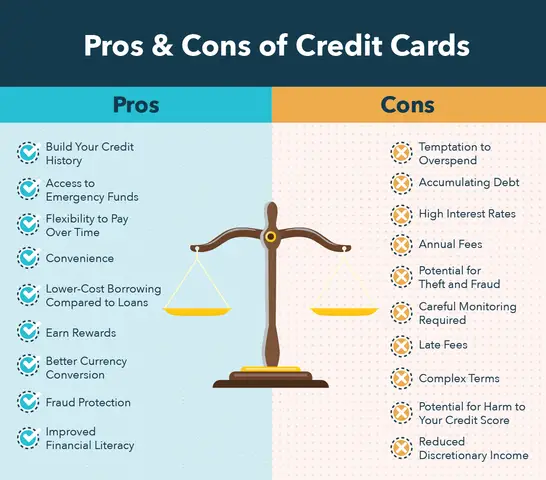

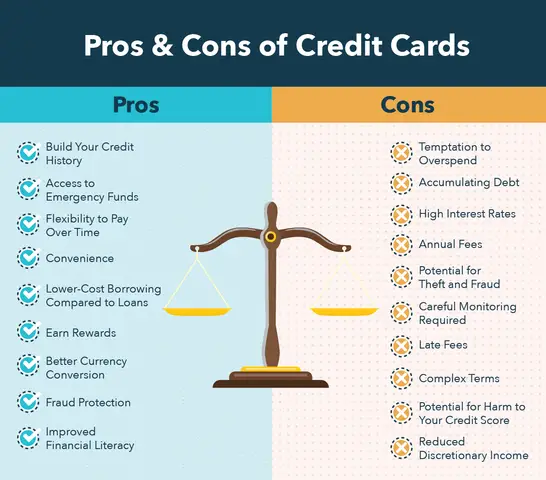

So, have you ever wondered if those credit card rewards programs are really worth it? I mean, there are so many different offers out there, it’s hard to know which one to choose. But today, I’m going to break it down for you and give you the lowdown on the pros and cons of credit card rewards programs. Trust me, by the end of this article, you’ll know exactly what to look for when it comes to maximizing those rewards.

Let’s start with the pros. One of the biggest advantages of credit card rewards programs is, well, the rewards! I mean, who doesn’t love getting cashback, airline miles, or even free hotel stays, just for spending money? It’s like getting a little bonus for all the shopping you would have done anyway. And let’s not forget about those sign-up bonuses – sometimes you can get a huge chunk of rewards just for opening a new card.

But of course, there are always cons to balance out the pros. One of the biggest downsides to credit card rewards programs is the temptation to overspend. I mean, it’s so easy to get caught up in the mindset of “I’m earning rewards, so why not spend more?” But remember, those rewards aren’t free – they’re funded by the interest rates and fees that come with credit cards. So, if you’re not careful, you could end up paying more in interest than you’re earning in rewards.

So there you have it – the pros and cons of credit card rewards programs. It’s all about finding the right balance and being disciplined when it comes to spending. In my upcoming article, I’ll dive deeper into how to choose the best rewards program for you and how to make the most of your rewards. Trust me, with a little know-how, you’ll be racking up those rewards and reaping the benefits in no time. Stay tuned!

The Pros and Cons of Credit Card Rewards Programs

Credit card rewards programs have become increasingly popular among consumers in recent years. These programs offer enticing incentives to cardholders in the form of valuable rewards, exclusive perks, and other benefits. However, it’s essential to weigh the pros and cons of these programs before diving in headfirst. In this article, I will discuss the advantages and disadvantages of credit card rewards programs so that you can make an informed decision.

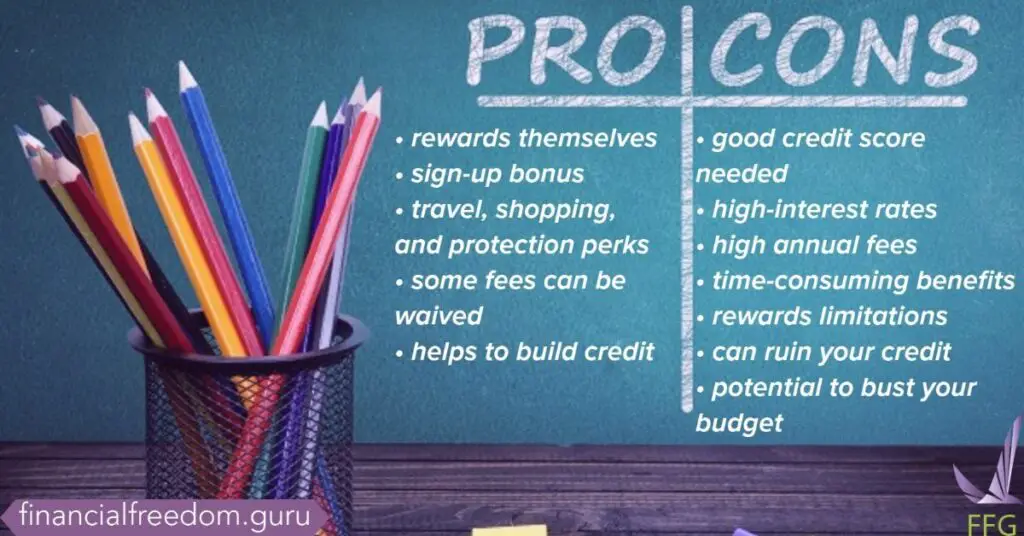

Earn Valuable Rewards

One of the most significant advantages of credit card rewards programs is the ability to earn valuable rewards. By using your credit card for everyday purchases, you can accumulate reward points that can later be redeemed for various benefits. Some of the most common types of rewards include cashback on purchases, travel rewards, gift cards, and merchandise rewards.

Cashback rewards allow you to earn a percentage of the purchase amount back in the form of cash. This can be particularly beneficial if you use your credit card for everyday expenses such as groceries, gas, and dining out. Travel rewards, on the other hand, can provide you with opportunities to earn airline miles or hotel points, which can be used for discounted or free travel in the future. Gift cards and merchandise rewards offer a wide range of options for cardholders to choose from, allowing you to select rewards that align with your preferences and needs.

Access to Exclusive Perks

Credit card rewards programs often come with exclusive perks that are not available to non-cardholders. These perks can enhance your overall cardholder experience and provide additional value. Some of the most common exclusive perks associated with credit card rewards programs include complimentary airport lounge access, travel insurance and cancellation protection, concierge services, and enhanced purchase protection.

Complimentary airport lounge access can be an exceptional benefit for frequent travelers. It allows you to relax in a comfortable and quiet environment before your flight, away from the bustling crowds of the airport. Additionally, travel insurance and cancellation protection can provide you with peace of mind when planning your trips, as they can reimburse you for unexpected expenses or cancellations. Concierge services offered by credit card companies can assist you in making travel arrangements, booking tickets to events, and even securing dinner reservations at hard-to-get-into restaurants. Enhanced purchase protection ensures that your purchases are covered in case they are lost, stolen, or damaged.

Convenient and Flexible Spending

Using credit cards for your day-to-day purchases offers a level of convenience and flexibility that other payment methods may not provide. Credit cards are widely accepted at most merchants, both online and in-store, making it easy to use them wherever you go. This wide acceptance eliminates the need to carry large amounts of cash or worry about finding an ATM.

Moreover, credit cards enable you to make large purchases without depleting your bank account. This can be particularly useful for significant expenses, such as home appliances or electronics, where it may be more convenient to spread out the cost over a few months rather than paying upfront. In emergency situations, having a credit card on hand can provide you with a necessary lifeline. Whether it’s a medical emergency or an unexpected car repair, having a credit card to cover those expenses can save you from financial hardship.

Lastly, credit cards offer convenient online and mobile banking platforms, allowing you to manage your finances at your fingertips. You can easily review your transactions, make payments, and track your expenses without the hassle of traditional paper-based banking.

Build Credit History

Another advantage of credit card use, specifically with rewards programs, is the ability to build a positive credit history. Having a good credit history is vital for various aspects of your financial life. It can help you qualify for better loan terms, such as lower interest rates on mortgages or personal loans. Additionally, a positive credit history can improve your credit score, making it easier to obtain credit in the future. This can be particularly crucial if you’re planning to finance a car, purchase a home, or start your own business.

By responsibly using a credit card and making timely payments, you demonstrate to lenders and financial institutions that you can effectively handle credit. This builds trust and increases your chances of being approved for future credit applications. It’s important to note, however, that building credit history requires discipline and careful financial management. It’s crucial to pay off your balances in full and on time to avoid accumulating debt and damaging your credit score.

Now that we have explored the advantages of credit card rewards programs let’s take a closer look at some of the potential drawbacks.

High Annual Fees

One of the significant cons associated with credit card rewards programs is the presence of high annual fees. While these fees may vary from card to card, they can be quite substantial, often ranging from $100 to $500 per year. These annual fees can eat into the value of the rewards you earn, making it important to assess whether the benefits outweigh the cost.

Before committing to a credit card with a high annual fee, it is crucial to analyze your spending habits and estimate the rewards you would earn compared to the cost of the fees. Consider whether the rewards you would accumulate throughout the year exceed the annual fee and if the benefits provided by the card are worth the expense.

Potential for Overspending

Credit card rewards programs can lead to overspending if not used responsibly. The opportunity to earn rewards on every purchase, coupled with the ease of making payments with a credit card, can tempt individuals to spend more than necessary. This can lead to the accumulation of debt, which can have a negative impact on your financial health.

It is crucial to maintain good financial habits when using credit cards. Only charge purchases that you can afford to pay off in full each month to avoid falling into the debt trap. Setting a budget and monitoring your spending regularly can help you avoid overspending and stay within your means.

Complex Redemption Rules

Credit card rewards programs often come with complex redemption rules that can make it challenging to maximize the value of your rewards. These rules can include expiration dates, restrictions on redemption options, and limited availability of certain rewards.

Expiration dates can cause your hard-earned rewards to go to waste if not used within a specific timeframe. It is essential to familiarize yourself with the terms and conditions of your rewards program to ensure you don’t miss out on redeeming your points.

Furthermore, some rewards programs have restrictions on redemption options or limited availability of certain rewards. For example, travel rewards may have blackout dates or limited airline availability, making it difficult to use your points when you want to. It is crucial to research and understand the redemption options for your chosen rewards program to ensure the rewards align with your preferences and needs.

Limited Reward Options

While credit card rewards programs offer a wide range of benefits, they can sometimes have limited reward options. Some programs may only offer rewards in specific categories, such as travel or merchandise, leaving little room for customization or personal preference.

If your spending habits or interests don’t align with the available reward categories, you may find it challenging to fully utilize your rewards program. It’s important to consider whether the rewards offered by a particular program are meaningful to you and if they can enhance your overall financial well-being.

In conclusion, credit card rewards programs can provide valuable benefits to cardholders, such as earning valuable rewards, access to exclusive perks, convenient and flexible spending options, and the ability to build credit history. However, it’s crucial to weigh these advantages against the potential disadvantages, including high annual fees, the temptation for overspending, complex redemption rules, and limited reward options.

When considering a credit card rewards program, it’s important to assess your personal spending habits and financial goals. Analyze whether the rewards provided outweigh the annual fees, whether you have the discipline to use the card responsibly, and if the redemption options and available rewards are a good fit for your preferences.

By carefully evaluating the pros and cons, you can select the right credit card rewards program that aligns with your financial needs and allows you to make the most of your purchases. Remember, credit cards can be powerful financial tools when used responsibly, so be sure to make informed decisions that benefit your overall financial well-being.