Introduction

Welcome to the Ultimate Frugal Guide to Using Credit Cards! As someone who is passionate about leading a frugal lifestyle, I have gathered the most valuable information to help you make the most of your credit card usage. Whether you’re new to credit cards or have been utilizing them for years, this guide will provide you with essential tips and strategies to ensure that you use credit cards responsibly while maximizing the benefits they offer.

Credit Cards and Frugality

Credit cards can be a powerful tool in your frugal lifestyle arsenal if used wisely. They provide convenience, security, and often come with rewarding perks such as cashback, travel rewards, and more. However, it’s important to understand that credit cards should never be an excuse to overspend or live beyond your means. By utilizing the right frugal strategies, you can take advantage of credit cards without falling into the trap of debt.

Creating a Frugal Credit Card Strategy

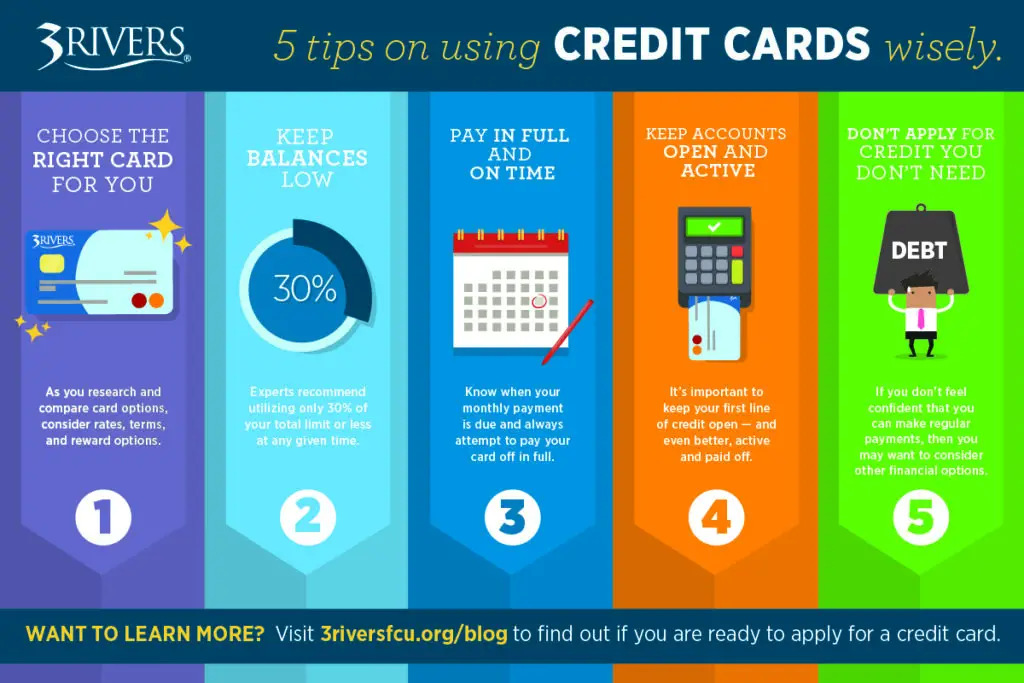

A frugal credit card strategy starts with choosing the right credit card. Look for cards that offer low or no annual fees, low interest rates, and rewards that align with your spending habits. Once you have selected the most suitable card, it’s important to establish a budget and stick to it. Set a limit on your monthly credit card spending and ensure that you can pay off the balance in full each month. By doing so, you can avoid interest charges and unnecessary debt.

Maximizing Credit Card Rewards

One of the key benefits of using credit cards frugally is the ability to earn rewards. Whether it’s cashback, travel points, or discounts at select retailers, these rewards can help save you money in the long run. Take advantage of sign-up bonuses, rewards on everyday spending, and special promotions to maximize your credit card rewards. However, always remember to pay off the balance in full and avoid unnecessary fees.

Benefits of Using Credit Cards

Credit cards offer a range of benefits that can help you manage your finances efficiently while also saving money. In this section, I will discuss three key advantages of using credit cards wisely.

Building Credit History

One major benefit of using credit cards is that they provide an opportunity to establish and build your credit history. By making consistent and timely payments, you can demonstrate your creditworthiness to lenders, making it easier to qualify for loans, mortgages, and better interest rates in the future. Additionally, having a positive credit history can also increase your chances of being approved for rental agreements or obtaining lower insurance premiums.

Rewards and Cashback Programs

Many credit cards come with rewards and cashback programs that can help you save money on your everyday expenses. These programs often offer incentives such as points or cashback for every dollar spent on eligible purchases. By using your credit card strategically, you can make the most of these rewards and earn valuable benefits like travel points, discounts on merchandise, or even cashback that can be applied directly to your credit card statement.

Consumer Protection

Credit cards also provide a layer of consumer protection that can be highly beneficial. Unlike cash or debit cards, credit card transactions are protected by federal regulations, such as the Fair Credit Billing Act. This means that if you encounter fraudulent activity or you are dissatisfied with a purchase, you have the right to dispute the charge and potentially recover your funds. Moreover, credit cards often offer extended warranties and purchase protection, ensuring that your purchases are protected against damage or theft.

using credit cards responsibly can have several advantages. They allow you to build a solid credit history, take advantage of rewards programs, and offer consumer protection. By understanding and utilizing these benefits, you can make the most of your credit card usage and improve your overall financial well-being.

Understanding Credit Scores

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. It is a crucial factor that lenders, such as banks and credit card companies, use to determine whether to approve your credit applications. Your credit score reflects your history of managing credit, including your payment history, amount of debt, and length of credit history.

Factors Affecting Credit Scores

Several factors contribute to your credit score. The most significant ones include your payment history, which accounts for 35% of your score. Late payments or defaults can significantly bring down your credit score. The amount of debt you owe, accounting for 30% of your score, is another critical factor. High credit card balances relative to your credit limit can negatively impact your score.

The length of your credit history contributes 15% to your credit score. Lenders prefer borrowers with a longer credit history, as it provides them with a more comprehensive understanding of your borrowing habits. Additionally, the types of credit you use, such as credit cards, loans, or mortgages, and the number of new credit accounts you open can also affect your credit score.

How to Improve Your Credit Score

To improve your credit score, focus on building a consistent history of on-time payments. Paying your bills promptly, including credit card balances, will positively impact your creditworthiness. Reduce the amount of debt you owe by paying off outstanding balances. Also, avoid opening multiple new credit accounts in a short period, as it can signal financial instability.

Regularly monitoring your credit report for errors is essential. Dispute any inaccuracies promptly to ensure an accurate representation of your creditworthiness. Building a long credit history by keeping old accounts open, even if they are not actively used, can also be beneficial.

Understanding credit scores is essential for anyone looking to use credit cards wisely. It allows you to maintain a good credit standing, making it easier to secure loans or obtain better terms and rewards on future credit card applications. By focusing on maintaining a strong credit score, you can ensure a more frugal financial future.

Choosing the Right Credit Card

When it comes to managing your finances, credit cards can be a powerful tool if used wisely. However, with countless options available, finding the perfect credit card for your frugal lifestyle can be overwhelming. Let me guide you through the essential factors to consider when choosing the right credit card.

Identifying Your Spending Habits

Before diving into the sea of credit card offers, it’s crucial to understand your spending habits. Take a close look at your monthly budget and determine where you spend the most. Are you a frequent traveler? A rewards credit card that offers airline miles or hotel points might be the way to go. If you prefer cashback, seek out a card with high cashback rewards on everyday purchases like groceries and gas. Understanding your spending patterns will aid in selecting a card that aligns with your financial goals.

Comparing Interest Rates

The interest rate on a credit card can significantly impact your overall financial situation. Begin by researching various credit cards and comparing their APRs (Annual Percentage Rates). Remember that a lower APR will save you money if you frequently carry a balance on your card. However, if you always pay your monthly balance in full, the interest rate becomes less relevant. Be sure to consider promotional rates as well, but be cautious of any potential future rate hikes.

Evaluating Annual Fees

Credit cards may come with annual fees, which can vary widely. While some frugal individuals prefer to avoid annual fees altogether, it’s essential to evaluate the benefits offered. If a card offers substantial rewards, such as extensive travel insurance or exclusive access to events, the annual fee might be worth the investment. On the other hand, if your financial goals are more focused on minimalism and cost-cutting, a no-annual-fee card may be a better fit.

Remember, choosing the right credit card is a personal decision that depends on your unique frugal lifestyle and preferences. By identifying your spending habits, comparing interest rates, and evaluating annual fees, you’ll be well-equipped to make an informed choice. So go ahead and leverage the power of credit cards to maximize your frugal living!

Credit Card Fees and Charges

Credit cards can be a useful tool for frugal individuals like me, as long as they are used responsibly. However, it is important to be aware of the various fees and charges associated with credit cards to avoid any unnecessary expenses. In this section, I will discuss the different types of fees that you should be mindful of when utilizing credit cards wisely.

Annual Fees

One common fee charged by credit card companies is the annual fee. This fee is typically charged on a yearly basis simply for owning the credit card. While it may be tempting to avoid credit cards with annual fees, it’s important to consider the benefits that these cards may offer, such as higher rewards or lower interest rates. If the perks outweigh the fee, it might still be a smart choice.

Balance Transfer Fees

If you’re looking to transfer your balance from one credit card to another with a lower interest rate, you should be aware of balance transfer fees. This fee is charged when you move the balance from one card to another. While the fee may vary depending on the credit card company, it is typically a percentage of the balance being transferred. It’s crucial to compare the fees and the potential interest savings before making a balance transfer.

Late Payment Fees

Late payment fees are perhaps one of the most dreaded charges associated with credit cards. If you fail to make your minimum payment by the due date, you may incur a late payment fee. These fees can add up quickly and can have a significant impact on your finances. To avoid this, make sure to always pay your credit card bill on time. Setting up automatic payments or alerts can help you stay organized and avoid incurring these fees.

By understanding and being aware of potential credit card fees and charges, I can use credit cards to my advantage while avoiding unnecessary expenses. Keeping these fees in mind will help me make informed decisions when choosing credit cards and managing my payments.

Credit Card Terms and Conditions

I understand that credit cards can be a double-edged sword when it comes to managing personal finances. However, with careful planning and responsible use, credit cards can actually be a valuable tool for frugal living. When it comes to using credit cards wisely, it’s important to familiarize yourself with the terms and conditions. Let’s take a closer look at some key aspects to pay attention to:

Interest Rates

One of the most crucial things to consider is the interest rate attached to your credit card. This rate determines the cost of borrowing money using your card. It’s essential to find a card with low interest rates to minimize the amount you’ll have to pay back. By doing your research and comparing different credit cards, you can find one that offers competitive rates.

Grace Periods

A grace period is a timeframe during which you can pay off your credit card balance without incurring any interest charges. It typically lasts around 21 to 25 days. Take advantage of this grace period by paying your balance in full before it expires. By doing so, you’ll avoid unnecessary interest charges and maintain control over your finances.

Minimum Payments

Credit card companies require a minimum payment each month to keep your account in good standing. It’s important to understand that paying only the minimum amount due will result in carrying a balance and incurring high interest charges. To be frugal and avoid debt, aim to pay off your credit card balance in full each month.

Remember, credit cards can provide convenience and even rewards when used wisely. Understanding the terms and conditions, such as interest rates, grace periods, and minimum payments, is crucial to utilizing credit cards effectively in a frugal lifestyle. By making informed decisions and staying disciplined with your spending habits, you can enjoy the benefits of using credit cards while minimizing any potential drawbacks. So, take the time to read and understand the fine print before selecting and using a credit card. Happy frugal spending!

Creating a Budget for Credit Card Usage

As someone who is committed to living a frugal lifestyle, I understand the importance of managing my finances responsibly. That’s why I believe it’s crucial to have a budget in place when it comes to using credit cards. By creating a budget for credit card usage, you can ensure that you are utilizing these financial tools in a way that aligns with your frugal goals and values.

Tracking Your Expenses

The first step in creating a budget for credit card usage is to track your expenses. This involves keeping a meticulous record of every transaction you make with your credit cards. By doing this, you can gain a clearer picture of where your money is going and identify areas where you may be overspending. Whether you choose to use a digital budgeting app or a simple spreadsheet, regularly tracking your expenses will empower you to make more informed financial decisions.

Setting Spending Limits

Once you have a comprehensive understanding of your expenses, it’s time to set spending limits for your credit cards. This involves determining how much you can comfortably afford to put on your credit cards each month. When setting these limits, it’s important to consider your income, fixed expenses, and financial goals. By setting realistic spending limits, you can avoid accumulating excessive credit card debt and stay on track with your frugal lifestyle.

Paying Off Your Balance

Another crucial aspect of managing your credit card usage frugally is to pay off your balance in full each month. This not only helps you avoid paying interest charges but also encourages responsible spending habits. By paying off your balance on time, you can maintain a good credit score and avoid getting into debt. Additionally, consider utilizing credit cards with favorable interest rates and rewards programs to optimize your frugal credit card usage.

creating a budget for credit card usage is an essential step in living a frugal lifestyle. By tracking your expenses, setting spending limits, and paying off your balance, you can ensure that credit cards work in your favor rather than becoming a financial burden. Remember to always practice responsible financial habits and make decisions that align with your frugal goals.

Avoiding Credit Card Debt

One of the most important aspects of using credit cards wisely is to avoid accumulating debt. It can be tempting to overspend and rely on credit cards as a source of funds, but this can lead to a dangerous cycle of debt and financial instability. To ensure a frugal approach to credit card usage, there are several key strategies that can be employed.

Understanding Your Financial Limitations

Before even considering using a credit card, it is essential to have a clear understanding of your financial limitations. Take the time to assess your income, expenses, and savings goals. By establishing a realistic budget, you can determine how much you can afford to spend on a monthly basis and avoid falling into debt that you cannot repay.

Using Credit Cards for Necessities Only

When it comes to using credit cards wisely, it is crucial to limit their usage to necessities. This means using credit cards for essential expenses such as groceries, utilities, and recurring bills. By reserving credit card usage for these necessary items, you can avoid the temptation of making impulse purchases and racking up unnecessary debt.

Avoiding Impulse Purchases

One common pitfall of credit card usage is succumbing to impulse purchases. It can be easy to give in to the allure of sales and deals, but being mindful of these temptations is essential. Before making any purchases, take the time to evaluate whether it is a genuine necessity or simply a fleeting desire. By establishing this discipline, you can prioritize your spending and avoid accumulating unnecessary debt.

By following these strategies, you can navigate the world of credit cards in a frugal and responsible manner. Understanding your financial limitations, using credit cards for necessities only, and avoiding impulse purchases are all key components to ensure that credit cards contribute to your financial stability and not your debt. Remember, by exercising caution and discipline in your credit card usage, you can maintain a frugal lifestyle while benefiting from the convenience and rewards that credit cards offer.

Tips for Responsible Credit Card Usage

Paying Your Bills on Time

One of the most important aspects of using credit cards responsibly is paying your bills on time. By doing so, you can avoid unnecessary charges such as late fees and interest charges. Additionally, paying your bills on time helps to maintain a good credit score, which is crucial for future financial endeavors. To ensure timely payments, consider setting up automatic bill payments or setting reminders for yourself.

Limiting Your Credit Utilization Ratio

Another key tip for responsible credit card usage is limiting your credit utilization ratio. This ratio is calculated by dividing your credit card balances by your credit limit. It is recommended to keep your credit utilization ratio below 30%, as exceeding this ratio could negatively impact your credit score. To maintain a low credit utilization ratio, consider spreading out your purchases across different credit cards or paying off your balances multiple times per month.

Monitoring Your Credit Reports

Monitoring your credit reports regularly is essential to ensure that they are accurate and to detect any signs of identity theft or fraudulent activity. You are entitled to receive one free credit report each year from each of the major credit bureaus. Reviewing these reports can help you identify any errors or unauthorized accounts, allowing you to take the necessary steps to rectify the situation.

By incorporating these responsible credit card usage tips into your financial routine, you can make the most of your credit cards while minimizing any potential drawbacks. Remember to pay your bills on time, keep your credit utilization ratio low, and stay vigilant by monitoring your credit reports. These practices will help you maintain a healthy financial profile and make informed decisions when it comes to managing your credit.

Avoiding Credit Card Frauds and Scams

In today’s digital age, it is crucial to take necessary precautions to protect yourself from credit card frauds and scams. With the increasing prevalence of online transactions, it has become easier for malicious individuals to gain access to your sensitive credit card information. In this section, I will discuss some essential steps you can take to ensure the safety and security of your credit card.

Keeping Your Credit Card Information Safe

One of the first steps to avoid credit card fraud is by safeguarding your credit card information. Never share your card details with anyone unless it is a trusted financial institution or a legitimate merchant. Be cautious when providing your credit card information over the phone or through email, as scammers often try to trick individuals into revealing their details.

Additionally, it is essential to protect your physical card. Keep it in a safe place, and never leave it unattended. Regularly monitor your card statements for any unauthorized charges, and report them immediately to your credit card issuer.

Verifying Online Merchants

Before making a purchase from an online merchant, take the time to verify their credibility. Look for secure payment options, such as SSL encryption, which ensures that your credit card details are protected during transmission. Check for customer reviews and ratings to get an idea of their reputation.

If an online merchant appears suspicious or offers deals that seem too good to be true, trust your instincts and avoid making a purchase. It is better to be safe than sorry when it comes to protecting your credit card information.

Reporting Suspicious Activities

If you notice any suspicious activities on your credit card, such as unauthorized charges or unfamiliar transactions, contact your credit card issuer immediately. They have dedicated fraud prevention departments that can assist you in resolving any issues and protecting your account from further unauthorized usage.

Remember, staying vigilant and proactive plays a crucial role in preventing credit card frauds and scams. By following these simple steps, you can enjoy the convenience of credit cards while ensuring the safety of your financial information. Stay informed and protect yourself from potential threats in the digital world.

Strategies to Pay Off Credit Card Debt

Snowball Method

One effective strategy to pay off credit card debt is the snowball method. With this approach, I recommend starting by paying off the credit card with the smallest balance. By focusing on the smallest debt first, you can quickly eliminate it, providing a sense of accomplishment and motivation. Once that debt is paid off, take the money you were putting towards it and apply it to the next smallest balance. This way, your payments “snowball” as you tackle larger and larger debts. It’s a great way to build momentum and stay motivated throughout the debt repayment process.

Avalanche Method

Another strategy to consider is the avalanche method. This approach requires you to prioritize your debts based on interest rates. Start by identifying the credit card with the highest interest rate, and allocate as much money as possible towards paying it off while making minimum payments on the other cards. Once that high-interest debt is gone, move on to the card with the next highest interest rate. By attacking high-interest debts first, you can save more money in the long run by minimizing the amount of interest you pay.

Debt Consolidation

Debt consolidation is a strategy that involves combining multiple credit card debts into one loan or a new credit card with a lower interest rate. This can make your debt more manageable and potentially save you money on interest payments. However, it’s important to do thorough research and read the terms and conditions carefully before pursuing this option. Debt consolidation may not be suitable for everyone, and it’s crucial to weigh the pros and cons and seek professional advice if needed.

Using these strategies can help you take control of your credit card debt and work towards a financially stable future. Remember to stay disciplined, create a budget, and avoid accumulating additional debt while you focus on paying off your credit cards. With determination and the right approach, you can become debt-free and enjoy the freedom of financial independence.

Conclusion

In conclusion, using credit cards wisely can be a valuable tool in living a frugal lifestyle. By maximizing rewards, avoiding unnecessary fees, and practicing responsible spending habits, you can make the most of your credit cards while staying within your budget.

Maximize Rewards

To make the most of your credit card rewards, research and choose cards that align with your spending habits and offer the best rewards programs. Take advantage of sign-up bonuses, cashback offers, and airline miles to save on everyday expenses and travel. Remember to pay off your balances in full each month to avoid interest charges and maximize the value of your rewards.

Avoid Unnecessary Fees

To stay frugal while using credit cards, it is crucial to avoid unnecessary fees. Be mindful of annual fees, foreign transaction fees, and late payment fees. Use credit cards with no annual fees or negotiate with your card issuer to have them waived. When traveling abroad, use credit cards that don’t charge foreign transaction fees. By eliminating these fees, you can keep more money in your pocket.

Practice Responsible Spending Habits

Credit cards are not an excuse to overspend. Use them as a tool for convenience and rewards, not as an opportunity to live beyond your means. Set a budget, track your expenses, and only charge what you can afford to pay off in full each month. This will prevent accumulating debt and paying unnecessary interest charges.

By following these frugal credit card strategies, you can make the most of your cards while staying within your budget. Remember to evaluate your credit card usage regularly to ensure you are maximizing rewards, avoiding fees, and practicing responsible spending habits. With thoughtful planning and discipline, credit cards can be a valuable tool in your frugal lifestyle. So go ahead, apply the tips mentioned above, and start using your credit cards wisely to save money and achieve your financial goals!