Have you ever wondered how much it really costs to own something? I mean, sure, you know the price tag when you buy it, but what about all the other expenses that come along with it? That’s what we’re going to uncover today – the true cost of ownership and how having less can actually be more.

When it comes to living a frugal lifestyle, it’s all about understanding the hidden costs that come with owning things. Take, for example, a car. Sure, you may have bought it at a great price, but what about the insurance, gas, maintenance, and repairs? All those expenses can quickly add up and eat into your wallet.

But it’s not just big-ticket items like cars that have hidden costs. Even the small things we own can drain our bank accounts. Think about all the clothes in your closet that you barely wear, or the kitchen gadgets that collect dust on your counter. These items may have seemed like a good idea at the time of purchase, but if you really break it down, you’ll realize that owning less can actually save you money.

So, in this article, we’re going to dive deep into the true cost of ownership. We’ll explore different areas of our lives, from housing and transportation to clothing and accessories, and uncover the hidden expenses that come with owning more. By the end, you’ll have a better understanding of how having less can actually be more beneficial, not just for your bank account, but for your overall well-being. So, let’s get started on this journey of uncovering the true cost of ownership.

Uncovering the True Cost of Ownership: How Less Can Be More

As a consumer society, we are constantly bombarded with advertisements and messages telling us that more is better. We are led to believe that owning more possessions will make us happier and more fulfilled. But what if I told you that this mindset is not only misleading, but also detrimental to our overall well-being?

In today’s article, I want to shed light on the concept of the true cost of ownership and how embracing a frugal lifestyle can actually lead to greater financial, health, and environmental benefits. By understanding the hidden costs of our possessions, evaluating the role of quality in cost of ownership, recognizing the hidden costs of convenience, and breaking free from consumerism, we can uncover a simpler, more fulfilling way of life.

Understanding the concept of true cost

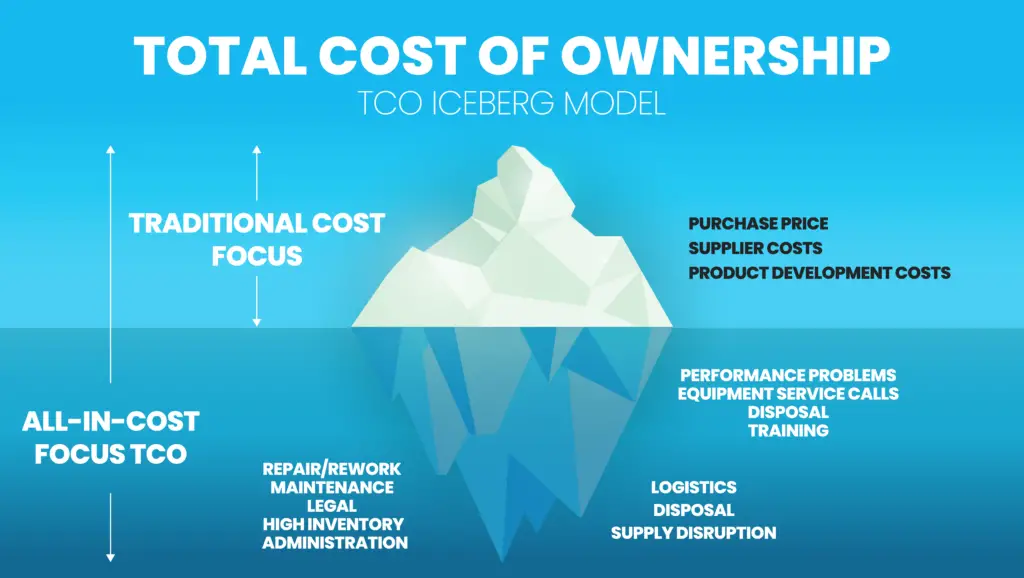

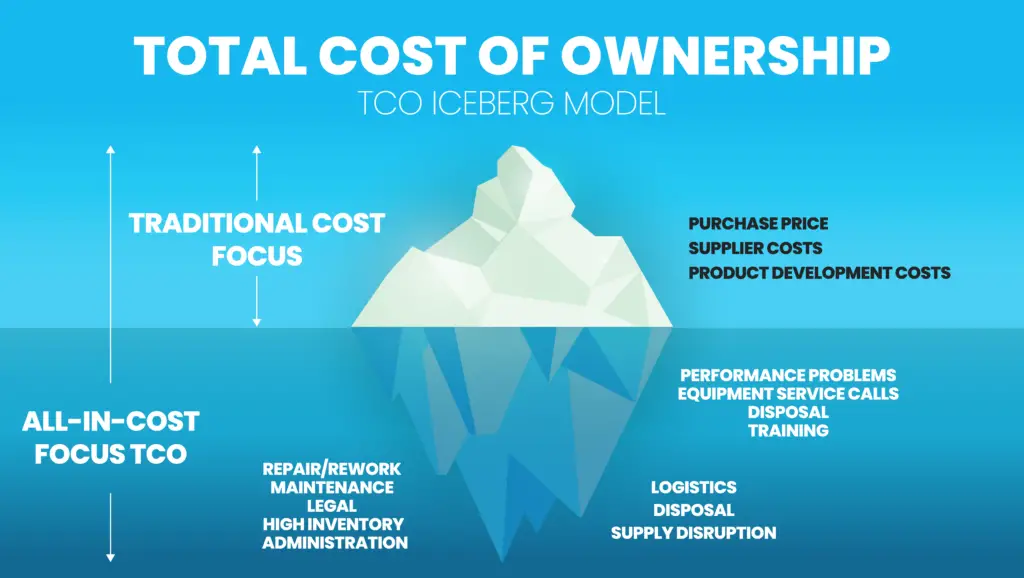

Before we delve into the specifics, let’s first define what we mean by the true cost of ownership. The true cost of ownership refers to the total expenses associated with a particular possession over its lifespan. It goes beyond the initial purchase price and takes into account factors such as maintenance, repairs, depreciation, and even the impact on our overall well-being.

When we only consider the upfront cost of an item, we often overlook the long-term expenses associated with it. By understanding the true cost, we gain a clearer picture of the financial implications of our purchasing decisions.

Factors influencing the true cost

Several factors influence the true cost of ownership. One of the most important factors is the quality of the product. Higher quality items may have a higher upfront cost, but they often require less maintenance and are more durable, resulting in lower long-term costs.

Another factor to consider is convenience. Convenience is a highly valued attribute in our fast-paced society, but it often comes at a price. Opting for convenience can lead to higher expenses, both financially and in terms of our health and well-being.

Lastly, depreciation plays a significant role in the true cost of ownership. Many possessions lose value over time, making them less valuable and more costly to maintain or repair.

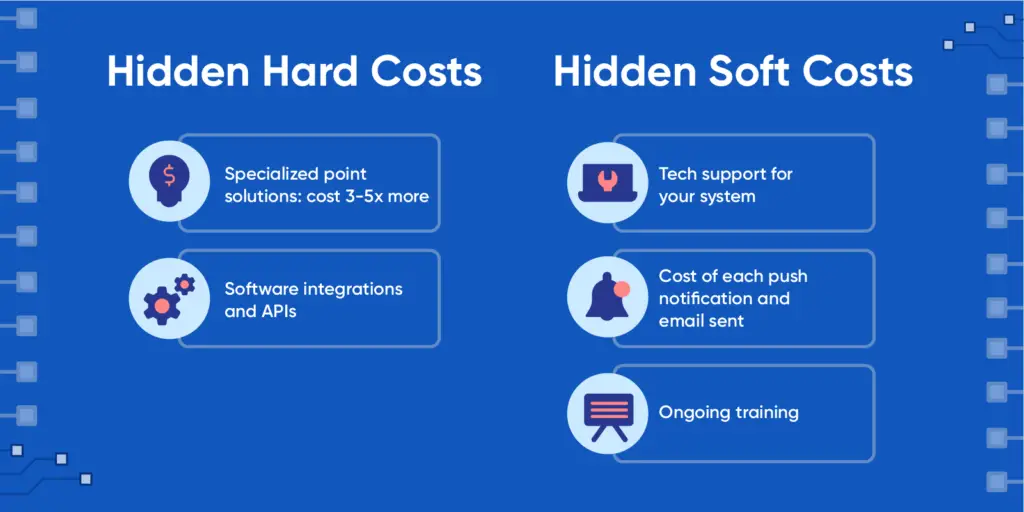

Examples of hidden costs

To truly understand the true cost of ownership, let’s explore some examples of hidden costs. Take the example of owning a car. The initial purchase price of a car might seem affordable, but when you factor in fuel costs, insurance premiums, regular maintenance, and occasional repairs, the true cost becomes much higher.

Similarly, technology is another area where hidden costs can add up. Upgrades, repairs, and the rapid obsolescence of devices can lead to significant expenses over time. What may seem like a bargain at the moment of purchase can become a burden in the long run.

The benefits of a frugal lifestyle

Now that we have a better understanding of the concept of true cost, let’s explore the benefits of embracing a frugal lifestyle. Frugal living is about making intentional choices to maximize value and minimize waste. Contrary to popular belief, living frugally doesn’t mean depriving ourselves; rather, it’s about finding fulfillment in simplicity and mindfulness.

Introduction to frugal living

Living frugally means being intentional with our purchases and prioritizing our needs over our wants. It involves finding value in the things that truly matter and finding joy in the experiences rather than material possessions.

Financial advantages of a frugal lifestyle

One of the most obvious benefits of a frugal lifestyle is the financial advantage it provides. By consciously evaluating our purchases and focusing on the true cost of ownership, we can save a significant amount of money in the long run. This money can be put towards financial goals, such as paying off debt, saving for the future, or pursuing our passions.

Health and environmental benefits

Living frugally not only benefits our wallets but also our health and the environment. By consuming less and prioritizing quality over quantity, we reduce waste and minimize our impact on the planet. Additionally, by focusing on experiences rather than material possessions, we find greater satisfaction and fulfillment, leading to improved mental and emotional well-being.

Evaluating the true cost of possessions

Now that we understand the benefits of a frugal lifestyle, let’s delve deeper into evaluating the true cost of our possessions. By analyzing the initial purchase price, considering maintenance and repair expenses, and understanding the impact of depreciation, we can make more informed purchasing decisions.

Analyzing initial purchase price vs. long-term costs

When making a purchase, it’s essential to look beyond the initial price tag. Consider how long the item is likely to last and the cost of maintaining it over time. By taking these factors into account, we can make smarter decisions and avoid being blindsided by unexpected expenses.

Consideration of maintenance and repair expenses

Maintenance and repair expenses are often overlooked when calculating the true cost of ownership. Regular upkeep, such as servicing a car or maintaining appliances, can add up over time. By factoring in these costs, we can better understand the financial implications of ownership.

Impact of depreciation on overall cost

Depreciation is another significant factor in the true cost of ownership. Many possessions lose value over time, making them less valuable and more costly to maintain or repair. By considering the rate of depreciation, we can make wiser choices and avoid investing in items that rapidly lose their value.

The role of quality in cost of ownership

When evaluating the true cost of ownership, quality plays a crucial role. Higher quality items may have a higher upfront cost, but they often prove to be more cost-effective in the long run. Let’s explore the relationship between quality and cost and how investing in higher quality can save money.

Understanding the relationship between quality and cost

In general, higher quality items tend to have a longer lifespan and require less maintenance and repairs. While they may come with a higher price tag initially, their durability and longevity ultimately make them more cost-effective over time.

How investing in higher quality can save money

Investing in higher quality items may require a larger upfront investment, but it can save us money in the long run. By opting for superior craftsmanship and materials, we reduce the need for frequent replacements and repairs, which can add up to significant savings over time.

Long-term value vs. short-term savings

While it may be tempting to opt for cheaper alternatives in the short term, it’s important to consider the long-term value of our purchases. By investing in higher quality items, we can enjoy their benefits for longer, ultimately providing us with greater value and saving us money in the long run.

The hidden costs of convenience

In our fast-paced society, convenience is often valued above all else. However, convenience comes at a price, both financially and in terms of our health and lifestyle. Let’s explore the hidden costs of convenience and how they impact our overall cost of ownership.

Exploring the convenience factor

Convenience is all about saving time and effort. It’s the allure of having things done quickly and effortlessly. While convenience may seem enticing, it often leads to higher expenses and missed opportunities for personal growth and self-sufficiency.

Financial implications of opting for convenience

Opting for convenience often comes with a higher price tag. From pre-packaged meals and fast food to hiring professionals for household tasks, convenience can significantly increase our expenses. By recognizing the financial implications of these choices, we can make more conscious decisions and prioritize value over convenience.

Health and lifestyle consequences

Convenience often encourages a sedentary lifestyle and an overreliance on processed and unhealthy foods. By constantly seeking convenience, we compromise our health and well-being. By being mindful of the hidden costs of convenience, we can make healthier choices that benefit us in the long run.

Dealing with impulse purchases

Impulse buying can be a significant obstacle when it comes to understanding the true cost of ownership. The psychology behind impulse buying, the strategies to avoid impulsive spending, and the long-term financial impact of impulsive purchases are all important considerations.

Understanding the psychology behind impulse buying

Impulse buying is often driven by emotion rather than rational thinking. Retailers capitalize on our desires and impulses, tempting us with limited-time offers and sales. Understanding the psychological factors that influence impulse buying can help us make more informed and intentional purchasing choices.

Implementing strategies to avoid impulsive spending

Avoiding impulse buying requires conscious effort and self-control. By setting a budget, making shopping lists, and waiting before making a purchase, we can resist the temptation to make impulsive decisions. These strategies can help us prioritize our needs over our wants and avoid unnecessary expenses.

Long-term financial impact of impulsive purchases

Impulse purchases may provide momentary satisfaction, but they often have long-term financial repercussions. By assessing the true cost of ownership and understanding the consequences of impulsive spending, we can make better choices and achieve greater financial stability.

Breaking free from consumerism

Consumerism has become deeply ingrained in our society, leading us to prioritize material possessions over experiences and creating a sense of emptiness. To uncover the true cost of ownership, we must break free from the grasp of consumerism and embrace a more minimalist mindset.

Examining the impact of consumerism on society

Consumerism promotes a culture of excess and overconsumption. It perpetuates the belief that happiness and fulfillment can be found through material possessions. However, this mindset is unsustainable and has detrimental effects on our environment and overall well-being.

Adopting a minimalist mindset

Minimalism offers an alternative to the consumerist mindset. It encourages us to reevaluate our relationship with possessions and prioritize what truly matters. By adopting a minimalist mindset, we can free ourselves from the constant desire for more and find joy and contentment in simplicity.

Finding satisfaction in experiences over material possessions

When we shift our focus from material possessions to experiences, we discover a newfound sense of fulfillment. Experiences create lasting memories and bring us closer to the people and things that truly matter. By embracing a minimalist approach, we can find satisfaction in moments rather than things.

The importance of conscious consumption

Conscious consumption involves making informed choices as a consumer. By supporting sustainable and ethical practices, we can create a positive impact on the world around us. Let’s explore the significance of conscious consumption and how it can shape a more sustainable and ethical future.

Making informed choices as a consumer

As consumers, we have the power to shape the market by supporting businesses and products that align with our values. By researching and understanding the impact of our purchases, we can make more informed choices that promote sustainability and ethical practices.

Supporting sustainable and ethical practices

Sustainability and ethics should be at the forefront of our purchasing decisions. By supporting businesses that prioritize sustainable sourcing, fair labor practices, and environmentally friendly production methods, we can contribute to a more just and sustainable world.

Creating a positive impact through mindful consumption

Mindful consumption involves being intentional with our purchases and considering the broader impact of our choices. By living a more conscious and mindful life, we can create a positive ripple effect and inspire others to do the same. Together, we can shape a more sustainable and ethical future.

How to calculate the true cost of ownership

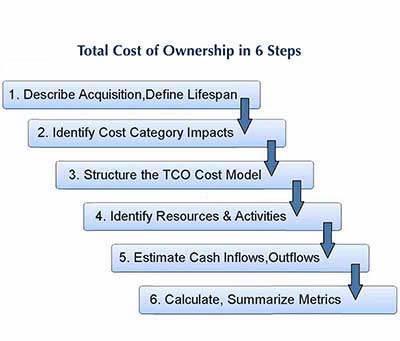

Now that we understand the importance of the true cost of ownership, let’s explore how to calculate it. By following a step-by-step guide to assessing costs, identifying and quantifying hidden expenses, and determining the overall cost of ownership, we can make more informed and value-driven purchasing decisions.

Step-by-step guide to assessing costs

To calculate the true cost of ownership, start by determining the initial purchase price. Then, consider the expected lifespan of the item and the estimated maintenance and repair expenses. Finally, factor in the rate of depreciation to arrive at the overall cost of ownership.

Identifying and quantifying hidden expenses

Hidden expenses, such as maintenance, repairs, and depreciation, can significantly impact the true cost of ownership. By identifying and quantifying these expenses, we gain a comprehensive understanding of the financial implications of owning a particular possession.

Determining the overall cost of ownership

To determine the overall cost of ownership, add up the initial purchase price, maintenance and repair expenses, and the estimated depreciation. This final number provides a more accurate representation of the true cost and allows for more informed decision-making.

Embracing minimalism for financial freedom

One of the key principles of living a frugal and mindful lifestyle is embracing minimalism. Minimalism is about intentionally simplifying our lives by removing excess and focusing on what truly brings us joy and fulfillment. Let’s explore the benefits of simplifying our lives and how it can lead to financial independence.

Understanding the principles of minimalism

Minimalism is not about depriving ourselves, but about finding purpose and joy in the things that truly matter. It involves decluttering our physical and mental space, prioritizing experiences over possessions, and embracing a simpler, more intentional way of life.

Benefits of simplifying one’s life

By simplifying our lives, we can reduce stress and overwhelm. Having fewer possessions allows us to focus on what truly matters and frees up time and energy for the things that bring us joy. Additionally, by reducing our expenses, we can achieve greater financial stability and freedom.

Achieving financial independence through minimalism

Minimalism provides a path towards financial independence by eliminating unnecessary expenses and focusing on our true values. By living below our means and intentionally saving and investing, we can create a secure financial future and have the freedom to pursue our passions and dreams.

Examples of true cost of ownership in everyday life

To illustrate the concept of the true cost of ownership, let’s explore some examples in everyday life. From cars to technology, understanding the hidden costs associated with these possessions can help us make more informed decisions and prioritize value over frivolous spending.

Cars: fuel, insurance, maintenance

Owning a car involves more than just the upfront purchase price. Fuel costs, insurance premiums, regular maintenance, and occasional repairs should all be considered in the overall cost of ownership. By factoring in these expenses, we can make wiser decisions when it comes to choosing a vehicle or deciding whether car ownership is necessary.

Technology: upgrades, repairs, obsolescence

Technology is another area where the true cost of ownership can easily be overlooked. Upgrades, repairs, and the rapid obsolescence of devices can lead to significant expenses over time. By considering the long-term costs associated with technology, we can make more conscious choices and avoid unnecessary expenses.

Balancing value and cost in purchasing decisions

When making purchasing decisions, it’s crucial to evaluate value beyond monetary cost. By considering long-term satisfaction, utility, and the overall impact on our well-being and the environment, we can find the sweet spot for optimal value. It’s about striking a balance between what we need, what brings us joy, and what aligns with our values.

Evaluating value beyond monetary cost

Value is subjective and goes beyond monetary cost. It involves considering the joy, utility, and longevity of a possession. By evaluating value holistically, we can make more informed choices that align with our priorities and values.

Considering long-term satisfaction and utility

When making a purchase, it’s important to consider the long-term satisfaction and utility of a possession. Will it truly enhance our lives and bring us lasting joy? By prioritizing long-term satisfaction over short-term gratification, we can make wiser choices that align with our true desires.

Finding the sweet spot for optimal value

strive to find the sweet spot where value and cost intersect. It’s about finding the optimal balance between cost and value, considering factors such as quality, durability, and the overall impact on our lives and the environment. By striking this balance, we can make purchases that provide us with the most value and satisfaction.

Educating future generations about true cost

In our quest for a more sustainable and mindful future, it’s essential to educate future generations about the true cost of ownership. By teaching children about responsible consumption, instilling financial literacy and critical thinking skills, and empowering the next generation, we can lay the foundation for a more sustainable future.

Teaching children about responsible consumption

Early education plays a crucial role in shaping the values and behaviors of future generations. By teaching children about responsible consumption and the true cost of ownership, we can help them develop a more mindful and responsible approach to consumerism.

Instilling financial literacy and critical thinking

Financial literacy and critical thinking are invaluable skills that help individuals make informed decisions in all aspects of life. By instilling these skills in our children, we empower them to navigate the complexities of the consumer society and make wise choices that align with their values.

Empowering the next generation for a sustainable future

By educating future generations about the true cost of ownership, we inspire them to question societal norms and make conscious choices that contribute to a more sustainable future. It’s about empowering them to think critically, prioritize value over excess, and create positive change.

Conclusion

In conclusion, uncovering the true cost of ownership reveals that less can indeed be more. By understanding the hidden costs of our possessions, evaluating the role of quality, recognizing the hidden costs of convenience, and breaking free from consumerism, we can embrace a frugal and mindful lifestyle that leads to greater financial, health, and environmental benefits.

Through conscious consumption, minimalism, and the calculation of the true cost of ownership, we can make more informed decisions and prioritize value over excess. By educating future generations about responsible consumption and financial literacy, we can shape a more sustainable and mindful future.

So let’s take a step back, evaluate our possessions, and ask ourselves if they truly bring us joy and align with our values. By embracing a frugal and mindful lifestyle, we can uncover a simpler, more fulfilling way of life where less is indeed more.