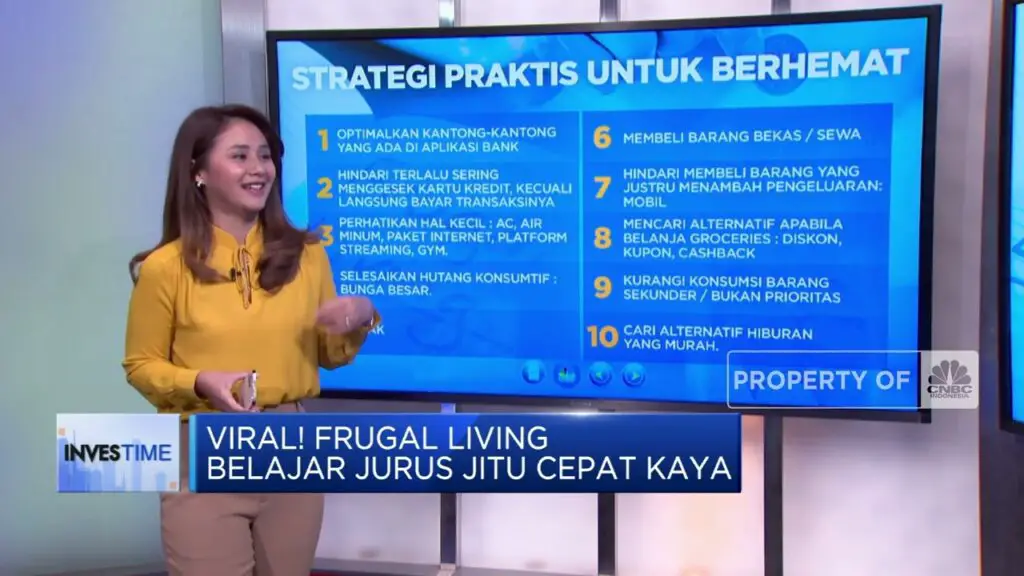

Frugal living is a practical and mindful way of managing your finances and living within your means. It involves budgeting, separating expenses, and prioritizing saving. By practicing frugal living, you can achieve financial stability, pay off debts, and work towards financial freedom. It also promotes making practical decisions, such as avoiding unnecessary credit card usage and finding cheaper alternatives for entertainment. Implementing frugal living can have long-term benefits, such as teaching future generations the importance of financial responsibility and mindful spending. While it may pose challenges for those in the “sandwich generation” who have financial responsibilities towards both their parents and children, it is possible to overcome these challenges by working harder and finding additional sources of income.

Overview of Frugal Living

Frugal living is a way of life that focuses on living within one’s means and being mindful of expenses. It involves budgeting and planning one’s finances, separating expenses into different categories, and prioritizing saving. By practicing frugal living, individuals can achieve financial stability, pay off debts, and work towards financial freedom. It also encourages making practical decisions, such as avoiding unnecessary credit card usage, being mindful of small expenses, and finding cheaper alternatives for entertainment. Frugal living can be passed on to future generations, teaching them the importance of financial responsibility and mindful spending.

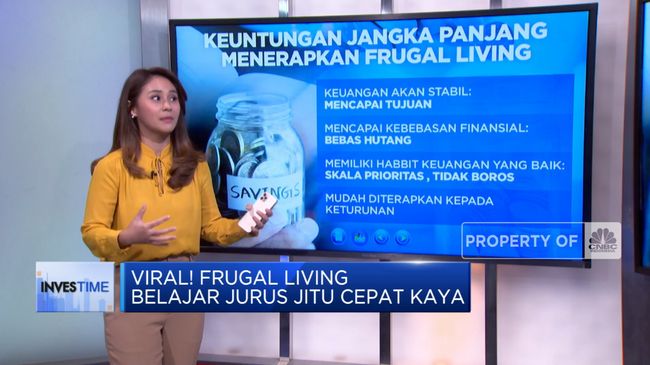

Financial Benefits of Frugal Living

Achieving Financial Stability

One of the main benefits of frugal living is the ability to achieve financial stability. By living within your means and being mindful of your expenses, you can ensure that your income is sufficient to cover all your necessary expenses. This allows you to avoid constantly living paycheck to paycheck and gives you a sense of security and peace of mind.

Paying off Debts

Frugal living also provides the opportunity to pay off debts more effectively. By cutting back on unnecessary expenses and focusing on saving, you can allocate more money towards debt repayment. This can help you become debt-free faster and save money on interest payments in the long run.

Working towards Financial Freedom

Frugal living is a crucial step towards achieving financial freedom. By prioritizing saving and investing your money wisely, you can build wealth over time. Financial freedom means having enough passive income to cover all your expenses and being able to live a life of your choosing without the burden of financial stress. Frugal living sets the foundation for this by fostering good saving habits and a mindset of mindful spending.

Practical Decision Making

Avoiding Unnecessary Credit Card Usage

One practical decision you can make to support frugal living is to avoid unnecessary credit card usage. While credit cards can be convenient, they can also lead to excessive spending and debt if not used responsibly. Instead, opt for cash or debit card payments to stay more aware of your spending and avoid accumulating high-interest debt.

Being Mindful of Small Expenses

Small expenses can add up quickly over time and have a significant impact on your overall budget. Being mindful of these expenses can help you identify areas where you can cut back and save money. Keep track of your daily spending and evaluate whether each expense aligns with your priorities and financial goals.

Finding Cheaper Alternatives for Entertainment

Entertainment expenses can often take up a significant portion of your budget. Look for cheaper alternatives for entertainment, such as free community events, movie nights at home, or exploring nature. Additionally, consider utilizing streaming services instead of expensive cable subscriptions and finding creative ways to have fun without breaking the bank.

Teaching Financial Responsibility

Passing on Frugal Living to Future Generations

Frugal living is a valuable lesson that can be passed on to future generations. By teaching children and grandchildren about the importance of living within their means, making conscious financial decisions, and prioritizing saving, you can help them develop strong financial habits that will benefit them throughout their lives.

Importance of Mindful Spending

Mindful spending is a key component of frugal living. By teaching the value of money and the importance of considering the long-term impact of purchases, you can instill responsible spending habits in younger generations. Encourage them to think critically about their wants versus needs and to prioritize experiences and meaningful connections over material possessions.

Developing Strong Saving Habits

Saving is an essential aspect of frugal living. By teaching younger generations about the power of savings, setting savings goals, and automating savings contributions, you can help them develop strong saving habits. Teach them about the importance of emergency funds, retirement savings, and long-term financial planning.

Challenges Faced by the Sandwich Generation

Financial Responsibilities towards Parents and Children

The sandwich generation refers to individuals who have financial responsibilities towards both their aging parents and young children. This can pose unique challenges when it comes to implementing frugal living. The financial strain of supporting two generations can make it difficult to allocate funds towards saving and building wealth.

Strategies to Overcome Challenges

To overcome the challenges faced by the sandwich generation, it is important to prioritize financial planning and open communication. Set realistic expectations with your parents and children about the financial support you can provide. Look for ways to cut costs and find additional sources of income, such as taking on a side gig or exploring work-from-home opportunities.

Finding Additional Sources of Income

Finding additional sources of income can significantly alleviate the financial burden faced by the sandwich generation. Consider exploring part-time work, freelance opportunities, or starting a small business. This additional income can be used to cover expenses, pay off debt, and even contribute to savings and investments.

Long-Term Effects of Frugal Living

Building Wealth for the Future

One of the long-term effects of practicing frugal living is the ability to build wealth for the future. By consistently saving and investing your money wisely, you can accumulate wealth over time. This can provide financial security and open up opportunities for you and your family.

Creating Financial Security

Frugal living promotes financial security by teaching individuals to live within their means and prioritize saving. By having a solid financial foundation, you can weather unexpected expenses and emergencies without going into debt or experiencing financial distress. This sense of security and stability can bring peace of mind.

Reducing Stress and Anxiety

Financial stress is a common source of anxiety for many people. By practicing frugal living, you can reduce financial stress by being in control of your finances and having a clear plan for your money. Knowing that you are actively working towards your financial goals can alleviate anxiety and provide a sense of empowerment.

Frugal Living and Sustainability

Reducing Waste and Consumption

Frugal living aligns with the principles of sustainability by encouraging individuals to reduce waste and consumption. By being mindful of your purchases and finding ways to repurpose or reuse items, you can minimize your environmental impact. Frugal living promotes conscious consumerism and discourages excessive consumption.

Embracing Minimalism

Minimalism is often associated with frugal living. By embracing minimalism, you focus on living with fewer material possessions and prioritizing experiences and relationships. This can lead to a more fulfilling and intentional lifestyle while also reducing your environmental footprint.

Making Eco-Friendly Choices

Frugal living promotes making eco-friendly choices by encouraging the use of energy-efficient appliances, reducing water consumption, and adopting sustainable habits. By being mindful of your environmental impact and seeking out sustainable alternatives, you can contribute to a healthier planet while also saving money.

Frugal Living as a Lifestyle Choice

Developing Contentment

Frugal living encourages the development of contentment and gratitude for what you have rather than constantly striving for more. By prioritizing experiences and relationships over material possessions, you can find joy and fulfillment in the simple things in life. This mindset shift can lead to a happier and more fulfilling life overall.

Focusing on Experiences over Material Possessions

Frugal living emphasizes the importance of experiences over material possessions. Instead of constantly chasing after the latest gadgets or trends, focus on creating meaningful memories and engaging in activities that bring you true joy. This perspective can lead to a more fulfilling and balanced life.

Creating a More Fulfilling Life

Frugal living promotes intentional living and aligning your actions with your core values and priorities. By being mindful of your financial decisions and focusing on what truly brings you happiness and fulfillment, you can create a life that is aligned with your values and brings you a deep sense of satisfaction.

Implementing Frugal Living in Different Areas

Frugal Living in Housing

Implementing frugal living in housing involves making conscious decisions about where and how you live. Consider downsizing your living space to reduce expenses, exploring alternative housing options such as co-living or house-sharing, or looking for ways to decrease your utility bills by being mindful of energy usage.

Frugal Living in Transportation

Frugal living in transportation means finding cost-effective ways to get around. Consider using public transportation, carpooling, or biking instead of owning and maintaining a car. If owning a car is a necessity, explore ways to minimize costs such as purchasing a used vehicle or opting for a more fuel-efficient model.

Frugal Living in Food and Grocery

Food and grocery expenses can often take up a significant portion of the budget. Embrace frugal living in this area by meal planning, buying in bulk, shopping for sales and discounts, and minimizing food waste. Consider growing your own food or participating in community gardens to further reduce expenses.

Conclusion

In conclusion, frugal living offers numerous benefits and can have a long-term impact on your financial well-being and overall lifestyle. By living within your means, being mindful of expenses, and making practical decisions, you can achieve financial stability, pay off debts, and work towards financial freedom. Frugal living can be passed on to future generations, teaching them the importance of financial responsibility and mindful spending. It also aligns with sustainability principles by reducing waste and consumption. Ultimately, frugal living is a lifestyle choice that can lead to a more fulfilling and content life. So, embrace the principles of frugal living and start reaping the rewards today.