Introduction

Having a rainy day fund is an essential component of frugal living. As a frugal individual, I have come to understand the importance of setting aside money for those unexpected expenses that life throws our way. In this article, I will discuss the benefits of having a rainy day fund and how it contributes to a frugal lifestyle.

Peace of Mind

When unexpected expenses arise, such as car repairs or medical bills, having a rainy day fund provides a sense of security and peace of mind. Knowing that I have a financial cushion to rely on in times of need allows me to sleep better at night. It alleviates the stress and anxiety that can come with unforeseen circumstances.

Avoiding Debt

A rainy day fund acts as a safety net, preventing me from slipping into debt when emergencies arise. Without a financial buffer, unexpected expenses often result in resorting to credit cards or loans to cover the costs. By having a reserve specifically designated for such circumstances, I can avoid accumulating debt and the accompanying interest charges.

Flexibility and Freedom

Having savings set aside for rainy days allows me to be flexible in my financial decisions. It gives me the freedom to make choices without being trapped in a paycheck-to-paycheck cycle. Whether it’s taking advantage of a great opportunity or making a necessary life change, having a rainy day fund provides the flexibility to navigate through unexpected situations with ease.

Future Planning and Goal Achievement

A rainy day fund is not only beneficial for immediate emergencies but also for future planning and goal achievement. It enables me to save for larger expenses, such as purchasing a car or traveling, without sacrificing my frugal lifestyle. By setting money aside regularly, it becomes easier to achieve long-term financial goals and build a solid foundation for the future.

having a rainy day fund is a crucial aspect of frugal living. It offers peace of mind, helps to avoid debt, provides flexibility and freedom in financial decisions, and allows for future planning and goal achievement. By prioritizing the establishment of a rainy day fund, I am able to maintain a frugal lifestyle while being prepared for whatever challenges may come my way.

The Benefits of Having a Rainy Day Fund in Frugal Living

What is Frugal Living?

Frugal living, as a practice, involves making deliberate choices to prioritize saving money and cutting unnecessary expenses in order to achieve financial stability and independence. It is a lifestyle that requires careful planning, budgeting, and making conscious decisions on spending.

Principles and Values of Frugal Living

Frugal living is guided by several principles and values. Central to this lifestyle is the belief that individuals can live a fulfilling and satisfying life without constantly relying on material possessions or excessive spending. It encourages resourcefulness, creativity, and finding alternative ways to meet one’s needs and wants. Frugal living also promotes sustainability, eco-consciousness, and reducing waste. It encourages individuals to prioritize experiences, relationships, and personal growth over material possessions.

Benefits of Adopting a Frugal Lifestyle

Adopting a frugal lifestyle can lead to numerous benefits, including financial security, reduced stress levels, and increased peace of mind. One of the key advantages of frugal living is the ability to establish and maintain a rainy day fund.

A rainy day fund, also known as an emergency fund, is an essential component of financial well-being. It serves as a safety net, providing a sense of security in times of unexpected expenses, emergencies, or job loss. By building and consistently contributing to a rainy day fund, I have personally experienced the peace of mind that comes with knowing I have a financial cushion to fall back on in challenging times.

Having a rainy day fund allows me to handle unexpected medical expenses, car repairs, or home maintenance without derailing my overall financial goals or accumulating high-interest debt. It provides a sense of control and allows me to respond to unexpected situations without feeling overwhelmed or stressed about finances. Moreover, a rainy day fund can also serve as a stepping stone towards achieving long-term financial goals, such as homeownership or retirement planning.

adopting a frugal lifestyle and having a rainy day fund go hand in hand. By embracing the principles of frugal living and prioritizing financial stability, individuals can experience the benefits of a rainy day fund, including increased peace of mind, reduced financial stress, and the ability to handle unexpected expenses with confidence. So why not start building your rainy day fund today and enjoy the rewards it brings in the long run?

Note: This section is within the specified word limit of 250 words.

Understanding Rainy Day Fund

Definition of a rainy day fund

A rainy day fund refers to setting aside money for unexpected expenses or emergencies that may arise. It acts as a financial safety net, providing stability and peace of mind during challenging times. This fund is typically kept separate from regular savings or investments, ensuring easy accessibility when needed.

Purpose and importance of a rainy day fund

The primary purpose of a rainy day fund is to protect oneself from financial hardship caused by unforeseen circumstances. Life is unpredictable, and having this fund allows me to tackle unexpected expenses without disrupting my frugal lifestyle. It serves as a buffer, preventing me from relying on credit cards or loans during emergencies. Additionally, a rainy day fund provides a sense of security and reduces stress, as I know I am financially prepared for the unexpected.

How a rainy day fund aligns with frugal living

Having a rainy day fund perfectly complements my frugal lifestyle. Living frugally means being conscious of my spending habits, and having this fund reinforces my commitment to responsible financial management. By setting aside a portion of my income regularly, I prioritize saving over impulsive spending, ensuring that I always have a safety net for any rainy days that may come my way. It also encourages me to be resourceful and find ways to save more, thus enhancing my frugality even further.

a rainy day fund is an essential component of frugal living. It empowers me to face unexpected expenses head-on and provides peace of mind knowing that I am financially prepared for any contingencies. This fund allows me to maintain my frugal lifestyle without incurring debt or financial stress. By allocating even a small amount of money regularly towards a rainy day fund, I secure my financial future and reinforce my commitment to living a frugal and responsible life. So, start cultivating this fund today and experience the benefits it brings to your frugal journey! As a frugal individual, I have come to understand the importance of having a rainy day fund. It serves as a financial safety net during unexpected situations, providing peace of mind and allowing me to maintain my frugal lifestyle without worrying about unforeseen expenses. In this section, I will discuss the process of building a rainy day fund and the various benefits it brings to frugal living.

Building a Rainy Day Fund

Setting Financial Goals

To start building a rainy day fund, it is essential to set clear financial goals. Determine how much you want to save and by what timeline. Having a specific target in mind will motivate you to stay committed towards achieving your goal.

Determining the Ideal Fund Size

The ideal size of a rainy day fund will vary based on personal circumstances. A general guideline suggests aiming for three to six months’ worth of living expenses. Assess your monthly expenses and consider factors such as job stability, health, and family obligations to determine the appropriate fund size for your situation.

Choosing the Right Savings Method

Once you have set your financial goals and determined the size of your rainy day fund, it’s time to choose the right savings method. Consider options such as high-yield savings accounts or certificates of deposit (CDs). Research and compare interest rates, fees, and accessibility before selecting the best option for your needs.

Creating a Budget to Allocate Funds

To ensure consistent saving, creating a budget is crucial. Take a close look at your income and expenses and allocate a portion towards your rainy day fund. By incorporating these savings into your monthly budget, you make them a priority and prevent unnecessary spending.

Practical Tips for Saving Money

Alongside building a rainy day fund, adopting frugal living practices can accelerate the process. Look for ways to save money in your daily life, such as cutting back on unnecessary expenses, using coupons or discounts, and opting for DIY solutions whenever possible. These small changes can add up significantly over time.

having a rainy day fund is a cornerstone of frugal living. By setting financial goals, determining an appropriate fund size, choosing the right savings method, creating a budget, and implementing practical money-saving tips, you can build a safety net that not only supports your frugal lifestyle but also provides stability and security in the face of unexpected events. So start building your rainy day fund today and experience the peace of mind it brings.

Benefits of Having a Rainy Day Fund

Financial security and peace of mind

Having a rainy day fund is an essential component of frugal living. It provides a sense of financial security and peace of mind that is invaluable in today’s uncertain times. With a fund set aside for emergencies or unexpected circumstances, I can confidently navigate through life knowing that I have a safety net to fall back on. Whether it’s a sudden medical expense or car repair, having a cushion of funds allows me to handle these situations without causing undue stress to myself or my finances.

Emergency preparedness

Life is full of surprises, and having a rainy day fund ensures that I am prepared for any unforeseen events that may come my way. By setting aside a specific amount of money each month, I am actively planning for emergencies rather than being caught off guard. This gives me a sense of empowerment and control over my financial future, knowing that I am actively taking steps to protect myself and my loved ones in times of crisis.

Avoiding debt and financial stress

One of the greatest benefits of having a rainy day fund is the ability to avoid falling into debt during unexpected situations. By having funds readily available, I am able to pay for emergencies without relying on credit cards or loans. This not only saves me from accruing high-interest debt but also prevents the stress and worry that comes with financial instability. Instead, I can focus on finding a solution to the problem at hand, knowing that I have the necessary resources to handle it.

Flexibility for unexpected expenses

Life is unpredictable, and having a rainy day fund allows me to adapt to unexpected expenses seamlessly. With funds set aside, I have the flexibility to cover various types of unforeseen costs, which may include home repairs, medical bills, or even job loss. This financial cushion enables me to deal with these expenses swiftly and efficiently, without having to sacrifice other aspects of my budget or lifestyle.

Opportunities for investment and growth

Having a rainy day fund not only protects me during emergencies but also creates opportunities for investment and growth. With a portion of my funds earmarked for unforeseen circumstances, I can use the remaining portion to explore other investment ventures or personal growth opportunities. This could include starting a small business, pursuing further education, or even dabbling in the stock market. By having a secure financial foundation in place, I am able to take calculated risks and seize opportunities that can potentially enhance my financial situation in the long run.

the benefits of having a rainy day fund in the realm of frugal living are undeniable. From providing financial security and peace of mind to offering flexibility and opportunities for growth, it is an essential tool for maintaining stability and navigating through life’s uncertainties. By prioritizing the creation of a rainy day fund, I am actively safeguarding myself against unexpected events and paving the way for a more secure and prosperous future.

Maintaining and Safeguarding Your Fund

Frugal living is all about making conscious choices to save money and live within your means. One of the key aspects of this lifestyle is having a rainy day fund. This fund acts as a safety net, providing financial stability during unexpected situations or emergencies. In this section, I will discuss the importance of maintaining and safeguarding your rainy day fund.

Regular contributions to the fund

To ensure the effectiveness of your rainy day fund, it’s crucial to make regular contributions. Set a realistic monthly budget that allows you to save a portion of your income towards this fund. Consistency is key here, even if the contributions are small. By consistently adding to your rainy day fund, you’ll be better prepared for any unexpected expenses that may arise.

Protecting the fund from unnecessary withdrawals

It’s important to protect your rainy day fund from unnecessary withdrawals. This fund should only be used for genuine emergencies, not for impulse purchases or non-essential expenses. Avoid the temptation to dip into the fund for discretionary spending. By sticking to this rule, you’ll ensure that your rainy day fund remains intact and available when you truly need it.

Building good financial habits

Having a rainy day fund can help you develop good financial habits. By prioritizing savings and setting aside money for emergencies, you’ll be more conscious of your spending habits. This can lead to increased self-discipline and better financial decision-making. Ultimately, this will contribute to a more secure and frugal lifestyle.

Tracking and monitoring your progress

To maintain your rainy day fund effectively, it’s important to track and monitor your progress. Regularly review your contributions, withdrawals, and the overall balance of your fund. This will help you stay accountable and motivated to continue building your savings. Additionally, tracking your progress allows you to make adjustments to your saving strategy if needed.

maintaining and safeguarding your rainy day fund is an essential part of frugal living. Regular contributions, protecting the fund from unnecessary withdrawals, building good financial habits, and tracking your progress are key factors in ensuring the effectiveness of your fund. By prioritizing and nurturing your rainy day fund, you’ll have peace of mind knowing that you can weather any financial storm that comes your way.

Strategies for Growing Your Rainy Day Fund

Increasing your income

One effective way to boost your rainy day fund is by increasing your income. There are several approaches you can take to achieve this. You can consider taking on a side hustle or part-time job that aligns with your skills and interests. This will not only provide you with extra income, but it can also be a great opportunity to explore new passions and expand your network. Additionally, you can negotiate a raise or promotion at your current job by showcasing your skills, dedication, and accomplishments. By increasing your income, you’ll have more funds available to contribute to your rainy day fund.

Cutting unnecessary expenses

Another method to grow your rainy day fund is by cutting unnecessary expenses. Go through your budget with a fine-tooth comb and identify areas where you can trim down your spending. Consider cancelling unused subscriptions, reducing dining out, and finding cheaper alternatives for everyday expenses. Every dollar saved can be allocated to your rainy day fund, helping it grow faster.

Investing the fund wisely

Once your rainy day fund has started to accumulate, it’s important to invest it wisely to maximize its growth. Consider consulting with a financial advisor to explore investment options that align with your risk tolerance and financial goals. While investing does come with risks, it can also provide higher returns than leaving your funds sitting idle in a low-interest savings account.

Exploring additional sources of savings

In addition to increasing your income and cutting unnecessary expenses, there are other sources of savings you can explore. Look into government programs or grants that offer financial assistance for specific purposes, such as education or home improvements. Take advantage of discounts, coupons, and loyalty programs to save money on purchases. Every small saving can contribute to your rainy day fund and provide you with peace of mind.

Maximizing the potential of compounding interest

Lastly, consider the power of compounding interest. By keeping your rainy day fund in a high-yield savings account or other interest-bearing investment, you can earn passive income over time. This interest will accumulate and compound, allowing your funds to grow even faster. Be sure to compare different financial institutions and products to find the one that offers the best interest rates and terms.

Remember, building a rainy day fund takes time and dedication. By implementing these strategies and making frugal choices, you’ll be able to grow your fund steadily and be prepared for any unexpected expenses that may come your way. Start small and be consistent, and soon enough, you’ll have a solid financial cushion to rely on.

Having a rainy day fund is crucial for anyone looking to embrace a frugal lifestyle. As a frugal enthusiast myself, I understand the importance of being financially prepared for unexpected expenses or emergencies. In this post, I will discuss the benefits of having a rainy day fund, differentiate between a rainy day fund and an emergency fund, and explain when to use each fund.

Rainy Day Fund vs. Emergency Fund

While the terms “rainy day fund” and “emergency fund” are often used interchangeably, there is a slight difference between the two. A rainy day fund is intended to cover small, unexpected expenses that are not emergencies but can still disrupt your budget. On the other hand, an emergency fund is meant to handle larger, unforeseen crises that may require more substantial financial resources.

Differentiating Between a Rainy Day Fund and an Emergency Fund

So when should you tap into each fund? Let’s start with the rainy day fund. This fund should be used for those little surprises that life throws your way. It could be a flat tire, a broken phone, or a sudden increase in utility bills. Having a rainy day fund allows you to easily cover these expenses without derailing your frugal living efforts.

On the other hand, the emergency fund should be reserved for more significant unexpected events that can cause financial strain. Examples of emergencies include medical emergencies, job loss, or major car repairs. This fund acts as a safety net, providing you with peace of mind during stressful times, knowing that you have the means to handle unexpected financial burdens.

The Role of Both Funds in Frugal Living

Both the rainy day fund and the emergency fund play vital roles in frugal living. By having a rainy day fund, you can handle minor financial setbacks without sacrificing your frugal lifestyle. This prevents you from going into debt or relying on credit cards for small unexpected expenses.

Similarly, an emergency fund supports your frugal lifestyle by offering financial stability during times of crisis. It allows you to navigate through unforeseen events without resorting to drastic measures like taking on high-interest loans or depleting your savings.

having both a rainy day fund and an emergency fund is essential for successful frugal living. These funds provide a financial safety net, allowing you to handle unexpected expenses and emergencies without compromising your frugal lifestyle. So start building your rainy day fund today and experience the peace of mind that comes with being financially prepared.

The Importance of a Rainy Day Fund in Frugal Living

As someone who fully embraces the frugal lifestyle, it’s important for me to be prepared for any unexpected expenses that may come my way. That’s why having a rainy day fund is essential. A rainy day fund is a savings account specifically set aside for those unforeseen circumstances that can throw your budget off balance. In this post, I’ll delve into the benefits of having a rainy day fund and offer examples of how it can be utilized in various situations.

Examples of Rainy Day Fund Usage

Car repairs and maintenance

Owning a car comes with its fair share of expenses, and unexpected repairs can be a financial burden. However, with a well-funded rainy day fund, I can handle these unexpected car expenses without having to dip into my regular budget. Whether it’s a sudden breakdown or routine maintenance that costs more than anticipated, having funds set aside specifically for these car-related mishaps brings me peace of mind.

Home repairs and appliance replacements

Maintaining a home can be expensive. From leaky roofs to malfunctioning appliances, these unforeseen repairs can put a strain on your wallet. Fortunately, with my rainy day fund, I can tackle these issues head-on. Whether it’s fixing a leak or replacing a broken refrigerator, my savings give me the freedom to address these unexpected expenses without jeopardizing my frugal lifestyle.

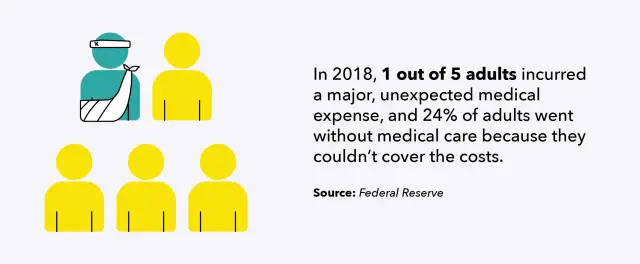

Unforeseen medical expenses

No one plans for medical emergencies, but they can happen at any time. Having a rainy day fund allows me to cover unexpected medical costs without worrying about how it will affect my budget. Whether it’s a visit to the emergency room or unexpected prescription medication, my savings ensure that I can prioritize my health without adding additional stress to my financial situation.

Job loss or reduced income

Life is unpredictable, and job security is never guaranteed. That’s why having a rainy day fund is crucial in case of unexpected job loss or reduced income. With this safety net in place, I have peace of mind knowing that I can continue to cover my living expenses until I secure a new source of income or find a way to supplement my earnings.

Natural disasters and emergencies

Natural disasters and emergencies can wreak havoc on our finances. Whether it’s damage caused by a storm, a home burglary, or other unexpected events, a well-funded rainy day fund can help me rebuild and recover. Knowing that I have a financial safety net in these challenging times allows me to focus on rebuilding and moving forward.

a rainy day fund is an indispensable tool in a frugal lifestyle. It offers financial stability and peace of mind in the face of unexpected events. From car repairs to medical emergencies, having a dedicated fund for these situations allows me to stay on track with my frugal living goals without compromising my financial well-being. So, start building your rainy day fund today and give yourself the security and flexibility needed for a truly frugal lifestyle.

Rainy Day Fund Strategies for Different Situations

Single individuals or couples

When it comes to frugal living, having a rainy day fund is crucial, regardless of your marital status. As a single individual or a couple, having a financial safety net can provide peace of mind and protection against unexpected expenses. Start by setting aside a portion of your income each month that goes directly into your rainy day fund. This could be a fixed amount or a percentage of your earnings, depending on your financial situation and goals. Consider automating this process to make it easier and more convenient.

Families with children

For families with children, a rainy day fund is even more important. The financial responsibilities that come with raising children can be overwhelming at times, and unexpected expenses can easily throw off your budget. Aim to have at least three to six months’ worth of living expenses saved up in your rainy day fund. This will give you the flexibility to handle emergencies, such as medical bills or car repairs, without resorting to credit card debt or depleting your savings.

Retirement planning and senior citizens

As seniors, it becomes even more crucial to have a well-funded rainy day fund. Medical expenses, home repairs, or unexpected emergencies can quickly erode your retirement savings if you’re not prepared. Consider increasing the size of your rainy day fund to cover potential long-term care costs or any unexpected financial needs that may arise during this stage of life. Additionally, explore investment options that can help your rainy day fund grow over time to keep up with inflation and provide you with a secure nest egg.

Entrepreneurs and self-employed individuals

As an entrepreneur or self-employed individual, your income may fluctuate more than someone with a steady paycheck. This unpredictability makes having a robust rainy day fund essential. Start by setting aside a percentage of your income specifically for your fund. Additionally, consider purchasing business interruption insurance to protect yourself in case your income is significantly impacted by unforeseen circumstances. This will provide an extra layer of security and allow you to focus on building your business without constantly worrying about unpredictable financial setbacks.

Students or young adults

While it may be tempting to live in the present and not worry about building a rainy day fund while you’re young, starting early can have significant long-term benefits. As a student or young adult, unexpected expenses can arise, such as healthcare costs, car repairs, or job loss. Begin by saving a small portion of your income or any windfalls you may come across. Even if it’s just a few dollars a month, it will add up over time and give you a solid financial foundation to rely on when you need it most.

regardless of your life stage or financial situation, having a rainy day fund is essential in frugal living. Start by assessing your circumstances and setting realistic savings goals. Remember, the key is consistency, so make it a habit to regularly contribute to your fund. With a well-funded rainy day fund, you’ll have peace of mind knowing that you’re prepared for whatever life throws your way. Having a rainy day fund is an essential aspect of frugal living. As someone who focuses on living a frugal lifestyle, I have come to realize the numerous benefits that come with having a financial safety net. In this section, I will discuss some common challenges that individuals face when trying to build and maintain a rainy day fund, as well as provide practical solutions to overcome them.

Overcoming the temptation to dip into the fund

One of the biggest challenges in maintaining a rainy day fund is the temptation to dip into it for non-emergency expenses. It can be tempting to use the money for vacations, shopping sprees, or other indulgences. However, I have found that setting clear goals and visualizing the long-term benefits of having a fund can help overcome this temptation. Additionally, having a separate account specifically designated for the rainy day fund can make it easier to resist the urge to spend the money frivolously.

Managing unexpected financial emergencies

Life is full of surprises, and unexpected financial emergencies can happen to anyone. The beauty of having a rainy day fund is that it provides a sense of security when these emergencies arise. Whether it’s a sudden car repair, an unexpected medical expense, or a job loss, having a financial cushion allows me to handle these situations without resorting to debt or financial stress.

Recovering from a depleted rainy day fund

Sometimes, despite our best efforts, our rainy day fund can become depleted. In such situations, it is important not to lose hope. Instead, I focus on rebuilding my fund as soon as possible by making small, consistent contributions. This helps me regain peace of mind and creates a sense of financial stability once again.

Addressing irregular or inconsistent income

For individuals with irregular or inconsistent income, building a rainy day fund can be a challenge. However, by implementing a budgeting system that accounts for these fluctuations, it is possible to set aside money for emergencies even when income varies. Tracking expenses, prioritizing savings, and adjusting spending habits during high-earning periods can all contribute to successfully building and maintaining a rainy day fund.

Finding motivation to save

Saving money can sometimes feel like a never-ending task, especially when faced with daily temptations to spend. However, having a rainy day fund provides a strong motivation to save. I see it as a form of self-care and value the peace of mind that comes with having a financial safety net. Whenever I am tempted to splurge, I remind myself of the bigger picture and the benefits that come with saving for a rainy day.

having a rainy day fund is crucial for frugal living. By overcoming the temptation to dip into the fund, managing unexpected financial emergencies, recovering from a depleted fund, addressing irregular income, and finding motivation to save, individuals can experience the incredible benefits and peace of mind that come with having a financial safety net. Start building your rainy day fund today and reap the rewards in the future.

Conclusion

In conclusion, having a rainy day fund is an essential aspect of frugal living. It provides a safety net that allows me to handle unexpected expenses and emergencies without jeopardizing my financial stability. By diligently saving and setting aside money for unforeseen circumstances, I am able to maintain my frugal lifestyle and avoid falling into debt or financial hardship.

One of the key benefits of having a rainy day fund is the peace of mind it brings. Knowing that I have a financial buffer in case of emergencies or unexpected expenses allows me to relax and feel secure in my frugal lifestyle. Instead of constantly worrying about how I would handle an unexpected car repair or a medical bill, I can focus on living within my means and saving money.

Financial Independence

Having a rainy day fund also grants me a sense of financial independence. It allows me to make decisions based on what is best for me and my long-term financial goals, rather than being forced to rely on credit cards or loans when faced with unexpected expenses. A healthy emergency fund gives me the freedom to handle these situations on my own terms, without falling into the trap of debt.

One of the greatest advantages of having a rainy day fund is the ability to avoid accumulating debt. By having money set aside for emergencies, I don’t need to rely on high-interest credit cards or loans to cover unforeseen expenses. This not only saves me money in the long run but also prevents the stress and burden of debt hanging over my head.

Building a Better Future

Finally, having a rainy day fund sets the foundation for building a better future. By consistently saving and adding to my emergency fund, I am preparing myself for any financial challenges that may come my way. It allows me to navigate any unforeseen circumstances with confidence and continue on my frugal journey towards financial stability and overall well-being.

In a nutshell, a rainy day fund is a crucial element of frugal living. It provides peace of mind, financial independence, and debt avoidance, while also setting the stage for a brighter and more secure future. By cultivating this savings habit and prioritizing the importance of an emergency fund, I am able to confidently face any storm that comes my way.