Hey, I’d like to talk to you about a fascinating topic called “Unlocking the Potential of Compound Interest.” I’m sure you’ve heard of it before, but let me give you some context to really get you thinking. It’s all about how you can tap into the incredible power of compound interest to grow your wealth over time.

One key aspect to consider is adopting a frugal lifestyle. By making mindful choices about how we spend and save our money, we can maximize the benefits of compound interest. The more we’re able to save, the more money we’ll have working for us, generating even more interest. This means that over time, our investment will grow exponentially, thanks to the compounding effect. It’s pretty amazing to think about how small, consistent contributions can add up to significant wealth in the long run.

Understanding the power of compound interest is crucial for anyone looking to build financial stability and set themselves up for a comfortable future. So, let’s explore this topic further, and unlock the full potential of compound interest together.

The Basics of Compound Interest

Definition of compound interest

Compound interest refers to the addition of interest on both the initial principal and any previously earned interest. In simple terms, it means earning interest on interest. This concept is widely used in various types of investments, such as savings accounts, certificates of deposit, and investments in the stock market. Unlike simple interest, which is calculated only on the principal amount, compound interest allows your money to grow at an accelerating rate over time.

How compound interest works

Compound interest works by continuously reinvesting the interest earned back into the principal. As time goes by, the interest accumulates and is added to the initial principal, resulting in a larger base for subsequent interest calculations. This compounding effect can lead to substantial growth of your investment over an extended period. The longer your money remains invested, the more significant the impact of compound interest becomes.

The difference between simple interest and compound interest

The key distinction between simple interest and compound interest lies in how the interest is calculated. With simple interest, the interest is calculated solely on the principal amount. On the other hand, compound interest takes into account both the initial principal and the accumulated interest. This crucial difference leads to a much faster rate of growth with compound interest. While simple interest provides linear growth, compound interest offers exponential growth potential.

Advantages of Compound Interest

Increased potential for growth

One of the significant advantages of compound interest is the exponentially increased potential for growth in your investment. As the interest earned is reinvested, the base upon which future interest is calculated expands. Over time, this compounding effect can lead to your investment growing faster and creating a snowball effect. The longer you let your money compound, the greater the growth potential becomes.

Harnessing the power of compounding

Compound interest allows you to tap into the power of compounding. By continuously reinvesting the interest earned, you create a compounding effect that significantly amplifies your investment returns. As your investment portfolio grows, the rate at which it generates additional earnings also increases. This compounding effect can lead to substantial wealth accumulation over the long run.

Time is on your side

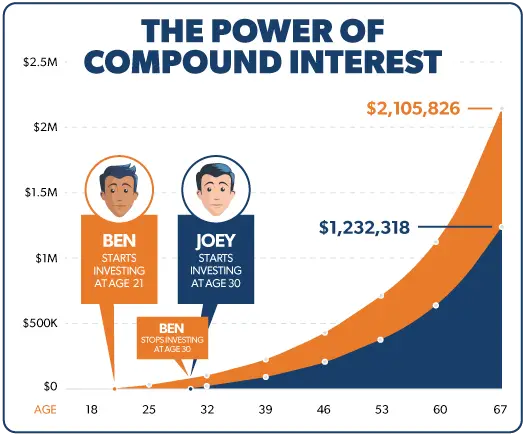

One of the most significant advantages of compound interest is that it rewards those who start investing early. The more time you have for your investments to compound, the more significant the growth potential becomes. By starting early, you give your investments ample time to grow and benefit from the power of compounding. Even smaller contributions made early on can lead to substantial wealth accumulation over time.

Importance of Starting Early

The impact of time on compound interest

Time plays a crucial role in maximizing the benefits of compound interest. The longer your investments have to compound, the greater the growth potential becomes. Starting early allows you to take full advantage of the compounding effect. Even small contributions made early on can grow significantly due to the extended investment duration.

Compound interest and retirement planning

Retirement planning is an area where compound interest can have a significant impact. By starting early and consistently contributing to your retirement funds, you give your investments ample time to compound. This allows your retirement savings to grow substantially over the years, ensuring a more comfortable and secure retirement.

Examples of the benefits of starting early

To understand the benefits of starting early, let’s consider an example. Suppose you begin investing $100 per month at the age of 25, and your investments earn an average annual return of 8%. By the time you reach 65, your investment would have grown to approximately $440,000. However, if you delay starting until the age of 35, your investment would only reach around $217,000, despite investing a total of $12,000 more. This example illustrates the significant advantages of starting early when it comes to compound interest.

Factors Influencing Compound Interest

Interest rate

The interest rate directly affects the growth of your investment through compound interest. Higher interest rates result in faster growth, while lower rates lead to slower growth. When comparing investment options, it’s essential to consider the interest rates they offer and how they will impact your overall returns.

Frequency of compounding

The frequency of compounding refers to how often the interest is added to the principal. The more frequently the compounding occurs, the faster your investment will grow. For example, daily compounding will yield higher returns compared to monthly or annual compounding.

Principal amount

The initial principal amount plays a crucial role in determining the growth potential of your investment. The larger the principal, the higher the interest earned, and the more significant the compound interest becomes. Increasing your principal amount can have a substantial impact on the overall returns generated.

Investment duration

The duration of your investment also affects the impact of compound interest. The longer your investment remains untouched, the more time it has to compound and grow. Time allows your investment to overcome short-term fluctuations and take advantage of the compounding effect. Longer investment durations generally yield higher returns.

Comparing Different Investment Options

Savings accounts

Savings accounts are a popular option for those looking for a low-risk investment with relatively quick access to their funds. While they offer compound interest, the rates are often lower compared to other investment options. Savings accounts are a suitable choice for short-term savings goals and emergency funds.

Certificates of deposit

Certificates of deposit (CDs) are fixed-term investments with a specified interest rate and maturity date. They typically offer higher interest rates compared to savings accounts but require you to lock in your funds for a specific period. Certificates of deposit are a safe option for those seeking predictable returns, especially for short to medium-term goals.

Stock market investments

Investing in the stock market can provide the potential for higher returns through both capital appreciation and dividends. While the stock market carries higher risks, it also offers the opportunity for substantial compound interest growth over the long term. It is essential to diversify your investments and conduct thorough research before investing in individual stocks or mutual funds.

Bonds

Bonds are debt instruments issued by governments or corporations to raise capital. They offer fixed interest payments at regular intervals and a return of the principal amount upon maturity. Bonds provide a relatively predictable stream of income and are often considered lower-risk investments. They can be an attractive option for those seeking stable returns and capital preservation.

The Role of Inflation in Compound Interest

Understanding inflation and its impact

Inflation refers to the gradual increase in the prices of goods and services over time. It erodes the purchasing power of money, reducing the value of future cash flows. While compound interest can help offset the impact of inflation by generating higher returns, it is crucial to consider inflation when evaluating investment options. Investments that outpace inflation are necessary to ensure real growth in wealth over the long term.

Adjusting your investments for inflation

To mitigate the impact of inflation, it is essential to choose investments that have the potential to outpace the inflation rate. Historically, investments such as stocks and real estate have been known to provide returns that surpass inflation. Additionally, it is important to regularly review and adjust your investment portfolio to ensure it remains aligned with your financial goals and the prevailing inflationary environment.

Compound Interest Strategies

Consistent contributions

Consistently contributing to your investment portfolio is crucial for maximizing compound interest growth. By regularly adding to your principal, you provide more substantial base for compounding to take effect. Setting up automatic contributions can ensure that you stay disciplined with your investment strategy and take advantage of the compounding effect.

Reinvesting interest

Reinvesting the interest earned from your investments can further amplify the power of compound interest. Instead of withdrawing the interest earned, consider reinvesting it back into your principal. This allows the interest to generate additional returns and accelerates the growth of your investment.

Diversification

Diversification is a key strategy for managing risk and maximizing returns. By spreading your investments across different asset classes and sectors, you reduce the impact of any single investment on your overall portfolio. Diversification helps protect against market volatility and ensures that you benefit from the growth potential offered by different investment options.

Common Misconceptions about Compound Interest

Misunderstanding exponential growth

One common misconception about compound interest is the failure to grasp the power of exponential growth. Some individuals underestimate the long-term effects of compound interest and the potential for their investment to multiply over time. By understanding the compounding effect, investors can make informed decisions and appreciate the long-term benefits of starting early.

Overestimating quick gains

Another misconception is the expectation of quick gains from compound interest. While compound interest can produce significant growth over time, it is not a mechanism for generating overnight wealth. Patience and a long-term mindset are essential when it comes to compound interest strategies.

Ignoring inflation

An often overlooked aspect of compound interest is the impact of inflation. Ignoring the effects of inflation can erode the purchasing power of your investment returns. It is crucial to consider the inflation rate when evaluating the performance of your investments and ensure that they are still generating real returns after accounting for inflation.

Compound Interest Calculations

Simple interest formula

The formula for calculating simple interest is: I = P * r * t. Where:

- I represents the interest earned

- P is the principal amount

- r is the annual interest rate

- t is the time in years

Compound interest formula

The formula for calculating compound interest is: A = P * (1 + r/n)^(n*t). Where:

- A represents the total amount after compound interest

- P is the principal amount

- r is the annual interest rate

- n is the number of times interest is compounded per year

- t is the time in years

Using online calculators

To simplify compound interest calculations, many online calculators are available. These calculators allow you to input the relevant variables, such as the principal amount, interest rate, compounding frequency, and time period. They provide instant results, enabling you to quickly assess the growth potential of your investments and make informed decisions.

Tips for Maximizing Compound Interest

Automating contributions

Automating your contributions is a convenient and effective way to maximize compound interest growth. By setting up automatic transfers from your bank account to your investment account, you ensure consistent contributions without the need for manual intervention. This strategy helps maintain discipline and ensures that you take full advantage of the compounding effect.

Increasing contributions over time

As your income grows and your financial situation improves, consider increasing your contributions to accelerate the growth of your investment. By consistently increasing the amount you invest, you provide a larger base for compound interest to work its magic. Incremental increases in contributions can lead to substantial wealth accumulation over time.

Taking advantage of employer matching

If your employer offers a retirement savings plan with a matching contribution, take full advantage of this benefit. Employer matching is essentially free money that can significantly boost your retirement savings. By contributing enough to receive the maximum employer matching, you not only benefit from compound interest but also from the additional contributions by your employer.

In conclusion, compound interest is a powerful concept that can lead to substantial growth in your investments over time. By understanding how compound interest works, taking advantage of starting early, considering different investment options, and implementing effective compound interest strategies, you can unlock the full potential of compound interest and secure a brighter financial future. Remember to regularly review and adjust your investment strategy to align with your goals and the prevailing economic conditions. With discipline, patience, and a long-term mindset, you can harness the value of compound interest to achieve your financial objectives.