Introduction

Creating and sticking to a budget may seem like a daunting task, but with a few simple steps, you can take control of your finances and achieve your financial goals. In this article, I will share some practical tips and strategies that have helped me successfully create and stick to a budget.

Step 1: Assess Your Current Financial Situation

The first step in creating a budget is to assess your current financial situation. Start by gathering information about your income, expenses, and debts. This will give you a clear picture of where your money is going and help identify areas where you can cut back. Take the time to review your bank statements, bills, and credit card statements to get an accurate understanding of your spending habits.

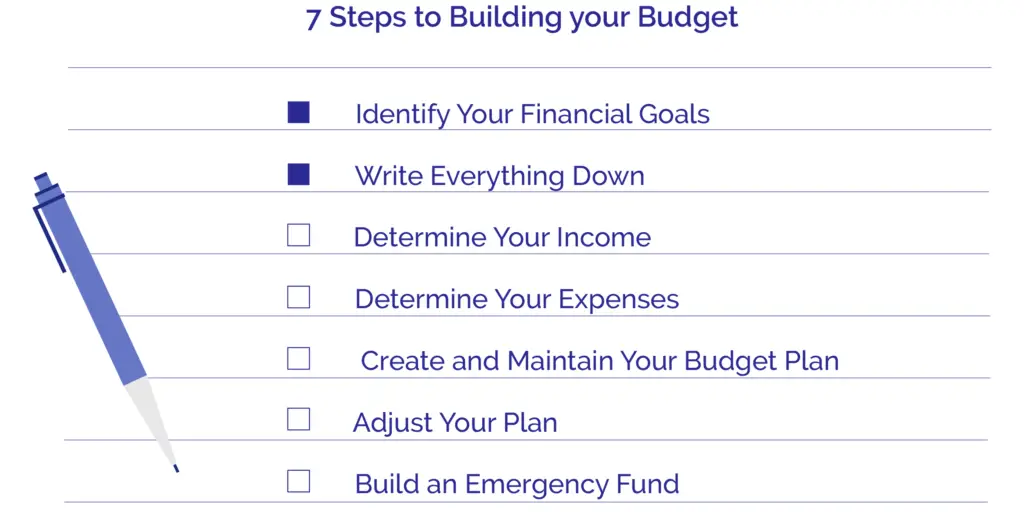

Step 2: Set Clear Financial Goals

Once you have assessed your current financial situation, it’s time to set clear financial goals. Ask yourself what you want to achieve with your budget. Do you want to save for a down payment on a house, pay off debt, or build an emergency fund? Setting specific goals will help you stay focused and motivated to stick to your budget.

Step 3: Create a Realistic Budget

Now that you know your financial goals, it’s time to create a budget that works for you. Start by listing all of your monthly income sources and your fixed expenses, such as rent or mortgage payments and utilities. Then, allocate a portion of your income towards savings and debt repayment. Finally, set aside some money for discretionary expenses like entertainment and eating out, but be sure to keep it within a reasonable limit.

Step 4: Track Your Spending

To stick to your budget, it’s important to track your spending regularly. Make a habit of recording all of your expenses, whether it’s through a smartphone app, a spreadsheet, or a simple pen and paper. By tracking your spending, you can identify any areas where you may be overspending and make adjustments as needed.

Step 5: Review and Adjust

Creating a budget is an ongoing process. It’s crucial to review your budget regularly and make adjustments as necessary. Life circumstances can change, and your budget should reflect those changes. Be flexible and open to making changes when needed to ensure your budget remains effective.

By following these simple steps, you can create a budget that aligns with your financial goals and stick to it. Remember, budgeting is a tool that empowers you to make informed financial decisions and live a more frugal lifestyle. Take control of your finances today and start working towards a brighter financial future!

Benefits of Having a Budget

Creating and sticking to a budget can have numerous benefits for your financial well-being. Not only does it help you achieve your long-term financial goals, but it also allows you to reduce debts and save money while eliminating financial stress. In this section, I will discuss these benefits in more detail.

Achieving Financial Goals

One of the primary benefits of having a budget is that it helps you track your income and expenses, enabling you to achieve your financial goals. With a well-planned budget, you can allocate funds towards specific objectives, such as saving for a down payment on a house, planning for retirement, or creating an emergency fund. By allocating money for these goals in your budget, you are actively working towards achieving them and turning your dreams into reality.

Reducing Debts and Saving Money

A budget is also a powerful tool for reducing debts and saving money. By carefully tracking your expenses and income, you can identify areas where you may be overspending and allocate those funds towards paying off debts. Moreover, a budget allows you to set aside a portion of your income for savings, which can provide you with a financial safety net and help you achieve future financial goals. Whether it’s paying off credit card debts or saving for a dream vacation, a budget empowers you to take control of your finances and improve your overall financial health.

Eliminating Financial Stress

Financial stress can be a significant burden, negatively impacting your physical and mental well-being. However, by creating and sticking to a budget, you can eliminate much of this stress. With a budget in place, you have a clear understanding of where your money is going, preventing any surprises or unexpected expenses. This knowledge empowers you to make informed financial decisions and avoid unnecessary stress caused by finances. As a result, you can enjoy a frugal lifestyle without constant worry about money, leading to improved overall well-being.

having a well-planned budget not only helps you achieve your financial goals but also reduces debts, saves money, and eliminates financial stress. By taking these simple steps towards creating and sticking to your budget, you can take control of your finances, live within your means, and achieve financial freedom. So, why wait? Start creating your budget today and enjoy the numerous benefits it brings to your life.

Understanding Your Income and Expenses

One of the first steps in creating and sticking to a budget is understanding your income and expenses. By carefully examining your financial situation, you can gain a clear picture of how much money you have coming in and where it is going.

Calculating Your Total Income

The first thing you need to do is calculate your total income. This includes all sources of income, such as your salary, side hustles, dividends, or any other money you receive regularly. Add up these amounts to determine your total monthly income.

Identifying Fixed and Variable Expenses

Once you know your income, it’s time to identify your fixed and variable expenses. Fixed expenses are those that remain the same each month, such as rent or mortgage payments, car payments, and insurance premiums. Variable expenses, on the other hand, fluctuate from month to month, like groceries, dining out, entertainment, and other discretionary spending.

Tracking and Categorizing Expenses

To gain a complete understanding of your spending habits, it’s important to track and categorize your expenses. This can be done using a spreadsheet, budgeting app, or even just a pen and paper. Start by recording all your expenses for a month and categorize them into different groups, such as housing, transportation, food, entertainment, and so on.

By tracking your expenses, you’ll be able to spot any patterns or areas where you may be overspending. This will help you identify areas where you can make adjustments and cut back if necessary.

Understanding your income and expenses is the foundation for creating a successful budget. It allows you to see exactly where your money is going and make informed decisions about how to allocate it. By taking the time to calculate your income, identify your fixed and variable expenses, and track and categorize your spending, you’ll be well on your way to creating a budget that suits your needs and helps you achieve your financial goals.

Setting Realistic Financial Goals

Setting realistic financial goals is an essential component of creating and sticking to a budget. Without clear objectives in mind, it can be challenging to stay motivated and focused on your financial journey. In this section, I will discuss the importance of setting short-term and long-term goals, prioritizing your financial objectives, and determining attainable goals.

Short-term and Long-term Goals

When setting financial goals, it is crucial to consider both short-term and long-term targets. Short-term goals are achievable within a year or less, while long-term goals typically take several years or even decades to accomplish. Short-term goals may include paying off debt, saving for a vacation, or building an emergency fund. Long-term goals could consist of saving for retirement, buying a house, or funding your children’s education.

Prioritizing Your Financial Objectives

To effectively manage your finances, it is essential to prioritize your financial objectives. Assess your current financial situation and identify which goals are most critical to you. Are you focused on becoming debt-free? Or is saving for a down payment on a house your top priority? By determining what matters most to you, you can allocate your resources accordingly and create a budget that aligns with your priorities.

Determining Attainable Goals

While it’s essential to dream big, it’s equally important to set realistic and attainable goals. Consider factors such as your income, expenses, and other financial commitments when determining what you can realistically achieve within a given timeframe. Setting overly ambitious goals can lead to frustration and can discourage you from sticking to your budget. Start with small, achievable targets and gradually work your way towards more significant milestones.

By setting realistic financial goals and prioritizing your objectives, you will have a clear roadmap for creating and sticking to your budget. Regularly review and reassess your goals to adapt to any changes in your financial circumstances or aspirations. Remember, creating a budget is not a one-time endeavor; it requires continuous effort and adjustments as you progress on your financial journey.

Creating a Budget Plan

Budgeting is an essential skill that enables individuals to manage their finances effectively. It allows us to track our income and expenses, ensuring that we can meet our financial goals and live a frugal lifestyle. Establishing a budget plan may seem daunting at first, but by following a few simple steps, you can create and stick to your budget effortlessly.

Listing Your Income Sources

The first step in creating a budget plan is to list down all of your income sources. This includes your salary, bonuses, rental income, or any other sources of regular income. By having a clear understanding of how much money you have coming in each month, you can better allocate funds to different expense categories.

Creating Expense Categories

Next, it’s important to create expense categories that align with your spending habits. These categories may include housing, transportation, groceries, utilities, entertainment, debt repayment, and savings, among others. Take some time to review your past expenses and determine how much you typically spend in each category. This will give you a starting point for allocating funds in your budget.

Allocating Funds for Each Category

Once you have established your income sources and expense categories, it’s time to allocate funds for each category. Start by prioritizing your essentials, such as housing, transportation, and groceries. Then, allocate a portion of your income towards debt repayment and savings. Be realistic and avoid overallocating funds to any one category. Remember that the goal is to find a balance that allows you to comfortably meet your needs while still saving for the future.

By following these simple steps, you can create a budget plan that suits your financial needs and goals. It’s important to regularly review and adjust your budget as circumstances change. Keep track of your expenses and compare them to your budget to ensure that you’re staying on track. With dedication and discipline, you can easily stick to your budget and achieve financial stability. So start today, take control of your finances, and live a frugal lifestyle.

Budgeting Techniques and Strategies

Creating and sticking to a budget is essential for managing your finances and leading a frugal lifestyle. By understanding your income and expenses, you can gain control over your money and work towards your financial goals. In this section, I will introduce you to three popular budgeting techniques and strategies that can help you achieve financial success.

50/30/20 Rule

The 50/30/20 rule is a simple budgeting technique that emphasizes balancing your income and expenses. According to this rule, 50% of your income should go towards essential expenses such as rent, utilities, and groceries. The remaining 30% can be allocated to discretionary spending, including dining out, entertainment, and shopping. Finally, the remaining 20% should be saved for your financial goals, such as paying off debt or building an emergency fund. This rule provides a clear framework for managing your money, ensuring that you prioritize both your needs and wants while saving for the future.

Envelope System

The envelope system is a hands-on budgeting strategy that involves allocating cash into labeled envelopes for different spending categories. Once you receive your paycheck, you divide the cash accordingly, placing the designated amount for each expense category into its respective envelope. Throughout the month, you only spend what is available in each envelope. This system helps you visually track your spending and reinforces the principle of living within your means. When an envelope is empty, you know you have reached your maximum spending limit for that category.

Zero-based Budgeting

Zero-based budgeting is a technique that requires assigning every dollar of your income to a specific expense or savings category. In this type of budget, your income minus your expenses should equal zero. This approach forces you to account for every dollar, ensuring that all your money is allocated and not wasted. By regularly reviewing and adjusting your zero-based budget, you can identify areas where you might be overspending and make necessary adjustments to stay on track.

By implementing these budgeting techniques and strategies, you can take control of your finances and achieve your financial goals. Whether you choose the 50/30/20 rule, envelope system, or zero-based budgeting, finding a method that works best for you and sticking to it will provide you with the foundation for a more secure financial future.

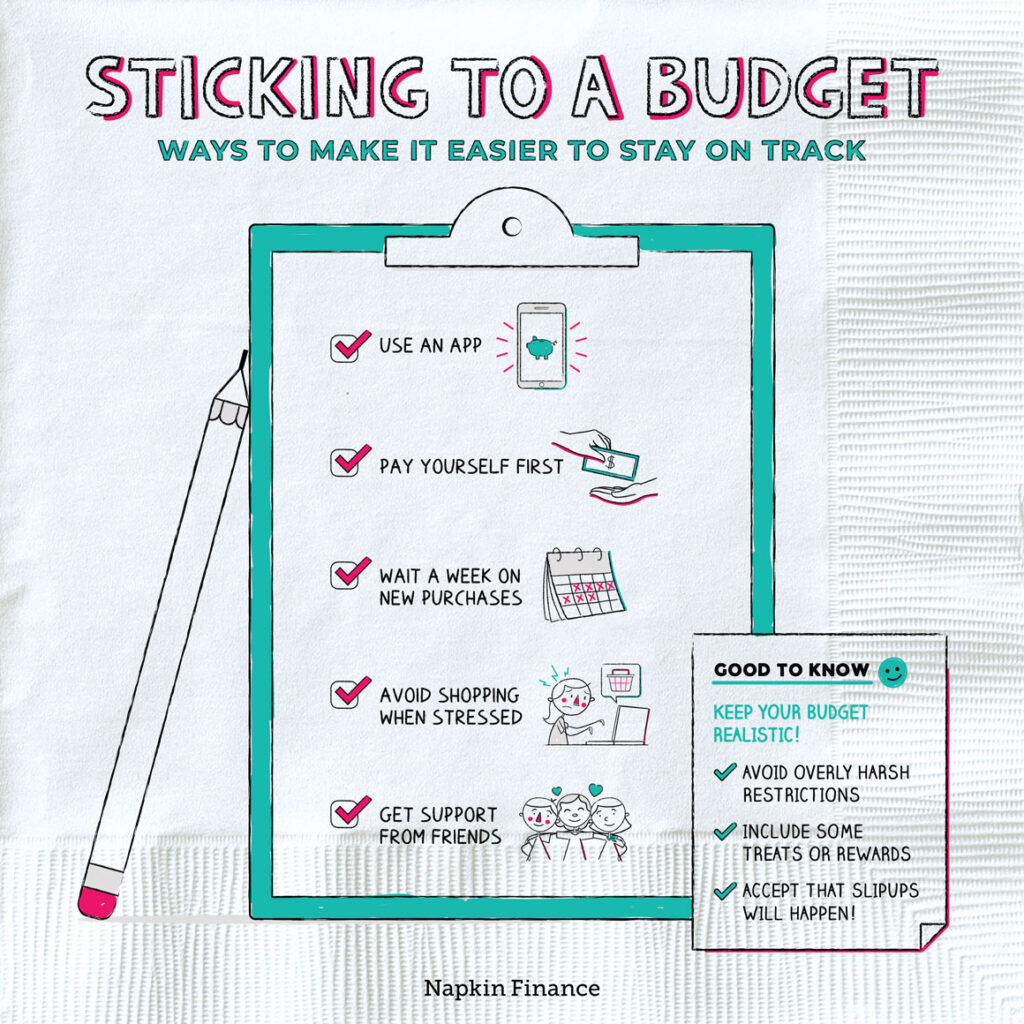

Tracking and Monitoring Expenses

Managing your finances and sticking to a budget can be challenging, especially when you’re trying to maintain a frugal lifestyle. However, there are simple steps you can take to create and stick to your budget successfully. Tracking and monitoring your expenses is one such step that is crucial to gaining control over your finances. By doing so, you become more aware of where your money is going and can make informed decisions about how to allocate your funds effectively.

Using Budgeting Apps and Tools

Utilizing budgeting apps and tools can make the process of tracking and monitoring expenses easier and more convenient. These apps allow you to record your expenses, categorize them, and generate visual reports that give you a clear picture of your spending habits. Features such as expense graphs and budget calculators are also available in some apps, which can help you visualize your progress and adjust your spending accordingly. By having all your financial information in one place, you can easily identify areas where you may be overspending and make necessary adjustments to your budget.

Reviewing Bank Statements and Receipts

In addition to using budgeting apps, regularly reviewing your bank statements and receipts is another effective way to track and monitor your expenses. Go through your bank statements every month and carefully analyze all the transactions. Make note of any unnecessary or excessive spending, identify patterns, and determine which areas of your budget need adjustment. Remember to keep your receipts as records, so you can compare them with your statements and ensure accuracy.

Regularly Updating Your Budget

Creating a budget is just the first step; to make it effective, you need to update it regularly. As your financial situation and priorities change, so should your budget. Make it a habit to review and update your budget every month, taking into account any new expenses or changes in income. By regularly revisiting your budget, you can stay on track and avoid any surprises or setbacks in your financial journey.

Tracking and monitoring your expenses through budgeting apps, reviewing bank statements and receipts, and regularly updating your budget are vital steps towards achieving your financial goals. With these simple strategies in place, you can take control of your finances, build savings, and maintain a frugal lifestyle that aligns with your aspirations. Start implementing these practices today, and you’ll soon notice the positive impact they have on your financial well-being.

Managing Irregular Income

Determining an Average Monthly Income

One of the challenges of managing a budget with an irregular income is not knowing the exact amount of money you’ll bring in each month. To tackle this issue, start by looking at your income over the past year, including all sources such as freelance work, side gigs, and any other irregular sources of income. Add up the total amount earned for the year and divide it by 12 to get an average monthly income. This will help you create a more accurate budget and give you a better understanding of your financial situation.

Creating a Variable Budget

With an irregular income, it’s crucial to create a budget that can adapt to fluctuations in your earnings. Instead of fixed amounts for expenses, consider creating a variable budget where you assign a percentage of your average monthly income to different categories such as housing, transportation, food, and savings. For example, you might allocate 30% of your income to housing, 15% to transportation, 25% to food, and 20% to savings. This way, when your income fluctuates, your expenses adjust accordingly, ensuring that your budget remains realistic and sustainable.

Building an Emergency Fund

Having an emergency fund is essential for anyone, but it’s even more crucial when you have irregular income. Since your earnings can be unpredictable, it’s essential to have a safety net in place to cover unexpected expenses or periods of low income. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This will provide you with peace of mind and financial security during challenging times.

Managing an irregular income requires flexibility and careful planning. By determining an average monthly income, creating a variable budget, and building an emergency fund, you can navigate the ups and downs of your financial situation with confidence. Remember, the key is to be realistic in your budgeting and adjust as necessary to ensure your financial stability. So, start taking control of your finances today and experience the freedom and security that comes with managing your budget effectively.

Adapting Your Budget when Circumstances Change

Adjusting for Income Changes

One of the challenges in sticking to a budget is when our income changes unexpectedly. Whether it’s a decrease in salary, loss of a job, or even a promotion that comes with an increase in income, these changes can disrupt our carefully planned budget. It’s important to stay proactive and adjust our budget accordingly.

If you experience a decrease in income, it’s necessary to reevaluate your expenses and find areas where you can cut back. This might mean reducing discretionary spending, reevaluating subscription services, or even downsizing certain aspects of your lifestyle. Remember, it’s crucial to stay realistic and prioritize your essential needs first.

On the other hand, if your income increases, it’s essential to resist the temptation to immediately upgrade your lifestyle. Instead, consider using the additional funds to pay off debts, increase your savings, or invest in your future financial goals. This way, you can maintain your frugal lifestyle while still benefiting from the extra income.

Dealing with Unexpected Expenses

Life is full of surprises, and often they come with unexpected expenses. It’s important to be prepared for these situations by building an emergency fund. This fund acts as a safety net, providing financial stability when unforeseen circumstances arise. By allocating a portion of your income towards the emergency fund each month, you can avoid falling into debt when faced with unexpected expenses such as medical bills, car repairs, or home emergencies.

Anticipating Major Life Events

Throughout life, certain major events are expected – whether it’s getting married, having children, or buying a home. These milestones often come with significant financial responsibilities, requiring careful budgeting and planning. It’s crucial to anticipate these events and adjust your budget accordingly.

Research and estimate the expenses associated with these major life events. This may include costs for a wedding venue, baby essentials, or a down payment on a new home. By planning ahead and adjusting your budget early on, you can ensure that you have the necessary funds to cover these expenses without sacrificing your financial stability.

Remember, adapting your budget when circumstances change is an ongoing process. It requires vigilance and flexibility. By being proactive, prepared for unexpected expenses, and adaptable to life’s transitions, you can successfully create and stick to a budget that aligns with your frugal lifestyle.

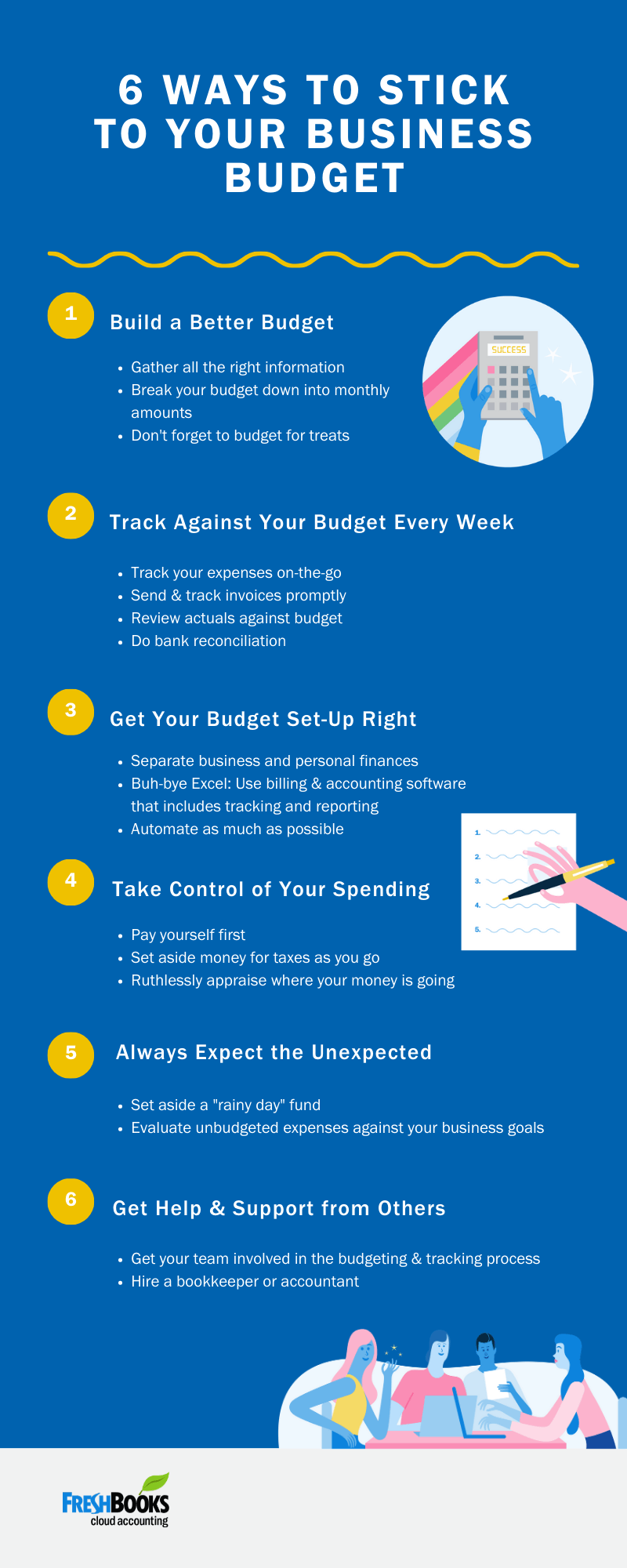

Tips for Sticking to Your Budget

Once you’ve created your budget, the next step is to stick to it. It can be challenging at first, but with a little practice and discipline, you’ll find that it becomes easier over time. Here are some practical tips to help you stay on track with your budget and maintain your frugal lifestyle.

Avoid Impulse Buying

One of the biggest enemies of a budget is impulse buying. We’ve all been there – you walk into a store with no intention of buying anything, but end up leaving with a bag full of items you didn’t need. To curb this habit, it’s important to recognize your triggers. Is it a particular store, online shopping, or seeing a sale sign? Once you identify your weak points, you can actively avoid them. Consider making a list before going shopping and stick to it. By planning your purchases ahead of time, you’ll be less likely to give in to spontaneous buying urges.

Shop Smart and Compare Prices

When it comes to shopping, being a smart consumer is essential for sticking to your budget. Before making a purchase, take the time to research and compare prices at different stores or online platforms. Look for sales, discounts, or coupons that can help you save money. Additionally, consider buying generic brands instead of name brands, as they often offer similar quality at a lower price. By being diligent and doing your homework, you can stretch your budget further and avoid overspending.

Find Affordable Alternatives

Another effective way to stick to your budget is by finding affordable alternatives to expensive products or services. Look for ways to cut costs without sacrificing your needs or quality. For example, instead of dining out at restaurants frequently, try cooking meals at home. You’ll not only save money but also have more control over your food choices. Similarly, consider switching to cheaper entertainment options like streaming services instead of going to the movie theater. Finding creative and cost-effective alternatives can help you stay within your budget without feeling deprived.

By implementing these simple yet effective tips, you’ll be well on your way to successfully sticking to your budget. Remember, it takes time and consistency to develop healthy financial habits, so be patient with yourself. With perseverance, you’ll soon see the positive impact it has on your overall financial well-being.

Seeking Professional Help for Financial Planning

Consulting a Financial Advisor

If you find yourself struggling to create and stick to a budget, seeking professional help from a financial advisor can be a wise decision. A financial advisor is an expert who can guide you through the intricacies of budgeting, offer personalized strategies, and help you make informed financial decisions. With their knowledge and experience, they can analyze your financial situation and provide tailored recommendations based on your goals and income. This can be particularly beneficial if you have complex financial circumstances or need assistance with long-term financial planning.

Working with a Budgeting Coach

Another option worth considering is hiring a budgeting coach. These professionals specialize in helping individuals develop effective budgeting techniques, set financial goals, and stay motivated to achieve them. A budgeting coach can provide accountability and support throughout your budgeting journey, offering guidance and practical tips to help you overcome any obstacles that may arise. They can also help you identify and address inefficient spending habits, teach you how to prioritize financial goals, and provide ongoing feedback and encouragement.

Attending Financial Planning Workshops

If you prefer a more interactive approach, attending financial planning workshops can be a great way to gain knowledge and skills in budgeting. These workshops often cover a wide range of topics, such as creating a budget, managing debt, saving for retirement, and investing. Led by experts in the field, these workshops provide hands-on learning experiences, allowing you to ask questions, engage in discussions, and learn from real-life examples. Additionally, attending workshops can also provide an opportunity to connect with like-minded individuals who share similar financial goals, fostering a supportive community.

seeking professional help for financial planning can greatly enhance your budgeting efforts. Whether it be consulting a financial advisor, working with a budgeting coach, or attending financial planning workshops, these resources can provide invaluable guidance and support as you strive to create and stick to your budget. With their expertise, you can gain a deeper understanding of your financial situation, develop effective strategies, and ultimately achieve your long-term financial goals. Remember, taking the necessary steps to seek professional help is an investment in your financial future.

Conclusion

Creating and sticking to a budget doesn’t have to be overwhelming. By following these simple steps, you can take control of your finances and work towards your financial goals. Remember, budgeting is a continuous process that requires discipline and commitment. Although it may be challenging at first, the rewards of a frugal lifestyle will be worth it in the long run.

Track your income and expenses

Start by understanding your income and expenses. Keep track of all your sources of income, such as your salary, side gigs, or investment returns. Next, track your expenses by categorizing them into fixed expenses (rent, bills) and variable expenses (groceries, entertainment). This will allow you to identify areas where you can potentially cut back and save money.

Set realistic financial goals

Based on your income and expenses, set realistic financial goals. Do you want to pay off your debt, save for a down payment on a house, or plan for retirement? Setting clear goals will give you motivation and help you prioritize your spending.

Create a detailed budget

Now that you have an understanding of your finances and goals, it’s time to create a budget. Break down your expenses into different categories and allocate funds accordingly. Be sure to include a category for savings and emergency funds. Remember to be realistic and flexible with your budget, allowing for unexpected expenses that may arise.

Use budgeting tools and apps

Take advantage of budgeting tools and apps that can help you track your expenses, set reminders for bill payments, and monitor your progress. These tools can make budgeting easier and more organized.

Evaluate and adjust periodically

Periodically review your budget to assess your progress and make any necessary adjustments. Evaluate your spending habits and identify areas where you can make further cuts or improvements. Budgeting is an ongoing process, so don’t be afraid to make changes as needed.

By following these simple steps and adopting a frugal lifestyle, you can create and stick to a budget that works for you. Remember, it’s all about being mindful of your spending, setting realistic goals, and making conscious decisions that align with your financial priorities. Start today and watch as your financial stability grows in the months and years to come.