Are you looking for tips to save money and lead a more frugal lifestyle? Look no further! In this article, we will share with you the top 10 money-saving tips that you can start implementing today. By adopting these frugal habits, you’ll not only be able to stretch your budget further but also develop a more mindful approach towards your finances. From cutting down on unnecessary expenses to finding creative ways to save, we’ve got you covered. So, let’s dive right in and discover how you can live a more frugal life without compromising on the things you love.

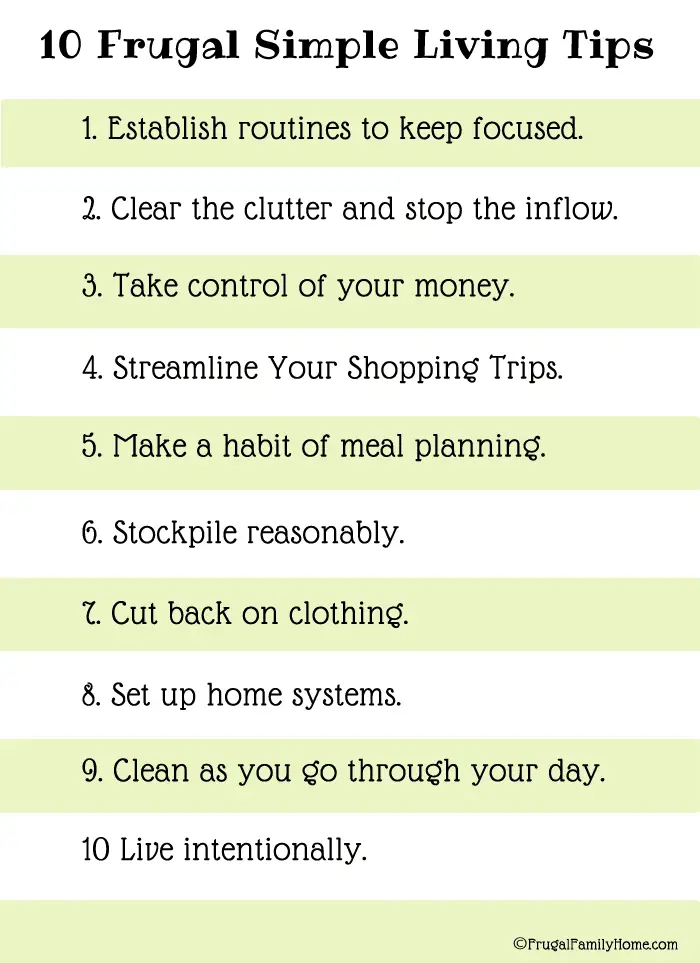

Top 10 Money-Saving Tips for a Frugal Lifestyle

Living a frugal lifestyle doesn’t mean sacrificing enjoyment or depriving yourself of the things you love. It’s about being mindful of your spending and making smart choices to stretch your hard-earned money further. By adopting these top 10 money-saving tips, you can embrace frugality without feeling deprived.

1. Create a Budget

The first step to a frugal lifestyle is creating a budget. Start by tracking your expenses for a month to get a clear picture of where your money is going. This will help you identify areas where you can cut back and make necessary adjustments. Once you have a better understanding of your spending habits, set saving goals to work towards.

– Track your expenses

Maintaining a record of all your expenses, big and small, can provide you with valuable insights into your spending habits. Keep a detailed log of every purchase you make, from groceries to entertainment, and categorize them for easy analysis.

– Identify areas to cut back on

Review your expense log and look for areas where you can reduce your spending. It could be dining out less frequently, cutting back on discretionary purchases, or finding more affordable alternatives for your everyday needs.

– Set saving goals

Setting specific, achievable saving goals can keep you motivated on your frugal journey. Whether you aim to save for a vacation, emergency fund, or future investments, having a target in mind will give your financial decisions a purpose and help you stay focused.

2. Save on Groceries

Groceries can be a major monthly expense, but with some smart planning and savvy shopping strategies, you can make a significant dent in your grocery budget.

– Plan meals in advance

Before heading to the grocery store, plan your meals for the week. Create a shopping list based on the ingredients you need, and stick to it. This will prevent impulse purchases and help you avoid wasting food.

– Use coupons and reward programs

Take advantage of coupons, discounts, and reward programs offered by stores. Sign up for loyalty cards, and keep an eye out for weekly specials and digital coupons. These small savings can add up over time.

– Buy in bulk

Consider buying non-perishable items in bulk. This can often result in substantial cost savings. Just be sure to compare prices and calculate the unit cost to ensure you’re getting the best deal.

– Grow your own food

If you have a green thumb, consider growing your own fruits, vegetables, and herbs. It not only saves money but provides you with fresh and organic produce right at your doorstep.

3. Reduce Utility Bills

Lowering your utility bills not only helps you save money but also reduces your environmental footprint. By making a few conscious changes, you can cut down on your energy consumption and save on these monthly expenses.

– Turn off lights and unplug electronics

Get into the habit of turning off lights when you leave a room and unplugging electronics when they’re not in use. Even in standby mode, electronics continue to draw power, known as phantom power, which can add up over time.

– Use energy-efficient appliances

Consider investing in energy-efficient appliances that bear the Energy Star label. These appliances are designed to consume less energy while still delivering top-notch performance. Over time, these upgrades can result in substantial savings on your utility bills.

– Lower your thermostat

In colder months, lower your thermostat by a degree or two and bundle up with an extra layer of clothing. In the summer, raise your thermostat slightly and use fans to supplement cooling. These small adjustments can have a significant impact on your energy consumption and savings.

– Insulate your home

Properly insulating your home helps maintain a comfortable temperature year-round, which reduces the strain on your heating and cooling systems. Insulation not only reduces your energy usage but can also qualify you for tax credits or utility rebates.

4. Cut Transportation Costs

Transportation costs can eat away at your budget, especially if you rely heavily on private vehicles. By exploring alternative modes of transportation and adopting some frugal habits, you can minimize your transportation expenses.

– Carpool or use public transportation

Carpooling with colleagues or using public transportation can significantly reduce your fuel expenses. Consider coordinating schedules with coworkers or using apps that connect commuters in your area. Public transportation can also be a cost-effective way to commute.

– Walk or bike for short distances

For short distances, consider walking or biking instead of driving. Not only will you save on fuel costs, but it’s also a great way to incorporate physical activity into your daily routine.

– Consolidate errands

Plan your errands efficiently to avoid unnecessary trips. Consolidating multiple tasks into one outing can save you time, money, and fuel. By combining your grocery shopping, dry cleaning drop-offs, and other errands, you’ll maximize your efficiency and minimize your expenses.

– Maintain your vehicle

Regular vehicle maintenance, such as keeping tires properly inflated and getting routine oil changes, can improve fuel efficiency. Taking care of your vehicle ensures it operates at its optimal performance level, reducing the risk of expensive repairs or breakdowns.

5. Ditch Expensive Habits

Certain habits can wreak havoc on your budget. By identifying and gradually eliminating these costly habits, you can significantly improve your long-term financial well-being.

– Quit smoking

Not only is smoking detrimental to your health, but it also burns a hole in your pocket. Quitting smoking not only saves you money on cigarettes but also reduces medical expenses and potential higher insurance premiums.

– Limit alcohol consumption

Alcohol can be costly, especially when consumed frequently. By limiting your alcohol consumption or opting for non-alcoholic alternatives, you can save a considerable amount of money over time.

– Cut back on eating out

Dining out can be a significant drain on your budget. Instead, try cooking more meals at home and exploring new recipes. Not only will this save you money, but it can also be a fun and rewarding experience.

– Reduce entertainment expenses

Reconsider expensive entertainment options and find cheaper or free alternatives. Instead of going to the movie theater, have a movie night at home with family or friends. Explore local parks and museums that offer free or discounted admission.

6. Shop Smartly

Shopping sensibly is a fundamental aspect of frugal living. By employing some smart shopping strategies, you can maximize your purchasing power and make your money go further.

– Compare prices and shop sales

Before making a purchase, compare prices across different retailers or online platforms. Take advantage of sales and promotional offers to secure the best price possible.

– Buy generic or store brand products

Consider buying generic or store brand products instead of name brands. In many cases, these products are of similar quality but at a lower price. Give them a try and see if you notice any difference.

– Avoid impulse purchases

Impulse purchases contribute to unnecessary spending. Before making a purchase, take a moment to evaluate if it’s a genuine need or a momentary want. Delaying gratification can help you avoid buyer’s remorse and save money.

– Wait for discounts or promotions

If there’s an item you’ve been eyeing, consider waiting for discounts or promotions. Sign up for newsletters or follow retailers on social media to stay informed about upcoming sales. Patience can often be rewarded with significant savings.

7. Reduce Housing Expenses

Housing expenses typically account for a significant portion of our budgets. By making strategic decisions and adopting frugal practices, you can reduce your housing costs without sacrificing comfort.

– Downsize or find a roommate

If your current living situation allows, downsizing to a smaller or more affordable property can cut your monthly expenses significantly. Alternatively, consider finding a roommate to share the rent or mortgage payments.

– Negotiate rent or mortgage payments

When renewing a lease or renegotiating a mortgage, don’t be afraid to negotiate for better terms. Research other similar properties in your area to understand the market rates and use that knowledge to your advantage.

– Conserve water and electricity

Being mindful of your water and electricity usage can result in substantial savings over time. Turn off taps while brushing your teeth, fix any leaks promptly, and unplug appliances when not in use. Opt for energy-efficient light bulbs and appliances to further reduce your utility bills.

– Consider alternative housing options

Explore alternative housing options that may offer cost savings without compromising your comfort. This could include downsizing to a tiny home, converting part of your property to a rental unit, or exploring co-housing communities.

8. Eliminate Debt

Escaping the burden of debt is essential for long-term financial stability. By adopting some debt-reducing strategies and focusing on a repayment plan, you can gradually eliminate debt and free up your financial resources.

– Pay off high-interest debts first

Prioritize paying off high-interest debts first, such as credit card balances or payday loans. These debts often have higher interest rates, which can accumulate quickly and keep you trapped in a cycle of debt.

– Consolidate loans or negotiate lower interest rates

Consider consolidating your debts into one manageable loan with a lower interest rate. Alternatively, contact your lenders to negotiate lower interest rates. Many financial institutions are willing to work with borrowers who demonstrate a commitment to repayment.

– Use cash instead of credit cards

Switch to a cash-based system for your day-to-day expenses. By using cash, you’ll have a better sense of your spending and can avoid accumulating more debt. Leave your credit cards at home to resist the temptation of impulse purchases.

– Create a repayment plan

Develop a structured repayment plan to systematically pay off your debts. Start by listing all your debts and determine how much you can allocate towards repayment each month. Prioritize your debts based on interest rates and devise a methodical strategy to eliminate them one by one.

9. Practice DIY

Learning to do things yourself can save you a significant amount of money in various aspects of your life. By developing some basic skills and embracing a Do-It-Yourself (DIY) mindset, you can tackle everyday tasks without incurring unnecessary expenses.

– Do basic home repairs yourself

Instead of calling a professional for every little repair or maintenance task, learn basic home repair skills. With the help of online tutorials or guidebooks, you can fix minor plumbing issues, replace light fixtures, or tackle simple carpentry tasks, saving on labor costs.

– Make homemade cleaners and beauty products

Rather than buying expensive cleaning products or beauty items, try making your own. There are countless recipes available online using common household ingredients like vinegar, baking soda, and essential oils. Not only are these products cost-effective, but they are also often more eco-friendly.

– Sew or mend clothes instead of buying new ones

Extend the life of your clothes by learning basic sewing and mending techniques. Instead of discarding items with minor tears or missing buttons, repair them yourself. With a sewing machine or a simple needle and thread, you can save money by increasing the longevity of your wardrobe.

10. Prioritize Free and Low-Cost Activities

Entertainment doesn’t have to come with a hefty price tag. By seeking out free or low-cost activities, you can still enjoy a fulfilling and enriching lifestyle without breaking the bank.

– Explore free local attractions and events

Your community likely offers a host of free or low-cost attractions and events. These can include art exhibitions, concerts, festivals, or outdoor activities. Take advantage of these opportunities to experience new things without straining your budget.

– Take advantage of community resources

Community centers, libraries, and parks often offer a range of resources and activities at little to no cost. Utilize these community resources to access books, fitness facilities, classes, or recreational programs that align with your interests.

– Engage in hobbies that don’t require spending

Discover hobbies or activities that don’t require significant financial investment. Whether it’s hiking, gardening, painting, or writing, there are countless ways to pursue your passions without splurging on expensive equipment or materials.

By combining these 10 money-saving tips and adopting a frugal mindset, you can gain better control over your finances and achieve your long-term goals. Remember, frugality is not about deprivation but rather making conscious choices that align with your values and priorities. Embrace the journey towards a frugal lifestyle, and you’ll reap the rewards of financial freedom, peace of mind, and increased resourcefulness.