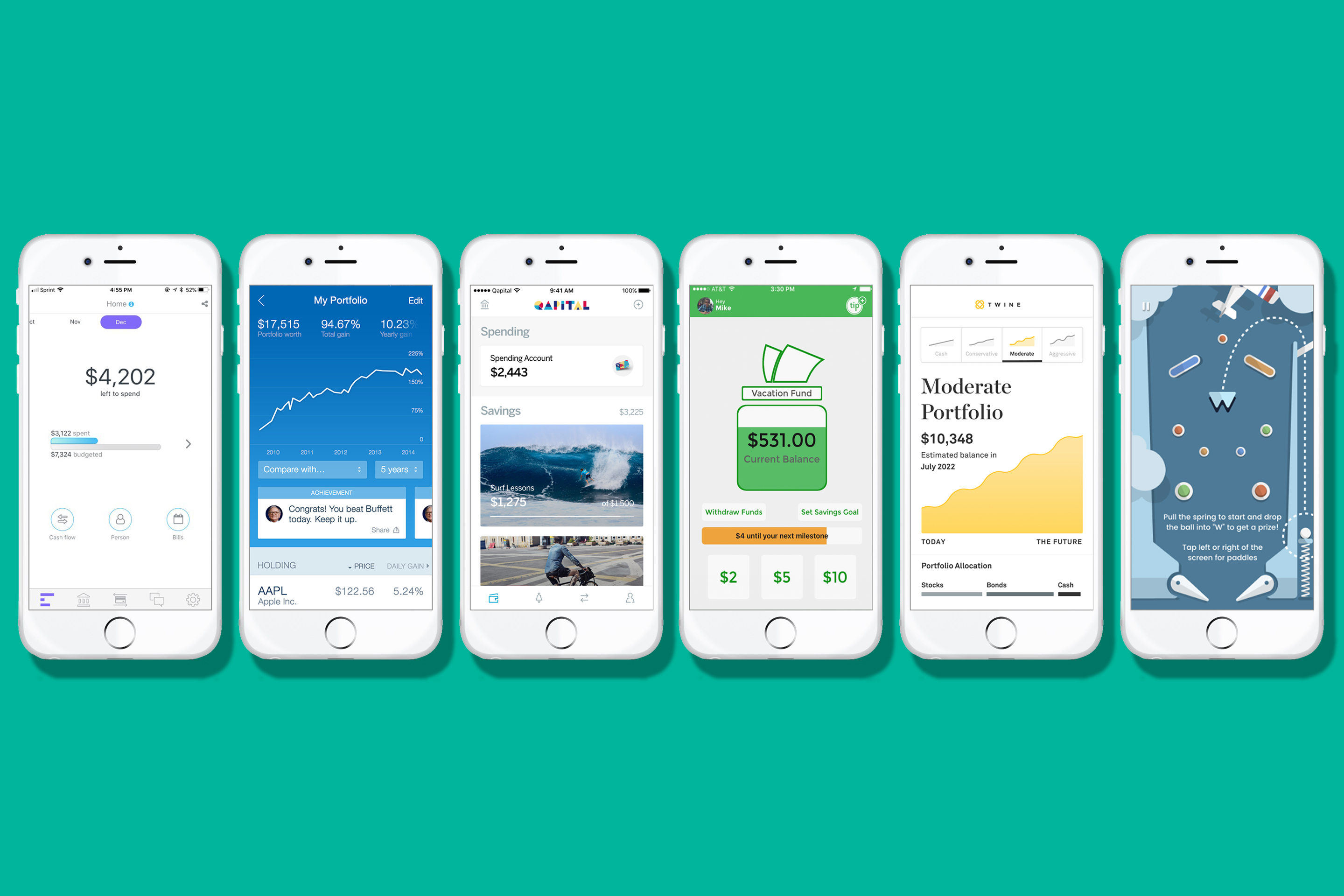

In this article, I will be discussing the top money management apps that can help you save money effectively. We will be exploring different app options that cater to a frugal lifestyle and provide you with the tools you need to stay on top of your finances. By the end of this article, you will have a better understanding of the best money management apps available and how they can benefit your saving goals. So, let’s dive in and discover these helpful apps!

Top Money Management Apps to Help You Save

As someone who strives for a frugal lifestyle, I understand the importance of effectively managing my finances. It can be a daunting task to keep track of expenses, create budgets, and achieve financial goals. That’s where money management apps come in handy. These apps not only simplify the process but also offer valuable insights and guidance to help you save money. In this article, I will discuss the benefits of using money management apps and highlight some of the top features to look for. Additionally, I will provide an overview of the 11 best money management apps that can assist you in your journey towards financial well-being.

Benefits of Using Money Management Apps

1. Track expenses in real-time

One of the significant benefits of using money management apps is the ability to track your expenses in real-time. With these apps, you can easily monitor your spending habits and gain a clear understanding of where your money is going. By categorizing your expenses, you can identify areas where you may be overspending and make necessary adjustments. Real-time expense tracking helps you stay on top of your financial situation and make informed decisions about your spending.

2. Set and monitor budget goals

Money management apps allow you to set and monitor budget goals effortlessly. Whether you want to save for a vacation, pay off debt, or build an emergency fund, these apps provide tools to help you achieve your financial objectives. By setting spending limits for different categories, you can stay within your budget and allocate funds accordingly. With regular updates and alerts, you can track your progress towards your budget goals and make adjustments as needed.

3. Receive personalized financial insights

Another valuable feature of money management apps is the ability to receive personalized financial insights. These apps use advanced algorithms and data analysis to provide you with a deeper understanding of your financial habits. They offer insights into your spending patterns, highlight areas where you can cut back, and suggest ways to save more effectively. By leveraging this information, you can make smarter financial decisions and improve your overall financial health.

Top Features to Look for in Money Management Apps

When choosing a money management app, it’s essential to consider the features it offers. Here are some of the top features to look for:

1. Expense tracking

A good money management app should have robust expense tracking capabilities. It should allow you to effortlessly enter and categorize your expenses so that you have a clear picture of your spending habits. Look for apps that offer automatic expense tracking and categorization to save you time and effort.

2. Budgeting tools

Comprehensive budgeting tools are crucial for effective money management. Look for apps that allow you to create customized budgets, set spending limits for different categories, and track your progress towards your budget goals. Some apps even provide budgeting recommendations based on your spending patterns.

3. Automatic bill payment reminders

Forgetting to pay bills can result in late fees and negative impacts on your credit score. Look for money management apps that offer automatic bill payment reminders to help you stay on top of your financial obligations. These reminders can be customized to your preferred frequency and can be set for specific bill due dates.

4. Financial goal setting

Setting financial goals is an important part of achieving financial success. Look for apps that provide tools and resources to help you set and track your financial goals. Whether it’s saving for a down payment on a house or paying off student loans, the app should offer features to help you stay motivated and on track towards achieving your goals.

5. Bank account integration

To effectively manage your finances, it’s crucial to have all your accounts in one place. Look for money management apps that offer bank account integration, allowing you to link your checking, savings, and credit card accounts. This integration simplifies the process of tracking your income and expenses and provides a comprehensive view of your financial situation.

6. Investment tracking

If you have investments, it’s important to choose an app that offers investment tracking features. Look for apps that allow you to monitor the performance of your investments, track dividends and interest, and provide insights into your portfolio. These tools can help you make informed decisions about your investment strategy.

7. Savings calculators

Saving money is a crucial part of managing your finances. Look for money management apps that provide savings calculators to help you determine how much you need to save for specific goals. These calculators take into account factors such as time frame, interest rates, and desired outcome to provide you with a clear savings plan.

Now that we have discussed the benefits of using money management apps and the essential features to look for, let’s delve into the top 11 money management apps available in the market.

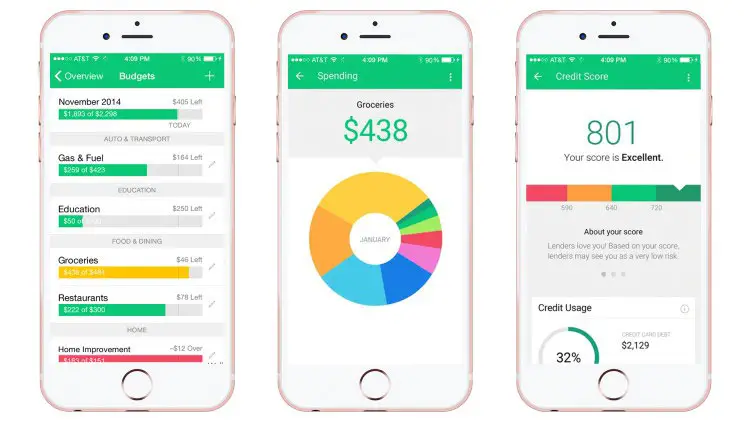

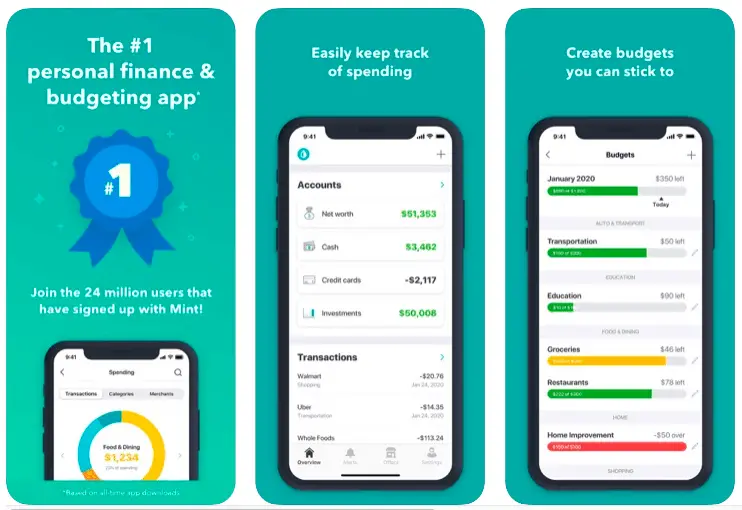

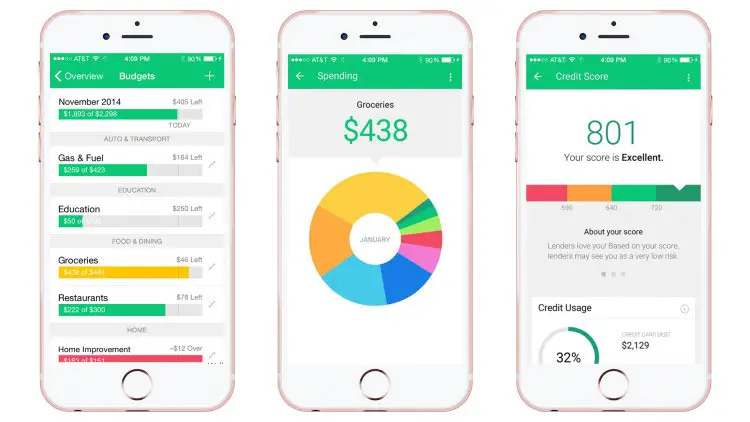

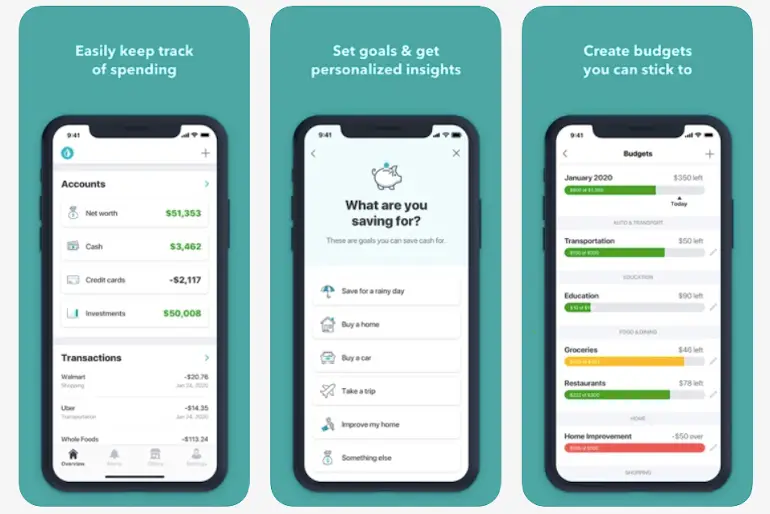

1. Mint

Overview of Mint

Mint is a popular money management app that offers a comprehensive set of features to help you track and manage your finances. It allows you to sync your bank accounts, credit cards, and investment accounts in one place, providing a holistic view of your financial situation. Mint is free to use and is available on both iOS and Android devices.

Expense tracking and categorization

Mint’s expense tracking feature allows you to effortlessly track your spending and categorize your expenses. It automatically imports and categorizes your transactions, saving you time and effort. You can create custom spending categories and set limits to stay within your budget. Mint also provides charts and graphs to visualize your spending habits.

Budget creation and tracking

With Mint, you can create personalized budgets based on your income and financial goals. The app analyzes your spending patterns and offers suggestions for budgeting in different categories. Mint sends alerts and notifications to keep you updated on your budget progress. You can easily make adjustments to your budget as needed.

Bill payment reminders

Mint helps you stay on top of your bills by providing automatic bill payment reminders. You can set up bill alerts for specific due dates, ensuring you never miss a payment. Mint also offers a bill tracking feature that allows you to see your upcoming bills and the amount due.

Credit score monitoring

Mint provides free credit score monitoring, allowing you to keep track of your credit health. It offers insights into factors that impact your credit score and provides tips on how to improve it. Mint also sends alerts when there are changes to your credit score, helping you stay informed.

2. Personal Capital

Overview of Personal Capital app

Personal Capital is a comprehensive money management app designed for those who want to track their finances and investments in one place. It offers features such as investment tracking, retirement planning tools, and fee analysis for investment accounts. Personal Capital is free to use, with premium services available for a fee. The app is available on both iOS and Android devices.

Investment tracking and analysis

Personal Capital’s investment tracking feature allows you to monitor the performance of your investment portfolio. It provides real-time updates on your holdings, including stocks, bonds, mutual funds, and more. The app also offers detailed analysis and visualizations to help you make informed decisions about your investments.

Retirement planning tools

Planning for retirement is crucial for long-term financial security. Personal Capital provides robust retirement planning tools that allow you to set retirement goals, estimate your future income needs, and track your progress. The app offers insights and recommendations to help you optimize your retirement savings strategy.

Fee analyzer for investment accounts

Investment fees can eat into your returns over time. Personal Capital’s fee analyzer feature helps you identify and understand the fees associated with your investment accounts. It provides a breakdown of the fees you are paying and offers suggestions on how to reduce them.

Net worth tracking

Personal Capital allows you to track your net worth by syncing all your accounts, including bank accounts, investment accounts, and liabilities. The app provides a real-time view of your net worth and helps you visualize the progress you are making towards your financial goals.

3. You Need a Budget (YNAB)

Introduction to YNAB

You Need a Budget, also known as YNAB, is a popular budgeting app that follows the zero-based budgeting approach. This approach means that every dollar you earn is assigned a job, whether it’s for bills, savings, or everyday expenses. YNAB offers a proactive approach to budgeting and focuses on helping you break the paycheck-to-paycheck cycle. The app is available on both iOS and Android devices, with a subscription fee required to use the service.

Zero-based budgeting approach

YNAB’s zero-based budgeting approach ensures that every dollar you earn has a specific purpose. The app helps you allocate your income towards different categories such as housing, transportation, groceries, and more. By assigning your money a job, you are better able to track and manage your spending.

Goal tracking and progress visualization

YNAB allows you to set spending and savings goals to help you stay on track towards your financial objectives. The app provides visualizations and progress reports to keep you motivated and engaged in achieving your goals. YNAB also offers insights and tips to help you save more effectively.

Debt paydown strategies

If you have debt, YNAB provides strategies to help you pay it down faster. The app allows you to enter your debt accounts and provides tools to prioritize and allocate funds towards debt repayment. YNAB helps you track your progress and offers guidance on how to become debt-free.

Educational resources

YNAB offers a wealth of educational resources to help you improve your financial literacy. The app provides articles, videos, and online classes on topics such as budgeting, saving, investing, and more. YNAB’s educational resources are designed to empower you to make informed financial decisions.

4. PocketGuard

Overview of PocketGuard

PocketGuard is a user-friendly money management app that focuses on helping you make smarter financial decisions. The app provides real-time updates on your spending and offers insights into your financial health. PocketGuard is free to use, with premium features available for a fee. The app is available on both iOS and Android devices.

Automated expense tracking and categorization

PocketGuard automatically tracks your expenses by syncing with your bank accounts, credit cards, and other financial institutions. It categorizes your transactions and provides a clear overview of your spending. The app also offers a budgeting feature that helps you set spending limits and alerts you when you’re approaching them.

Smart budgeting with custom categories

PocketGuard’s smart budgeting feature allows you to create custom spending categories based on your financial priorities. You can allocate funds for bills, groceries, entertainment, and more. The app provides insights into your spending patterns and offers suggestions on how to optimize your budget.

Bill tracking and timely reminders

Missing bill payments can lead to late fees and negatively impact your credit score. PocketGuard helps you stay on top of your bills by providing timely reminders and alerts. You can link your bill providers to the app, ensuring you stay organized and never miss a payment.

Bank account syncing

PocketGuard syncs with your bank accounts, allowing you to view all your financial transactions in one place. This synchronization provides a comprehensive view of your financial situation and helps you make informed decisions about your money. PocketGuard uses bank-level security to protect your sensitive information.

5. Albert

Introduction to Albert app

Albert is an all-in-one financial app that offers features such as smart savings automation, financial health analysis, overdraft protection, and expert investment advice. The app aims to help you improve your financial well-being and provides personalized recommendations based on your financial situation. Albert is available for free, with premium features available for a fee. The app is available on both iOS and Android devices.

Smart savings automation

Albert’s smart savings feature analyzes your income and spending patterns and automatically sets aside money for savings. The app determines the right amount to save based on your financial goals and helps you build an emergency fund or save for specific purposes. You can also set custom savings goals and track your progress.

Financial health analysis

Albert offers a comprehensive financial health analysis that evaluates your income, spending, and saving habits. The app provides insights into your financial strengths and weaknesses and offers guidance on how to improve your financial situation. Albert’s analysis takes into account factors such as debt, income stability, and savings rate.

Overdraft protection

Overdraft fees can add up and disrupt your financial stability. Albert offers overdraft protection by monitoring your bank account balance and providing alerts when you’re at risk of overdrawing. The app helps you avoid unnecessary fees and keeps you informed about the state of your finances.

Expert investment advice

If you’re looking for investment advice, Albert offers access to human financial advisors who can provide personalized guidance. The app allows you to ask questions and get expert recommendations based on your investment goals and risk tolerance. This feature is available as part of Albert’s premium service.

6. Clarity Money

Overview of Clarity Money

Clarity Money is a money management app that focuses on helping you take control of your finances. The app offers features such as expense tracking, bill negotiation, subscription cancellation, and credit score monitoring. Clarity Money is free to use and is available on both iOS and Android devices.

Expense tracking and categorization

Clarity Money allows you to effortlessly track and categorize your expenses. The app automatically imports and categorizes your transactions, saving you time and effort. You can create custom expense categories and set budget limits to stay within your financial goals. Clarity Money provides visualizations and insights into your spending habits.

Bill negotiation

Paying bills can be a significant expense, but Clarity Money helps you save money by negotiating lower rates for your bills. The app analyzes your bills and identifies opportunities for savings. Clarity Money’s bill negotiation feature contacts your service providers on your behalf and negotiates reduced rates or better terms.

Subscription cancellation

Unwanted subscriptions can quickly eat into your budget. Clarity Money identifies your recurring subscriptions and offers an easy way to cancel them. The app provides a list of your subscriptions, including details such as cost and billing cycle. You can cancel subscriptions directly through the app, saving you time and effort.

Credit score monitoring

Clarity Money provides free credit score monitoring, helping you stay on top of your credit health. The app offers insights into factors that impact your credit score and provides suggestions on how to improve it. Clarity Money sends alerts when there are changes to your credit score, keeping you informed and empowered.

7. Goodbudget

Introduction to Goodbudget

Goodbudget is a budgeting app that follows the envelope budgeting system. The app helps you allocate funds to different budget categories and gives you a clear overview of your spending habits. Goodbudget is available for free, with premium features available for a fee. The app is available on both iOS and Android devices.

Envelope budgeting system

Goodbudget’s envelope budgeting system allows you to assign funds to different categories through virtual envelopes. You can create envelopes for expenses such as groceries, entertainment, transportation, and more. When you spend money, you can track it by deducting from the corresponding envelope. Goodbudget provides visualizations to help you stay within your budget limits.

Shared budgeting with family or friends

If you share expenses with family or friends, Goodbudget offers a shared budgeting feature. The app allows you to sync your budget with others, ensuring everyone is on the same page. This feature is especially useful for couples or roommates who want to track and manage their shared expenses.

Expense syncing across devices

Goodbudget syncs your expenses across multiple devices, allowing you to manage your budget wherever you go. Whether you’re using a smartphone, tablet, or computer, your budget data is always up to date. Goodbudget also provides cloud backup, ensuring your financial information is secure and accessible.

Report generation

Goodbudget offers reporting capabilities that allow you to analyze your spending habits over time. You can generate reports to visualize your spending by category or time period. These insights provide a deeper understanding of your financial habits and help you make more informed financial decisions.

8. Wally

Overview of Wally app

Wally is a user-friendly money management app that offers features such as quick expense tracking, foreign currency conversion, smart notifications, and data backup and sync. The app focuses on simplicity and ease of use, making it ideal for those who want a straightforward way to manage their finances. Wally is available for free, with premium features available for a fee. The app is available on both iOS and Android devices.

Quick expense tracking

Wally allows you to quickly enter and categorize your expenses with just a few taps. The app offers a simple and intuitive interface that makes expense tracking effortless. You can add details such as date, amount, and category for each expense. Wally’s quick expense tracking feature saves you time and allows you to focus on managing your money.

Foreign currency conversion

If you often travel abroad or deal with foreign currencies, Wally offers a foreign currency conversion feature. The app provides up-to-date exchange rates and allows you to enter expenses in different currencies. Wally automatically converts your expenses to your home currency, giving you a clear understanding of how much you’re spending.

Smart notifications and reminders

Wally provides smart notifications and reminders to help you stay on top of your finances. The app sends alerts when you’re approaching budget limits or when bills are due. Wally’s reminders ensure you never miss a payment or exceed your budget.

Data backup and sync

Wally offers data backup and synchronization, ensuring your financial information is secure and accessible across devices. You can sync your data with multiple devices, allowing you to manage your finances wherever you are. Wally also offers cloud backup, giving you peace of mind knowing your information is safe.

9. Spendee

Introduction to Spendee

Spendee is a comprehensive money management app that helps you track your expenses, analyze your spending habits, and set financial goals. The app offers features such as real-time expense tracking, expense sharing and splitting, bill tracking, and insightful visualizations. Spendee is available for free, with premium features available for a fee. The app is available on both iOS and Android devices.

Real-time expense tracking

Spendee’s real-time expense tracking feature allows you to effortlessly track your spending. The app automatically imports your transactions and categorizes them for easy tracking. You can add cash expenses manually and split transactions between multiple categories. Spendee provides visualizations to help you understand your spending patterns.

Expense sharing and splitting

If you share expenses with family or friends, Spendee offers a feature that allows you to split expenses and track who owes whom. The app calculates the amount owed by each person and provides a clear overview of your shared expenses. Spendee ensures you stay organized and settle shared expenses without confusion.

Bill tracking and reminders

Spendee helps you stay on top of your bills by providing bill tracking and reminders. The app allows you to enter your upcoming bills and the amount due. Spendee sends reminders when bills are due, ensuring you never miss a payment.

Insightful visualizations

Spendee provides insightful visualizations that help you understand your financial habits at a glance. The app offers charts, graphs, and reports to help you analyze your spending patterns and identify areas where you can save. These visualizations give you a clear picture of your financial situation and assist you in making informed financial decisions.

10. Honeydue

Overview of Honeydue

Honeydue is a money management app designed for couples who want to track and manage their finances together. The app offers features such as joint bank account tracking, bill reminders and shared budgeting, expense notifications, and a chat feature for financial discussions. Honeydue is available for free, with premium features available for a fee. The app is available on both iOS and Android devices.

Joint bank account tracking

Honeydue allows couples to track their joint bank accounts and individual accounts in one place. The app syncs with multiple financial institutions, providing a comprehensive view of your combined finances. Honeydue’s joint bank account tracking feature allows you to easily monitor income, expenses, and balances.

Bill reminders and shared budgeting

Honeydue helps couples stay on top of their bills by providing bill reminders and shared budgeting features. The app sends alerts when bills are due, ensuring you never miss a payment. Honeydue also allows you to create shared budgets and allocate funds between different categories. This collaboration feature keeps both partners informed and engaged in managing their finances.

Expense notifications

Honeydue sends expense notifications to keep you updated on your spending. The app alerts you when new expenses are recorded, allowing you to stay informed about the state of your finances. Honeydue’s expense notifications help you create transparency and foster open communication about your financial habits.

Chat feature for financial discussions

Honeydue offers a chat feature that allows couples to discuss and make decisions about their finances. The app provides a secure and private space for financial discussions, ensuring both partners have a voice in managing their money. Honeydue’s chat feature promotes transparency and fosters a healthy financial relationship.

11. Acorns

Introduction to Acorns app

Acorns is a unique money management app that focuses on automated investing through spare change. The app rounds up your everyday purchases to the nearest dollar and invests the difference in a diversified portfolio of low-cost exchange-traded funds (ETFs). Acorns offers features such as portfolio diversification, round-up investments, and educational resources. The app is available for free, with premium features available for a fee. Acorns is available on both iOS and Android devices.

Automated investing through spare change

Acorns’ automated investing feature allows you to grow your savings effortlessly. The app rounds up your everyday purchases to the nearest dollar and invests the spare change in a portfolio of ETFs. Acorns offers a range of investment options based on your financial goals and risk tolerance. This feature helps you build long-term wealth through small, consistent investments.

Portfolio diversification

Acorns provides portfolio diversification to reduce risk and maximize returns. The app offers a selection of diversified portfolios designed by investment professionals. These portfolios are tailored to different risk levels and investment goals. Acorns regularly rebalances your portfolio to maintain its target allocation.

Round-up investments

Acorns’ round-up investments allow you to invest spare change from your everyday purchases. Whether it’s a cup of coffee or a meal, Acorns automatically rounds up your purchase to the nearest dollar and invests the difference. This feature harnesses the power of small, regular investments to help you build wealth over time.

Educational resources

Acorns offers a range of educational resources to help you improve your financial literacy. The app provides articles, videos, and online classes on topics such as investing, saving, and retirement planning. Acorns’ educational resources are designed to empower you to make informed financial decisions and achieve long-term financial success.

Conclusion

Choosing the right money management app can make a significant difference in your financial journey. These apps provide the tools and insights you need to take control of your finances, improve saving habits, and achieve financial peace of mind. Whether you’re looking to track your expenses, create budgets, or invest for the future, there is a money management app out there that suits your needs. By leveraging the benefits and features of these apps, you can embark on a path towards financial well-being and make significant progress in achieving your financial goals. So, why wait? Start exploring the top money management apps today and take the first step towards a brighter financial future.