Introduction

Why saving money on housing is important

As a frugal individual, I understand the importance of maximizing savings in all aspects of life, and one area where significant savings can be achieved is housing. Rent or mortgage payments often take up a large portion of our monthly budget, so finding ways to minimize this expense is crucial. By exploring frugal strategies for housing, we can free up valuable resources to invest in other areas, such as saving for retirement, paying off debt, or enjoying experiences that bring us joy.

Understanding the frugal lifestyle

Living a frugal lifestyle doesn’t mean depriving ourselves of comfort or happiness. It means being intentional with our spending, making thoughtful choices, and prioritizing long-term financial security. Being frugal allows us to live within our means, avoid unnecessary debt, and build financial independence.

Introducing the concept of a frugal renter

A frugal renter is someone who seeks out cost-effective solutions when it comes to housing. Instead of settling for the most expensive apartment or house in the trendiest neighborhood, a frugal renter looks for ways to maximize savings without sacrificing quality of life. This could involve finding affordable rental options, negotiating rent prices, sharing living spaces with roommates, or considering alternative housing arrangements.

By adopting a frugal mindset as a renter, we can make significant strides in reducing our housing expenses and creating more room in our budget for other financial goals. In this post, I will share insightful tips and strategies to help you become a frugal renter and maximize your savings on housing.

Choosing the Right Location

As a frugal renter, I have discovered that one of the most effective ways to save money on housing is by choosing the right location. When it comes to finding an affordable place to live, there are several factors that I consider. Here are some tips to help you maximize your savings on housing.

Researching Affordable Neighborhoods

Before signing a lease, it’s important to research different neighborhoods and their average rental costs. I always start by checking out online resources that provide information about rent prices in various areas. This allows me to compare different neighborhoods and identify those that fit within my budget. Additionally, I look for neighborhoods that offer a good balance between affordability and safety. By doing my homework, I can ensure that I’m getting the best deal possible on my rental.

Considering Proximity to Work or School

Another factor to consider when choosing a location is the proximity to your workplace or school. This is particularly important to me because transportation costs can add up quickly. By living within a reasonable commuting distance, I can save both time and money on transportation expenses. Additionally, being close to work or school reduces the need for a car, which saves me money on gas, parking, and maintenance.

Exploring Public Transportation Options

When it comes to saving money on transportation, public transportation is often the way to go. Before deciding on a location, I always research the availability and efficiency of public transportation in the area. Living near a bus or train station can significantly reduce my commuting costs, as I no longer have to rely on a car. Furthermore, taking public transportation is an eco-friendly choice that aligns with my frugal lifestyle.

By carefully selecting a location based on affordability, proximity to work or school, and public transportation options, I have been able to maximize my savings on housing. These considerations not only help me save money, but they also contribute to a more sustainable and frugal lifestyle. In fact, I have found that by making conscious choices about where I live, I can significantly cut down on my overall expenses. So, when it comes to finding the perfect rental, don’t forget to consider the location and the potential savings it can offer.

Renting vs. Buying: Pros and Cons

Analyzing the cost of renting

When it comes to housing, one of the biggest decisions to make is whether to rent or buy a home. Renting offers its own set of advantages and disadvantages that can greatly impact your financial situation. As a frugal renter, I always consider the cost of renting as a top factor in my decision-making process.

Renting typically involves paying a fixed amount each month, which may include utilities or other fees depending on the agreement. This cost is often lower than a mortgage payment, especially when you factor in other expenses such as property taxes, insurance, and maintenance that homeowners are responsible for. As a result, renting can free up more of my monthly budget for other savings goals or for investing.

Weighing the benefits of homeownership

Although renting has its benefits, homeownership offers its own set of advantages as well. When you own a home, your monthly payments go towards building equity, which can be a valuable asset in the long run. Additionally, you have the freedom to customize and renovate your living space as you please. However, it is crucial to consider the costs associated with purchasing and maintaining a home, as they can quickly add up.

Factors to consider when deciding between renting and buying

To make an informed decision between renting and buying, I take into account several factors. Firstly, my financial stability and long-term goals play a significant role. If I plan to live in an area for a short period or have uncertain job prospects, renting may be the more flexible option. On the other hand, if I am committed to staying in one place and have a stable income, homeownership may be a viable option.

I also consider the housing market and rental trends in the area. If housing prices are on the rise or rental rates are increasing significantly, it may be a better time to buy. Conversely, if the market is more favorable to renters, I could continue renting and take advantage of lower costs.

the decision between renting and buying a home is not one to be taken lightly. As a frugal renter, I carefully analyze the cost of renting, weigh the benefits of homeownership, and consider various factors unique to my situation. By doing so, I can maximize my savings on housing and make the most financially sound choice.

3. Budgeting for Rent

As a frugal renter, one of the most important steps in maximizing your savings is setting a budget for your rent expenses. By determining an affordable rent budget, identifying additional costs beyond the monthly rent, and learning effective negotiation tips, you can reduce your housing expenses and keep more money in your pocket.

Determining an affordable rent budget

When it comes to budgeting for rent, it’s crucial to consider your income and other financial obligations. Take a close look at your monthly income and expenses to determine how much you can comfortably allocate towards rent. Remember to factor in other essential costs such as groceries, transportation, and utilities.

Identifying additional costs beyond rent

Rent is not the only expense you need to consider when planning your budget. Additional costs such as security deposits, pet fees, parking fees, or utility deposits can add up quickly. Make sure to account for these expenses when calculating your overall housing budget. Researching and understanding these additional costs ahead of time will help you avoid any financial surprises once you’ve already moved in.

Tips for negotiating rent prices

Negotiating the price of your rent can be a powerful tool for saving money. Before signing a lease agreement, do thorough research on comparable rental properties in the same neighborhood. Armed with this knowledge, you can confidently negotiate with your potential landlord. Consider proposing a slightly lower rent or request additional amenities to be included in the lease. Landlords may be more willing to make accommodations if they believe they are securing a long-term and reliable tenant.

By carefully determining an affordable rent budget, considering additional costs beyond the monthly rent, and employing negotiation tactics, you can maximize your savings as a frugal renter. By staying mindful of your financial obligations, you can find a comfortable and affordable home while still having enough money left over to pursue your other financial goals.

Seeking Affordable Rental Listings

Finding affordable rental listings is a crucial step for any frugal renter in maximizing their savings on housing. With the rise of online rental platforms, alternative resources, and social networks, there are numerous avenues to explore in search of the perfect, budget-friendly rental. Let me break it down for you:

Utilizing online rental platforms

Online rental platforms have revolutionized the way we search for rental properties. Websites like FrugalDude.org offer a vast array of rental listings conveniently sorted by location, price range, and other specifications. These platforms often provide helpful filters that allow you to narrow down your search, making it easier to find affordable options that meet your requirements. Additionally, these platforms usually include detailed property descriptions, photos, and sometimes even virtual tours, giving you a comprehensive idea of the property before you even visit.

Considering alternative resources for rental listings

While online platforms tend to be the go-to for many renters, it’s essential not to overlook alternative resources. Local newspaper classifieds, community bulletin boards, and even word-of-mouth recommendations can sometimes lead to hidden gems that aren’t easily found online. Don’t hesitate to think outside the box and explore these alternative resources to uncover unique rental opportunities that others may have overlooked.

Utilizing social networks for potential housing leads

Social networks can also be a valuable resource in your search for affordable housing. Joining housing-related groups or pages on platforms like Facebook and Reddit can connect you with individuals who may be looking to rent out their property directly, without involving the traditional rental market. These personal connections can sometimes offer better deals and more flexible negotiation options.

By being proactive and exploring a variety of rental listing sources, you can increase your chances of finding an affordable rental that meets your needs. Keep in mind that different methods may work better depending on your location and specific preferences. Remember, finding a frugal rental is all about being resourceful and thinking outside the box.

5. Shared Housing and Roommates

As a frugal renter, one of the most effective ways to maximize your savings on housing is by considering shared housing and finding compatible roommates. Not only does this option reduce your monthly rent and expenses, but it also provides an opportunity to build social connections and create a supportive living environment.

Exploring the benefits of shared housing

Shared housing offers numerous advantages for frugal renters. Firstly, the cost of rent and utilities is divided among multiple individuals, significantly reducing the financial burden on each person. Additionally, shared housing often comes with shared amenities, such as a fully furnished living room or kitchen, allowing you to save on furniture and appliance costs. Moreover, splitting utilities like electricity, water, and internet can result in substantial savings.

Finding reliable and compatible roommates

When searching for roommates, it’s essential to find individuals who share similar values, habits, and financial goals. Start by reaching out to friends, coworkers, or family members who may be seeking affordable housing options. Alternatively, utilize online platforms and social media groups to connect with potential roommates in your area.

Prior to moving in together, conduct thorough interviews and background checks to ensure compatibility and reliability. Discuss everyone’s expectations regarding cleanliness, noise levels, overnight guests, and shared responsibilities to minimize future conflicts.

Establishing guidelines for living together harmoniously

To maintain a harmonious living environment, establishing clear guidelines and rules is crucial. Sit down with your roommates and discuss expectations regarding quiet hours, chore rotations, personal space, and shared expenses. It’s also beneficial to establish a method for resolving conflicts, such as regular house meetings or a shared online communication platform.

Shared housing and roommates can not only help you save money but also create a supportive and enjoyable living situation. By exploring the benefits of shared housing, finding compatible roommates, and setting clear guidelines, you can maximize your savings on housing while building valuable connections with others. So, why not consider this option and start reaping its financial and social rewards?

6. Negotiating Rental Terms

One of the key ways to save money as a frugal renter is by negotiating the terms of your rental agreement. By having a clear understanding of common rental terms and conditions, as well as applying effective negotiation tactics, you can potentially maximize your savings on housing.

Understanding common rental terms and conditions

When renting a property, it is important to familiarize yourself with the various terms and conditions that may be included in your rental agreement. This includes details such as the duration of the lease, the amount of rent, security deposit requirements, and any additional fees or charges. By understanding these terms, you can better assess whether they align with your budget and negotiate accordingly.

Tips for effective negotiation with landlords

Effective negotiation with your landlord can help you secure favorable rental terms. Start by doing thorough research on the rental market in your area to determine fair prices and trends. Armed with this information, confidently approach your landlord and propose a reasonable offer. Be prepared to highlight your strengths as a tenant, such as a good rental payment history or your willingness to sign a longer lease in exchange for a discounted rent.

Negotiating lease renewal or rent reduction

When your lease is up for renewal, it’s an opportunity to renegotiate your rental terms. If you’ve been a reliable tenant, consider requesting a rent reduction or other concessions, such as including utilities in your rent or requesting upgrades/repairs to the property. By demonstrating your value as a long-term tenant, you may be able to negotiate a rent reduction, saving you money in the long run.

negotiating rental terms is an essential skill for the frugal renter. By understanding common rental terms and conditions, applying effective negotiation tactics, and leveraging your strengths as a tenant, you can maximize your savings on housing. So don’t be afraid to speak up and secure the best possible rental agreement for your budget!

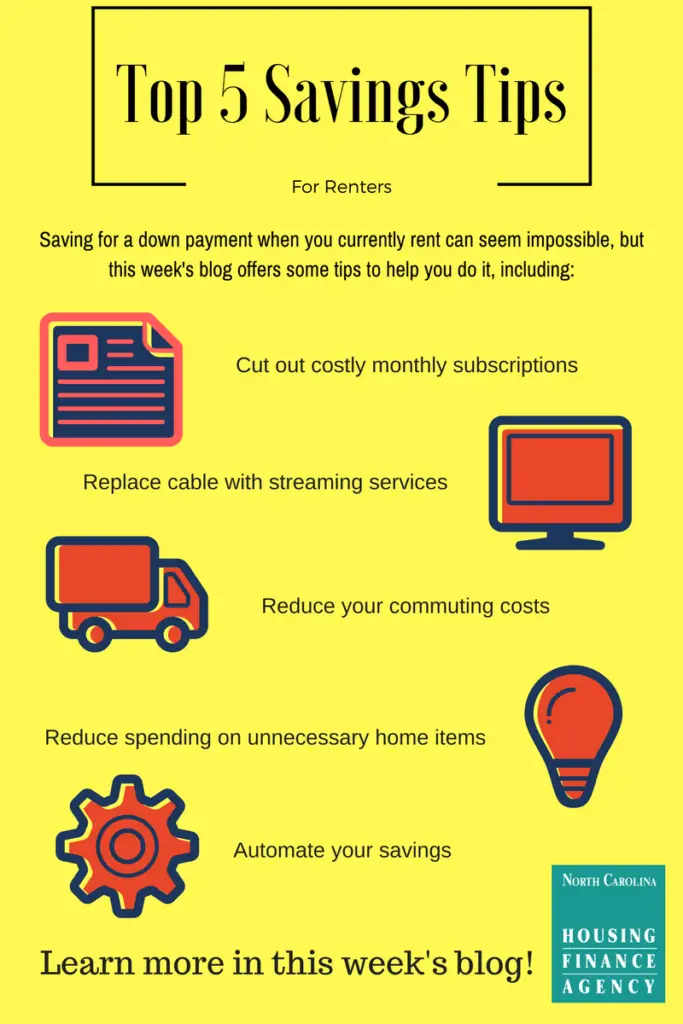

7. Saving on Utilities

As a frugal renter, finding ways to save money on utilities can dramatically impact your monthly expenses. By implementing a few energy-saving strategies, being mindful of water usage, and exploring alternative options for internet and cable, you can significantly reduce your utility costs.

Energy-saving tips for reducing electricity bills

Lowering your electricity bills starts with small changes that can add up to substantial savings over time. To begin, make it a habit to turn off lights when leaving a room and unplug electronics when they’re not in use. You can also replace traditional light bulbs with energy-efficient LED bulbs, which consume significantly less energy. Additionally, adjusting your thermostat by a few degrees can lead to substantial savings on your heating and cooling.

Conserving water to lower utility costs

Water conservation not only benefits the environment but also reduces your water bill. Consider installing low-flow showerheads and faucet aerators to minimize water usage without compromising water pressure. Repairing any leaking faucets or toilets promptly can also save you from wasting gallons of water. Furthermore, practicing responsible habits such as taking shorter showers and only running the dishwasher or washing machine with full loads can go a long way in conserving water and decreasing your utility expenses.

Exploring options for internet and cable alternatives

Internet and cable bills can often become a significant expense for renters. Thankfully, there are alternative options available that can help you save money. Consider subscribing to streaming services, which often offer a wide variety of entertainment without the hefty price tag of cable. Additionally, exploring internet providers other than the major companies can lead to significant savings. Research local providers, compare prices and packages, and choose the one that best fits your needs and budget.

By implementing these energy-saving strategies, conserving water, and exploring alternative options for internet and cable, you can maximize your savings on utilities as a frugal renter. These small changes can add up to substantial savings over time, allowing you to allocate those funds towards other financial goals or simply enjoy a more financially secure and comfortable life.

8. Efficient Home Furnishing

One of the keys to saving money on housing as a frugal renter is by efficiently furnishing your home. By adopting budget-friendly furniture shopping habits, trying out DIY home decor ideas, and maximizing storage in small living spaces, you can significantly reduce your expenses while still creating a comfortable and stylish home.

Budget-friendly furniture shopping

When it comes to furnishing your home on a budget, it’s important to prioritize functionality and value. Instead of splurging on brand-new furniture, consider shopping at thrift stores, secondhand furniture shops, or online marketplaces for gently used items. Not only can you find unique pieces that add character to your home, but you can also save a substantial amount of money.

DIY home decor ideas

Adding a personal touch to your living space doesn’t have to break the bank. Explore DIY home decor ideas by repurposing items or creating your own decorations. From painting old furniture to crafting wall art using inexpensive materials, there are countless creative ways to makeover your space without spending a fortune.

Maximizing storage in small living spaces

Living in a small apartment or rental home can present challenges when it comes to storage. However, with some smart organization techniques, you can make the most of your limited space. Invest in multifunctional furniture with built-in storage, utilize vertical storage solutions like wall shelves or hanging organizers, and declutter regularly to keep your space organized and efficient.

Remember, being a frugal renter doesn’t mean sacrificing style or comfort. With some thoughtful planning and resourceful decision-making, you can furnish your home in a way that maximizes savings without compromising on your personal taste or living needs. So whether you’re hunting for bargain furniture finds, exploring creative DIY projects, or implementing space-saving storage solutions, take these tips to heart and enjoy a frugal and fulfilling rental experience.

9. DIY Maintenance and Repairs

Basic maintenance skills every frugal renter should know

As a frugal renter, one of the most effective ways to maximize your savings on housing is by learning some basic maintenance skills. By taking care of simple repairs and maintenance tasks yourself, you can save a significant amount of money on costly professional services.

To start, familiarize yourself with some fundamental skills such as unclogging a drain, fixing a leaky faucet, or changing a light bulb. These may seem like minor tasks, but the money saved from not hiring a professional can add up over time. Online tutorials and instructional videos are valuable resources that can guide you through the process step-by-step.

Repairing common household issues on your own

Once you’ve mastered the basics, you can expand your repertoire of DIY maintenance and repairs to include more complex tasks. Minor electrical repairs, patching up small holes in walls, or even painting a room can all be accomplished with a little know-how and the right tools. By taking on these tasks yourself, you can save a substantial amount of money that would otherwise be spent on hiring a handyman or contractor.

Identifying when to call a professional

While it’s empowering to be able to fix common household issues on your own, it’s crucial to know when a situation calls for professional assistance. Certain issues, such as major plumbing problems or electrical malfunctions, require the expertise of a trained specialist. Attempting to address these complex issues without professional help can lead to further damage and costly repairs in the long run.

By developing your DIY maintenance and repair skills and knowing when to call a professional, you can strike the perfect balance between frugality and practicality in your rented space. These skills not only save you money but also provide a sense of accomplishment and self-reliance. So don’t be afraid to roll up your sleeves and tackle those household repairs yourself!

Renters Insurance

Understanding the importance of renters insurance

As a frugal renter, one of the best ways to protect your financial well-being is by investing in renters insurance. Many renters make the mistake of assuming that their landlord’s insurance will cover any damages or losses they may experience, but that is not always the case. Renters insurance is specifically designed to protect your personal belongings and provide liability coverage in case of accidents or damage within your rented space.

Not only can renters insurance replace your belongings in the event of theft, fire, or natural disasters, but it can also cover medical expenses if someone is injured on your property. This protection is especially crucial if you live in an apartment complex or shared housing, where accidents can occur more frequently.

Comparing different insurance providers

When it comes to finding the best renters insurance for your specific needs, it’s important to compare different providers. Look for companies that offer comprehensive coverage at an affordable price. Read customer reviews, check their financial stability and claims history, and evaluate their customer service ratings. Don’t be afraid to ask for discounts or bundle your renters insurance with other policies, such as auto insurance, to maximize your savings.

Tips for getting the best coverage at an affordable price

To ensure you get the best coverage at an affordable price, there are a few tips to keep in mind. First, consider opting for a higher deductible. While this means you’ll pay more out of pocket if you need to file a claim, it can significantly lower your monthly premium. Additionally, take inventory of all your possessions and estimate their value accurately. This will help you determine the appropriate coverage amount and avoid overpaying for insurance you don’t need.

You can also inquire about discounts for safety features in your rental unit, such as smoke detectors, security systems, or deadbolt locks. Additionally, maintaining a good credit score can also help lower your insurance premiums. Finally, regularly review and update your policy to ensure that it reflects your current needs and circumstances.

By understanding the importance of renters insurance, comparing different providers, and following these tips, you can protect your belongings and save money on housing expenses as a frugal renter. Remember, investing in renters insurance is a wise long-term financial decision that can provide peace of mind and protect your hard-earned savings.

Conclusion

Summarizing the benefits of being a frugal renter

Throughout this article, I have shared with you the various ways in which you can maximize your savings on housing as a frugal renter. By implementing these strategies, you can enjoy several benefits.

Firstly, being a frugal renter allows you to significantly reduce your expenses and save more money. It provides you with the opportunity to allocate your savings towards other financial goals, such as paying off debts or building an emergency fund. With less financial burden from high housing costs, you can experience a greater sense of financial freedom and security.

Secondly, adopting a frugal lifestyle when it comes to housing can help you become more mindful of your spending habits. By making conscious choices and evaluating your needs versus wants, you can develop a better understanding of your financial priorities. This awareness can extend to other areas of your life, ultimately leading to a more sustainable and fulfilling lifestyle overall.

Reiterating the importance of saving money on housing

Saving money on housing is crucial for many reasons. It allows you to create a more affordable and manageable budget, giving you the flexibility to pursue other passions or invest in your future. Being a frugal renter also allows you to have a greater sense of control over your finances, reducing the stress and anxiety that can come with high housing costs.

Encouraging readers to implement the frugal renter practices

I strongly encourage you to implement the frugal renter practices discussed in this article. Start by evaluating your current housing situation and exploring ways to reduce your monthly expenses. Consider downsizing to a smaller apartment or finding roommates to split the costs. Additionally, be proactive in negotiating your rent and seeking out the best deals.

Remember, being a frugal renter is not about sacrificing comfort or quality of life; it’s about making intentional choices that align with your financial goals. By adopting a frugal mindset and implementing these strategies, you can maximize your savings on housing and enjoy a more financially secure future. So, why wait? Start being a frugal renter today and watch your savings grow!