lot of money. It’s more about how you prioritize your spending and make the most out of what you have. In this article, you’ll learn some valuable tips on how to prioritize your expenses and budget wisely, so that you can live a fulfilling and prosperous life without breaking the bank.

When it comes to living a rich life on a budget, it’s all about understanding what really matters to you and aligning your spending with your values. Instead of mindlessly spending money on things that don’t bring you joy or add value to your life, focus on the things that truly make you happy and contribute to your overall well-being. By prioritizing your spending, you can allocate your money towards experiences, relationships, and activities that bring you joy and fulfillment, rather than wasting it on unnecessary or temporary pleasures. With the right mindset and conscious decision-making, you can live a rich life on a budget and make the most out of every dollar.

Prioritizing Your Way to a Rich Life on a Budget

Living a rich and fulfilling life doesn’t always mean having an abundance of money. It’s about making smart choices, setting priorities, and finding joy in the simple things. Achieving financial freedom and building wealth can be challenging, especially when resources are limited. However, with the right mindset and a focus on your goals, it is possible to live abundantly on a budget.

Evaluating Your Spending Habits

The first step in prioritizing your expenses is evaluating your spending habits. Take a close look at where your money is going each month. Are you spending on things that truly bring you value and happiness? Are there areas where you can cut back without sacrificing your well-being? By identifying your spending patterns, you can make informed decisions about where to allocate your limited resources.

Identifying Essential vs. Non-Essential Expenses

Once you have evaluated your spending habits, it’s essential to distinguish between essential and non-essential expenses. Essential expenses include things like rent/mortgage, utilities, groceries, transportation, and healthcare. These are the items that are necessary for your basic needs. Non-essential expenses, on the other hand, are things that are nice to have but not crucial for your well-being. By prioritizing your essential expenses, you can ensure that your basic needs are met before allocating money towards non-essential items.

Cutting Back on Unnecessary Costs

To live a rich life on a budget, it’s important to cut back on unnecessary costs. Look for areas where you can make small changes that can add up over time. For example, instead of dining out at expensive restaurants, try cooking at home and packing your lunch. Cancel unused subscriptions or memberships. Cut back on discretionary spending by being mindful of your purchases. By eliminating unnecessary costs, you can free up money to put towards your financial goals.

Creating a Budget Plan

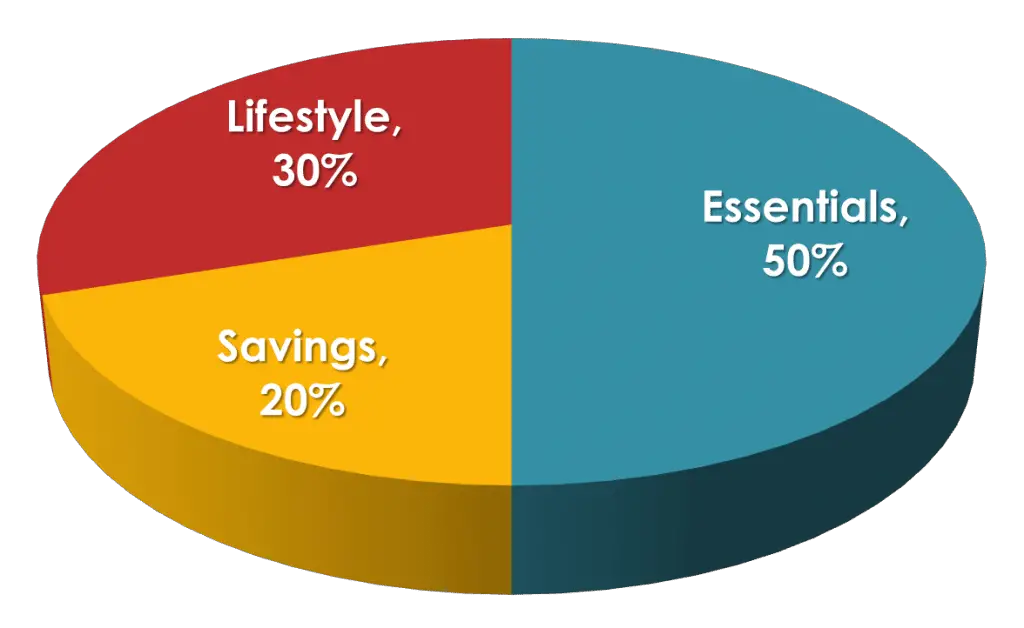

A budget plan is a crucial tool in managing your expenses and achieving financial freedom. By creating a detailed budget, you can allocate your income towards your priorities and track your progress over time. Start by listing your sources of income and expenses. Be sure to include savings as a line item in your budget to ensure you are setting aside money for the future. Regularly review and update your budget to stay on track and adjust as needed.

Building Wealth through Saving

Setting Realistic Savings Goals

Saving money is a fundamental aspect of building wealth. Setting realistic savings goals can help you stay motivated and on track with your financial aspirations. Take some time to determine what you are saving for, whether it’s an emergency fund, a down payment on a home, or retirement. Break down your goals into smaller, achievable targets and track your progress. Celebrate milestones along the way to stay motivated and inspired.

Automating Your Savings

One way to make saving easier is by automating your savings. Set up automatic transfers from your paycheck to your savings account or utilize budgeting apps that can automatically set aside money for you. By automating your savings, you remove the temptation to spend the money and ensure that you are consistently building your nest egg.

Tracking Your Expenses

Tracking your expenses is a critical step in achieving financial freedom. By keeping a record of your spending, you can identify areas where you may be overspending or where you can cut back. There are numerous budgeting apps and online tools that can help you track your expenses effortlessly. This will also provide you with a clear picture of your financial health and make it easier to stick to your budget plan.

Exploring Different Saving Strategies

There are various saving strategies that you can explore to maximize your savings. Consider opening a high-yield savings account to earn more interest on your money. Look for opportunities to save on daily expenses, such as using coupons and discounts, buying in bulk, or shopping during sales. Additionally, consider exploring different investment options that can generate passive income and help grow your wealth over time.

Investing Wisely with Limited Resources

Understanding Investment Options

Investing is a powerful tool for growing your wealth, even with limited resources. It’s important to understand the different investment options available to you. Educate yourself about stocks, bonds, mutual funds, and real estate investment trusts (REITs), among others. Each investment option has its own level of risk and potential for returns. Assess your risk tolerance and investment goals before making any investment decisions.

Researching Low-Cost Investment Opportunities

When investing on a budget, it’s important to research low-cost investment opportunities. Look for brokerage firms or investment platforms that offer low-cost or commission-free trading. Exchange-traded funds (ETFs) are a popular investment option that allows you to diversify your portfolio and avoid high fees associated with actively managed funds. By doing thorough research and finding low-cost investment options, you can make your money work harder for you.

Diversifying Your Investment Portfolio

A key principle of investing wisely is diversifying your investment portfolio. Diversification helps spread risks and potential losses across different asset classes. Consider investing in a mix of stocks, bonds, real estate, and other investment vehicles to minimize risk. By diversifying your portfolio, you can also increase your chances of earning higher returns over the long term.

Maximizing Returns with a Balanced Risk

Investing on a budget requires a balanced approach to risk. While higher-risk investments may offer the potential for higher returns, they also come with increased uncertainty. It’s important to find a balance between risk and reward that aligns with your financial goals and risk tolerance. Consider consulting with a financial advisor to develop an investment strategy that maximizes returns while managing risk effectively.

Managing Debt and Financial Obligations

Creating a Debt Repayment Plan

Debt can be a significant obstacle to achieving financial freedom. Creating a debt repayment plan is crucial in managing your financial obligations. Start by listing all your debts, including credit cards, student loans, and personal loans. Prioritize your debts based on interest rates, aiming to pay off the highest-interest debts first. Allocate as much money as possible towards debt repayment each month, while still meeting your essential expenses.

Prioritizing High-Interest Debts

High-interest debts, such as credit card debts, can quickly accumulate and hinder your financial progress. It’s essential to prioritize these debts in your repayment plan. Explore options to consolidate your debts or negotiate with lenders for lower interest rates. By paying off high-interest debts first, you can reduce the amount of interest you pay over time and accelerate your journey to debt-free living.

Negotiating Lower Interest Rates

In some cases, negotiating lower interest rates on your debts can help alleviate financial burdens. Contact your creditors and explain your situation. They may be willing to work with you to lower the interest rates or offer a more manageable repayment plan. Remember that creditors want to collect their money, so they may be open to negotiating if it means you can repay the debt.

Seeking Professional Financial Advice

Managing debt and financial obligations can be overwhelming, especially if you are facing limited resources. Seeking professional financial advice can provide valuable insights and guidance tailored to your specific situation. A financial advisor can help you create a personalized plan to manage your debts, set achievable goals, and work towards a stable financial future.

Making Smart Purchasing Decisions

Comparison Shopping for the Best Deals

One way to stretch your budget is by comparison shopping for the best deals. Before making a purchase, take the time to research different sellers or retailers to find the best price. Use websites and apps that compare prices across multiple platforms to ensure you are getting the best deal. By being a savvy shopper, you can save money and make your limited resources go further.

Avoiding Impulsive Buying

Impulsive buying can quickly derail your budget and hinder your financial progress. Avoid making impulsive purchases by practicing mindful and intentional shopping. Before making a purchase, ask yourself if it aligns with your priorities and if you truly need it. Consider waiting a day or two before making a purchase to ensure it is a well-thought-out decision.

Using Coupons and Discounts

Coupons and discounts are powerful tools in reducing costs and saving money. Look for coupons or promotional codes before making a purchase, whether online or in-store. Subscribe to newsletters or follow social media accounts of your favorite brands to stay updated on discounts and special offers. By utilizing coupons and discounts, you can make significant savings over time.

Considering Second-Hand Options

Consider exploring second-hand options for items you need. Thrift stores, consignment shops, and online marketplaces offer a wide range of gently used items at a fraction of the retail price. Buying second-hand not only saves money but also helps reduce waste and promote sustainable consumption. Embrace the thrill of finding unique treasures while staying within your budget.

Increasing Income Streams

Expanding Your Skill Set

Increasing your income streams can significantly improve your financial situation. One way to do this is by expanding your skill set. Identify areas where you can enhance your qualifications or learn new skills that are in demand. This could be through online courses, workshops, or vocational training. By investing in yourself and expanding your skill set, you can open doors to new opportunities and potentially earn a higher income.

Negotiating a Higher Salary

If you are currently employed, consider negotiating a higher salary. Prepare a compelling case highlighting your achievements and the value you bring to your organization. Research industry standards for salaries to ensure you are requesting a fair and competitive rate. Negotiating a higher salary can have a significant impact on your finances and help you achieve your financial goals faster.

Exploring Side Hustles

Side hustles are a popular way to earn extra income in your spare time. Whether it’s freelancing, tutoring, pet sitting, or starting a small business, side hustles can provide an additional financial boost. Identify your skills and interests and explore opportunities that align with them. Side hustles not only provide extra income but can also be a source of fulfillment and personal growth.

Passive Income Opportunities

Passive income opportunities are another way to increase your income without significant effort. Examples of passive income include rental properties, dividends from investments, or creating digital products to sell online. While generating passive income may require upfront investment or effort, the potential to earn money with minimal ongoing work can enhance your financial situation and provide long-term stability.

Prioritizing Health and Wellness

Safeguarding Your Physical Wellbeing

Health is wealth, and prioritizing your physical well-being is essential for maintaining a rich life on a budget. Practice good hygiene, exercise regularly, and get enough rest. Take preventive measures to protect yourself from illnesses, such as getting vaccinated and practicing proper hand hygiene. Investing in your physical health now can save you money on healthcare costs in the long run.

Maintaining a Balanced Diet

A balanced diet is crucial for overall well-being and can be achieved even on a limited budget. Focus on affordable nutrient-dense foods like whole grains, fruits and vegetables, lean proteins, and legumes. Plan your meals in advance and cook at home as much as possible. Batch cooking and meal prepping can help save time and money while maintaining a healthy and budget-friendly diet.

Exercising on a Budget

Regular exercise is essential for both physical and mental health. You don’t need an expensive gym membership to stay active. Consider outdoor activities like walking, running, or cycling. Many communities offer free or low-cost fitness classes in public parks. Alternatively, explore workout videos or apps that provide guided exercises from the comfort of your own home. Get creative with your exercise routine and find activities that are enjoyable and fit your budget.

Investing in Preventive Healthcare

Investing in preventive healthcare can save you money in the long run. Schedule regular check-ups and screenings to catch potential health issues early. Take advantage of free or low-cost preventive services offered by your healthcare provider or community organizations. By investing in preventive healthcare, you can avoid costly medical bills and ensure that you are taking proactive steps to maintain your well-being.

Achieving a Fulfilling Social Life

Identifying Free or Low-Cost Activities

Having a fulfilling social life does not have to come at a high price. Look for free or low-cost activities in your community. Take advantage of local parks, libraries, and community centers that offer free events and classes. Host potluck gatherings where everyone contributes a dish, reducing the cost of socializing. Be open to exploring new activities and experiences that fit within your budget.

Building Relationships within Your Community

Building relationships within your community is not only rewarding but can also lead to new opportunities and shared resources. Attend community events, join local clubs or organizations, and volunteer your time to connect with like-minded individuals. By building a strong support network within your community, you can create meaningful connections that enrich your life without straining your budget.

Organizing Potluck or Budget-Friendly Gatherings

Hosting gatherings doesn’t have to break the bank. Instead of shouldering the entire financial burden, organize potluck or budget-friendly gatherings where everyone brings a dish or contributes in some way. This not only shares the expense but also creates a sense of community and togetherness. Get creative with themes or activities that can make these gatherings memorable and enjoyable for everyone involved.

Exploring Free Cultural Events and Festivals

Cultural events and festivals often offer free or low-cost entertainment options. Keep an eye out for local events in your area, such as concerts, art exhibitions, or street fairs. These events offer opportunities to engage with your community, experience different cultures, and enjoy entertainment without going over budget. Embrace the diversity and vibrancy of your community while staying within your means.

Finding Affordable Travel Options

Planning in Advance for Cheaper Flights

Traveling on a budget requires careful planning, especially when it comes to flights. Start planning your travel well in advance to take advantage of cheaper flight options. Subscribe to fare alert emails or use comparison websites to monitor prices and find the best deals. Consider flying on weekdays or during off-peak travel seasons when prices tend to be lower. By planning in advance, you can snag affordable flights and save money on your travel expenses.

Utilizing Travel Reward Programs

If you enjoy traveling, consider utilizing travel reward programs to save money. Many airlines and credit card companies offer reward programs that allow you to earn points or miles for your purchases. These points can be redeemed for discounted or even free flights, hotel stays, or other travel-related expenses. Take advantage of these programs to maximize your savings and make your travel dreams a reality.

Opting for Off-Season Travel

Traveling during off-peak seasons can significantly reduce your expenses. Prices for accommodations, flights, and attractions are often lower during times when tourist demand is lower. By opting for off-season travel, you can explore popular destinations without breaking the bank. Additionally, destinations during off-peak seasons tend to be less crowded, allowing for a more authentic and enjoyable experience.

Researching Budget Accommodation

Accommodation expenses can be a significant portion of your travel budget. Research budget-friendly accommodation options, such as hostels, guesthouses, or vacation rentals. Booking directly with the property or using online travel agencies can often yield competitive rates. Consider staying in less touristy areas or exploring alternative accommodation options like house-sitting or couch-surfing. By prioritizing affordable accommodation, you can stretch your travel budget further.

Investing in Personal Development

Reading Self-Improvement Books

Personal development plays a crucial role in achieving a rich life on a budget. Invest your time in reading self-improvement books that offer insights and strategies for personal growth. These books often provide valuable guidance on finances, mindset, career development, relationships, and overall well-being. Utilize your local library or online resources to find a wide range of self-improvement books at no cost.

Taking Advantage of Free Online Courses

In today’s digital age, there is an abundance of free online courses available on various platforms. Take advantage of these courses to expand your knowledge and acquire new skills. Whether it’s learning a new language, developing coding skills, or improving your financial literacy, these courses allow you to invest in your personal development without spending a dime. Continuous learning can open doors to new opportunities and positively impact your financial journey.

Attending Local Networking Events

Networking events provide opportunities to connect with professionals in your field and build valuable relationships. Many networking events are free or have a minimal cost to attend. Look for local industry-specific events, job fairs, or professional organization gatherings. Be prepared with your elevator pitch and business cards to make the most out of these events. By attending these events, you can expand your professional network and potentially uncover new career prospects.

Finding Mentors for Professional Growth

Having a mentor can be invaluable in your professional growth journey. Seek out individuals who have achieved success in your field or possess the skills and knowledge you aspire to have. Reach out to them and ask for guidance or mentorship. While some mentors may charge for their services, there are also many individuals who are willing to offer mentorship and advice at no cost. Investing in mentorship can provide you with valuable insights and guidance tailored to your goals and aspirations.

Cultivating Hobbies on a Budget

Exploring Low-Cost or Free Hobbies

Hobbies are essential for personal fulfillment and can be pursued on a budget. Explore low-cost or free hobbies that align with your interests. Whether it’s gardening, painting, writing, or playing a musical instrument, find activities that bring you joy and relaxation without draining your finances. Free resources online or at your local library can help you get started with your chosen hobby.

DIY Crafts and Projects

Engaging in do-it-yourself (DIY) crafts and projects is not only a budget-friendly hobby but also a creative outlet. Look for DIY projects that utilize recycled materials or repurpose items you already have at home. DIY crafts can include knitting, sewing, woodworking, or even upcycling furniture. Embrace the satisfaction of creating something with your own hands while saving money and reducing waste.

Utilizing Public Resources, Like Libraries

Public resources like libraries are treasure troves for individuals looking to cultivate hobbies on a budget. Borrow books, magazines, or DVDs related to your interests. Many libraries also offer resources for learning new skills, such as language courses or crafting workshops. Take advantage of these resources to explore new hobbies without spending a fortune.

Joining Community Groups with Shared Interests

Joining community groups related to your hobbies is a great way to connect with like-minded individuals and learn from each other. Look for local clubs or organizations that align with your interests. These groups often organize events, workshops, or classes, providing opportunities for personal growth and social interaction. By joining community groups, you can engage with others who share your passions while staying within your budget.

Maintaining a Positive Mindset

Practicing Gratitude

Maintaining a positive mindset is crucial for living a rich life on a budget. Practicing gratitude can help shift your focus towards what you have rather than what you lack. Take time each day to reflect on the things you are grateful for, whether it’s good health, supportive relationships, or fulfilling experiences. By cultivating an attitude of gratitude, you can find contentment and fulfillment even with limited resources.

Surrounding Yourself with Supportive People

Surrounding yourself with supportive people can significantly impact your mindset and overall well-being. Seek out individuals who inspire and motivate you. Foster relationships with people who share similar values and aspirations. Cultivate a support network that understands and supports your journey towards financial freedom. By surrounding yourself with positive influences, you can maintain a positive mindset and stay motivated on your path to a rich life.

Finding Joy in Simple Pleasures

Finding joy in simple pleasures is key to living a rich life on a budget. Take time to appreciate the beauty of nature, enjoy a home-cooked meal, or engage in activities that bring you joy and fulfillment. By finding happiness in everyday moments, you can cultivate a rich and meaningful life without relying on extravagant expenses. Embrace the simplicity and appreciate the small things that truly matter.

Embracing Minimalism and Mindful Consumption

Embracing minimalism and mindful consumption can help shift your mindset towards intentional living and financial freedom. Assess your possessions and consider decluttering your living space. Focus on quality over quantity when making purchases and avoid unnecessary acquisitions. By adopting a minimalist lifestyle and practicing mindful consumption, you can simplify your life, reduce financial stress, and prioritize what truly brings you joy.

Continually Educating Yourself Financially

Staying Up-to-Date with Financial News

Staying up-to-date with financial news is essential for making informed decisions about your finances. Stay informed about market trends, economic indicators, and changes in regulations. Read reputable financial newspapers, websites, or subscribe to financial newsletters to stay informed. Being knowledgeable about financial matters can help you make sound financial decisions and adapt to changing circumstances.

Listening to Personal Finance Podcasts

Personal finance podcasts are a valuable resource for financial education. They provide insights, tips, and strategies on various financial topics, including budgeting, investing, and debt management. Listen to personal finance podcasts during your commute or while doing chores to gain valuable knowledge and stay motivated on your financial journey. There are numerous podcasts available on different platforms, catering to various financial levels and goals.

Attending Financial Seminars and Workshops

Attending financial seminars and workshops is an excellent way to increase your financial knowledge. Look for local events or online webinars that cover topics like budgeting, investing, or retirement planning. Some financial institutions or community organizations offer free or low-cost financial literacy programs. Take advantage of these opportunities to expand your knowledge and gain insights from experts in the field.

Educating Yourself about Investments and Taxation

Investments and taxation play a significant role in building wealth and managing your finances effectively. Educate yourself about different investment options, tax strategies, and retirement planning. There are numerous books, online resources, and courses that can provide you with insights and knowledge in these areas. By continuously educating yourself about investments and taxation, you can make informed decisions and optimize your financial outcomes.

Conclusion

Prioritizing your way to a rich life on a budget requires thoughtful decision-making, discipline, and a focus on what truly matters. By evaluating your spending habits, identifying essential expenses, and cutting back on unnecessary costs, you can allocate your limited resources towards your financial goals. Building wealth through saving, investing wisely, managing debt, and increasing income streams are essential steps in achieving financial freedom. Additionally, prioritizing health, cultivating fulfilling relationships, and pursuing personal development contribute to overall well-being and happiness. By maintaining a positive mindset, embracing minimalism, and continually educating yourself financially, you can navigate the challenges of a frugal lifestyle and live abundantly even with limited resources.

Living a rich life is not solely determined by the amount of money in your bank account but rather by the choices you make and the importance you place on the things that truly matter. By prioritizing wisely, making smart purchasing decisions, and consciously choosing to invest in personal growth and well-being, you can achieve a rich and fulfilling life on any budget. So take the first step today and start prioritizing your way to a rich life on a budget.