So, have you ever wondered what the difference is between being frugal and being cheap? I mean, at first glance, the two may seem similar, but trust me, there’s actually quite a big difference. Stick around, and I’ll break it down for you.

Alright, let’s start with the frugal lifestyle. Being frugal means being conscious of your spending and finding ways to save money without sacrificing your overall quality of life. It’s all about making smart choices and prioritizing your expenses. For example, a frugal person may choose to cook at home instead of eating out, or use coupons and shop during sales to get the best deals. It’s not about being stingy or depriving yourself, but rather about being mindful of where your money goes.

Now, cheap, on the other hand, well that’s a whole different story. Being cheap means putting a disproportionate emphasis on the lowest price possible, often at the expense of quality or fairness. Cheap people are the ones who’ll buy the $2 knockoff headphones instead of investing in a durable and reliable pair that might cost a bit more. They may cut corners by skimping on tipping or not contributing their fair share in group activities. It’s a mentality of always trying to get the absolute cheapest option, even if it means sacrificing quality or integrity. So, as you can see, there’s quite a contrast between being frugal and being cheap. In the upcoming article, I’ll dive deeper into the nuances of these two lifestyles and help you discover which approach might be right for you. Stay tuned!

What Does it Mean to be Frugal?

Frugal Living: Defined

Frugality is often misunderstood and confused with being cheap, but there are important distinctions between the two. Being frugal means being mindful and intentional with our money, making smart choices to prioritize our financial goals and values. It is about living within our means, making sacrifices when necessary, and finding creative ways to save money without compromising our quality of life.

Benefits of Living a Frugal Lifestyle

Living frugally comes with numerous benefits that extend beyond financial gain. It allows us to have more control over our money, reducing financial stress and providing a sense of security. By adopting frugal habits, we can also reduce our environmental impact and contribute positively to our community. Moreover, frugality helps us develop a healthy relationship with money and encourages us to find satisfaction in non-materialistic aspects of life.

How Frugal People Spend Money Responsibly

Frugal individuals understand the value of money and spend it responsibly. They prioritize their needs over wants, focusing on essential expenses first. They are diligent in comparing prices and seek out the best deals without compromising on quality. Frugal people also embrace the concept of delayed gratification, saving money patiently until they can afford to make purchases without going into debt or overspending. They are mindful of their spending habits, frequently evaluating whether a purchase aligns with their long-term financial goals.

The Negative Connotations of Being Cheap

The Pitfalls of Being Cheap

Being cheap, on the other hand, often has negative connotations and is viewed as being stingy or unwilling to spend money even when necessary. Cheap individuals prioritize saving money above all else, often at the expense of their own well-being or the well-being of others. They may cut corners and compromise on quality, leading to shoddy purchases or poorly maintained possessions. Being cheap can also strain relationships, as others may perceive it as selfishness or an unwillingness to contribute their fair share.

Why Being Cheap Can Be Detrimental in the Long Run

While being cheap may result in short-term savings, it can have significant long-term consequences. By always opting for the cheapest option available, we may end up spending more in the long run due to frequent replacements or repairs. Cheap purchases often lack durability and reliability, leading to additional expenses down the line. Moreover, being perceived as cheap can damage relationships, as it may be seen as a lack of generosity or unwillingness to invest in meaningful experiences. In the pursuit of saving money, cheapness can lead to missed opportunities and a diminished quality of life.

Frugality: A Mindset and a Lifestyle

Understanding the Frugal Mindset

Frugality is not just about cutting expenses; it is a mindset that extends to all aspects of life. Adopting a frugal mindset involves shifting our perspective on money and finding fulfillment in non-materialistic aspects of life. By focusing on our values and priorities, we can make intentional choices that align with our long-term goals. Frugality encourages mindfulness, gratitude, and contentment, as we learn to appreciate what we have instead of constantly seeking more.

How to Cultivate a Frugal Lifestyle

Cultivating a frugal lifestyle is an ongoing process that requires conscious effort and commitment. It starts with setting clear financial goals and creating a budget to track expenses and identify areas where we can save money. Frugal living involves making conscious choices in daily life, such as cooking meals at home instead of eating out, cutting unnecessary subscriptions, and using resources efficiently. It also requires embracing minimalism and decluttering, as excess possessions can be a burden both financially and emotionally. By adopting frugal habits gradually and consistently, we can transform our mindset and build a sustainable frugal lifestyle.

Recognizing the Distinctions between Frugal and Cheap

Frugal vs. Cheap: Defining the Terms

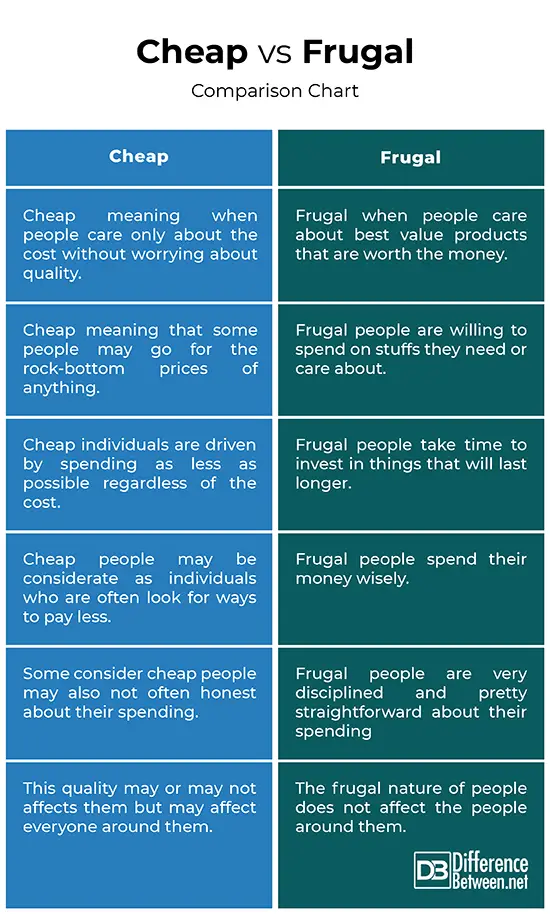

Frugality and cheapness are often used interchangeably, but they have distinct meanings. Frugality is about making smart choices to prioritize our financial goals and values without sacrificing quality or well-being. It is a conscious and intentional approach to managing money. Being cheap, on the other hand, refers to prioritizing savings at any cost, often at the expense of quality, relationships, and personal well-being. Cheapness is a short-sighted and narrow-minded approach to money management.

Key Differences in Attitudes and Behaviors

The key differences between frugality and cheapness lie in their underlying attitudes and behaviors. Frugal individuals are mindful, purposeful, and value-oriented in their spending habits. They seek value for their money and make choices that align with their long-term goals. Cheap individuals, however, prioritize saving money above all else, often cutting corners and compromising on quality. They may exhibit a reluctance to spend money even when necessary, resulting in missed opportunities and strained relationships.

The Financial Impact of Frugality

How Frugality Can Lead to Long-Term Financial Stability

Frugality is a powerful tool for achieving long-term financial stability. By consistently saving money, reducing expenses, and avoiding unnecessary debt, frugal individuals can build a strong financial foundation. Frugality allows for the accumulation of savings, which can provide security during emergencies and unexpected expenses. It also enables individuals to invest in their future, whether through retirement savings, education, or other long-term goals. By living within their means and avoiding excessive consumption, frugal individuals can create financial stability and independence.

Building Wealth Through Frugal Habits

Frugality is not just about saving money; it can also help individuals build wealth over time. By practicing mindful spending and prioritizing long-term financial goals, frugal individuals can invest their savings wisely. Whether it’s through diversified investments, real estate, or entrepreneurship, frugal individuals have the resources to seize opportunities and grow their wealth. The savings accumulated through frugality can be a powerful tool for creating a better financial future, providing freedom and flexibility in life choices.

The Social Impact of Living Frugally

Frugal Living and its Effects on Relationships

Frugal living can have both positive and negative effects on relationships. On one hand, frugality can foster communication and cooperation within relationships, as financial decisions are made collaboratively and with consideration for long-term goals. Frugal individuals often prioritize experiences over material possessions, leading to meaningful shared experiences and memories. On the other hand, if one partner is excessively frugal or perceived as cheap, it can create tension and resentment within the relationship. It is important to find a balance and communicate openly about financial values and priorities to avoid strain on relationships.

How Frugality Can Influence the Environment

Frugality inherently promotes sustainable living and has a positive impact on the environment. By consuming less and making mindful choices, frugal individuals reduce waste and minimize their carbon footprint. Frugal living encourages practices such as recycling, repurposing, and energy conservation. By opting for second-hand goods, using public transportation, or carpooling, frugal individuals contribute to the reduction of resource consumption and greenhouse gas emissions. Frugality not only benefits our personal finances but also makes a significant difference in creating a more sustainable and eco-friendly world.

Making Wise Choices to be Frugal

Strategies for Practicing Frugality in Daily Life

Practicing frugality in daily life requires a combination of practical strategies and mindset shifts. It starts with creating a budget and tracking expenses to identify areas where savings can be made. Meal planning, cooking at home, and packing lunches are effective ways to save money on food. Embracing do-it-yourself projects, such as home repairs or small renovations, can also lead to significant savings. Frugal individuals prioritize purchases that provide long-term value and avoid impulse buying. They also take advantage of coupons, discount codes, and sales to maximize savings. By consistently implementing these strategies, frugality becomes a natural part of everyday life.

Budgeting and Saving Money Effectively

Budgeting is a crucial component of frugal living, as it allows us to allocate our resources effectively and prioritize our financial goals. A well-structured budget includes fixed expenses, such as rent or mortgage payments, utilities, and debt repayments, as well as variable expenses, such as groceries, entertainment, and discretionary spending. By setting realistic spending limits and tracking expenses diligently, frugal individuals can identify areas where they can cut back and save money. Budgeting also helps in planning for future expenses and building an emergency fund, providing a safety net in times of financial uncertainty.

Avoiding the Pitfalls of Being Cheap

How to Recognize and Overcome Cheap Habits

Recognizing cheap habits is the first step towards overcoming them and adopting a more balanced approach to frugality. Cheap habits often involve obsessively seeking the lowest prices, even when quality is compromised. It is important to evaluate purchases based on factors beyond just the price, such as durability, functionality, and long-term value. Overcoming cheap habits requires a mindset shift towards prioritizing value over immediate savings. By considering the long-term costs and consequences of cheap purchases, we can make more informed and responsible decisions.

Finding Balance Between Frugality and Generosity

Finding a balance between frugality and generosity is essential for maintaining healthy relationships and personal well-being. While frugality encourages intentional spending and prioritizing savings, it is important to allow for acts of kindness and generosity when appropriate. This could involve treating loved ones to a special occasion, donating to meaningful causes, or simply offering help when needed. By finding the right balance between frugality and generosity, we can maintain strong relationships, contribute to our communities, and experience genuine joy in helping others.

Incorporating Frugality into Different Areas of Life

Frugal Home Makeovers and Interior Design

Frugal living extends to all aspects of life, including home makeovers and interior design. By embracing creativity and resourcefulness, frugal individuals can transform their living spaces without breaking the bank. Upcycling furniture, repurposing old items, and shopping second-hand are effective ways to save money while creating a personalized and stylish home. DIY projects, such as painting walls or making home decor, can add a personal touch and save significant costs. Frugal individuals also prioritize energy efficiency in homes, reducing utility bills and minimizing environmental impact.

Frugal Travel Tips and Saving Money on Vacations

Traveling on a budget is entirely possible with a frugal mindset and a bit of planning. Frugal travelers prioritize value over luxury, seeking out affordable accommodations and transportation options. They take advantage of travel reward programs, loyalty discounts, and off-season promotions to maximize savings. Frugal travelers also plan their itineraries carefully, opting for free or low-cost activities, exploring local cuisine, and embracing public transportation. By being flexible and avoiding unnecessary splurges, frugal individuals can experience the joy of travel without breaking the bank.

The Psychological Aspect of Frugality

The Mindset Shift: Embracing Frugality without Sacrificing Happiness

Frugality is often associated with sacrifice and deprivation, but it doesn’t have to be that way. A mindset shift is necessary to embrace frugality while maintaining happiness and fulfillment. Shifting our focus from material possessions to experiences and relationships allows us to find joy and contentment in non-materialistic aspects of life. By identifying our values and aligning our spending habits with them, we can live a frugal lifestyle that brings us genuine satisfaction and happiness. Embracing frugality as a choice rather than a burden allows us to live within our means while still enjoying life to the fullest.

Overcoming the Fear and Stigma Associated with Frugality

Frugality can, at times, be associated with fear or stigma, particularly in a society that often equates spending with success. Overcoming these negative perceptions requires a shift in our mindset and a reevaluation of our priorities. We can challenge societal norms by openly discussing our financial goals and values, showcasing the benefits of frugality and its positive impact on our lives. By embracing frugality confidently and without shame, we can inspire others and change the narrative around money and success.

Taking the First Step towards Frugality

Developing a Frugal Mindset: Changing Perspectives on Money

Taking the first step towards frugality starts with developing a frugal mindset. This involves changing our perspectives on money, shifting from a consumer-driven mindset to one focused on value and long-term goals. By setting clear financial goals and aligning our spending habits with those goals, we can make intentional choices that prioritize our financial well-being. Adopting a minimalist approach to possessions and embracing gratitude for what we already have help cultivate a frugal mindset. Over time, this shift in perspective becomes ingrained, leading to a more intentional and fulfilled life.

Practical Tips for Transitioning to a Frugal Lifestyle

Transitioning to a frugal lifestyle can seem daunting, but practical tips can help ease the process. Start by decluttering your living space, getting rid of items that no longer serve a purpose or bring you joy. This not only helps in creating a more minimalist environment but also frees up mental and physical space for new opportunities. Create a budget and track your expenses to gain a clearer understanding of your spending habits and areas for improvement. Gradually implement frugal habits, such as meal planning, seeking out free or low-cost activities, and setting savings goals. Consistency and patience are key during the transition to a frugal lifestyle.

Conclusion

In conclusion, understanding the difference between being frugal and being cheap is essential for making informed financial decisions and living a fulfilled life. Frugality is a mindset and a lifestyle that prioritizes financial goals and value-oriented spending, leading to long-term financial stability and personal growth. Being cheap, on the other hand, focuses solely on saving money without consideration for quality, relationships, or personal well-being. By embracing frugality and making wise choices, we can build a sustainable and fulfilling life that aligns with our values and priorities.